Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

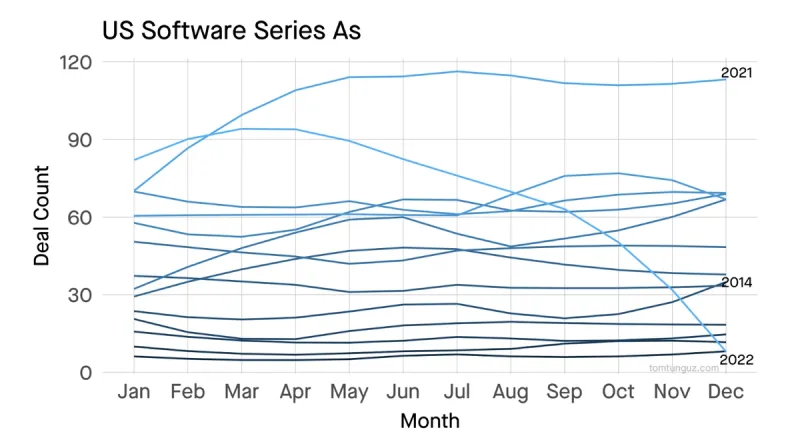

2022 has been a challenging year in the startup world. After a hot start to the year, funding and growth has slowed. As Tomasz Tunguz pointed out in the chart below, funding has collapsed since October.

At Visible, we’ve spent 2022 building tools to help founders update investors, raise capital, and track key metrics. With the help of these 6 new features, founders will be able to level up their investor relations and strike when the funding iron is hot. Check them out below:

Share and Comment on Fundraising Pipelines

You can now share a fundraising pipeline via link. This allows you to ask current investors or peers for introductions or information about investors in your pipeline. In turn, your investors or peers can leave a quick comment to help make an introduction to investors they know.

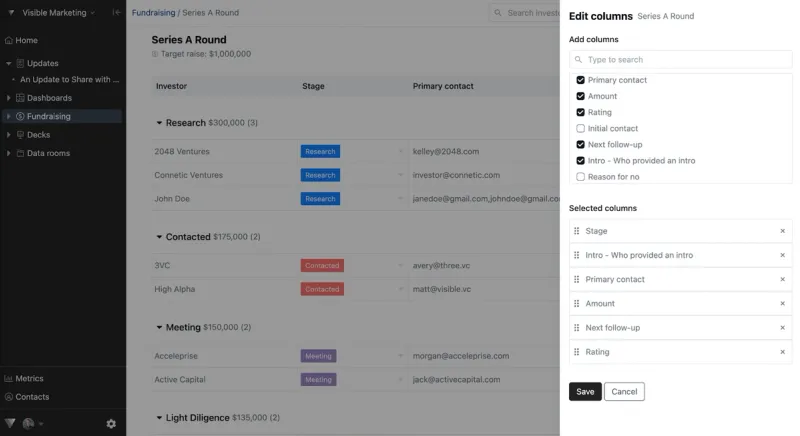

Customize Fundraising Columns and Properties

Our fundraising pipelines have become more flexible so you can further tailor your pipeline to match your fundraise. With customizable fundraising columns and properties, you will be able to select the properties you would like to see at the pipeline level. Check out some of the most popular custom fundraising properties below:

- Min & max check size

- Who can make/made a connection?

- Data room shared?

- Investor type

- Will they lead?

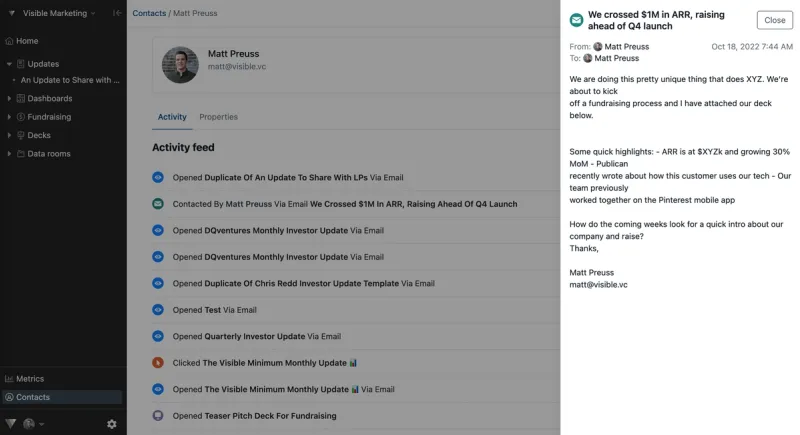

Log Emails with Potential Investors in Visible

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

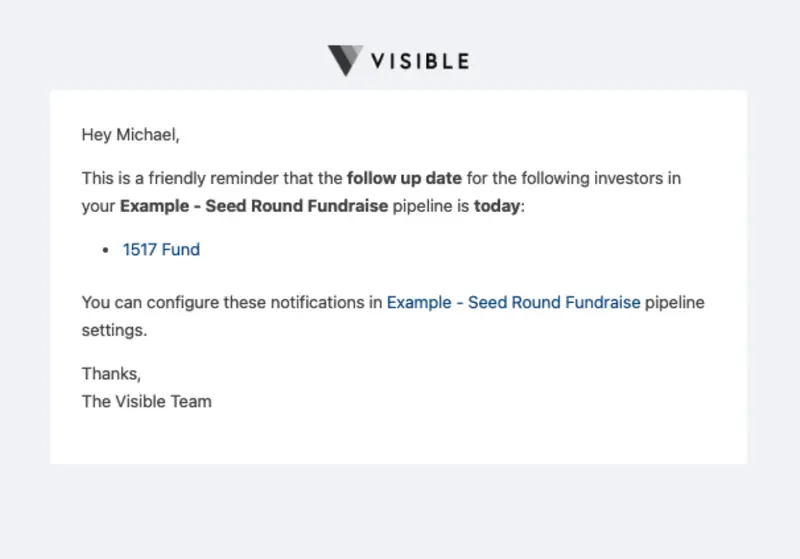

Automatic Fundraising Follow-up Reminders

Over the course of a fundraise, most founders should expect to communicate with 50-100+ investors. In order to best help you stay on top of their ongoing conversations, you can now set email reminders for when to follow up with potential investors. This is a great way to speed up the fundraising process and get back to what matters most — building your business.

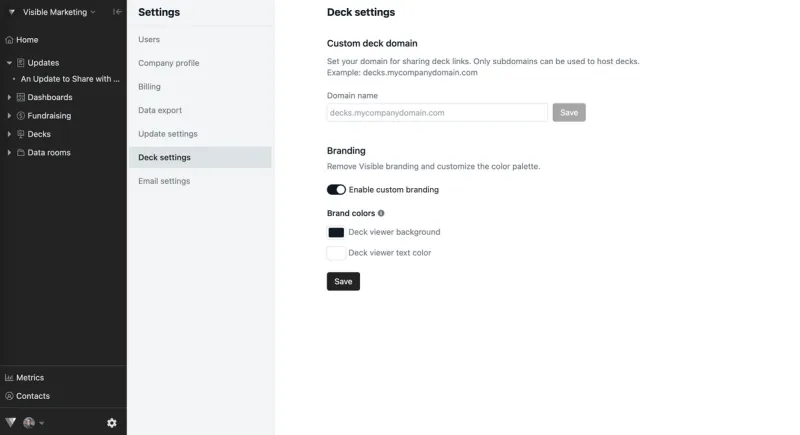

Pitch Deck Branding and Custom Domains

Control your fundraise from start to finish. With Visible Decks, you can share your deck using your own domain. Plus you can customize the color palette of your deck viewer to match your brand. You can check out an example here.

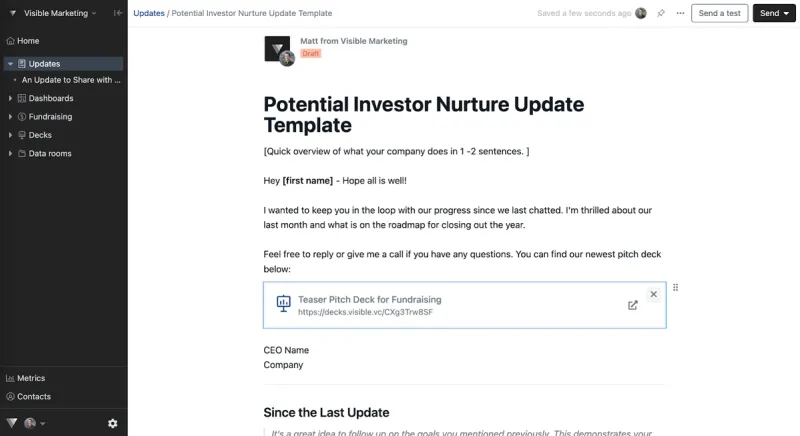

Include Pitch Decks in Updates

Keeping current and potential investors in the loop is a great way to speed up the process when you are ready to raise capital. In order to best help nurture current and potential investors, you can now include your Visible Decks directly in Updates. This can help when kicking off a raise, nurturing potential investors, or sharing a board deck with your board members.

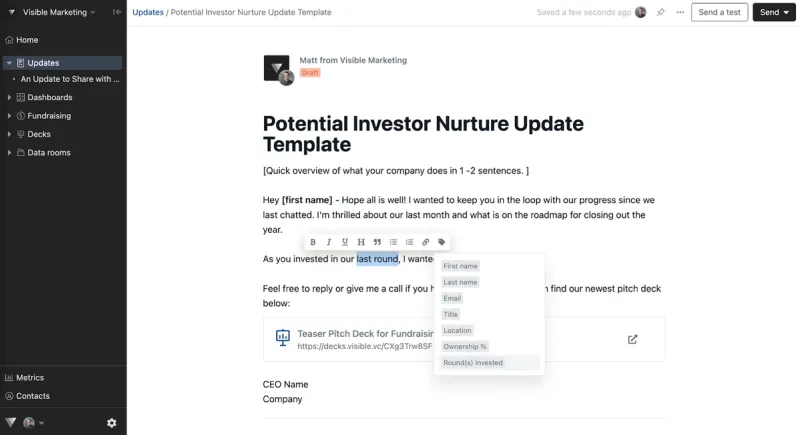

Custom Properties as Merge Tags in Updates

As we mentioned above, updating current investors and nurturing potential investors is a great way to speed up a fundraise when the time is right. To best help you customize your Visible Updates, you can now use custom properties as merge tags in Updates. For example, if you’re tracking the city in which your investors live you can use that in an Update.

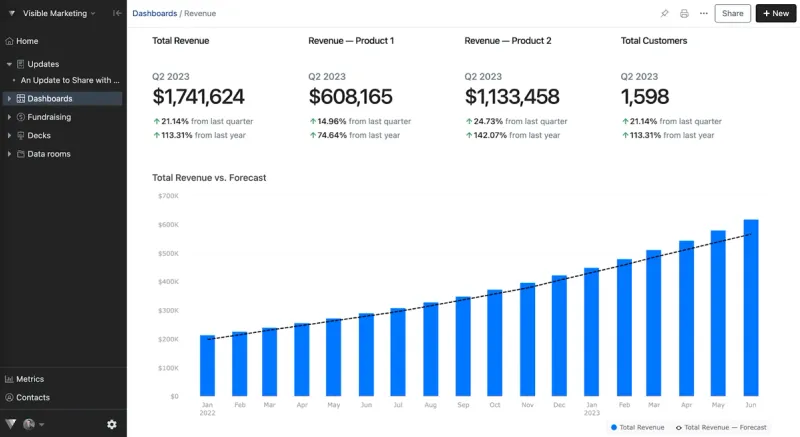

Improved Dashboard Layout and Widgets

If you’re sharing Visible Dashboards with your team or more involved investors, you can now customize the layout and include additional widgets (like text, tables, and variance reports). This will allow you to give additional context to any of the data your key stakeholders might be looking at regularly.

Our mission at Visible is to help more founders succeed. Over the next 12 months, we’ll be building more tools to help you do just that. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.