Key Takeaways

-

Miami has become a leading U.S. startup and venture capital hub, offering founders a strategic gateway to Latin American markets and fast-growing sectors like fintech, health tech, logistics, and web3.

-

The city’s pro-business climate, tax advantages, and expanding investor community make it an attractive place for fundraising, especially for early-stage startups.

-

Founders raising venture capital in Miami should differentiate through traction, capital efficiency, and sector alignment while targeting investors with a proven interest in South Florida startups.

-

Miami’s maturing ecosystem presents challenges — including talent gaps and fewer later-stage funds — but founders can offset them by leveraging remote talent, national investors, and structured accelerator programs.

-

This guide highlights the top 10 VC firms in Miami and offers tactical fundraising advice to help founders navigate the city’s unique ecosystem and secure the right investment partners.

Since the early 2020s, Miami has cemented itself as a vibrant hub for startups and venture capital investment, not just a trend, but a durable part of the U.S. innovation landscape. With a unique blend of cultural diversity, strategic access to Latin America and the Caribbean, and a pro‑business environment, Miami continues to attract founders and investors from across the globe.

Building on its strengths in fintech, health tech, logistics, and blockchain/web3, the city now benefits from a deeper bench of local talent and a more mature investor base, including funds and operators who have relocated from traditional tech hubs.

This article explores the top 10 venture capital firms in and around Miami poised to fund and support high‑potential startups in 2025, along with practical guidance for founders actively raising capital in this flourishing ecosystem.

Why Miami is Ideal for Startup Fundraising

Miami has emerged as a prime destination for startup fundraising, offering several strategic advantages:

Access to International Markets

Miami's geographic location positions it as a gateway to Latin America and the Caribbean, providing startups with unique opportunities to tap into these emerging markets. The city's robust trade infrastructure and multicultural environment facilitate cross-border business operations, enabling startups to expand their reach and customer base effectively.

Favorable Business Climate

Florida's business-friendly environment enhances Miami's appeal for startups. The state boasts no personal income tax and a relatively low corporate tax rate, allowing entrepreneurs to reinvest more capital into their ventures. Additionally, pro-business regulations and government incentives, such as grants and tax credits, support business growth and innovation.

Growing Investor Community

In recent years, Miami has experienced a significant influx of investors and tech leaders relocating from traditional hubs like Silicon Valley and New York. This migration has increased the availability of capital and diversified the investment landscape, providing startups access to a broader network of potential investors and mentors. The city's evolving ecosystem fosters collaboration and innovation, making it an attractive destination for fundraising.

Challenges to Consider When Raising Venture Capital in Miami

While Miami offers numerous advantages for startups seeking funding, founders should be mindful of several realities of the ecosystem in 2025—and plan accordingly.

Competitive Landscape

As Miami's reputation as a startup hub has grown, the number of startups vying for venture capital has increased, intensifying competition for investment. Founders need to clearly demonstrate differentiated value, capital efficiency, and credible paths to scale.

What this means for founders:

- Lead with traction and efficiency. Miami investors often favor startups that show real revenue, clear unit economics, and disciplined burn, not just top‑line growth.

- Tailor your story to Miami’s strengths. Explicitly connect your business to fintech, LatAm access, logistics, health tech, or other areas where Miami has a clear edge.

- Be intentional about investor fit. Build a focused list of 30–50 investors who have recently backed Miami or South Florida companies or your specific sector, rather than blasting a generic list of 200+ VCs.

Developing Ecosystem

Compared to established tech hubs like Silicon Valley and New York, Miami's startup ecosystem is still maturing. There may be fewer locally based later-stage funds and a smaller pool of mentors with deep operating experience in specific niches.

How to mitigate this as a founder:

- Combine Miami capital with national/global investors. Use Miami‑based angels and seed funds to anchor early rounds, while targeting coastal or international VCs who already invest in Florida or LatAm.

- Leverage remote talent. Pair a Miami HQ or presence with remote teams in other hubs to access specialized technical or go‑to‑market talent.

- Tap structured programs. Use accelerators, founder fellowships, and sector‑specific programs (both in Miami and remote) to fill gaps in mentorship and network.

Access to Local Talent

Sourcing specialized talent locally can still be challenging in certain deep tech or niche SaaS categories.

Tactics to try:

- Partner with local universities. Collaborate with institutions like the University of Miami, FIU, and others to build intern and graduate pipelines.

- Be remote‑first where it counts. Keep leadership or go‑to‑market in Miami while hiring specialized roles (e.g., ML, security, advanced infra) from national or global talent pools.

- Use Miami’s lifestyle as a recruiting advantage. Many experienced operators are open to relocating if the role is compelling and the company offers flexibility, competitive comp, and upside.

Top Venture Capitalists in Miami

1. Ocean Azul Partners

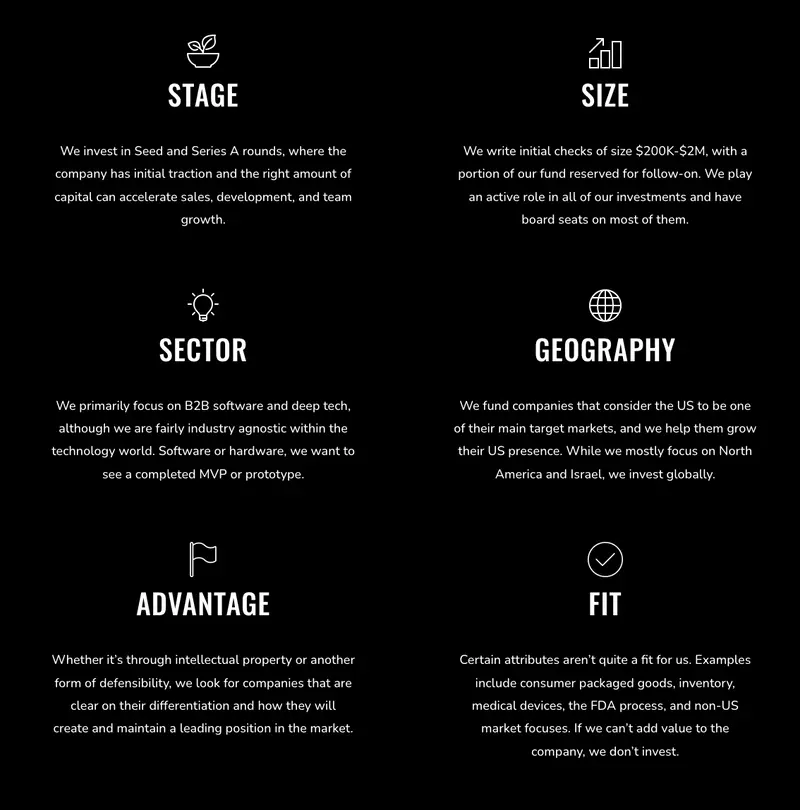

As the team at Ocean Azul Partners put on their website, “We are an early-stage venture capital firm passionate about helping entrepreneurs bring innovative technology solutions to market. We’re operators who are determined to use our successes and lessons learned to provide significant value to the teams with which we work. We are proud to support entrepreneurs building unique solutions that will shape the futures of their industries.”

Investment Range

As put on their website, “We write initial checks of size $200K-$2M, with a portion of our fund reserved for follow-on. We play an active role in all of our investments and have board seats on most of them.”

Industries

The team at Ocean Azul primarily focuses on B2B software.

Related Resources: The 12 Best VC Funds You Should Know About

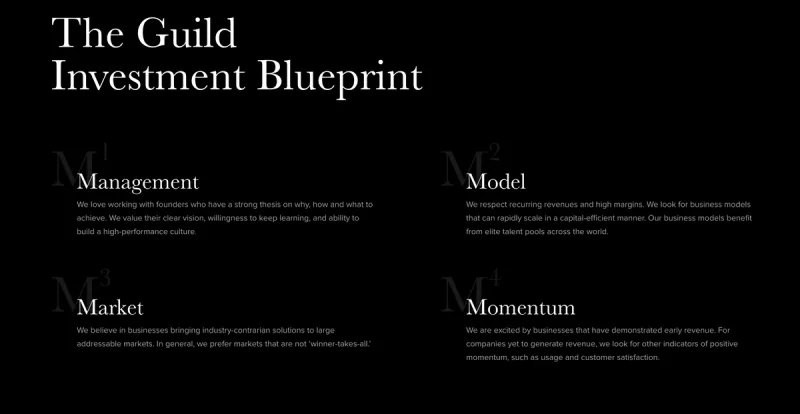

2. Guild Capital

As the team put on their website, “Guild Capital is an early-stage venture capital firm. Founded in 2009, we have been dedicated to venture further than conventional Silicon Valley-based VC patterns to look for growth-stage teams who can evolve into great companies.”

Investment Range

The team at Guild does not publicly state their investment range but does look to companies that have “generated early revenue” or those that have not generated revenue that shows signs of momentum.

Industries

The team at Guild does not have a specific industry but shares their thesis for industries and markets by stating, “We believe in businesses bringing industry-contrarian solutions to large addressable markets. In general, we prefer markets that are not ‘winner-takes-all.”

3. Starlight Ventures

As put on their website, “We are an early stage venture firm designed to address humanity’s biggest challenges and opportunities through breakthrough technology. We aim to enable long-term human flourishing: a prosperous civilization that responds effectively to large-scale opportunities and existential threats alike.”

Investment Range

The team at Starlight does not publicly state their investment range.

Industries

The team at Starlight does not publicly state-specific industries but rather invest in companies that impact long-term human flourishing.

4. Fuel Venture Capital

As put by their team, “Fuel Venture Capital has brilliantly executed against this mission and has become known and trusted as leaders who are founder-focused and investor-driven. Our world-class venture executives have deployed over $400MM of capital from our global LP base following a disciplined “Phased Investment Thesis” managing risk while driving return on investment.”

Investment Range

The team at Fuel invests across multiple stages as put below:

Industries

The team at Fuel invests across many industries but ultimately look to, ‘disruptive global, tech-driven companies.”

5. LAB Miami Ventures

As put by their team, “LAB Ventures is a VC Fund and Startup Studio dedicated to accelerating early-stage real estate and construction technology companies… We invest in early-stage real estate and construction technology companies. We invite investors with an interest in these sectors to join our growing network and stay on the leading edge of tech trends.”

Investment Range

The team at LAB does not publicly state their investment range but typically invests in pre-seed, seed, and series A rounds.

Industries

As put by their team, “Our focus is on early-stage technology businesses that serve the Real Estate and Construction industries – Property Technology, or “PropTech” for short. We take a very broad view of what is included in PropTech, but have a preference for software over hardware, recurring revenue, and enterprise over the consumer.”

6. Krillion Ventures

As put by their team, “Krillion Ventures is a Miami-based venture capital fund that actively invests in early-stage technology companies solving problems in healthcare, financial services, and real estate.”

Investment Range

The team at Krillion Ventures does not publicly list their investment range but gives the following information, “We invest in companies that can demonstrate proof of concept and are seeking capital to accelerate their growth. We make follow-on investments in our portfolio companies on a deal-by-deal basis.”

Industries

The team at Krillion is focused on companies in the health tech space.

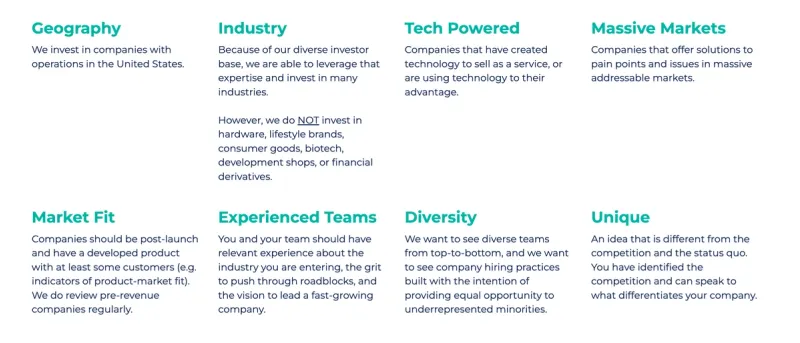

7. Miami Angels

As put by the team at Miami Angels, “We bring together exceptional entrepreneurs and accomplished accredited investors to fuel success.

Our group is comprised of over 150 angel investors, many of whom have been entrepreneurs themselves. Beyond providing capital, we collaborate with our founders to ensure they have access to talent and future funding.”

Investment Range

The team at Miami Angels does not publicly state what their investment range is. You can learn more about their investment criteria below:

Industries

As put on their website, “Because of our diverse investor base, we are able to leverage that expertise and invest in many industries.

However, we do NOT invest in hardware, lifestyle brands, consumer goods, biotech, development shops, or financial derivatives.”

8. Secocha Ventures

As put by their team, “Secocha Ventures is an Investment Firm focused on early stage Consumer Products & Services, Fintech & Healthcare Technology companies.”

Investment Range

The team at Secocha Ventures does not publicly disclose their investment range. They do mention, “We invest in startups raising their Pre-Seed, Seed, or Series-A rounds.”

Learn more about the Secocha Ventures investment criteria below:

Industries

As shown above, the team at Secocha Ventures states, “We invest in FinTech, HealthTech, and Consumer Products & Services.”

Related Resources: Private Equity vs Venture Capital: Critical Differences

9. SaaS VC

"Investing in visionary SaaS founders all across the country at the earliest stages"

Investment Range

"Many attractive companies are able to raise significant capital, but often struggle to efficiently fill an entire early-stage (Pre-seed, Seed, Post-Seed) round with value added investors. We like to invest in these rounds and assist in identifying other quality investors to complete the financing. We are honored to collaborate with the best and brightest to create successful enterprises."

Industries

Enterprise , SaaS, Supply Chain, Logistics, Fintech, Cybersecurity, Security, E-Commerce, ESG, Consumer Goods

10. TheVentureCity

As put by their team, “TheVentureCity is a global, early-stage venture fund that refuses to follow the conventional crowd. We offer promising founders investment with bespoke data insights and operating expertise – designed for product-led growth.”

Investment Range

According to their Visible Connect Profile, the team at TheVentureCity typically writes checks between $1M and $4M.

Industries

As put on their website, “We are generalists, but index high on Fintech, HealthTech, AI/ML/Data and B2B SaaS. We like businesses that are “needed” and are not just “nice to haves”.”

Key Sectors Attracting VC Investment in Miami

Miami’s thriving startup ecosystem has become a magnet for venture capital, with key sectors emerging as top choices for investors looking to back high-potential innovations:

Fintech and Financial Services

Leveraging its status as a major financial hub, Miami has become a fertile ground for fintech innovation. The city's robust financial industry presence provides startups with access to established financial institutions and a diverse customer base. Notably, companies like Pipe, a Miami-based fintech startup, have achieved remarkable success, raising $250 million in strategic equity funding and reaching a $2 billion valuation within just ten months of its public launch.

Healthcare and Biotech

Miami's proximity to leading medical institutions and research centers has spurred health tech and biotech startup growth. Innovative companies are developing telemedicine, medical devices, and biotechnology solutions, attracting venture capital interested in advancing healthcare technologies. The city's diverse population provides a unique environment for clinical trials and health tech innovation.

Blockchain, Web3, and Digital Assets

In the early 2020s, Miami aggressively branded itself as a “crypto capital,” with high‑profile conferences, initiatives like MiamiCoin, and a rush of web3 startups and investors arriving in 2021. By 2025, the ecosystem has evolved from pure speculation toward more durable, infrastructure‑driven, and enterprise‑focused plays. Founders now see interest from investors in:

- Web3 infrastructure (wallets, compliance, custody, developer tools)

- Tokenless or low‑token products that use blockchain under the hood

- Use cases tied to Miami’s strengths in finance, logistics, and cross‑border transactions

For founders, this means:

- Be realistic about the market cycle. Investors in 2025 expect clear business models, regulatory awareness, and validated demand, not just token economics.

- Highlight real‑world traction. Emphasize paying customers, institutional partnerships, or regulatory progress.

- Position Miami as an advantage. If you’re leveraging the city’s financial ecosystem, LatAm connectivity, or community of crypto‑native operators, spell this out in your deck and investor conversations.

E-commerce and Logistics

Miami's strategic location and world-class port and logistics infrastructure make it an ideal base for e-commerce and logistics startups. The city's status as a gateway to Latin America and the Caribbean enables efficient distribution channels, attracting venture capital investment in companies focused on supply chain optimization, last-mile delivery solutions, and cross-border e-commerce platforms.

Resources and Support Systems for Founders in Miami

Miami's burgeoning startup ecosystem offers a wealth of resources to support entrepreneurs at various stages of their journey.

Incubators and Accelerators

- 500 Startups Miami: A renowned global venture capital firm and startup accelerator, 500 Startups Miami provides early-stage companies with funding, mentorship, and access to a vast network of investors and industry experts.

- Venture Hive: This accelerator offers a 12-week mini-MBA program focused on business development, providing weekly one-on-one mentoring sessions, consultations with specialists, and access to a growing network of entrepreneurs and investors.

- The LAB Miami: A co-working space and accelerator that offers mentorship, workshops, and events for entrepreneurs in tech, design, and social entrepreneurship.

Co-working Spaces

Government and Non-profit Initiatives

- Miami-Dade Innovation Authority: A nonprofit organization formed with seed funding from the John S. and James L. Knight Foundation, Citadel CEO Ken Griffin, and Miami-Dade County. It provides grants to startups addressing community challenges in climate, health, housing, transit, and more.

- Miami Open for Business Program: Managed by The Miami Foundation, this program supports historically underserved small business owners in Miami-Dade County by providing grants and loans for the purchase and ownership of critical business assets, such as technology, equipment, machinery, inventory, and property.

- Miami-Dade Economic Advocacy Trust (MDEAT) Business Resource and Education Grant Program: This program offers $2,500 grants to qualified start-up businesses to improve or stabilize neighborhood businesses throughout Miami-Dade County.

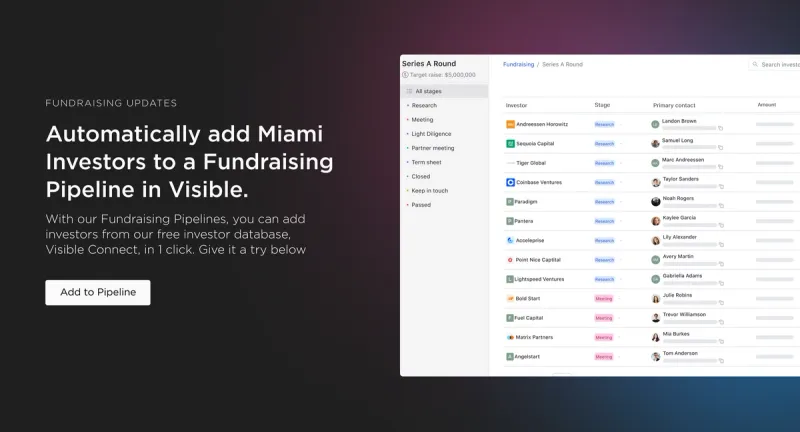

Find Investors In Miami With Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and, ideally, closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

Frequently Asked Questions

What makes Miami a strong city for startup fundraising?

Miami is a strong city for startup fundraising thanks to its pro-business environment, tax advantages, and access to Latin American markets. Founders benefit from a growing investor community, expanding tech talent, and sector strengths in fintech, health tech, logistics, and web3. These factors create a supportive ecosystem for early-stage startups seeking venture capital.

Which industries attract the most venture capital in Miami?

The industries attracting the most venture capital in Miami include fintech, health tech, proptech, logistics, and emerging blockchain/web3. Investors are drawn to Miami’s financial hub status, strong healthcare institutions, and world-class logistics infrastructure. This diverse mix positions Miami as a competitive location for startups building scalable technology across multiple verticals.

How do founders find venture capital investors in Miami?

Founders can find venture capital investors in Miami by researching local VC firms, engaging Miami-based angels, and leveraging tools like Visible Connect. Many founders also combine Miami capital with national or international funds already investing in Florida or LatAm, improving their chances of building a well-rounded investor pipeline.

What challenges do startups face when raising venture capital in Miami?

Startups raising venture capital in Miami may face competition for early-stage funding, limited later-stage options, and gaps in specialized local talent. Founders can overcome these challenges by demonstrating strong traction, targeting investors aligned with Miami’s core sectors, and supplementing local resources with remote talent or national VC partners.

Are there startup resources or accelerators available in Miami?

Yes, Miami offers several startup resources and accelerators, including 500 Startups Miami, Venture Hive, and The LAB Miami. These programs provide mentorship, capital access, and structured training. Founders can also leverage Miami-Dade nonprofit initiatives, co-working spaces, and sector-specific programs to strengthen their fundraising strategy and operational foundation.