At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

A strong sales and marketing funnel starts by identifying the right leads for your business. The same idea is true for founders looking to find investors for their business — find the right investors for your business.

If you’re a founder located in Israel and would like to find the right investors for your business, check out our list of active investors in the area below:

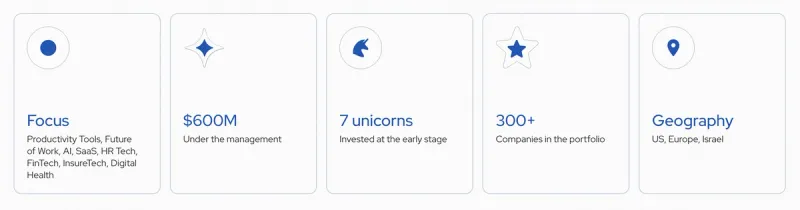

1. Altair Capital

https://connect.visible.vc/investors/altair-capitalAs put by their team, “We invest in the world’s most promising companies with disruptive ideas and great return potential. We invest in early and growth stage startups in sectors such as Productivity tools, Fintech, Insuretech, AI, Digital Health. Great and motivated teams, strong product vision, scalable business model and big potential market are a must!”

Location

Altair Capital invests in companies in Israel, the US, and Europe.

Company Stage

Altair looks for companies that have achieved initial traction.

Preferred industries

As put by their team, “We are interested in productivity tools/future of work, SaaS, Fintech, Insuretech, AI, Digital Health.”

Portfolio Highlights

Some of Altair’s most popular investments include:

- Miro

- Deel

- OpenWeb

2. Pitango Venture Capital

As put by their team, “Pitango is home to visionary entrepreneurs and groundbreaking companies from stealth mode to growth. We partner with exceptional founding teams via three parallel funds Pitango First, Pitango Growth and Pitango HealthTech.”

Location

Pitango is located in Tel Aviv and invests in companies across the globe.

Company Stage

Pitango VC invests in companies from the earliest stages to growth stages.

Preferred industries

Pitango invests in multiple sectors and has funds dedicated to HealthTech and Growth stage companies.

Related Resource: How Venture Capital is Funding the Future of Healthcare + 7 VC Firms Making Investments

Portfolio Highlights

Some of Pitango’s most popular investments include:

- Via

- Logz.io

- Tulip

3. Vertex Ventures

As put by their team, “We’ve worked with some of the most iconic startups to come out of Israel. Our experience and diverse backgrounds support our founders in their journey to grow their companies and become industry leaders. Vertex Ventures Israel funds are consistently ranked as top performers. We invest cross-verticals, from Seed to B.”

Location

Vertex Ventures is located in Tel Aviv and invests in companies across Israel.

Company Stage

Vertex invests in companies from Seed to Series B and beyond.

Related Resource: The Understandable Guide to Startup Funding Stages

Preferred industries

Vertex Ventures is industry agnostic.

Portfolio Highlights

Some of Vertex Ventures’ most popular investments include:

- Base

- Yotpo

- EasySend

4. Jerusalem Venture Partners

As put by their team, “Founded in 1993 under the famed Yozma program by Dr. Erel Margalit, Jerusalem Venture Partners VP has created and invested in over 160 companies in Israel, the US and Europe. JVP’s investment strategy is spearheaded by a deep expertise in identifying opportunities from inception and growing them into global industry leaders. Through our theme-driven focus and strong network of strategic partners, we seek to stay ahead of the latest market trends and address the most relevant market needs.”

Location

Jerusalem Venture Partners has office locations across Israel.

Company Stage

JVP is stage agnostic and invests in companies from seed to growth stages.

Preferred industries

JVP invests across many industries and has a focus on Cyber Security, Big Data, Enterprise Software, and FoodTech.

Related Resources: 10 Foodtech Venture Capital Firms Investing in Food Innovation and 15 Cybersecurity VCs You Should Know

Portfolio Highlights

Some of JVP’s most popular investments include:

- Dealhub

- Quali

- Nanit

5. Grove Ventures

As put by their team, “Grove Ventures is a leading early-stage venture capital investment firm with over half-a-billion dollars under management. We partner early with exceptional Israeli entrepreneurs who believe that the Deep Future is now and are ready to build it.”

Location

Grove Ventures is located in Israel and invest in companies across the globe.

Company Stage

Grove Ventures is focused on early-stage companies.

Preferred industries

Grove Ventures is hyperfocused on Deep Future companies.

Portfolio Highlights

Some of Grove Ventures’ most popular investments include:

- Rapid

- Lamigo

- Navina

6. Viola Ventures

As put by their team, “Viola is a multi-strategy investment house with focused, separate investment arms. We partner with companies from inception to growth. Each partnership operates independently with a dedicated investment team, investors, pool of funds, and portfolio companies, but shares access to added-value services, best practices and insights.”

Location

Viola is located in Tel Aviv and invests in companies across the globe.

Company Stage

Viola has 5 different funds that invest in companies across many stages.

Preferred industries

Viola uses their 5 funds to invest in companies across different industries and markets.

Related Resource: FinTech Venture Capital Investors to Know

Portfolio Highlights

Some of Viola Ventures’ most popular investments include:

- Ridge

- Grove

- Addressable

7. Entrée Capital

As put by their team, “Entrée Capital was founded in 2010 to provide multi-stage funding to innovative seed, early and growth-stage companies all over the world. Entrée Capital manages over $1.2 billion across nine funds and has invested in over 180 startups.”

Location

Entree has office locations in New York, London, and Tel Aviv. They invest in companies across the globe.

Company Stage

Entree invests in companies from Pre-seed to Series C.

Preferred industries

Entree focuses on a wide variety of different industries. Including everything from Crypto to SaaS to Games & Social.

Related Resource: 14 Gaming and Esports Investors You Should Know

Portfolio Highlights

Some of Entree Capitals’ most popular investments include:

- Stripe

- Monday

- Deliveroo

8. Magma Venture Partners

As put by their team, “Magma Venture Partners is a leading Israeli venture capital firm, dedicated to investing in Israel’s Information, Communications and Technology space (‘ICT’), including the software, semiconductor and new media spheres. We seek bright ideas at their earliest stages, and serve as a springboard for our entrepreneurs as they develop and evolve into industry leaders. Our goal is to enable a flow of innovation from the earliest stage all the way through until a company realizes its potential reach.”

Location

Magma Venture Partners is headquartered in Tel Aviv and focuses on companies across Israel.

Company Stage

Magma Venture Partners is focused on early-stage companies.

Preferred industries

As put by their team, “Information, Communications and Technology space (‘ICT’), including the software, semiconductor and new media spheres.”

Portfolio Highlights

Some of Magma Venture Partners’ most popular investments include:

- Guesty

- Waze

- Trink

9. Cardumen Capital

As put by their team, “Our general partners are investors, founders and operators. We have over a decade of experience founding and operating companies and helping entrepreneurs build, scale, and sell tech companies in Israel, Europe and in the United States. Our team is a diverse group of people from different backgrounds and upbringings. We strongly believe that different perspectives lead to better decision-making.”

Location

Cardumen Capital is located in Israel and invests in companies across Israel, Europe, and the United States.

Company Stage

Cardumen Capital is focused on companies between Pre-seed and Series A.

Preferred industries

Cardumen Capital is industry agnostic.

Related Resource: 17 Travel & Tourism VC Investors that can Fund Your Startup

Portfolio Highlights

Check out some of Cardumen Capital’s most popular investments below:

- Munch

- Peech

- Spotlight.ai

Join Visible and connect with the right investors for your business

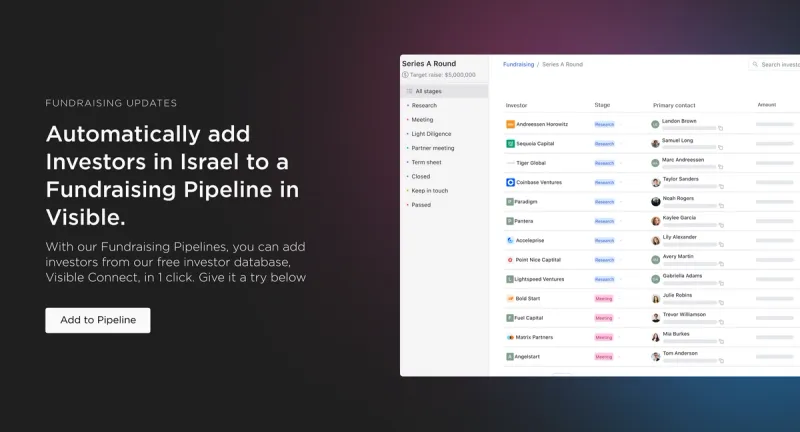

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.