Key Takeaways

-

New Orleans is an emerging startup hub for health, climate and water, logistics, food, and culture, supported by SSBCI capital, university programs, and experienced Gulf Coast and Southeast partners.

-

Fundraising is relationship-driven and stage-specific, with smaller checks and a premium on traction, disciplined revenue, and sound unit economics; local ties can accelerate a lead.

-

Follow a focused playbook: map SSBCI participants and ecosystem funds, line up a local pilot or LOI before seed, leverage Techstars Louisiana and non-dilutive capital, and organize a clean data room to streamline diligence.

-

Tap into the ecosystem at New Orleans Entrepreneur Week, university startup nights at Tulane, UNO, and LSU Health, Idea Village events, and coworking spaces like The Shop at the CAC, Propeller, and The Warehouse to secure warm introductions.

-

Build your New Orleans venture pipeline with Visible by sourcing firms like LongueVue Capital, Camelback Ventures, Future Factory, and New Orleans BioFund via Visible Connect, sharing decks and data rooms, and sending updates to keep regional co-investors engaged.

New Orleans is building a distinct startup market. Founders here work at the intersection of health, climate and water, logistics, food, and culture. Capital comes from local funds, family offices, corporate partners, and regional investors across the Gulf Coast and Southeast.

Raising in New Orleans is relationship-driven and stage-specific. Check sizes tend to be smaller than in larger hubs, and investors expect clear traction, revenue discipline, and practical unit economics. Local programs and university ties can shorten the path to a lead.

This guide will help you map the investor landscape, target firms that match your stage, and run a tight fundraising process. You will find a vetted list of top venture firms with offices in New Orleans, their focus areas, stages, and contacts. You will also learn how local investors evaluate deals, current trends, and how to plug into accelerators, grants, pitch events, and communities.

Use this to build a focused pipeline, prep for investor meetings, and connect with the right partners. The goal is simple: save time, raise on better terms, and grow with support from New Orleans and the broader Gulf South network.

Top New Orleans Venture Capital Firms Actively Investing

LongueVue Capital

About: LongueVue Capital is a New Orleans-based private equity firm focused on providing human capital, financial capital, and a skill set built upon a successful 20+ year track record of partnering with entrepreneurs and management teams to drive value creation in middle market companies. With 150 years of combined operating and investing experience, our team is the ideal partner for middle market companies at inflection points and seeking to maximize value, as evidenced by our industry leading investment track record spanning four funds and over $850 million of committed capital.

Camelback Ventures

About: Camelback Ventures is an accelerator that identifies, develops, and promotes early-stage underrepresented entrepreneurs with the aim to increase individual and community education, and generational wealth.

Future Factory

About: Future Factory provides capital and business services to emerging companies.

New Orleans Biofund

About: The innovative BioFund program supports small businesses that may not qualify for traditional financing options. These investments help bridge a critical funding gap, thus allowing companies to better position themselves for growth and success. The New Orleans BioFund operates in all industries, but places a special emphasis on biotechnology as a part of its mission. Furthermore, the fund is currently transitioning to a micro-venture capital model. This will provide startup investment options such as equity, convertible debt, and loan financing options.

The New Orleans Venture Landscape at a Glance

New Orleans' founders are rising into a more connected, better-capitalized local ecosystem than a few years ago. Two dynamics matter most right now: targeted state programs that unlock more early-stage capital, and a maturing set of local partners who help de-risk deals and syndicate with regional leads.

Where the Capital is Coming From

- State Small Business Credit Initiative (SSBCI): The U.S. Treasury approved up to $113 million for Louisiana’s SSBCI programs, administered by Louisiana Economic Development (LED). These funds support equity co-investments, loan participation, and credit programs that help early-stage companies bridge from local validation to larger seed rounds.

- Local partners who turn programs into checks: In New Orleans, founders most often interact with SSBCI-adjacent resources and investor networks through university and nonprofit partners and NOLA-headquartered funds. These groups help with diligence prep, customer pilots, and co-investment:

Programs That Open Doors

Louisiana partnered with Techstars to run an accelerator program in the state, investing in cohorts and connecting founders to mentors and capital networks. This gives New Orleans startups exposure beyond the region and creates a clearer on-ramp to institutional funding.

The New Orleans Startup Fund (NOSF), an evergreen nonprofit seed fund, has invested over $2 million in more than 40 companies. Its portfolio has attracted $65 million in follow-on capital, showing the leverage of early local checks for downstream rounds.

Founder playbook for New Orleans

- Build a tight investor map of SSBCI participants and ecosystem funds. Prioritize five to eight targets that match your stage and sector, and pursue warm introductions through mentors and alumni.

- Land a credible pilot or LOI with a local enterprise buyer before formal seed outreach. This is a strong local signal.

- Use accelerators and non-dilutive capital to reach clear proof points. Techstars Louisiana and university programs expand investor access and shorten diligence.

- Prepare a simple data room: 12–24 months of monthly financials, pipeline by stage, three customer references, and a regulatory plan if applicable.

- Expect a measured pace. Share updates to keep momentum with local and regional co-investors.

Networking, Events, and Coworking in New Orleans

Events

- New Orleans Entrepreneur Week (NOEW)

- The city’s flagship founder event; investors, corporates, and media attend. Ideal for batching meetings and announcing milestones.

- University Startup Nights (Tulane, UNO, LSU Health)

- Here you can find talent, advisors, and early angel checks with alumni ties. Ask the entrepreneurship center staff to make intros to active alumni angels and mentors; offer to guest-mentor for visibility.

- Idea Village

- Founder meetups and mentor office hours.

Coworking Spaces

- The Shop at the CAC (Warehouse District)

- Best for: Investor drop-ins during NOEW, professional vibe for hosting meetings.

- Propeller (Broadmoor)

- Best for: Climate/health/food social impact founders; program access and mission-aligned partners.

- The Warehouse (CBD)

- The Warehouse offers private offices, dedicated desks, and flexible coworking memberships in the Bywater neighborhood of New Orleans.

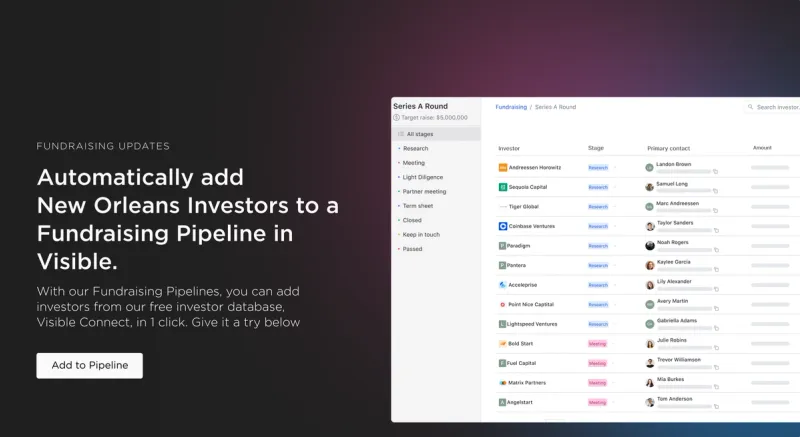

Find investors in New Orleans with Visible

As we previously mentioned, a venture fundraise oftentimes mirrors a traditional B2B sales and marketing funnel. Just as sales and marketing teams have dedicated tools to track their funnel, shouldn’t founders have dedicated tools to manage their most important asset – equity?

With Visible, you can track and manage every part of your fundraising funnel.

- Find investors at the top of your funnel with Visible Connect, our free investor database

- Add them directly to your fundraising pipeline directly in Visible

- Share your pitch deck and data room with investors in your pipeline

- Send updates to current and potential investors to keep them engaged with the progress of your business.

Take your investor relations to the next level with Visible. Give Visible a try for free.

Frequently Asked Questions

What makes New Orleans venture capital different from larger startup hubs?

New Orleans venture capital is relationship-driven with smaller average check sizes and a strong focus on traction, revenue discipline, and sound unit economics. Founders benefit from SSBCI-backed programs, university ties, and local partners who de-risk deals and syndicate with Gulf Coast and Southeast investors. Accelerators and pilots help shorten diligence.

How can a New Orleans startup build an investor pipeline efficiently?

Start by mapping SSBCI participants, New Orleans venture capital firms, and ecosystem funds aligned to your stage and sector. Prioritize five to eight targets, pursue warm introductions via mentors and alumni, and leverage Visible Connect to track outreach. Share concise updates, proof points, and a simple data room to keep momentum with regional co-investors.

Which New Orleans venture capital firms are actively investing in startups?

Active firms include LongueVue Capital, Camelback Ventures, Future Factory, and New Orleans BioFund. Each targets distinct stages and sectors, from middle market growth to early-stage and biotech-focused financing. Use firm theses, check sizes, and portfolio patterns to ensure a match, then pursue warm intros through local programs, accelerators, and university networks.

How do SSBCI programs support New Orleans startup fundraising?

Louisiana’s SSBCI programs deploy up to $113 million through equity co-investments, loan participation, and credit initiatives. In New Orleans, founders often access these resources via university, nonprofit, and local fund partners that assist with diligence, customer pilots, and co-investment. SSBCI helps bridge from local validation to larger seed rounds.

What are the best networking events and coworking spaces for founders in New Orleans?

Top touchpoints include New Orleans Entrepreneur Week for investor meetings, university startup nights at Tulane, UNO, and LSU Health for talent and early angels, and Idea Village mentor events. Coworking hubs like The Shop at the CAC, Propeller, and The Warehouse provide visibility, warm introductions, and a professional venue for fundraising conversations.

What is the fundraising playbook for a New Orleans startup at pre-seed or seed?

Secure a credible local pilot or LOI before formal seed outreach, then target a tight list of SSBCI-aligned and ecosystem funds. Leverage Techstars Louisiana and non-dilutive grants to hit clear proof points. Maintain a clean data room with monthly financials, pipeline, customer references, and any regulatory plans to speed investor diligence.