Raising venture capital for an e-commerce startup in 2025 is both more challenging—and more promising—than ever before. The global e-commerce market is projected to reach USD 73.52 trillion by 2030, growing at a compound annual growth rate (CAGR) of about 19.2 percent, fueled by rapid adoption of AI-driven retail technology, the explosive growth of social commerce platforms like TikTok Shop, and increasing cross-border buying habits.

Yet with these opportunities come new challenges: investors are becoming more selective in the wake of tighter capital markets, competition is intensifying across borders, and customer acquisition costs remain at historically high levels.

For founders, navigating this evolving investment landscape means more than knowing your financial metrics—it requires understanding current fundraising trends, identifying the right venture capital partners, and positioning your business to thrive in multiple markets. Whether you’re launching a DTC brand in Europe, building a B2B e-commerce platform in Southeast Asia, or scaling a marketplace in North America, securing the right funding at the right time can be the deciding factor in your long-term success.

This guide compiles the top venture capital firms actively investing in e-commerce startups globally—sourced from our connect investor database and reports – alongside e-commerce-specific fundraising strategies, pitch tips, and global networking resources. Backed by up-to-date research, this is your go-to playbook for raising capital and scaling your e-commerce venture.

Top VCs Investing in E-commerce Startups

Imag/nary Ventures

About: Founded by Natalie Massenet and Nick Brown, Imaginary Ventures is venture capital firm that invests in early–stage opportunities at the intersection of retail and technology in Europe and the US.

Ascend

About: Ascend is the most active pre-seed venture capital fund in the Pacific Northwest.

Thesis: Pre-seed investor in marketplace, consumer brands, E-commerce, and B2B software.

14W

About: 14W is a venture capital firm specializing in consumer internet, marketplace, E-commerce, CPG, and media.

RevTech Ventures

About: RevTech Ventures is a venture capital fund with a focus of early-stage investments at the intersection of retail and technology. We make dozens of small, initial investments, with larger follow-on investments in those companies that demonstrate rapid growth and sustainable advantage. We provide year-round content and support led by our managementteam and our large pool of world-class mentors.

Thesis: We invest in technologies and concepts that help the retail industry adapt in the age of Amazon.

Mu Ventures

About: Early stage venture capital investing in the future of commerce.

Thesis: Investing where Vertical AI meets Agentic Commerce. Powering the next era of frictionless transactions.

- Commerce infrastructure

- Vertical AI and marketplaces

- Consumer software, AI-native brands

1984 Ventures

About: 1984 Ventures is an early-stage venture capital firm proptech, fintech, healthcare, marketplace, SaaS, e-commerce, and consumer.

Thesis: Looking for companies from pre-revenue to 100k+ in MRR

Act One Ventures

About: Seed stage fund focused on enterprise software and research from LA Universities. We believe in community, diversity, and Los Angeles.

Sweetspot check size: $ 1M

Thesis: Investing in capital-efficient companies with excellent founder-market fit

AppWorks

About: Based in Taiwan, AppWorks is the largest startup accelerator in Greater Southeast Asia and one of the region's most active early-stage VCs.

Detroit Venture Partners

About: Detroit Venture Partners is an American venture capital firm that funds seed- and early-stage technology companies.

Sweetspot check size: $ 250K

Thesis: Detroit Venture Partners is an American venture capital firm that funds seed- and early-stage technology companies.

Harlem Capital

About: Harlem Capital is an early-stage venture firm that invests in post-revenue tech-enabled startups, focused on minority and women founders.

Sweetspot check size: $ 750K

Traction metrics requirements: Post product ($6k+ MRR pref)

Thesis: Women or POC founders (no deep tech, bio, crypto, hardware)

Global E-Commerce Resources, Accelerators, and Networking Opportunities

While capital is crucial, access to the right networks, mentorship, and market entry opportunities can be just as valuable for e-commerce founders. The global ecosystem offers a wide range of accelerators, incubators, events, and communities designed to help founders refine their business models, connect with investors, and scale internationally.

Leading Global Accelerators and Programs for E-Commerce Founders

- Y Combinator — While not exclusively focused on e-commerce, Y Combinator has backed multiple category-defining companies like Stripe and DoorDash. Its global reach, network, and investor access make it a strong launchpad for founders with scalable e-commerce models.

- Techstars — Techstars runs retail and commerce-focused accelerators in partnership with major corporations, offering mentorship and early-stage investment. One being Techstars Future of E-commerce Powered by eBay Announces Inaugural Cohort.

- Plug and Play — Based in Silicon Valley with offices worldwide, this program connects startups with global brands and investors in retail, logistics, and digital commerce.

- 500 Global — Known for its extensive international network, 500 Global supports cross-border e-commerce ventures with an emphasis on market expansion.

- Chinaccelerator — Specializes in helping international startups enter the Chinese market, which is the largest e-commerce market in the world.

Key Industry Events and Conferences

- Shoptalk — A leading global retail and e-commerce conference held in the US and Europe, focusing on innovation, technology, and consumer trends (shoptalk.com).

- NRF Retail’s Big Show — Hosted in New York, this event draws global retail leaders and showcases the latest in commerce technology (nrf.com).

- eTail — Regional editions in North America, Europe, and Asia-Pacific cover actionable insights on omnichannel strategy and scaling online sales (etail.com).

- Seamless — A major fintech, payments, and e-commerce event held across multiple continents, including the Middle East, Africa, and Asia (terrapinn.com).

International Funding and Cross-Border Considerations

- Investor Syndicates and Platforms — Platforms like our connect investor database allow founders to raise from a global base of investors.

- Cross-Border Logistics Partners — Success in international expansion often depends on partnerships with logistics leaders like DHL, Maersk, or SF Express, which can reduce delivery times and costs.

- Regulatory Compliance — Be prepared to address international data privacy regulations (e.g., GDPR, PDPA) and import/export rules during investor discussions. Demonstrating compliance readiness can give investors confidence in your scalability.

Podcasts and Communities Tailored to E-Commerce Founders

- E-commerce Fuel: Hosted by Andrew Youderian, this podcast delivers weekly insights from seasoned store owners, including real numbers and growth strategies. It’s part of the broader eComFuel community, known for data-driven discussions and annual research reports.

- Down to Chat (DTC): Cody Plofker and Eli Weiss dive into DTC strategies spanning paid acquisition, retention tactics, and actionable growth playbooks from successful e-commerce founders.

- 9-Figure Operators: Hosted by founders of multi-million-dollar brands (e.g., HexClad, Ridge Wallet), this show features candid discussions about scaling, economic headwinds, and operational decision-making.

- Honest E-commerce: Chase Clymer interviews merchants who share real-life lessons—including CAC figures and near-bankrupt campaigns—making this a refreshingly transparent podcast.

- The E-commerce Playbook: A data-rich podcast by Common Thread Collective’s Taylor Holiday and Richard Gaffin, offering metrics-driven strategies for ROAS, attribution models, and more.

- Beyond the Inbox: Presented by The Drip Team, this podcast explores email automation, abandonment recovery, and actionable sequences with real conversion data—ideal for founders focused on retention.

- E-commerce Conversations: Hosted by Beardbrand’s Eric Bandholz, this weekly show delivers interviews with e-commerce entrepreneurs that dive into the true realities of building online businesses.

- The E-commerce Coffee Break: Targeted at Shopify merchants, this podcast provides actionable marketing and conversion tips tailored to growing online stores.

Newsletters That Keep E-Commerce Founders Ahead

- In The Snow: Founder-led newsletter packed with DTC and performance marketing wisdom—especially on Meta, TikTok, and AI-driven advertising tactics.

- The Operators: Provides deep, founder-level interviews and operational playbooks from top e-commerce operators—think strategies that don’t make it into Twitter threads.

- Driving Influence: Focuses on AI, culture, and commerce—highlighting how brands can adapt in an evolving digital-first landscape.

- Modern Retail: Sharp editorial coverage on commerce evolution, platform changes, and retail innovation, especially useful for digital-first brands.

- DTC Newsletter: Daily dose of growth-focused content for DTC founders—creative testing, CRO strategies, ad performance breakdowns, and toolkits.

- Retail Brew (by Morning Brew): A tri-weekly roundup of retail and e-commerce trends, insights, and news delivered in an engaging, easy-to-digest format.

- Digital Commerce 360: Offers daily, weekly, or monthly updates on B2B and retail e-commerce news—complete with topic-specific alerts in logistics, tech, and global commerce.

- Chase Dimond’s E-commerce Newsletter: Every Monday, receive tactical email marketing insights—from copywriting to campaign strategies—straight from an expert practitioner.

- Shopifreaks: Newsletter with over 13,000 subscribers, covering strategy, partnerships, platform insights, seed rounds, and industry developments across Shopify, Amazon, and more.

Additional Resource from Shopify: 27 Retail News Sites & Newsletters to Follow

E-commerce Fundraising Trends & Insights

Raising capital for an e-commerce startup in 2025 requires more than a compelling product and growth story. Investors are navigating a market shaped by rapid technological change, evolving consumer behaviors, and tighter capital conditions. For founders, staying competitive means understanding the forces driving VC interest, adapting to new investment criteria, and positioning their companies for long-term sustainability.

Macro Trends Driving E-commerce Investment

AI-powered retail tech and intelligent tools: AI is reshaping e-commerce operations from the ground up. Startups are using AI for inventory optimization, demand forecasting, product recommendations, and dynamic pricing strategies. Investors are prioritizing companies that integrate AI into their core offerings rather than as an add-on feature, as these solutions often deliver measurable operational and revenue impact.

Social commerce and creator-led marketplaces: Platforms such as TikTok Shop, Instagram Shopping, and other video-first marketplaces are driving a shift from search-led to discovery-led buying. Creator partnerships allow smaller brands to scale without heavy upfront ad spend, making social commerce one of the fastest-growing channels for customer acquisition in 2025.

Logistics, local fulfillment, and micro-warehousing: Consumers increasingly expect same-day or next-day delivery, pushing demand for decentralized fulfillment networks. Startups offering micro-warehousing, cross-border logistics optimization, and regionally adaptive supply chains are gaining traction with investors who see logistics as a critical enabler of global E-commerce expansion.

Investor Expectations Have Shifted

Profitability or a clear path to profitability: The growth-at-all-costs era has given way to disciplined scaling. Investors now expect founders to show a roadmap to profitability, supported by strong unit economics, efficient operations, and realistic growth projections.

Preference for SaaS-style revenue models: Recurring revenue, low churn, and predictable cash flow have become more appealing to VCs than purely transactional business models. E-commerce infrastructure providers, subscription platforms, and hybrid SaaS-commerce businesses stand out for their scalability and margin potential.

How Founders Can Stay Ahead

Founders can increase their fundraising success by aligning with the trends and investor preferences shaping the market. This includes focusing on contribution margins, retention rates, CAC payback periods, and overall capital efficiency. Demonstrating durability—whether through resilient supply chains, consistent demand, or market adaptability—is essential. Building a first-party data strategy is also critical as privacy changes and rising ad costs make third-party data less reliable. Above all, investors want to hear a scalable vision that connects market opportunity with platform potential, network effects, and long-term leadership.

Pitching to E-Commerce VCs: Sector-Focused Tips

Raising venture capital in today’s e-commerce landscape means proving that your business can scale profitably, adapt to shifting consumer behaviors, and leverage technology as a competitive advantage. While general pitch advice applies, e-commerce founders need to tailor their approach to address the nuances of this sector and the current investor mindset.

Craft a Compelling Narrative

Your pitch should quickly convey what makes your business stand out in a crowded market. This is more than describing your product—it’s about framing your company as the solution to a high-value, urgent problem. Examples include:

- Reducing logistics friction in a fast-growing market.

- Delivering AI-driven personalization for niche consumer segments.

- Enabling B2B e-commerce in emerging economies.

By anchoring your story in a real, validated pain point, you position your startup as a must-have, not a nice-to-have.

Showcase the Right Metrics

Investors in e-commerce are increasingly data-driven. Go beyond top-line revenue and present the numbers that matter for sustainable growth:

- Customer lifetime value (CLTV) to customer acquisition cost (CAC) ratio.

- Retention and repeat purchase rates.

- Contribution margin and gross margin trends.

- CAC payback period.

Including these metrics in your deck demonstrates both operational understanding and investor alignment.

Demonstrate Global Readiness

E-commerce is inherently global, and cross-border opportunities are expanding. Show how your product, logistics, payments, and compliance strategies support entry into new markets. Highlight any localization efforts—such as language, currency, and regional fulfillment—that make your business adaptable and competitive internationally.

Tailor the Deck for E-Commerce

While every pitch deck should cover the essentials (problem, solution, traction, market, team, financials), e-commerce decks benefit from added depth in certain areas:

- Detailed unit economics with a path to profitability.

- Market behavior insights specific to your target geography or niche.

- Your technology stack and how it supports scalability (e.g., automation, AI, micro-fulfillment).

- Partnerships with marketplaces, logistics providers, or payment platforms.

Anchor with Platform or Infrastructure Value

If you’re building a marketplace or infrastructure tool, emphasize the network effects and scalability potential. Show data that illustrates growing engagement between buyers and sellers, increasing GMV (gross merchandise value), and any early signs of defensibility, such as exclusive supplier relationships or proprietary technology.

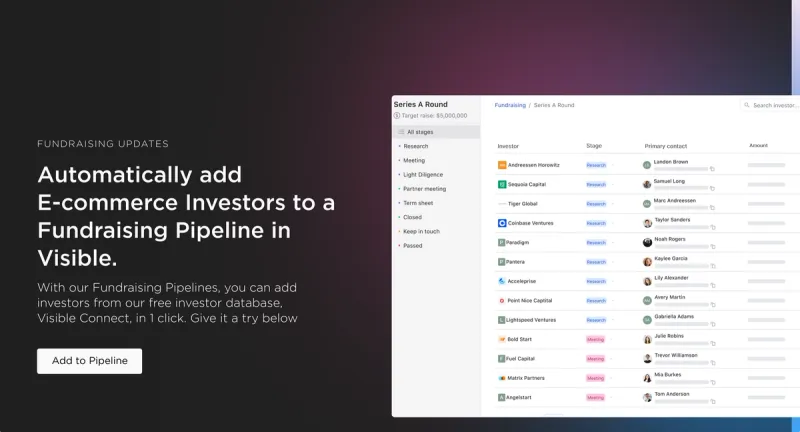

Find VCs Investing in E-commerce Companies with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in E-commerce here.

For E-commerce startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the E-commerce sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.