Key Takeaways

-

Fundraising in 2026 demands a flight to quality strategy. While overall funding has stabilized at $6.79 billion, capital is concentrating in late-stage rounds and Deep Tech sectors, meaning seed-stage founders must demonstrate clear unit economics over growth-at-all-costs metrics.

-

Fundraising in 2026 demands a flight to quality strategy. While overall funding has stabilized at $6.79 billion, capital is concentrating in late-stage rounds and Deep Tech sectors, meaning seed-stage founders must demonstrate clear unit economics over growth-at-all-costs metrics.

-

The Series B Crunch is the new valley of death. A severe bottleneck has emerged between Series A and B, requiring founders to secure roughly 24 months of runway and prove profitability before unlocking growth capital from risk-averse investors.

-

Top-tier investor access requires targeted selection. We have curated a list of the 15 most active VC firms for 2026, including Peak XV and East Ventures, distinguishing between zombie funds and those actively deploying capital into AI, SaaS, and climate tech.

-

Non-dilutive resources are critical for early survival. Beyond venture capital, founders should leverage high-value 2026 programs like the AI Accelerate grant (up to S$1.2M) and equity-free support from Google for Startups to extend runway without sacrificing equity.

Fundraising is difficult regardless of your location, but the energy in Southeast Asia right now is distinct. While many global markets are still recovering from the liquidity crunches of recent years, this region has quietly decoupled from the downturn. We are witnessing a shift from the speculative "tourist capital" of the early 2020s to a new era of disciplined, high-conviction funding.

The ecosystem here has matured rapidly. We are no longer seeing funding rounds driven solely by potential user growth or copycat business models. The market is now defined by second-generation founders building resilient companies with clear paths to profitability. Investors here have deep liquidity, but their standards for due diligence and business fundamentals have never been higher.

Navigating this landscape requires more than just a good pitch deck. You cannot copy and paste a Silicon Valley fundraising strategy into this region. Southeast Asia is a fragmented map of varying regulations, cultural nuances, and investor expectations that shift significantly once you cross a border.

This guide serves as your strategic roadmap to that complexity. We have stripped away the noise to provide you with a vetted list of active investors, a breakdown of regional incentives, and the specific resources you need to close your round. Here is how to navigate the Southeast Asian capital markets this year.

The Southeast Asia Fundraising Landscape in 2026

Southeast Asia's startup funding in 2025–2026 tells two contradictory stories simultaneously. On the surface, the region is recovering: total startup funding reached $6.79 billion across 335 equity rounds in 2025, representing a 14% increase from 2024. The first half of 2025 saw $2 billion deployed, a modest 7% year‑over‑year increase that signals tentative stabilization after years of contraction.

But beneath these headline numbers lies a fundamentally transformed capital allocation: late‑stage funding surged 140% in H1 2025 compared to H2 2024, reaching $1.4 billion, while seed‑stage funding collapsed by 50% to just $50.7 million and early‑stage funding dropped 27% to $167 million.

This is not a recovery in the traditional sense; it is a reallocation. Investors are concentrating capital into fewer, larger bets on companies with proven business models, while early‑stage founders face a dramatically tighter environment.

By the first nine months of 2025, seed‑stage funding had fallen to just $110 million, down 72% from $386 million a year earlier, and the total number of equity deals closed in H1 2025 reached only 229, the weakest level in over six years.

This shift reflects what industry observers call an "ecosystem maturity" trend, where prominent investors, including East Ventures, 500 Global, and Wavemaker Partners are recalibrating their investment theses toward growth‑stage winners rather than speculative early bets.

The concentration of mega‑deals further illustrates this phenomenon. In fintech alone, historically Southeast Asia's dominant sector, three transactions (Thunes $150M Series D, Airwallex $150M Series F, and Bolttech $147M Series C) accounted for over half of all fintech funding in the region during H1 2025, even as the sector as a whole saw a 31% increase to $776 million. This pattern repeats across sectors: capital is flowing upward and inward, concentrating in later rounds and fewer companies, leaving founders at the seed and Series A stage to navigate a fundamentally different fundraising playbook than their predecessors.

Active VC Firms Investing in Southeast Asia 2026

500 Startups Vietnam

500 Startups Vietnam is a US$14 million fund to invest in promising Vietnam-connected startups.

AVV (fka Ascend Vietnam Ventures)

Early stage venture capital fund investing in the growth of Southeast Asia

FEBE Ventures

FEBE Ventures, acronym for “For Entrepreneurs, By Entrepreneurs,” is a global seed-focused venture capital firm led by a team of ex-founders who have collectively built more than 30 companies and backed ~200+ startups.

We champion people, not geos or sectors. We partner with action-oriented entrepreneurs globally, from day one, with a particular focus on B2B marketplaces, B2B software, AI, health, and sustainability. But we’re open to discovering new business innovations—founders know best.

Forge Ventures

Forge Ventures is a seed-stage venture capital firm that partners with founders building the future in Southeast Asia. We invest with high conviction, leading seed and pre-seed financing rounds and working hand-in-hand with founders to get from zero to one. We provide access to experts across every sector and function through our network of collaborators, advisors and limited partners.

1337 Ventures

1337 is a technology accelerator and early stage venture capital focused on doing pre-seed and seed stage investments in Malaysia.

Jungle Ventures

Jungle Ventures is a Singapore-based Venture Capital Firm that invests in and helps build tech category leaders from Asia.

Kadan Capital

Kadan Capital is an early-stage VC firm investing proprietary capital in industry-defining startups in Fintech and AI in Asia and beyond.

Monk's Hill Ventures

Monk’s Hill Ventures is a venture capital fund investing in post-seed stage tech startups in Southeast Asia.

M Venture Partners (MVP)

M Venture Partners (MVP) is deeply committed to driving positive change. We actively seek out visionary founders throughout India and Southeast Asia who are driven not just by outsized success but by a profound commitment to improving lives and the world we inhabit.

Beenext Capital

BEENEXT is a venture capital firm investing in startups from India, Southeast Asia, Japan, and USA.

Techstars Singapore

The Eastern Pacific Accelerator powered by Techstars, based in Singapore, is the world’s first global MaritimeTech accelerator.

Peak XV Partners (formerly Sequoia India & SEA)

About: The deepest pockets in the region. Since rebranding, they have doubled down on early-stage AI, SaaS, and deep tech. If you are building a platform with global ambitions from Day 1, this is your first stop.

East Ventures

About: Founded in 2009, East Ventures is an early-stage sector-agnostic venture capital firm. The firm has supported more than 170 companies in the Southeast Asian region that are present across Indonesia, Singapore, Japan, Malaysia, Thailand, and Vietnam.

Founder Resources: Accelerators, Incubators & Networks in 2026

The "Big Three" Accelerators: Surge, Iterative & Antler

In Southeast Asia, acceptance into one of these three programs is often viewed by downstream investors as a preliminary due diligence check.

- Iterative (The "Y Combinator of SEA"):

- Focus: Operations and growth. Founded by the creators of Lazada, this program is less about "demo day theater" and more about fixing your retention cohorts and unit economics.

- Antler (The "Day Zero" Specialist):

- Focus: Pre-seed and talent density. Antler is unique because you do not need a product or a co-founder to apply. Their "Residency" model is designed to help you find a co-founder and validate an idea in 10 weeks.

- Surge (In Collaboration with Peak XV):

- Focus: The "Gold Standard" for seed funding. Acceptance here typically comes with a check of up to $3M and instant regional validation.

Corporate & AI-Specific Programs (Non-Dilutive & Grants)

For technical founders, equity-free support is often more valuable than seed cash. The following programs for 2026 offer compute power and grant funding without taking a slice of your cap table.

- AI Accelerate (BLOCK71 x Microsoft):

- About: his is currently the most lucrative program for AI startups. It is a 10-week sprint designed to scale AI-first companies. Qualified startups can access up to S$1.2 million in grant funding (via the Startup SG Tech grant scheme) for Proof-of-Concept (PoC) and Proof-of-Value projects.

- Google for Startups Accelerator: AI First (Singapore):

- About: This is an equity-free program. It is specifically designed for startups where AI is the core product, not just a feature.

- Value Add: Selected startups get access to Google's internal AI sandbox and significant Cloud credits, which can offset the massive GPU costs that usually kill early-stage AI companies.

- UOB FinLab (GreenTech & AI):

- Focus: Best for B2B Fintech and Sustainability founders selling to enterprises.

- Value Add: Unlike traditional accelerators, FinLab focuses on commercial pilots. They connect you directly with UOB’s SME client base to test your product in the real world. Their 2026 "GreenTech Accelerator" is actively looking for solutions in energy efficiency and carbon tracking.

Essential Networking Events in 2026

- Money20/20 Asia (Bangkok):

- Dates: April 21–23, 2026.

- Why attend: This is the premier event for Fintech. If you are building in payments, lending, or crypto, this is where the regional bank executives and decision-makers meet. It is less about "pitching" and more about securing commercial partnerships.

- Echelon Singapore 2026:

- Dates: June 3–4, 2026.

- Why attend: Held at Suntec Singapore, this is the "town hall" of the SEA ecosystem. The 2026 edition features a dedicated "AI Workflow Competition" and an "SME Growth Track," making it ideal for founders looking for mid-tier VC exposure and press coverage.

- Tech Week Singapore:

- Dates: September 29–30, 2026.

- Why attend: This is for the "Hard Tech" founders. It co-locates events like Cloud & AI Infrastructure Asia and Big Data & AI World. If you are selling B2B infrastructure or enterprise SaaS, the buyers are here.

- Singapore FinTech Festival (SFF):

- Dates: November 18–20, 2026.

- Why attend: The largest gathering of its kind in the world. It is massive and chaotic, but it is the only place to meet global regulators and sovereign wealth funds in one venue.

Mapping Southeast Asia’s Startup Hubs

Investors often speak of Southeast Asia as a single block, but this is a dangerous simplification. The region spans diverse economies, including Singapore, Indonesia, Vietnam, Malaysia, Thailand, the Philippines, and frontier markets like Cambodia, Laos, and Myanmar. Each market operates with distinct languages, regulations, and levels of digital maturity.

Geographically, Singapore now dominates regional capital flows to an unprecedented degree. In the first half of 2025 it captured about 92% of Southeast Asia’s total startup funding and 88% of fintech funding, reflecting its role as the primary hub for venture capital, regulatory clarity, and regional headquarters, but also raising concerns about the depth and resilience of ecosystems in Indonesia, Vietnam, Malaysia, and Thailand.

At the same time, structural data on the broader landscape underlines how large the opportunity set has become: as of January 2026, Southeast Asia hosts roughly 149,000 startups, including about 14,700 funded companies that have collectively raised $291 billion, and has produced 51 unicorns across more than 12,800 recorded funding rounds.

Singapore

Singapore is the undisputed headquarters for capital and innovation in the region. It hosts 80 of the world’s top 100 tech companies and consistently ranks in the top 10 worldwide on innovation indices. The city-state acts as a magnet for global talent and high-tech manufacturing.

The capital concentration here is staggering. By the first half of 2025, Singapore captured approximately 92% of Southeast Asia’s startup funding and 88% of fintech funding. This underlines a critical reality for founders: most serious regional fundraises route through Singapore, even if your primary market and operations are elsewhere.

Indonesia

Indonesia offers the largest population in the region with over 270 million people and massive demand for digital services. It is home to major players like Gojek and Tokopedia and sees strong government backing for its digital economy. The IoT market was projected to reach significant volumes recently, supporting critical sectors like agriculture and manufacturing.

Despite these structural strengths, the funding environment has tightened significantly. Indonesia captured only about 8% of regional startup funding in H1 2025, a sharp drop from historical highs. The takeaway for founders is clear: the consumer upside is huge, but you may need to rely on Singapore-centred capital to fuel that growth.

Vietnam

Vietnam has solidified its position as the region’s third-largest startup ecosystem. With a young, tech-savvy population, Hanoi and Ho Chi Minh City have become major centres for software development. ICT contributed over 8% to the national GDP as early as 2021, creating a strong digital base.

The market remains resilient despite global headwinds. Vietnam raised approximately $529 million in 2023, with standout growth in healthcare and education funding. We are also seeing Vietnamese fintech and SaaS companies increasingly leading cross-border expansions into neighboring markets like Thailand.

Malaysia

Kuala Lumpur is growing as a hub for fintech, cybersecurity, and enterprise SaaS. The country boasts strong digital infrastructure with high broadband and cellular penetration rates. The National IoT Roadmap actively positions Malaysia as a regional hub, targeting a contribution of billions to the Gross National Income.

While fundraising volume lags behind Singapore and Indonesia, Malaysia offers unique advantages. Founders can access attractive public sector support and angel tax incentives, which are increasingly valuable in an era where seed funding is tight.

Thailand

Thailand continues to see strong growth in e-commerce and food delivery. Regional giants like Shopee and Grab dominate the landscape, but a local startup scene is rising to complement them. The government’s “Thailand 4.0” policy explicitly uses smart infrastructure as a lever for digital transformation.

Funding volumes here remain modest compared to the top-tier markets. However, the policy-driven demand in logistics and industrial IoT creates clear entry points. Founders building B2B or infrastructure-adjacent startups will find a receptive market here.

Philippines

Manila’s startup scene is maturing rapidly around outsourcing-enabled SaaS and fintech. The country benefits from strong English proficiency and a deep heritage in business process outsourcing.

The Philippines still captures a small slice of total regional capital. However, investors view it as a high-growth market for credit and fintech solutions. This is especially relevant as other markets like Indonesia face stricter regulatory caps on fintech lending.

Frontier Markets: Cambodia, Laos, and Myanmar

These smaller ecosystems are increasingly part of broader regional strategies rather than standalone targets. Founders here often rely on virtual accelerators for support. Programs like Sramana Mitra / 1Mby1M provide remote mentorship and curriculum specifically designed to serve founders in these developing markets.

Investors typically access these geographies via regional platform bets. A logistics or fintech player expanding outward from a major hub is the most common route for capital to reach these borders.

The Regional Reality: Singapore as Hub, Rest as Engines

The data paints a clear picture of the current landscape. Singapore provides the capital, headquarters, and regulatory clarity. Indonesia and Vietnam offer population scale and manufacturing upside. Malaysia, Thailand, and the Philippines provide policy-driven niches and rising local capital.

The centralization of capital is undeniable. With Singapore capturing 92% of funding, while Indonesia and Vietnam combined account for roughly 14% of the remainder, your strategy must be split. You need to decide where to incorporate, where to build, and where to fundraise. These three answers are often different.

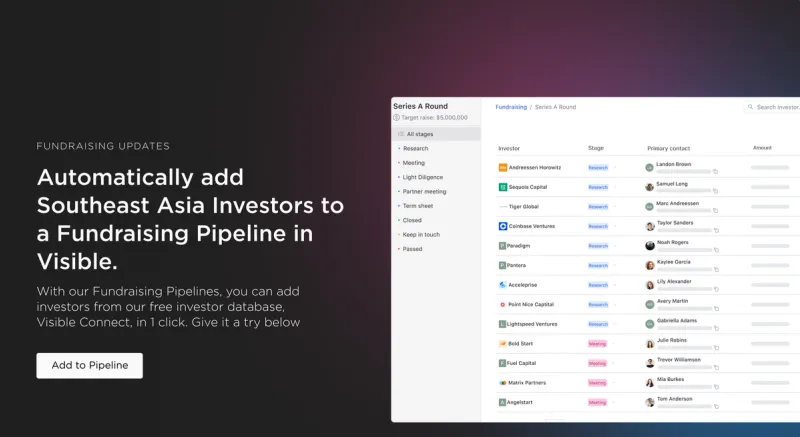

Connect With Investors in Southeast Asia Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of investors.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

Frequently Asked Questions

What is the outlook for startup fundraising in Southeast Asia in 2026?

The market has stabilized with $6.79 billion raised recently, but capital distribution is uneven. While late-stage funding surged by 140%, seed-stage funding dropped by 50%. Investors are prioritizing profitability and Deep Tech over growth-at-all-costs models, making 2026 a flight to quality market for founders.

Why do most Southeast Asian startups incorporate in Singapore?

Singapore acts as the region's financial hub, capturing 92% of all startup funding in early 2025. Investors prefer its regulatory clarity and established legal framework. Even if your primary operations are in Indonesia or Vietnam, a Singapore holding company is often a prerequisite for securing regional venture capital.

Which sectors are attracting the most venture capital in Southeast Asia?

Capital is rotating away from generic consumer e-commerce toward Artificial Intelligence, Climate Tech, and specialized Fintech. Active firms like Peak XV and Wavemaker Partners are deploying funds into startups with defensible technical moats and clear unit economics, rather than those relying solely on user acquisition and marketing spend.

What is the Series B Crunch in Southeast Asia's startup market?

This term refers to the severe bottleneck for startups trying to graduate from Series A to Series B. Investors now demand 24 months of runway and proven profitability before writing growth checks. Consequently, many startups with strong top-line growth but poor margins are failing to secure this critical financing.

Are there non-dilutive grants available for startups in Southeast Asia?

Yes, particularly for technical founders. Programs like the AI Accelerate (by BLOCK71 and Microsoft) offer up to S$1.2 million in grant funding for proof-of-concept projects. Additionally, founders can access equity-free support and compute credits through corporate initiatives like the Google for Startups AI First accelerator.

Is the IPO market open for Southeast Asian tech companies in 2026?

The exit window is reopening, with analysts projecting roughly 150 to 170 new listings in 2026. However, public markets have shifted focus from growth to value. Unlike the 2021 boom, successful listings now require a track record of net income, making secondary sales a more common liquidity option for early employees.