South Carolina's startup scene is rapidly becoming a vibrant hub for innovation and entrepreneurship. With a lower cost of living, access to top talent from universities like Clemson and the University of South Carolina, and a supportive community, South Carolina offers unique advantages for founders looking to build and scale their ventures. As investor interest surges, navigating the fundraising landscape can be a daunting task.

This article is your guide to the top venture capital firms actively investing in South Carolina startups. We'll provide insights into their investment focus, and you can check out their profiles to learn more about what they look for in the startups they invest in. Beyond the list of top VCs, we'll also get into the current ecosystem trends, key networking opportunities, and local resources available to South Carolina founders.

Top VCs in South Carolina

IDEA Fund Partners

About: As one of the most active early-stage investment firms in the Southeast, we seek to serve the underserved through capital and guidance.

Sweetspot check size: $ 750K

Traction metrics requirements: $0 - 2 million of revenue

Thesis: As one of the oldest and most active early-stage investment firms based in the Southeast, our investment philosophy has been honed from years of experience. We fund entrepreneurs who are applying technology and business model innovations to industries in the earliest stages of digital disruption with an emphasis on underserved places and stages.

VentureSouth

About: VentureSouth is an early stage venture firm that operates angel groups and funds in the Southeast.

Thesis: We fund early stage ventures in the southeast.

Good Growth Capital

About: Early stage VC firm known for its exceptional expertise in finding, cultivating and assessing complex science and deep-tech start-ups.

Azalea Capital

About: Azalea Capital partners with entrepreneurs, management teams, and family-owned companies with revenues of at least $10 million. We provide growth capital, operating expertise, and industry experience to significantly enhance the long-term value of our investments.

Thesis: Azalea is a pro-active investor with a defined value creation strategy. In every investment, we partner with a proven industry executive to enhance our operationally focused approach. We invest in manufacturing, distribution, and business services companies in a variety of industries with a particular interest in the following sectors: -Consumer Products – Food, Pet, & Health & Wellness -Industrials.

Intersouth Partners

About: Intersouth is an early-stage venture capital firm that invests in technology and life science companies across the Southeast.

IAG Capital Partners

About: A private investment group focused on investing in early-stage technology-focused companies.

Thesis: IAG Capital Partners is a Venture Capital firm that leads rounds from Seed to Series C.

Alerion Ventures

About: Alerion Ventures is an evergreen venture capital firm focused on early-stage investments in scalable startups. Based in Charleston, SC, Alerion partners with entrepreneurs primarily in the Southeast.

Thesis: Alerion will consider companies in a variety of industries, so long as they are capital-efficient and are targeting markets that will allow for substantial scale and return-on-investment. Primary areas of interest include business-to-business software and technology-enabled services and, more selectively, healthcare software and services and energy-efficient technologies. Alerion will not consider consumer-facing companies, drug discovery, medical devices, energy production, or project finance opportunities.

The South Carolina Startup Ecosystem

Current State and Growth of the Ecosystem

South Carolina’s startup ecosystem is experiencing robust growth, with new ventures emerging across the state and attracting increasing attention from investors. In 2025, SC Biz News highlighted 20 standout startups launched within the past five years, spanning industries from technology and life sciences to retail and lifestyle. These companies are recognized for their innovation, rapid growth, and impact on the local economy, signaling a maturing and vibrant entrepreneurial landscape in the Palmetto State.

Key Industries Driving Innovation

The most active sectors among South Carolina startups include manufacturing technology, logistics, health innovation (notably mental health), agriculture, and financial services. Many of these companies serve both regional and national markets, leveraging South Carolina’s strategic location and business-friendly environment to scale their operations.

Advantages of Building a Startup in South Carolina

South Carolina offers several unique advantages for founders:

- Lower Cost of Living and Operations: Startups can stretch their capital further, allowing for more investment in growth and talent.

- Access to Talent: The state is home to top universities such asClemson University, the University of South Carolina, and Furman University, which produce a steady pipeline of skilled graduates.

- Supportive Community: The startup culture in South Carolina values collaboration, mentorship, and long-term relationships, making it easier for founders to find support and guidance.

- State and Local Support: Programs like the South Carolina Department of Commerce’s Relentless Challenge and StimulateSC grants provide funding and resources to foster innovation statewide.

Recent Success Stories

Recent years have seen several South Carolina startups achieve significant milestones, including major funding rounds and successful exits. Companies like Proterra (electric vehicle technology), Kiyatec (biotech), and MoonClerk (fintech) exemplify the state’s capacity to nurture high-growth ventures.

In addition to these established names, SC Biz News has highlighted 20 promising startups to watch in 2025, spanning technology, lifestyle, and life sciences. These honorees are recognized for their innovation, growth, and impact. They are celebrated in the annual “In the Lead: Best Startup Businesses” feature and awards ceremony, further showcasing the state’s vibrant entrepreneurial landscape.

Local Resources and Networks for South Carolina Startups

Startup Support Organizations

- South Carolina Research Authority (SCRA): Provides funding, mentorship, and infrastructure support for early-stage companies. SCRA’s SC Launch program is a major source of seed capital and commercialization support for local startups.

- Universities and Innovation Centers:

- Clemson University Center for Entrepreneurship and Innovation: Offers incubator space, mentorship, and access to student talent.

- University of South Carolina Office of Innovation, Partnerships, and Economic Engagement: Provides accelerator programs, research partnerships, and commercialization support.

- Medical University of South Carolina (MUSC) Innovation Center: Focuses on health tech and biotech startups, offering lab space and funding opportunities.

- Incubators and Accelerators:

- NEXTGen: Greenville-based incubator and accelerator providing workspace, mentorship, and investor connections.

- Charleston Digital Corridor: Offers coworking, accelerator programs, and tech-focused networking in Charleston.

- Beaufort Digital Corridor: Supports tech startups in the Lowcountry with workspace, events, and mentorship.

- Founder Institute South Carolina: Global accelerator with a local chapter, providing structured programs for early-stage founders.

- Angel Networks:

- VentureSouth: One of the most active angel investment groups in the Southeast, with a strong presence in South Carolina.

- Coworking Spaces:

- SOCO: Collaborative workspace in Columbia, SC, with a strong community of founders and creatives.

- Atlas Local: Flexible workspace and networking hub for Greenville entrepreneurs.

Key Networking Events and Opportunities

- StartupGVL Events: Regular meetups, pitch competitions, and bootcamps in Greenville, connecting founders, investors, and mentors.

- Tech After Five: Monthly networking events for tech professionals and founders in multiple South Carolina cities.

- TechStars Startup Weekend: 54-hour events where entrepreneurs, developers, and designers collaborate to launch new startups.

- DIG SOUTH Tech Summit: The Southeast’s largest annual technology conference, held in Charleston, featuring speakers, panels, and networking for founders and investors.

- SCBIO Annual Conference: Focused on life sciences and biotech, this event brings together founders, investors, and industry leaders.

- South Carolina Business Review and Local Chambers of Commerce: Regularly host business expos, pitch events, and networking mixers for entrepreneurs across the state.

Additional Local Resources for Founders

- South Carolina Department of Commerce – Innovation Office: Offers grants, business development resources, and connections to state programs for startups.

- South Carolina Small Business Development Centers (SBDC): Offers consulting, training, and funding guidance for startups and small businesses statewide.

- Local Meetups and Online Communities: Platforms like Meetup.com and LinkedIn host dozens of active groups for South Carolina founders, including industry-specific and city-based communities.

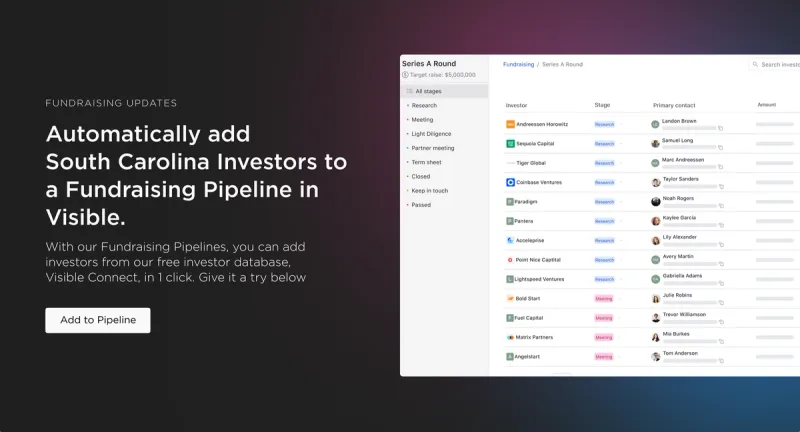

Connect With Investors in South Carolina Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of South Carolina's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.