Switzerland, renowned for its innovation, technological advancements, and entrepreneurial spirit, stands as a premier destination for startups and investors alike. The country's robust economy, world-class universities, and a business-friendly environment create a fertile ground for groundbreaking ventures.

For startup founders eyeing the Swiss landscape, understanding the venture capital ecosystem is paramount. This guide serves as your comprehensive, up-to-date resource on the top venture capital firms currently funding startups in Switzerland. In addition to the list, we also cover insights on navigating the Swiss startup scene and leveraging local resources.

Top VCs in Switzerland

Verve Ventures

About: Verve Ventures invests from EUR 500k to several million from Seed to Series B and beyond across Europe. Verve Ventures’ dedicated team helps companies with their most pressing needs such as hiring, client introductions and access to an expert network of high-profile individuals.

Sweetspot check size: $ 1.50M

Thesis: Investing in (deep -) technology and science-driven startups. Adding value through our exclusive network of investors.

Nextech Invest

About: Nextech is a global, cancer therapeutics-focused venture capital firm headquartered in Zurich, Switzerland. We focus almost exclusively on oncology therapeutics, and on helping to drive value creation for our portfolio companies. We invest in the most promising drug discovery companies with the potential to create multiple medicines. Our portfolio is focused throughout the US and Europe with investments from company inceptions to crossover rounds.

Vi Partners

About: VI Partners is a Swiss venture capital firm providing university spin-off's as well as other promising start-up companies with capital, coaching and networks. VI Partners is the advisor to multiple funds. The first fund was established by McKinsey & Company and the Swiss Federal Institute of Technology in Zürich (ETHZ) in 2001.

Spicehaus Partners

About: Spicehaus Partners AG is an independent Swiss venture capital investor. We focus on seed and early stage companies in the technology sector in Switzerland. We are hands-on investors and actively accompany our portfolio companies on their road to success.

Endeavour Vision

About: Endeavour Vision is a leading venture capital and growth equity advisory firm focusing on commercial-stage medtech and digital health companies. We support transformative healthcare technologies that provide superior clinical benefits for patients or bring significant efficiencies to health systems. Our team offers strategic and operational expertise and extensive international experience investing in companies in Europe and North America. We have a proven track record of successful exits with recently realized investments that include Relievant Medsystems, Vertiflex, and Symetis, as well as several IPOs. Endeavour Vision’s international investment teams are located in Geneva, Switzerland, Minneapolis, US and San Francisco, US.

Emerald Technology Ventures

About: Emerald is a globally recognized venture capital firm, founded in 2000, that manages and advises assets of over €1 billion from its offices in Zurich, Toronto and Singapore. The firm invests in start-ups that tackle big challenges in climate change and sustainability, with four current funds, hundreds of venture transactions and five third-party investment mandates, including loan guarantees to over 100 start-ups. Bold Ideas. Bright Future.

Momenta Ventures

About: Momenta is the leading Industrial Impact® venture capital firm, accelerating industrial innovators across energy, manufacturing, smart spaces, and the supply chain. For over a decade, our team of deep industry operators has helped scale industry leaders and innovators to improve critical industries, the environment, and people's quality of life.

Sweetspot check size: $ 1M

Seedstars International Ventures

About: Seedstars Capital is an alternative investment platform specialized in emerging markets. The platform incubates, accelerates and invests in first-time and emerging venture capital funds.

Sweetspot check size: $ 200

Swisscom Ventures

About: Swisscom Ventures is the corporate venture capital arm of Swisscom, that specializes in early stage tech investments.

Thesis: Swisscom Ventures invests in growth companies with emerging business models and technologies of strategic relevance to Swisscom's core business. As a value-add investor, Swisscom brings its investees the technicalexpertise and strategic insights of an incumbent telecom operator.

Swiss Startup Capital AG

About: Swiss Startup Group is a venture platform for scouting, building, accelerating, and investing in the most promising startups.

Sweetspot check size: $ 1M

Thesis: We are looking for leading tech entrepreneurs

TA Ventures

About: We are backing companies in Europe and North America at Seed – Series A, alongside high-profile co-investors, across a range of tech sectors, with a special interest in Digital Health, Mobility, Enterprise Software and IndustrialTech.

Sweetspot check size: $ 250K

Traction metrics requirements: No specific requirements

Blue Horizon

About: Blue Horizon is accelerating the transition to a Sustainable Food System that delivers outstanding returns for investors and the planet. The company is a global pioneer of the Future of Food. As a pure play impact investor, Blue Horizon has shaped the growth of the alternative protein and food tech market. The company invests at the intersection of biology, agriculture and technology with the aim to transform the global food industry. Blue Horizon was founded in 2016 and is headquartered in Zurich, Switzerland. To date, the company has invested in more than 70 companies. Its business model offers an attractive opportunity to invest in the evolution of the global food system while contributing to a healthy and sustainable world. www.bluehorizon.com

Thesis: Financial performance paired with an attractive risk-return profile and tangible impact.

DART Labs & Ventures

About: DART Labs is an Incubator for teams that build technologies for a more human future.

Sweetspot check size: $ 250K

Thesis: We accelerate impactful European founders. We invest in breakthrough technologies that positively impact health and climate.

Kickfund

About: Kickfund exclusively invests in Swiss pre-seed and seed stage technology startups that have successfully completed the Venture Kick competition. Established in Luxembourg, the fund was initiated by supporters of the Swiss startup and innovation ecosystem.

FoodHack c/o HackVentures

Thesis: Investing globally from Stealth to Series A in companies that move the needle to a better people and planet (climate, health, food).

Sweetspot check size: $ 100K

Privilège Ventures

About: Privilège Ventures is a Swiss-based Venture Capital firm, authorized by the Swiss Financial Market Supervisory Authority (FINMA, www.finma.ch) as venture capital asset manager, investing in promising early-stage startups. With offices in Lugano, Zurich and Boston, we aim to support young founders on a mission to build the future. Our unique values derive from previous experiences as founders, entrepreneurs, operators and investors. We provide unceasing support, expertise, and valuable network access to help entrepreneurs forge ahead.

Sweetspot check size: $ 500K

Thesis: Agnostic seed stage fund across Europe with a focus in Switzerland. Don't invest in Biotech and Crypto.

Rewired.gg

About: Launched in summer 2017, Rewired is a deep-tech fund, investing in applied science and technologies that advance machine perception.

Thesis: We invest in applied science and technology ventures that can power the new economy whilst also doing good.

Quadia

About: Founded in 2010, Quadia specializes in direct impact investments, though equity, debt and funds. In line with its mission «we finance the solutions for a regenerative economy», Quadia targets companies which have positioned their business model and strategic development on products and services that contribute to a regenerative economy. These transformative companies operate in the areas of sustainable food, circular products & materials, and clean energy.. An internal impact management methodology is implemented by Quadia in collaboration with each portfolio company, allowing it to go beyond simple measurement of impact, promoting an environmental and social transition among all its stakeholders. Since its creation, Quadia has financed over 45 companies, projects and investment funds for the equivalent of EUR 220 million.

Sweetspot check size: $ 3.50M

Why Switzerland? Understanding the Swiss Startup and Venture Capital Ecosystem

Switzerland consistently ranks among the world’s most innovative countries, earning top positions in the Global Innovation Index for over a decade. This reputation is built on a foundation of strong economic fundamentals, political stability, and a high quality of life—factors that make Switzerland a magnet for ambitious founders and investors.

World-Class Innovation and Talent Pipeline

Thanks to its world-class universities (ETH Zurich, EPFL) and research institutions, Switzerland consistently ranks at the top of the Global Innovation Index. These institutions are not just talent factories—they actively support spin-offs and technology transfer, making it easier for founders to access technical expertise and early-stage support. Founders should leverage university incubators, such as ETH’s Entrepreneurship Lab and EPFL’s Innovation Park, for mentorship, lab space, and networking with investors and corporate partners.

Key Sectors and Funding Trends

The Swiss startup scene is especially strong in healthtech, fintech, deep tech, and sustainability. In 2024, healthtech startups attracted over CHF 1.2 billion in funding, with AI-driven diagnostics and personalized medicine leading the way. Fintech startups raised CHF 800 million, benefiting from Switzerland’s regulatory clarity and global financial reputation. Green tech and sustainability-focused startups secured CHF 900 million, driven by national strategies like Energy Strategy 2050 and a strong ESG investment culture.

Tip: Founders in these sectors should target specialized VCs and government grants (e.g., Innosuisse), and participate in sector-specific accelerators such as Kickstart Innovation (Zurich) and Venturelab (Lausanne).

Funding Environment and Investor Landscape

Despite a recent dip in total funding volume (CHF 2.3 billion in 2024, down 15% from 2023), Switzerland remains a magnet for both local and international investors. Early-stage investments surged by 35% in 2024, and the number of AI-focused deals doubled, reflecting strong investor appetite for innovation. Zurich, Geneva, and Lausanne are the main hubs, but Basel and Zug are rapidly emerging, especially for life sciences and blockchain.

Government Support and Local Resources

Switzerland’s government is highly supportive of startups. Innosuisse, the Swiss Innovation Agency, offers grants, coaching, and access to global networks. Programs like Switzerland Global Enterprise and the Swissnex Network help startups expand internationally. The government’s Health2030 and 2050 Energy Strategy provide additional funding and regulatory support for healthtech and green tech startups.

Tip: Apply early for Innosuisse coaching and grants, and leverage Swissnex for international market entry. Explore the Swiss Startup Radar for data-driven insights and ecosystem benchmarks.

Networking and Community

Switzerland’s startup community is highly collaborative, with regular events, pitch competitions, and industry meetups. Key events include Swiss Startup Days, Venture Leaders, and the Swiss Software Festival. These gatherings are essential for meeting investors, partners, and fellow founders.

Tip: Join local associations like Swiss Startup Association and Digital Switzerland for ongoing support and advocacy.

Regulatory Environment and Market Access

Switzerland offers a stable regulatory environment, strong IP protection, and easy access to European and global markets. However, founders should be aware of high operational costs and a relatively small domestic market. Regulatory requirements can be complex, especially in healthtech and fintech, so early legal and compliance advice is crucial.

Tip: Engage with local legal experts and industry associations early in your journey. Use government resources to understand visa, tax, and compliance requirements.

Current Challenges and Opportunities

While funding rounds and total investment volume have declined since 2022, the ecosystem remains robust, with a strong focus on AI, healthtech, and sustainability. Female founder participation is growing, especially in healthtech, but remains an area for improvement (14% of founders in 2024 were women, with the highest share in healthtech at 21%).

Tip: Female founders should explore dedicated programs and networks, such as Female Founders Initiative and Women in Tech Switzerland.

Key Networking Opportunities and Startup Events in Switzerland: Where Founders Meet Investors and Partners

Swiss Startup Days

Swiss Startup Days is one of the country’s flagship business and networking events, held annually in Bern. It brings together startups, investors, corporates, and enablers for a full day of pitching, workshops, and 1:1 meetings. Founders can apply to pitch, schedule meetings with investors in advance, and gain visibility through the event’s newcomer program.

Startup Nights

Startup Nights in Winterthur is Switzerland’s largest startup event, attracting over 8,000 participants, including founders, investors, and corporate partners. The two-day event features keynotes, hands-on workshops, a pitching competition, and extensive networking opportunities. Founders can showcase their startups, connect with investors, and join workshops to sharpen their skills.

Swiss Startup Association Events

The Swiss Startup Association organizes regular Founders Dinners, education sessions, and webinars across Switzerland. These events offer a relaxed atmosphere to meet fellow founders, learn from experts, and connect with investors. The association also hosts special events for female founders and scaleup executives.

Venturelab Events

Venturelab runs a comprehensive program of events, workshops, and international roadshows for Swiss startups. Highlights include the Venture Leaders program (with sector-specific tracks in fintech, biotech, and more), the TOP 100 Swiss Startup Award, and regular pitch events. These are excellent opportunities to gain exposure, receive feedback, and build investor relationships.

Startupticker.ch Event Calendar

Startupticker.ch maintains the most complete calendar of startup events, pitch competitions, and training sessions across Switzerland. Founders can filter by location, sector, and event type to find relevant opportunities, from local meetups to major conferences like Swiss Medtech Day and Energy Startup Day.

Local and Thematic Meetups

Regular pitch nights, investor lunches, and tech meetups are held in Zurich, Geneva, Lausanne, and other hubs. For example, Investor Connect: Pitch & Network Night Zürich and Startup Pitch & Networking Zürich are recurring events where founders can pitch and network with investors in an informal setting.

Accelerators, Incubators, and Co-Working Spaces

Many Swiss accelerators and incubators, such as Kickstart Innovation (Zurich), Tenity (fintech, Zurich), and EPFL Innovation Park (Lausanne), host demo days, open houses, and networking sessions. Co-working spaces like Impact Hub Zurich and Basel also organize community events and workshops, providing ongoing opportunities to connect with peers and mentors.

Online Communities and Associations

Joining organizations like the Swiss Startup Association, Digital Switzerland, and Women in Tech Switzerland gives founders access to exclusive events, advocacy, and peer support. Many of these groups also run online forums and Slack channels for ongoing networking.

Tip: Founders should build relationships with both Swiss and international VCs, attend major events like the Swiss Startup Days and use platforms like Startup.ch to track active investors and recent deals.

Resources and Support Systems for Startups in Switzerland

Government-Backed Support Agencies

- Innosuisse: Switzerland’s federal innovation agency, Innosuisse, is the first stop for many founders. It offers non-dilutive grants, personalized coaching, and access to internationalization programs. Innosuisse’s Startup Coaching program matches founders with experienced mentors, while its Innovation Projects fund R&D collaborations with universities and industry partners.

- Switzerland Global Enterprise (S-GE): S-GE helps startups expand internationally by providing market entry advice, export consulting, and access to a global network of business hubs. Their “GoGlobal” programs are especially useful for founders looking to scale beyond Switzerland.

- Swissnex: Swissnex connects Swiss startups with innovation hubs worldwide, offering soft-landing programs, networking events, and support for international partnerships. With offices in key global cities, Swissnex is a gateway for founders aiming for global reach.

Leading Accelerators, Incubators, and Innovation Parks

- Kickstart Innovation: Based in Zurich, Kickstart is one of Switzerland’s largest multi-corporate accelerators, focusing on deep tech, fintech, health, and sustainability. Startups benefit from pilot projects with corporate partners, mentorship, and access to funding.

- Tenity: Tenity is a global fintech and insurtech accelerator with programs in Zurich and beyond. It offers pre-seed and seed-stage support, industry connections, and demo days for investor exposure.

- EPFL Innovation Park: Located in Lausanne, this park supports high-tech startups, especially in life sciences, engineering, and digital. It offers office space, access to labs, and a vibrant community of researchers and entrepreneurs.

- Impact Hub: With locations in Zurich, Basel, Geneva, and Lausanne, Impact Hub provides co-working, community events, and startup programs focused on social innovation and sustainability.

Legal, Tax, and Regulatory Support

- Startup Desks and Advisory Services: The Swiss Startup Association offers Startup Desks covering legal, IP, finance, and regulatory topics, with free or discounted consultations for members. Many cantons also provide startup advisory services, helping with company formation, tax optimization, and compliance.

- Startup.ch: This platform provides a directory of Swiss startups, investors, and service providers, making it easy to find legal and financial advisors with startup expertise.

Funding Resources Beyond VCs

- Angel Networks: Groups like Swiss ICT Investor Club (SICTIC) and Business Angels Switzerland (BAS) connect early-stage founders with active angel investors. These networks host regular pitch events and offer hands-on support.

- Public Grants and Loans: Besides Innosuisse, many cantons and cities offer startup grants, innovation vouchers, and low-interest loans. Check your local economic development office for region-specific programs.

- Crowdfunding Platforms: Platforms like wemakeit and Swisspeers allow founders to raise funds from the public, often for product launches or early validation.

Directories, Toolkits, and Online Platforms

- Startupticker.ch: News, event calendars, and directories of awards, grants, and investors.

- Swiss Startup Association: Resource library, event listings, and advocacy for founders.

- Venturelab: Training, international programs, and pitch events for high-growth startups.

How to Combine These Resources for Maximum Impact

- Early Stage: Start with Innosuisse coaching, join a local incubator or Impact Hub, and attend pitch events to build your network.

- Growth Stage: Apply to accelerators like Kickstart or Tenity, leverage S-GE and Swissnex for international expansion, and seek angel or VC funding.

- Scaling: Use legal and tax advisory services to optimize your structure, and tap into public grants or crowdfunding for non-dilutive capital.

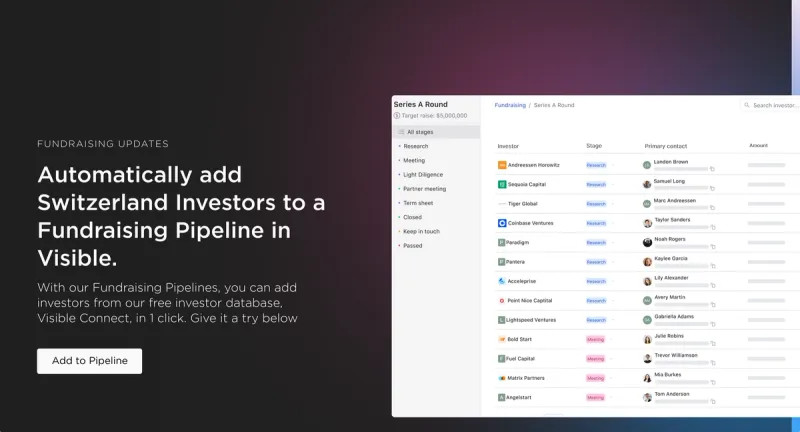

Connect With Investors in Switzerland Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of the Switzerland's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.