Securing venture capital is a critical milestone for any startup, and in Pennsylvania, a vibrant and growing ecosystem is making it an increasingly attractive destination for founders. In 2024 alone, Pennsylvania startups raised over$1.6 billion in venture funding, signaling a robust environment ripe with opportunity.

This article serves as your comprehensive guide to navigating the Pennsylvania VC landscape. We've curated a list of the top 15 venture capital firms actively investing in Pennsylvania-based startups, providing you with the insights needed to identify potential partners and secure the funding you need to scale.

Beyond just a list, we'll delve into the local fundraising landscape, highlighting key networking opportunities, valuable resources, and current trends shaping the Pennsylvania startup scene.

Top VCs in Pennsylvania

Dreamit Ventures

About: Dreamit is a venture fund and growth-focused accelerator for Urbantech, Securetech, and Healthtech startups

Sweetspot check size: $ 1M

Traction metrics requirements: Seek healthtech and securetech companies with early commercial traction and proven product market fit that are focused on scaling.

Thesis: Dreamit Ventures is a fund and growth program focused on startups with revenue or pilots that are ready to scale.

SeventySix Capital

About: SeventySix Capital is at the epicenter of sports & tech, investing in smart and nice entrepreneurs who are building game changing startups.

Sweetspot check size: $ 1M

Thesis: Investing in and building the tech companies that are bringing streaming, augmented/virtual reality, NFTs, blockchain, Web 3.0 and the Metaverse to the sports industry.

Boathouse Capital

About: Boathouse Capital invests mezzanine debt and equity in high quality lower middle market companies in partnership with management teams and private equity funds. Their principals have a combined 50+ years of lower middle market investing experience, and have deployed over $1 billion as a team. Boathouse was founded in 2008 on a foundation of fair dealing, hard work and the belief that the best deals are those grounded in trust and common goals.

Sweetspot check size: $ 15M

Traction metrics requirements: $7mm of ARR or $10mm or traditional revenue

Comcast Ventures

About: Focuses its investments in advertising, consumer, enterprise and infrastructure. They look for innovative ideas that can scale big, a defensible technology, and a solid team.

Sweetspot check size: $ 5M

Global Venture Capital Advisors

Sweetspot check size: $ 250K

Traction metrics requirements: Initial traction needed

Thesis: ESG sustainable impact investments

BioAdvance

About: BioAdvance provides funding to startup life sciences companies in Southeastern Pennsylvania through its Greenhouse Fund. They invest in therapeutics, devices, diagnostics and platform technologies focused on human health. Since its first investments in 2003, BioAdvance has become one of the nation's leading investors providing pre-seed and seed-stage funding. To date they have committed $19.6 million to 29 seed-stage companies and 15 pre-seed investments.

Riverfront Ventures

About: Riverfront Ventures is a venture capital firm specializing in seed and early-stage investments. The firm seeks to invest in companies in Pittsburgh with the potential to create high-paying jobs. It was founded in 2013 and is headquartered in Pittsburgh, Pennsylvania.

Sweetspot check size: $ 1M

Birchmere Ventures

About: Birchmere Ventures, with more than $115 million under management, has a successful track record of investing in and building early-stage technology and life sciences companies. They focus principally on early stage, pre-revenue start-ups where they have direct operational or investing experience. They prefer to lead syndicated deals with other institutional investors. They limit the number of board seats each partners holds.

Thesis: Ramping up a successful company is the hardest thing you’ll ever do. It is also the most rewarding and the most fun.

Robin Hood Ventures

About: Robin Hood Ventures is a group of angel investors, focused on early-stage, high-growth companies in the Greater Philadelphia region. We help entrepreneurs build great companies, providing capital, mentoring, expertise and connections to help companies reach their potential. Robin Hood generally invests $250k to $1 million, and collaborates with angels, institutions and VCs in our network. We invest as a single entity in businesses we know and understand, in a way that gets deals done. Since 1999, we have invested in over 45 companies in industries including software, medical devices, biotech, internet and financial technology.

1315 Capital

About: 1315 Capital provides expansion and growth capital to commercial-stage healthcare services, medical technology, medtech & pharma outsourcing, and health & wellness companies. We believe that these investment areas are attractive largely due to numerous niche market sub-segments and business models where high-quality management teams can rapidly grow small platform companies, in a capital efficient way, into large and important businesses. The firm targets $10-$40 million investments in commercial healthcare entities that we believe have the potential to scale to approximately $100 million of revenue, a level we believe is highly attractive for acquisition or to access the public markets.

EnerTech Capital

About: EnerTech Capital specializes in startups, early, mid, later, to expansion stage investments, and growth capital.

Dorm Room Fund

About: Dorm Room Fund is the strongest community of entrepreneurial students in the nation

Sweetspot check size: $ 20K

Thesis: We support founders across the US from day zero.

GMH Ventures

About: GMH Ventures focuses on investing in companies well positioned for growth opportunities with the intention of owning and operating for the long-term. The company has flexibility in its approach and strategy, but primarily seeks exceptional returns and diversification of family office assets through partnerships with high caliber owners and managers.

Ben Franklin Technology Partners

About: Ben Franklin Technology Partners combines the best practices of early stage investing with a higher purpose – to lead the region’s technology community to new heights, creating jobs and transforming lives.

Eos Ventures

About: Eos Ventures invests in companies across the value chain of insurance and related sectors. We seek experienced, exceptional founders who are at the forefront of innovation and are looking for a strategic capital partner to accelerate their vision.

Atelier Ventures

About: Early-stage VC fund investing in the passion economy and platforms that broaden access to work.

Thesis: New integrated platforms empower entrepreneurs to monetize individuality and creativity. In the coming years, the passion economy will continue to grow. We envision a future in which the value of unique skills and knowledge can be unlocked, augmented, and surfaced to consumers.

AlphaLab

About: AlphaLab is Pittsburgh’s leading accelerator and has been supporting startups since 2008. We cover several focus areas, including software, hardware, life sciences, and robotics. All participants receive the same core support, with resources tailored to their industry.

Sweetspot check size: $ 50K

Traction metrics requirements: Any early-stage company with at least one physical product component can apply.

Draper Triangle

About: Draper Triangle is a venture capital firm that partners with the Midwest’s most extraordinary entrepreneurs who set out to change the world. Our firm was formed in the crucible of Pittsburgh’s reinvention from Steel City to leading center of technology. We have expanded across the Midwest and financed some of the most dynamic entrepreneurs and successful technology companies as modern entrepreneurship has spread throughout the region.

Rittenhouse Ventures

About: Rittenhouse Ventures is an emerging growth venture fund focused on innovative software solutions that power enterprises in healthcare, life sciences, financial services, human resources, and general business services. With a unique combination of right-sized investments, deep expertise, and a proven track record, we optimize capital and growth strategies for entrepreneurs. Based in Philadelphia and investing across the Mid-Atlantic region, we build long-term partnerships with entrepreneurs, leveraging our extensive local network to our portfolio's advantage.

MissionOG

About: MissionOG partners with high-growth businesses that have proven models in segments where we have had success as operators and investors, including financial services and payments, data platforms, and software. To help accelerate our partner companies, we invest financial capital and leverage a broad network of industry experts. Headquartered in Philadelphia, MissionOG is led by a team that has effectively built and scaled companies through their various stages of growth to successful acquisitions.

Thesis: We partner with high-growth B2B companies that are driving the digitization of the economy. We are thematic investors in key market segments where we have deep operational knowledge, including fintech, data, and software. We seek to invest $5 million to $10 million with significant follow-on capital where necessary.

Adams Capital Management

About: Adams Capital is a national venture capital firm noted for its domain expertise in disruptive technologies in the Information Technology, Telecommunications and Semiconductors industries. As active, lead investors with $700 million currently under management, they support emerging market leaders in billion dollar industries and help them navigate through their formative stages.

Pennsylvania Startup Landscape

Pennsylvania's startup ecosystem is witnessing renewed growth, driven by a combination of innovative talent, strategic investments, and a supportive community. Over the past few years, the state has seen significant growth in key sectors such as technology, healthcare, and advanced manufacturing, making it an increasingly attractive destination for entrepreneurs.

Current Trends in the Pennsylvania Startup Scene

In 2024, Pennsylvania startups collectively raised over $3.3 billion in venture funding, a testament to the state's growing prominence on the national stage. Cities like Philadelphia, Pittsburgh, and State College are emerging as innovation hubs, attracting both early-stage and growth-stage companies. The state's unique blend of academic institutions, research facilities, and a skilled workforce creates a fertile ground for innovation and entrepreneurship.

Key Networking Opportunities for Founders

Building connections is crucial for startup success, and Pennsylvania offers a wealth of networking opportunities for founders. Some prominent events and organizations include:

- Philadelphia Startup Leaders (PSL): A community of entrepreneurs, investors, and service providers dedicated to supporting the growth of startups in the Philadelphia region.

- Pittsburgh Tech Council: A leading technology trade association that hosts numerous events and programs for startups in the Pittsburgh area.

- Ben Franklin Technology Partners: An early-stage investor and incubator that supports tech-based startups across Pennsylvania.

Government Resources and Support

Pennsylvania is committed to fostering a thriving startup ecosystem by providing a range of government programs, grants, tax incentives, and other resources to support entrepreneurs and innovative companies. This section offers a comprehensive overview of these resources, helping startups navigate the landscape and access the support they need to succeed.

Pennsylvania Department of Community and Economic Development (DCED)

The DCED is the primary state agency responsible for supporting business growth and economic development in Pennsylvania. It offers a variety of programs and resources for startups, including:

- Pennsylvania First Program: Provides financial assistance to companies that create and retain jobs in Pennsylvania.

- Qualified Manufacturing Innovation and Reinvestment Deduction (QMIRD): Provides a tax deduction for qualified manufacturing innovation and reinvestment expenses.

- Research and Development Tax Credit: Offers a tax credit for companies that conduct qualified research and development activities in Pennsylvania.

Ben Franklin Technology Development Authority

The Ben Franklin Technology Development Authority is a state-funded organization that supports tech-based startups and innovation in Pennsylvania. It provides funding, business expertise, and access to a network of resources.

Then there is the Ben Franklin Technology Partners which operates regional offices throughout Pennsylvania, offering early-stage funding, incubation services, and mentorship to tech startups.

Pennsylvania Industrial Development Authority (PIDA)

PIDA provides low-interest loans for land and building acquisition, construction, and renovation projects.

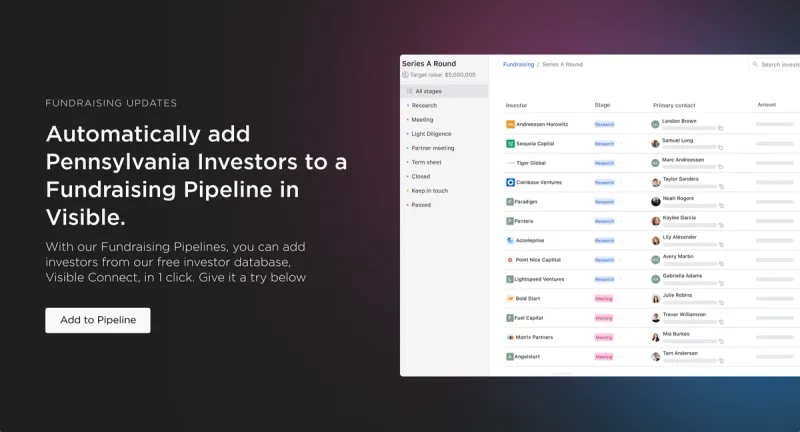

Connect With Investors in Pennsylvania Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Pennsylvania's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.