Greece’s startup ecosystem has experienced remarkable growth over the past few years, transforming into one of Southern Europe’s most dynamic innovation hubs. With a surge in tech talent, increased government support, and a wave of successful exits, the country is now attracting significant attention from both local and international venture capital firms. In 2025, Greek startups are raising record amounts of funding, and the landscape is more competitive—and promising—than ever before.

For founders building in Greece, understanding the local investment landscape is crucial. The right venture capital partner can provide funding, strategic guidance, access to networks, and credibility in the market. However, navigating the VC scene can be challenging, especially as new funds emerge and established players evolve their focus.

This article is designed as a resource for startup founders actively fundraising in Greece. You’ll find a curated list of the top venture capital firms in Greece currently investing in startups, key trends shaping the ecosystem, and essential local resources and networking opportunities available to founders.

Top VCs in Greece

VentureFriends

About: VC fund based in Athens but investing across Europe, LatAm & the Middle East. We focus on FinTech, PropTech, B2C, Marketplaces & B2B SaaS. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach.

Sweetspot check size: $ 1M

Thesis: We are attracted to scalable B2C and B2B startups that can develop a sustainable moat over time and have a sweet spot for PropTech, FinTech, Marketplaces, TravelTech and SaaS. We are founder driven investing in Pre-Seed, Seed and Series A starups

Velocity.Partners

Thesis: We invest at pre-seed / seed stage, across sectors, in market pull companies with global focus led by Greek founders.

Sweetspot check size: $ 500K

Marathon Venture Capital

About: Marathon Venture Capital is a seed-stage fund, helping ambitious founders build world-class technology companies.

Thesis: We provide founders the full picture of our terms and processes upfront - so you can avoid surprises and focus on what really matters.

Genesis Ventures

About: Genesis Ventures is an angel co-investment fund providing pre-seed/seed capital & hands-on support to early-stage founders in Greece & SE Europe.

Metavallon VC

About: We are a venture capital fund investing in early stage technology startups connected to Greece. We provide initial funding up to € 1.5m and hands-on support to our Seed and Seed+ stage investments.

Big Pi Ventures

About: We partner with teams who are developing exceptional technologies or ingenious business models. We invest where we see opportunities to change people’s lives for the better or transform whole industries. We support them with capital and with advice born of our experience. We’re anchored in Greece, targeting global markets.

TECS Capital

About: TECS Capital is an Alternative Investment Fund (AIF) established under Greek law and headquartered in Thessaloniki. As a Seed-stage investment platform, it targets emerging Industry 4.0 opportunities, generating value through the commercialization of research. The Management Team brings diverse backgrounds, extensive experience, and proven expertise. Our investors span various industries, with the Hellenic Development Bank for Investments (HDBI) serving as the lead investor.

Thesis: Our focus lies in Deep Tech verticals, where we prioritize virtuous data cycles—measurable objectives that deliver tangible value and leverage data sets that create cumulative advantage. We are also drawn to Transformative Tech verticals, favoring innovative business models and new applications of established technologies.

Current Trends in the Greek Startup Ecosystem (2025)

Greece’s startup ecosystem is entering a new era of growth, resilience, and international recognition. In 2025, founders are benefiting from a maturing investment landscape, a surge in sectoral innovation, and a wave of success stories that are putting Greek entrepreneurship on the global map. Here’s what you need to know about the latest trends shaping the Greek startup scene.

Fastest-Growing Sectors in Greece

The Greek startup ecosystem is more diverse than ever, with several sectors standing out for their rapid growth and investment activity:

Artificial Intelligence (AI): AI is at the forefront of Greek innovation, with startups applying advanced machine learning to fields such as enterprise software, health diagnostics, and maritime technology. The sector is attracting both local and international venture capital, and Greek AI companies are increasingly competitive on a European scale.

Fintech: Fintech remains a powerhouse, led by success stories like Viva Wallet. New ventures are emerging in payments, neobanking, and financial infrastructure, serving both the Greek market and the broader EU.

Healthtech & Life Sciences: Startups in digital health, biotechnology, and medical devices are thriving, supported by strong academic research and a growing pool of technical talent. Digital health solutions and biotech innovations are drawing significant investment and international partnerships.

Green Energy & Sustainability: With the EU’s focus on climate and sustainability, Greek startups are innovating in renewable energy, energy storage, and climate tech. Government incentives and VC interest are fueling growth in this sector.

Maritime Technology: Greece’s shipping legacy is driving a new wave of maritime tech startups, building solutions in logistics, fleet management, and marine sustainability.

Travel & Tourism Tech: Leveraging Greece’s global tourism appeal, tech-driven platforms for travel, hospitality, and experiences continue to scale rapidly, modernizing one of the country’s most important industries.

Deep Tech & Robotics: There is a growing presence of startups in robotics, IoT, and advanced analytics, often spun out of Greek universities and research centers.

Sources: Found.ation 2024-2025 Report, EBAN Foundation Startups in Greece Report 2024-2025, Premier Access Invest

Recent Success Stories and Notable Exits

Greece’s ecosystem is now defined by a series of high-profile exits and scale-ups, which are validating the country’s innovation potential and attracting further investment:

Viva Wallet: Greece’s first unicorn, Viva Wallet, reached a €1.7 billion valuation after J.P. Morgan acquired a 49% stake. The company’s pan-European neobank model is a flagship for Greek fintech and a case study in scaling from Athens to the world.

BETA CAE Systems: The $1.24 billion acquisition of BETA CAE Systems marks the largest tech exit in Greek history, highlighting the global competitiveness of Greek engineering software.

InstaShop: Founded by a Greek entrepreneur, InstaShop was acquired by Delivery Hero for $360 million, demonstrating the potential for Greek-founded companies to scale and exit internationally.

Softomotive (acquired by Microsoft): This robotic process automation company was acquired by Microsoft for over $150 million, showcasing the strength of Greek deep tech.

Blueground: Approaching unicorn status, Blueground has raised over $180 million and operates in more than 10 countries, proving that Greek startups can build global businesses.

Workable: With over $85 million raised and hundreds of employees across Athens, London, and Boston, Workable is a leading example of Greek SaaS success.

Shifts in Founder Demographics and Internationalization

The profile of the Greek founder is evolving, and the ecosystem is becoming more global and inclusive:

- Gen Z and Youth Entrepreneurship: A new generation of Gen Z founders is driving innovation, with a focus on digital transformation, sustainability, and global impact. Many are launching startups straight out of university or after gaining experience abroad.

- Gender Diversity: While women remain underrepresented (24% of founders), targeted initiatives like Elevate Greece and WE LEAD are working to close the gender gap and support female entrepreneurship.

- Brain Circulation: The trend of “brain drain” is reversing, with experienced Greeks returning from international tech hubs to launch or join startups in Greece, bringing valuable expertise and networks.

- Global Orientation: Over 80% of Greek startups target international markets from day one, a rate higher than the European average. This global mindset is driven by the small domestic market and the ambition to scale rapidly.

- International Investment: Foreign VCs and corporate investors are increasingly active, with 156 international investors participating in Greek startup funding rounds in 2024—36% of whom are US-based.

Key Networking Opportunities and Startup Events in Greece

For founders in Greece, building a strong network is essential for fundraising, finding partners, and scaling internationally. The Greek startup ecosystem offers a vibrant calendar of events, active incubators and accelerators, and university-driven programs designed to help founders connect, learn, and grow.

Major Annual Conferences and Startup Events

Startup Greece Week: A flagship event for the Greek tech community, Startup Greece Week brings together founders, investors, mentors, and policymakers for a week of workshops, panels, and networking. It’s a must-attend for anyone looking to immerse themselves in the local ecosystem and make high-value connections.

BEYOND Expo & Startup Village: BEYOND is Southeastern Europe’s leading digital technology and innovation conference, now hosted in Athens. The BEYOND Tomorrow Startup Village offers startups exhibition space, pitching opportunities, and direct access to investors and decision-makers. The event attracts thousands of visitors, including international VCs and media, making it a prime venue for exposure and fundraising.

Thessaloniki International Fair (TIF): TIF is one of the largest business expos in Southeast Europe, featuring a dedicated innovation and entrepreneurship pavilion. Startups can showcase their products, meet corporate partners, and connect with investors from Greece and abroad.

Athens Startup Universe: A global online program and event series connecting Greek founders with international mentors, investors, and resources. It’s especially valuable for early-stage startups seeking guidance and global exposure.

StartupNow Forum: A major annual event focused on entrepreneurship, innovation, and investment, StartupNow Forum features pitch competitions, B2B meetings, and panels with leading VCs and corporate partners.

Active Incubators, Accelerators, and Co-Working Spaces

These organizations offer space, access to mentors, investors, and a supportive founder community.

- The Egg (Eurobank): One of Greece’s most established incubators, The Egg offers acceleration programs, mentoring, and access to funding for early-stage startups.

- Orange Grove: Supported by the Dutch Embassy, Orange Grove is a leading incubator in Athens, providing workspace, training, and a strong international network.

- Found.ation: A hub for innovation and entrepreneurship, Found.ation runs acceleration programs, corporate innovation projects, and community events.

Other Notable Spaces:

- Athens Center for Entrepreneurship and Innovation (ACEin)

- Corallia Innovation Hub

- JOIST Innovation Park (Larissa & Ioannina)

- Impact Hub Athens

- OK!Thess (Thessaloniki)

University and Research Center Programs

Greek universities and research centers are increasingly active in supporting founders. These programs provide technical expertise, access to research, and a pipeline of talent for startups.

- National Technical University of Athens (NTUA): Runs entrepreneurship labs and spin-off support programs.

- Athens University of Economics and Business (AUEB): Home to ACEin, a leading university incubator.

- Foundation for Research and Technology – Hellas (FORTH): Based in Heraklion, FORTH supports deep tech and biotech startups.

- Aristotle University of Thessaloniki: Offers innovation and entrepreneurship programs, often in partnership with local VCs and corporates.

Connect With Investors in Greece Using Visible

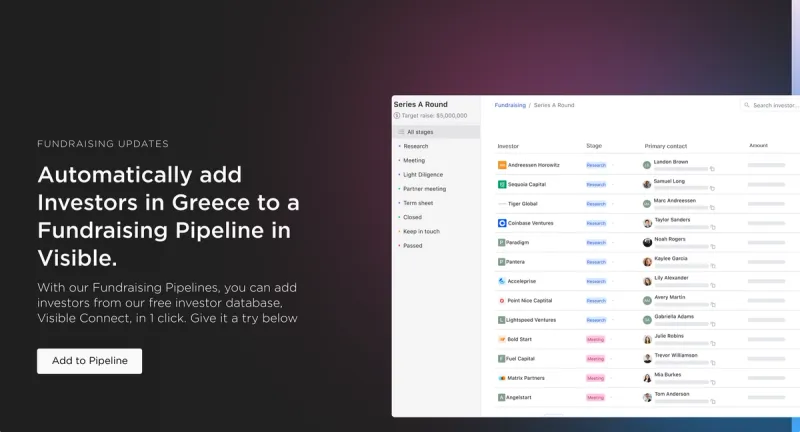

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Greece's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.