Key Takeaways

-

Learn how Wisconsin’s startup ecosystem is expanding through new venture funds, public-private investment programs, and founder-focused accelerators.

-

Discover the top venture capital firms and angel networks actively funding early-stage startups across Madison, Milwaukee, Green Bay, and La Crosse.

-

Get practical insights into investor expectations, local funding trends, and how to attract attention from Wisconsin-based VCs and corporate investors.

-

Explore accelerators, grants, co-working spaces, and university-backed programs that help founders gain traction and connect with capital.

-

Find the best events, pitch competitions, and networking opportunities to build investor relationships and raise capital more effectively in Wisconsin.

Raising capital in Wisconsin has become more achievable as the state strengthens its position as a Midwest startup hub. Founders now benefit from a growing mix of local venture firms, state-backed programs, and an active network of investors and accelerators. Key cities like Madison, Milwaukee, Green Bay, and La Crosse are building momentum, supported by new funds and collaborative partnerships that connect local talent with capital.

This guide is a practical playbook for founders raising in Wisconsin. You will find a vetted list of active investors, an overview of how the local funding market works, and clear steps to plug into accelerators, grants, and co-working hubs. You will also find the best events and communities for meeting investors, plus tips on how to build the relationships that lead to term sheets.

Top Venture Capital Firms in Wisconsin

4490 Ventures

About: We are a team of investors, founders and operators with more than 100 years of combined experience who bring capital and a network of resources to help entrepreneurs build the next generation of tech companies. We are high conviction, high concentration early-stage investors focused on companies outside of Silicon Valley.

Wisconsin Valley Ventures (WVV)

About: WVV is a $100M early-stage venture capital fund established as a joint-venture between Foxconn, Advocate Aurora Health, Johnson Controls, and Northwestern Mutual. We target transformation and interdisciplinary innovations in health care, technology, manufacturing and financial services. Our unique partnership among four leading companies enables us to support our portfolio companies at a deeper level than traditional venture capital funds.

HealthX Ventures

About: HealthX Ventures is healthcare technology focused venture fund investing in pre-revenue and early stage companies.

Gener8tor

About: gener8tor is a nationally ranked, concierge accelerator that invests in high-growth startups.

Winnow Fund

About: Winnow Fund is a venture capital fund investing in proof of concept and pre-seed stage Wisconsin-based innovations. The Fund is industry agnostic and invests in companies across the state, but places a focus on sourcing opportunities from Wisconsin's university and college campuses.

TitletownTech

About: TitletownTech is an early-stage venture capital firm that invests in entrepreneurs solving meaningful problems in industries core to Wisconsin and the Midwest.

Capital Midwest Fund

About: Capital Midwest Fund (CMF) invests in revenue-stage Central United States companies providing customer-centric, problem-solving, business-to-business technology solutions, including software, services, and products, with specific interest in industrial, manufacturing, and healthcare markets.

Thesis: CMF focuses on companies where management: (1) has a fundamental understanding of trending technology themes; (2) has applied that understanding in a practical way to solve specific customer problems; and (3) has shown traction in garnering market acceptance.

Rock River Capital Partners

About: Rock River Capital is a midwest-based, early-stage venture firm looking for companies with initial product/market fit & positioned for growth. They are industry agnostic but look for some form of a technical disruptor to that industry, often in the form of software. Investments made by Rock River Capital are done with the entrepreneur in mind.

Idea Fund

About: The Idea Fund partners with seed- and early-stage startup businesses across the region. We support the Upper Midwest’s best entrepreneurs, people who are solving challenging problems with passion and drive. We bring capital, connections and years of experience building exceptional businesses, all laser-focused on helping you accelerate your vision.

American Family Ventures

About: American Family Ventures is the branch of American Family Insurance dedicated to venture capital investment. American Family Ventures is an Insurtech venture capital pioneer, focusing on early stage startups that are shaping the future of the insurance industry. Their initial investments typically range from $100k to $2M.

Resources and Support for Wisconsin Founders

Wisconsin’s startup community is supported by a strong network of accelerators, government programs, co-working spaces, and early-stage investors. These resources give founders access to capital, mentorship, and community connections that accelerate growth and improve fundraising readiness.

Startup Accelerators and Incubators

- gener8tor runs nationally ranked programs across Madison, Milwaukee, and Appleton. It operates 12-week accelerators and shorter seven-week gBETA programs that help founders secure funding and connect with investors. Both programs accept startups from any industry and focus on hands-on mentorship and investor introductions. Applications are accepted year-round for rolling cohorts.

- UW–Madison Discovery to Product (D2P) supports founders emerging from university research with programs that guide commercialization and early capital raising.

- MadWorks Accelerator in Madison works with idea-stage founders, offering structured support for business development and investor readiness.

- BizStarts Milwaukee provides business coaching, mentoring, and access to local funding networks for founders across southeastern Wisconsin.

Government and Public Funding Programs

Public programs play a major role in bridging Wisconsin’s early-stage funding gap.

- The Wisconsin Economic Development Corporation (WEDC) provides early-stage grants, investor tax credits, and venture support programs designed to expand capital access for startups across industries.

- The Wisconsin Investment Fund is a 50 million dollar public-private partnership launched under WEDC in 2024. Combined with private matching, the fund makes up to 100 million dollars available to early-stage companies through venture fund partners.

- The Wisconsin Technology Council offers guidance on Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) grants. Through its matching grant programs, founders can secure up to 50 percent of federal research awards to extend development runway.

- The Wisconsin Women’s Business Initiative Corporation (WWBIC) provides loans, financial workshops, and mentoring for early-stage and small business founders, with locations in Madison, Milwaukee, Racine, and Kenosha.

Co-working and Innovation Spaces

Collaborative workspaces across Wisconsin give founders more than just office space. They serve as community hubs where entrepreneurs meet investors, mentors, and peers.

- Ward4 in Milwaukee provides flexible office setups and access to gener8tor’s entrepreneurship programs.

- 100state in Madison is a long-standing creative community offering memberships, mentorship sessions, and member events.

- Irontek in Beloit supports early-stage companies through affordable workspace and connections with regional investors.

- StartingBlock Madison is the state’s largest entrepreneurial hub, with accelerator offices, pitch events, and venture partnerships.

- The MKE Tech Hub in Milwaukee connects startups with corporate partners and promotes local tech workforce growth.

- The Whitewater Innovation Center supports early-stage technology and manufacturing startups in southeastern Wisconsin, offering affordable lab and office space.

Angel and Micro-VC Networks

Wisconsin’s angel investor networks provide crucial early-stage capital for startups before conventional venture rounds.

- Wisconsin Investment Partners (WIP) in Madison invests in early-stage technology and life science companies and is one of the most active angel groups in the Midwest.

- Golden Angels Investors in Milwaukee connects entrepreneurs with a network of over 100 investors focusing on healthcare, manufacturing, and software.

- Tundra Angels in Green Bay invests in emerging Wisconsin startups and offers mentorship and access to regional business networks.

- Silicon Pastures focuses on early technology and software ventures, primarily in the Milwaukee area.

University Programs

University connections remain one of Wisconsin’s most powerful innovation drivers, linking academic research to investor networks and commercial markets.

- The Wisconsin Alumni Research Foundation (WARF) supports university spinouts and invests in early commercialization opportunities.

- Local college programs such as the UW-Oshkosh Alta Resource Center and UW-Whitewater Innovation Center host pitch competitions and student accelerators that help early founders raise initial rounds.

Networking and Community Opportunities for Founders

Wisconsin’s founder community thrives on collaboration, local partnerships, and shared learning. Networking remains one of the most valuable ways to build investor relationships and uncover funding opportunities. Across the state, organizations and events bring together entrepreneurs, investors, and ecosystem leaders with the shared goal of growing Wisconsin’s startup economy.

Pitch Events and Startup Showcases

Participating in local pitch events helps founders connect with investors, mentors, and fellow entrepreneurs. Wisconsin hosts several high-value opportunities throughout the year.

- Startup Wisconsin Week is held every November across multiple cities. It offers panels, pitch nights, and community events that spotlight local innovation and investment opportunities. Founders can meet early-stage investors and learn from other entrepreneurs across the state.

- The Governor’s Business Plan Contest, hosted by the Wisconsin Technology Council, is a signature competition supporting startups with mentoring, exposure, and cash prizes. Winning or placing in the contest can attract venture interest and media attention.

- The +Venture North Conference, organized by NVNG Investment Advisors, connects founders with corporate investors, fund managers, and policymakers. The event focuses on using venture capital as a tool for statewide economic growth.

- The New North Summit brings together leaders from northeastern Wisconsin to discuss innovation, talent, and investment strategies. It includes networking sessions and showcases for regional startups.

Founder and Investor Communities

- MKE Tech Hub Coalition is a nonprofit that bridges startups, corporations, and community partners to grow the state’s tech workforce and innovation capacity.

- The Wisconsin Venture Capital Association brings investors together to share insights, advocate for policies that support growth, and encourage early-stage collaboration.

- The Startup Wisconsin Network connects local founders and organizes ongoing events, newsletters, and pitch opportunities across the state’s regions.

How to Build Relationships That Lead to Funding

Funding in Wisconsin often starts with building genuine connections. Founders who engage early and maintain regular communication with investors tend to raise more effectively.

- Start locally. Attend regional events before seeking outside capital. Most Wisconsin investors prefer to back entrepreneurs they have met through the community.

- Stay in touch. Send thoughtful updates about traction, milestones, and progress before formally asking for funding.

- Refine your pitch. Lead with your problem, your solution, and how your traction validates both. Local investors respond well to clear business fundamentals and measured growth plans.

- Ask for feedback. Use early meetings to learn what investors look for rather than pushing for immediate commitments.

- Engage your ecosystem. Judges, mentors, or past founders at pitch competitions often serve as warm introductions to active investors.

Find investors in Wisconsin with Visible

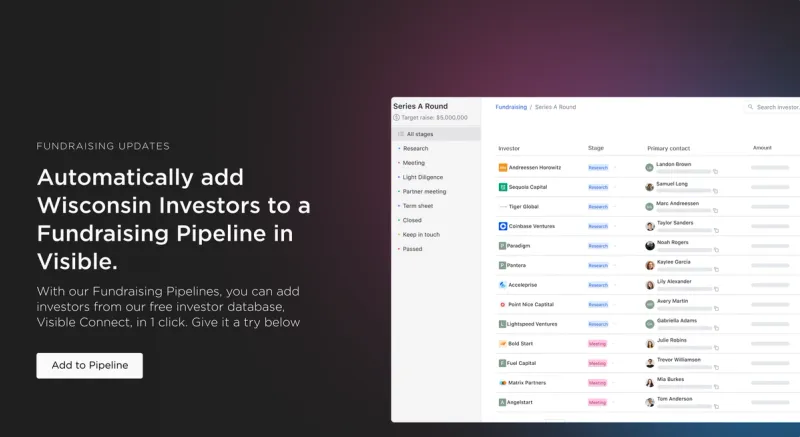

As we previously mentioned, a venture fundraise oftentimes mirrors a traditional B2B sales and marketing funnel. Just as sales and marketing teams have dedicated tools to track their funnel, shouldn’t founders have dedicated tools to manage their most important asset- equity?

With Visible, you can track and manage every part of your fundraising funnel.

- Find investors at the top of your funnel with Visible Connect, our free investor database

- Add them directly to your fundraising pipeline directly in Visible

- Share your pitch deck and data room with investors in your pipeline

- Send updates to current and potential investors to keep them engaged with the progress of your business.

Take your investor relations to the next level with Visible. Give Visible a try for free.

Frequently Asked Questions

What are the best ways to raise startup capital in Wisconsin?

Raising capital in Wisconsin starts with tapping local venture firms, angel networks, and state-backed programs. Prioritize warm intros via communities like MKE Tech Hub and StartingBlock. Apply to accelerators like gener8tor and gBETA, pursue WEDC grants and tax credits, and maintain consistent investor updates to convert relationships into term sheets.

Which venture capital firms invest in Wisconsin startups?

Top Wisconsin venture capital firms include 4490 Ventures, Wisconsin Valley Ventures, HealthX Ventures, TitletownTech, Rock River Capital Partners, Capital Midwest Fund, Winnow Fund, and American Family Ventures. Many focus on early-stage tech, healthcare, and industrial innovation. Start with partner theses, ask for warm introductions, and show proof of traction and customer validation.

How do Wisconsin grants and public programs support fundraising?

Wisconsin founders can leverage WEDC early-stage grants, Qualified New Business Venture tax credits, and SBIR/STTR guidance via the Wisconsin Technology Council. The Wisconsin Investment Fund, launched in 2024, pairs public-private capital through venture partners. These programs extend runway, de-risk rounds, and attract matching private investment.

What accelerators and incubators should Wisconsin founders consider?

Gener8tor’s flagship accelerator and gBETA programs provide hands-on mentorship and investor access across Madison, Milwaukee, and Appleton. University-linked D2P supports commercialization out of UW–Madison. MadWorks and BizStarts offer structured programming for idea-stage founders. These accelerators speed fundraising readiness and expand investor networks statewide.

How can I meet investors and build relationships that lead to funding in Wisconsin?

Start locally: attend Startup Wisconsin Week, Governor’s Business Plan Contest, +Venture North, and New North Summit. Engage consistently, share monthly updates, milestones, and asks. Seek feedback over commitments, leverage judges and mentors for warm intros, and demonstrate disciplined traction to align with Midwest investor expectations.

Where can I find Wisconsin investors and manage my fundraising pipeline?

Use Visible to discover investors through Visible Connect, add prospects to your pipeline, share your deck and data room, and send investor updates from one platform. This sales-like funnel approach helps Wisconsin founders stay organized, nurture relationships, and convert interest into committed capital more efficiently.