Key Takeaways

-

Louisiana fundraising rewards focus and fit. This guide shows how to raise venture capital in Louisiana by aligning your story with the state’s strongest lanes, including energy, logistics, healthcare, and tech.

-

Get a curated list of Louisiana investors actively writing checks, from early-stage venture capital firms like Callais Capital and Boot64 Ventures to New Orleans-focused capital sources like the New Orleans Biofund and university-linked networks like 1834 Ventures.

-

Plug into the highest-leverage founder infrastructure in New Orleans, Baton Rouge, and beyond. You will learn which incubators and accelerators to prioritize, including The Idea Village, LSU Innovation Park, and the Tulane Student Venture Incubator.

-

Use Louisiana’s non-dilutive and ecosystem support to extend runway and improve investor readiness. We break down how programs like Louisiana Economic Development (including SSBCI participation), the Louisiana SBDC, and the New Orleans Business Alliance can support funding prep, partnerships, and incentives.

-

Navigate the Louisiana startup ecosystem map with a practical city-by-city strategy. You will see where to build and fundraise in New Orleans, Baton Rouge, Lafayette, and Shreveport.

Raising capital in Louisiana looks different from raising in larger coastal hubs, and that can work in your favor if you understand how the market works. The state blends deep industry roots in energy, logistics, health, and culture with a growing base of founders and investors who want to back companies with strong ties to the region. As public and private capital flow into innovation programs, more seed and early-stage checks are being written locally.

This guide is for founders who are actively raising now or planning to raise soon in Louisiana. You will get a clear view of which venture firms are active, what they look for, and how they like to work with founders. We will also cover the most useful incubators, accelerators, university programs, and pitch events that can help you meet investors and refine your story.

Top Louisiana Venture Capital Firms Actively Investing In Startups

Callais Capital

Callais Capital Management is an early-stage venture capital firm and investment manager based in Southern Louisiana primarily covering the South and Mississippi River Delta Region. The firm serves as an manager to a diverse asset strategy mix comprised of Venture Capital, Real Estate, and Private Credit.

Advantage Capital Partners

Advantage Capital Partners invests in emerging and rapidly developing companies operating in a variety of industries. They are generally predisposed to companies that develop or apply innovative technologies to products, systems, and services in the following industries: Information technology and the Internet, telecommunications and media, healthcare and life sciences, and energy related technologies.

New Orleans Biofund

The innovative BioFund program supports small businesses that may not qualify for traditional financing options. These investments help bridge a critical funding gap, thus allowing companies to better position themselves for growth and success. The New Orleans BioFund operates in all industries, but places a special emphasis on biotechnology as a part of its mission. Furthermore, the fund is currently transitioning to a micro-venture capital model. This will provide startup investment options such as equity, convertible debt, and loan financing options.

LongueVue Capital

LongueVue Capital is a New Orleans-based private equity firm focused on providing human capital, financial capital, and a skill set built upon a successful 20+ year track record of partnering with entrepreneurs and management teams to drive value creation in middle market companies. With 150 years of combined operating and investing experience, our team is the ideal partner for middle market companies at inflection points and seeking to maximize value, as evidenced by our industry leading investment track record spanning four funds and over $850 million of committed capital.

Boot64 Ventures

Boot64 Ventures is an investment fund that discovers, invests in, and supports Louisiana based entrepreneurs in need of start-up capital. The primary goal of the fund is to identify early stage small businesses ready to create jobs and improve Louisiana's economy.

1834 Ventures

1834 Ventures invests in startups founded by Tulane University alumni, faculty, students, and members of its extended community—including those who have engaged with university programs, partnerships, or innovation initiatives.

Incubators and Accelerators

The Idea Village (New Orleans)

The Idea Village is one of the best-known entrepreneurship hubs in New Orleans. It supports founders through mentorship, programming, and access to investors. Its work is part of why New Orleans is seen as a focal point for tech startups in the state, especially in software, fintech, healthtech, and AI.

Founders use The Idea Village to refine their business model, build a local network, and get in front of funds.

LSU Innovation Park (Baton Rouge)

LSU Innovation Park is a hub for tech-based startups tied to Louisiana State University. It provides office and lab space, research access, and business support services for high-growth companies. For founders in energy, climate, or deep tech, LSU Innovation Park can be a bridge to both technical resources and investors.

Tulane Student Venture Incubator

Tulane’s Student Venture Incubator supports early-stage companies with ties to the university. It focuses on healthcare, sustainability, and technology ventures and connects founders to mentors, alumni, and local partners.

Government Programs and Support

Louisiana Economic Development (LED)

Louisiana Economic Development runs programs aimed at growing startups and diversifying the state’s economy. Ecosystem profiles point to LED initiatives, including Innovation Louisiana, as important support for founders.

LED also manages the state’s participation in the federal State Small Business Credit Initiative (SSBCI), which helps capitalize local venture funds and credit programs.

Louisiana Small Business Development Center (LSBDC)

The Louisiana Small Business Development Center network offers free or low-cost consulting, training, and resources for entrepreneurs statewide.

You can use LSBDC for:

- Financial projections and funding prep

- Business planning and go-to-market support

- Connections to lenders and sometimes to equity investors

New Orleans Business Alliance (NOLABA)

New Orleans Business Alliance is a key partner for local entrepreneurs. It offers resources, networking opportunities, and programs designed to help startups connect with investors, mentors, and strategic partners.

Founders use NOLABA to:

- Learn about incentives and city-level support

- Meet corporate partners and anchor institutions

- Find events that put them in front of capital and customers

Industry Meetups and Events

NOLATech Week

A multi-event tech week in New Orleans featuring talks, workshops, security sessions, and networking, including highlights like NolaCon and the launch of local tech career guides. It brings together developers, founders, and tech leaders across software, AI, cybersecurity, and more.

NolaCon (part of NOLATech Week)

A security and hacking-focused conference in New Orleans, featuring hands-on workshops, talks on the state of security, and strong networking with engineers and security leaders. It is highlighted as a key event within NOLATech Week’s lineup.

Startup Grind New Orleans

Local chapter of the global Startup Grind community, hosting founder and investor fireside chats and networking events. It is positioned as a place to meet other founders, potential co-founders, and investors in the New Orleans ecosystem.

Cleantech Open NOLA

Brings together climate, cleantech, and energy-transition founders, mentors, and investors in New Orleans. These are strong fits for energy, climate, and resilience startups.

Operation Spark Events

(Hour of Code and community sessions): Operation Spark runs coding events and workshops in New Orleans, including the “Hour of Code” and other gatherings that bring together students, junior talent, and local tech companies. These are useful for founders hiring engineers and connecting to the talent pipeline.

Louisiana Startup Ecosystem Map

Louisiana’s startup ecosystem is not one scene. It’s a handful of smaller hubs that feel meaningfully different in industry access, talent pipelines, and the types of support programs you’ll find.

Here’s a quick map you can use to decide where to plug in (or where to hunt for customers and capital).

New Orleans: Density, Community, and Founder Visibility

New Orleans is the state’s most connected startup hub. It’s where you’ll find the most consistent drumbeat of founder programming, mentorship, and pitch-stage exposure.

What it’s known for: software/SaaS, fintech, healthtech, and an increasingly strong “Gulf South” brand that’s attractive to out-of-state investors looking for capital-efficient teams.

What’s most available to founders here:

- Higher concentration of mentors, founder operators, and community-led events

- More opportunities to get “on stage” (pitch competitions, demo days, ecosystem weeks)

- Strong cross-pollination between tech + culture (useful if you’re building in media, creator economy, music, or consumer)

Best fit if: you want community density, fast feedback loops, and a higher volume of founder-to-founder connections.

Baton Rouge: Research, Deep Tech, and Commercialization Pathways

Baton Rouge is anchored by LSU and tends to be more institution-driven. If your company benefits from research relationships, lab access, or commercialization support, Baton Rouge has an advantage, primarily through LSU Innovation Park and LSU’s broader innovation ecosystem.

What it’s known for: LSU-linked commercialization, energy/industrial adjacency, and research-backed ventures (including agtech and applied technology spinning out of university networks).

What’s most available to founders here:

- A clearer pathway for university-affiliated founders (faculty, students, IP)

- Proximity to research infrastructure and technical talent

- Better fit for climate/energy, industrial, and technical products where credibility and validation matter early

Best fit if: you’re building something technical (deep tech, energy/climate, industrial, agtech) and can leverage LSU or research partnerships as a wedge.

Lafayette / Acadiana: Tight-knit Builders and Practical Support

Lafayette often feels more “builder-first” and community-driven, less flash, more consistent help. The hub here includes Boot64 and organizations like Opportunity Machine, which is positioned as a key partner in Lafayette’s innovation ecosystem.What it’s known for: collaborative founder community, practical startup support, and an increasing emphasis on tech and healthcare innovation programming.

What’s most available to founders here:

- Hands-on mentorship and workspace/community infrastructure through Opportunity Machine

- Strong roll-up-your-sleeves culture that supports early validation, customer discovery, and execution

- Regional connections that can help with hiring and partnerships across Acadiana

Best fit if: you want a supportive local network, prefer practical programming, and are focused on getting to revenue/pilots efficiently.

Shreveport / North Louisiana: Structured Support and Regional Acceleration

North Louisiana is often overlooked by founders based farther south, but Shreveport has purpose-built support designed to help startups get investor-ready—most notably through BRF’s Entrepreneurial Accelerator Program (EAP), a public/private partnership focused on nurturing high-growth companies.

What it’s known for: regional economic development-driven entrepreneurship and structured accelerator-style support.

What’s most available to founders here:

- Startup acceleration services aimed at viability testing, investor matching, and early company-building

- Region-specific programs and competitions that can be a strong entry point for local founders (and a good sourcing channel for angels/operators)

- A smaller scene where founders can stand out faster if they show traction and ambition

Best fit if: you want structured, hands-on acceleration and you’re building in a region where it’s easier to become “the company to watch.”

Connect With Investors in Louisiana Using Visible

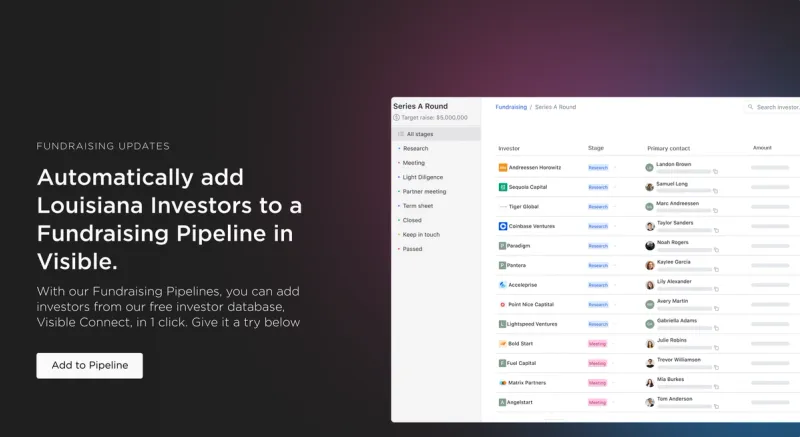

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of investors.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

Frequently Asked Questions

How do I raise venture capital in Louisiana as an early-stage startup?

To raise venture capital in Louisiana, start by targeting Louisiana venture capital firms and regional funds that match your stage and sector. Build a tight investor list, warm intros through accelerators, and show traction. Expect a process that can take dozens of investor conversations, not just a handful.

What Louisiana venture capital firms actively invest in startups?

Louisiana venture capital firms include locally based funds and regionally active investors, often concentrated around New Orleans and other hubs. In this article, examples include Callais Capital, Boot64 Ventures, and the New Orleans Biofund, plus Louisiana-adjacent investment groups. Your best results come from aligning sector, stage, and geography before outreach.

What industries do Louisiana investors and venture capital firms prefer?

Many Louisiana investors focus on companies tied to the state’s economic strengths and research base. High-interest areas often include energy and the energy transition, logistics and industrial tech, healthcare and life sciences, and university-linked innovation. Founders should position their wedge around local customers, infrastructure, or talent advantages.

Are there Louisiana funding programs like SSBCI that support venture capital for startups?

Yes. Louisiana participates in the State Small Business Credit Initiative (SSBCI), which can support capital access through state programs and fund structures. Eligibility requirements vary, but generally the business must be registered to operate in Louisiana and maintain an in-state office. Use these programs to extend runway and complement equity fundraising.

What should I know about the Louisiana Growth Fund if I want to raise venture capital in Louisiana?

The Louisiana Growth Fund is part of Louisiana’s SSBCI-related venture strategy and can invest directly into companies using standard structures like convertible notes or priced equity. Notably, it may not accept SAFEs, so founders should plan financing documents accordingly. Treat it like an institutional investor with clear process expectations.

Which Louisiana incubators and accelerators help founders raise venture capital in Louisiana?

Louisiana incubators and accelerators can materially improve your odds of raising venture capital in Louisiana by strengthening your narrative, metrics, and investor access. Prioritize programs with consistent mentor and investor networks, then use their demo days and partner events for warm introductions and faster feedback loops on your pitch.