Key Takeaways

-

Get a curated list of active Indiana venture capital firms and angels, with clear stage and focus areas so you can target the right investors fast.

-

Learn proven outreach paths in Indiana, such as portfolio founder intros, university channels (IU Ventures, Purdue Innovates), accelerators (gener8tor, Elevate Nexus), and corporate networks.

-

Plug into Indiana’s highest-leverage events and communities, including TechPoint’s Mira Awards, VisionTech Angels pitch nights, university demo days, and 16 Tech meetups, to grow your network and line up customer pilots.

-

Use industry groups such as AgriNovus, BioCrossroads, and Conexus Indiana to secure pilot sponsors and warm intros, a key diligence signal for local investors evaluating capital efficiency and customer validation.

-

Manage your entire fundraising funnel with Visible: find Indiana investors via Connect, track outreach with the Fundraising CRM, share Investor Updates and Decks, and organize diligence in Data Rooms to close your round.

Indiana’s startup scene has experienced rapid growth over the past five years, with increased funding, corporate partnerships, and sector depth in hard tech, software, logistics, and life sciences. The state’s cost advantages, research universities, and manufacturing base create a strong foundation for venture-backed companies.

This guide explains how to target active Indiana investors, what they look for, and how to prep for a process that fits the market. You will learn which firms are investing now, how they define stage fit, and how to differentiate yourself during diligence. You will also find the best programs, events, and communities to expand your network and accelerate your round.

We cover the strengths and challenges of fundraising in Indiana so you can plan with clear expectations. This includes timelines, traction thresholds, sector focus, and strategies for blending local and out-of-state capital.

Top Indiana VC Firms Actively Investing

High Alpha

About: High Alpha creates and funds companies through a new model for entrepreneurship that unites company building and venture capital.

Ivy Ventures

About: We provide high-potential founders with the smart capital, industry expertise, and partner network they need to accelerate their ideas.

Boomerang Ventures

About: Boomerang Ventures is a combination venture studio and fund. We partner with founders, investors, and institutions that are leveraging technology to disrupt healthcare for the better.

Gravity Ventures

About: Gravity Ventures is a member-managed seed capital fund based in Indiana and Arkansas, investing in early-stage technology and tech-enabled businesses across a variety of industries. What began in 2008 with only a handful of investors managing a single seed capital fund in Indiana, has quickly become an accomplished investment group of more than 60 members overseeing a growing portfolio of early-stage technology businesses.

Elevate Ventures

About: Elevate Ventures is among the largest venture capital firms in Indiana and a top provider of funding to entrepreneurs launching and building businesses in the state. Because funding isn’t always easy to come by in Indiana, we make every effort to make capital more accessible to high-growth startups and entrepreneurs.

Allos Ventures

About: Investors in early-stage B2B software and business services companies in the Midwest.

VisionTech Partners

About: We are VisionTech. Over the last decade, we’ve emerged as one of the Midwest’s most active angel investing networks, adding fuel in the form of capital and business acumen to some of the region’s and nation’s hottest early growth companies. Our process is meticulous and proven.

Twilight Venture Partners

About: Twilight Venture Partners invests exclusively in early-stage biotech and med tech companies.

Connecting with Indiana Investors

Warm introductions convert at higher rates in Indiana. Use the channels below to build targeted, credible paths into partner calendars. Where possible, cite customers, pilots, or university links in your intro. Apply early to programs with fixed cycles and follow each org’s intake process.

Portfolio Founder Intros

Founders in a fund’s portfolio are trusted filters. A short, specific referral can move you from cold outreach to a first meeting.

How to do it:

- Map each target fund’s Indiana portfolio. Identify founders in your sector or buyer type.

- Ask for a two-sentence forwardable blurb focused on fit and traction.

- Offer a quick reference call for reciprocity.

Portfolio’s to check:

- High Alpha portfolio: see firm portfolio page for B2B SaaS companies

- Allos Ventures portfolio: regional B2B software focus

- Elevate Ventures portfolio and reports: statewide coverage

- Hyde Park Venture Partners portfolio: Midwest software

Indiana Startup Events and Networking Opportunities

Key Annual and Recurring Events

- TechPoint

- Mira Awards: statewide tech awards and networking with investors and execs. Great for visibility and warm intros.

- TechPoint Events: Innovation events, meetups, and talent programs appear on the main calendar.

- Elevate Nexus

- Regional pitch competitions awarding grants and pre-seed checks. Strong investor attendance and follow-on intros.

- VisionTech Angels

- Regular pitch nights and diligence sessions with angel investors across the state.

- University demo days

- IU Ventures showcases and StartupIU events.

- Purdue Innovates and Purdue Foundry: pitch days and commercialization showcases.

- The Heritage Group ecosystem

- Accelerator/demo activities and corporate innovation forums. Good for climate, materials, and industrial tech.

- 16 Tech Innovation District

- District-wide meetups, maker demos, and founder gatherings in Indianapolis.

Accelerators and Incubators With Networking Opportunities

- gener8tor and gBETA (Indiana programs)

- Cohort-based programming with investor office hours and demo days. gBETA is pre-accelerator and gener8tor runs full accelerator cycles.

- Elevate Nexus

- Grant-funded pitch cycles that pull investors, mentors, and EIRs into one room.

- Purdue Innovates and Purdue Foundry

- Company-building, SBIR/STTR support, and investor showcases for Purdue-affiliated startups.

- IU Ventures

- Investment programs, alumni network access, and founder events.

- 16 Tech Maker Space and community

- Prototyping resources, peer groups, and investor-friendly showcases for hardtech.

Industry-Specific Groups for Deeper Connections

- AgriNovus Indiana (AG/ Food)

- Industry council, member events, and innovation challenges. Strong access to producers and processors.

- BioCrossroads (Life Sciences)

- Forums, reports, and convenings across pharma, medtech, diagnostics, and health data.

- Conexus Indiana (Advanced Manufacturing and Logistics)

- Corporate network, supply chain roundtables, and innovation programming.

- Indiana Manufacturers Association

- Policy updates and member events useful for industrial pilots and introductions.

- The Heritage Group and HG Ventures (industrial, Materials, Climate)

- Corporate pilot pathways and investor access for relevant startups.

Local Meetups, Coworking, and Community Hubs

- TechPoint

- Statewide programs, meetups, and talent initiatives that include investors and operators.

- Indy Chamber and Regional Chambers

- Business leader access and corporate intros across the metro and state.

- Co-working hubs

- The Union 525 (Indy): frequent startup events and investor presence.

- Industrious, Nexus, and other hubs often host pitch nights and workshops. Search their event calendars for dates.

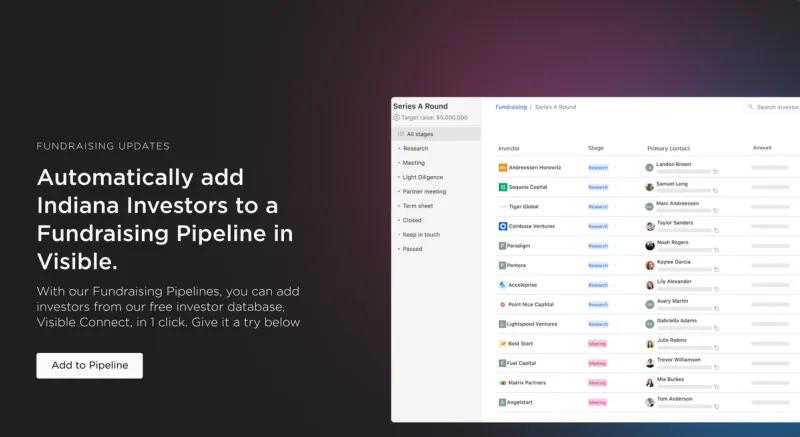

Connect With Investors in Indiana Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Indiana's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

FAQ

What types of startups do Indiana venture capital firms typically invest in?

Indiana venture capital firms invest across B2B SaaS, hardtech, advanced manufacturing, logistics, and life sciences. Many prioritize startups with ties to IU or Purdue and those with customer validation from regional corporates. Indiana investors value clear unit economics, capital efficiency, and a credible path to pilots or revenue with Midwest buyers.

How can I get a warm introduction to Indiana investors?

Warm introductions drive better outcomes in Indiana fundraising. Ask founders in a target fund’s portfolio for a short referral, use IU Ventures and Purdue Innovates channels, and apply to programs like gener8tor and Elevate Nexus. Industry groups such as TechPoint and BioCrossroads also create direct paths to partners and corporate sponsors.

Are there grants or non-dilutive funding options for Indiana startups?

Indiana founders can access Elevate Nexus grants through regional pitch competitions, state matching programs, and university support for SBIR/STTR. Purdue and IU offer guidance on proposals and commercialization. These non-dilutive options help de-risk milestones, validate technology, and extend runway ahead of a seed or Series A raise.

What are the key networking events for Indiana founders?

High-impact Indiana events include TechPoint’s Mira Awards and innovation summits, Elevate Nexus pitch competitions, and VisionTech Angels pitch nights. University demo days from IU Ventures and Purdue Innovates are strong for investor exposure. Sector events by AgriNovus, BioCrossroads, and Conexus Indiana connect founders with customers and partners.

How does fundraising in Indiana compare to coastal markets?

Fundraising in Indiana features smaller average check sizes but stronger emphasis on capital efficiency and customer validation. Founders benefit from lower costs, access to university talent, and a dense corporate base for pilots. Many teams blend Indiana seed capital with out-of-state co-investors for larger rounds and national reach.