Raising venture capital as a Real Estate startup founder is a unique journey—one that demands a deep understanding of both the property sector and the fast-evolving world of technology investment. The Real Estate industry, long known for its complexity and capital intensity, is now at the forefront of innovation, with PropTech, smart buildings, and digital marketplaces transforming how we buy, sell, manage, and experience property worldwide.

Yet, securing the right investment partners in this space is far from straightforward. Real Estate startups face distinct challenges, including navigating regulatory hurdles, managing lengthy sales cycles, and proving value in a sector where disruption is both necessary and challenging. At the same time, global trends—such as the rise of sustainable development, the integration of AI and IoT, and the growing appetite for cross-border deals—are creating unprecedented opportunities for founders who know where to look and how to pitch.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Real Estate, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Real Estate ecosystem.

Top Real Estate VCs

Moderne Ventures

About: Moderne Ventures is a venture fund that invests in tech real estate, mortgage, finance, insurance, and home service companies.

Sweetspot check size: $ 5M

M7 Structura

About: Real Estate/PropTech Seed to Series A European-focused VC firm.

Sweetspot check size: $ 700K

Traction metrics requirements: Revenue or other clear commercial traction

Thesis: We invest in companies developing technology solutions to improve and create efficiencies through the real estate lifecycle and built environment.

GoEx Venture Capital

Sweetspot check size: $ 250K

Thesis: GoEx is a $5MM pre-seed fund in Nashville, TN, focusing on real estate technology companies across the U.S.

Alate Partners

About: Alate Partners is the result of a partnership built between Dream, one of Canada’s largest real estate companies, and Relay Ventures, an established early stage venture capital fund.

Sweetspot check size: $ 3M

Thesis: Alate Partners empowers entrepreneurs who are rethinking real estate.

Fifth Wall

About: At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

Sweetspot check size: $ 10M

MetaProp

About: MetaProp is a New York-based venture capital firm focused on the real estate technology (“PropTech”) industry. Founded in 2015, MetaProp’s investment team has invested in 175+ technology companies across the real estate value chain. The firm manages multiple funds for both financial and strategic real estate investors that represent a pilot- and test-ready sandbox of 20+ billion square feet across every real estate asset type and global market. The firm’s investment activities are complemented by pioneering community leadership including the PropTech Place innovation hub, MetaProp Accelerator at Columbia University programs, global events including NYC Real Estate Tech Week, and publications Global PropTech Confidence Index and PropTech 101.

Camber Creek

About: Camber Creek is a venture capital firm providing strategic value and capital to operating technology companies focused on the real estate market.

Thesis: Focused on the real estate market

Alate Partners

About: Alate Partners is the result of a partnership built between Dream, one of Canada’s largest real estate companies, and Relay Ventures, an established early stage venture capital fund.

Sweetspot check size: $ 3M

Thesis: Alate Partners empowers entrepreneurs who are rethinking real estate.

JLL Spark

About: JLL Spark has invested more than $380 million in more than 45 early-stage PropTech startups—from IoT sensors to investment platforms and more.

Thesis: Spark believes that no one company can produce all the innovation required to serve today’s clients, so we invest and partner with the brightest startups that share our vision and values and are dedicated to bringing positive change to the real estate industry globally.

Second Century Ventures

About: Second Century Ventures (SCV) is a venture capital fund focused on promoting innovation in the real estate industry.

Traction metrics requirements: We are round-agnostic, favoring investments in organizations with strong market traction and proof of product market fit.

Thesis: Second Century Ventures invests in strong teams and technologies with the potential to serve multiple industries.

Fundraising Insights, Trends, and Practical Tips for Real Estate Startups

Current Global Trends in Real Estate Venture Funding

The Real Estate technology (PropTech) sector remains a focal point for innovation and investment in 2025, though overall venture capital funding has moderated compared to the record highs of previous years. According to the Center for Real Estate Technology & Innovation (CRETI), global PropTech venture capital funding totaled $615 million in January 2025, with the U.S. accounting for nearly half of that activity. This reflects a more disciplined and strategic investment environment following a cautious 2023, when global PropTech VC deals reached just $2.2 billion through May.

North America and Europe continue to lead in deal volume and capital deployed, but Asia-Pacific and the Middle East are emerging as fast-growing hubs, particularly in areas like smart cities, green building, and digital infrastructure. Investors are prioritizing startups that address climate risk, energy efficiency, and regulatory compliance—trends accelerated by tightening regulations and growing demand for sustainable solutions.

The integration of AI, IoT, and advanced data analytics is now a baseline expectation for new PropTech entrants. Solutions that enable remote property management, digital transactions, and enhanced tenant experiences are in high demand. Notably, cross-sector convergence is accelerating: innovations from agtech and foodtech—such as vertical farming and urban agriculture—are drawing Real Estate investors interested in mixed-use, sustainable developments.

Unique Challenges Facing Real Estate Startups

Raising capital in Real Estate comes with sector-specific hurdles. Sales cycles are often lengthy, as enterprise clients and institutional landlords require extensive due diligence and pilot programs before fully adopting the solution. Regulatory complexity is another major challenge, with zoning, building codes, and data privacy laws varying widely across regions.

Additionally, Real Estate is a capital-intensive industry. Startups must often demonstrate not just product-market fit, but also the ability to scale operations, manage physical assets, and navigate conservative industry mindsets. Building trust and credibility—through partnerships, pilot projects, and a strong advisory board—is essential for overcoming skepticism and unlocking larger funding rounds.

Opportunities for Innovation and Differentiation

Despite these challenges, 2025 presents unprecedented opportunities for Real Estate founders. Sustainability and ESG (Environmental, Social, and Governance) are now top priorities for both investors and property owners. Startups offering solutions for energy management, carbon tracking, and green construction are seeing increased interest and premium valuations.

AI-powered analytics, predictive maintenance, and digital twin technologies are enabling smarter asset management and operational efficiency. In emerging markets, there is growing demand for affordable housing, modular construction, and digital marketplaces that connect buyers, sellers, and renters in new ways. Fractional ownership and tokenization of real assets are also gaining traction, opening up Real Estate investment to a broader audience.

Real Estate-Specific Due Diligence: What VCs Look For

Venture capitalists in Real Estate are particularly focused on:

- Market Size and Growth Potential: Is your target market large and expanding?

- Regulatory Compliance: Are you prepared for local and international legal requirements?

- Technology Differentiation: How defensible and scalable is your tech?

- Team and Industry Expertise: Do you have the right mix of technical and Real Estate experience?

- Proof of Concept: Have you demonstrated your solution in real-world settings?

Networking, Accelerators, and Global Resources for Real Estate Founders

Key Networking Opportunities and Industry Events

- MIPIM (Cannes, France): The world’s leading Real Estate event, attracting 20,000+ industry leaders, VCs, and innovators. MIPIM 2025 will focus on sustainability, smart cities, and PropTech.

- CREtech New York & London: Premier PropTech conferences featuring top VCs, founders, and corporates. CREtech’s 2025 agenda includes panels on AI, ESG, and cross-border investment.

- PropTech Connect (London): Europe’s largest PropTech gathering, with a strong focus on networking and deal-making.

- EXPO REAL (Munich, Germany): Europe’s largest Real Estate and investment trade fair, with a growing PropTech pavilion.

Leading Accelerators and Incubators for Real Estate Startups

- MetaProp Accelerator (New York): The world’s leading PropTech accelerator, offering investment, mentorship, and access to a global network of Real Estate corporates.

- REACH by Second Century Ventures (Global): Operates in North America, Australia, UK, and Latin America, focusing on scaling Real Estate innovation.

- Pi Labs (London): Europe’s first PropTech VC and accelerator, supporting early-stage startups with funding and industry access.

- Plug and Play Real Estate & Construction (Silicon Valley, Global): Connects startups with major Real Estate and construction corporates worldwide.

Online Communities, Networks, and Founder Resources

- PropTech Collective: A global community for PropTech founders, investors, and professionals, offering events, Slack channels, and curated content.

- CREtech Community: Online forums, webinars, and networking for Real Estate tech innovators.

- Newsletters & Podcasts:

- Propmodo, PlaceTech, and The PropTech Podcast deliver news, trends, and founder stories.

- Government and NGO Resources:

- Startup Genome provides global ecosystem reports and benchmarking.

- The World Bank and local innovation hubs offer grants, regulatory guidance, and support for market entry.

Find an Investor for Real Estate with Visible

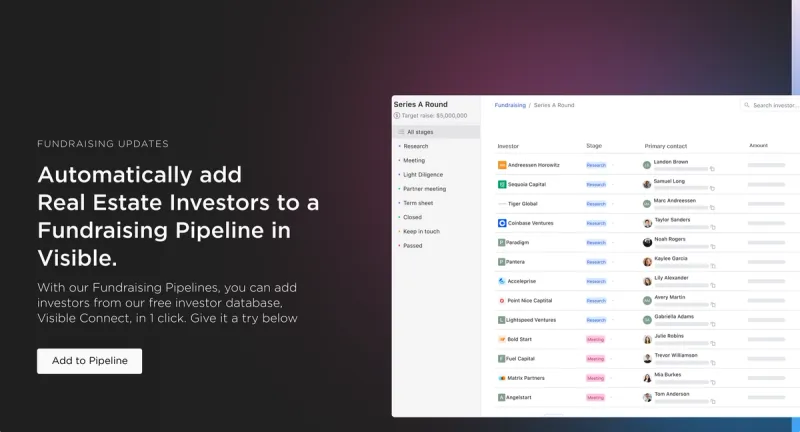

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Real Estate here.

For Real Estate startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Real Estate sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.