Key Takeaways

-

The Nordics are Europe’s top startup region for 2026, producing more unicorns per capita than anywhere outside Silicon Valley and surpassing $500 billion in total ecosystem valuation, with venture investment accelerating again after a 2024 slowdown.

-

Fundraising in Sweden, Denmark, Finland, Norway, and Iceland now rewards capital efficiency, deep tech defensibility, and impact, with median round sizes holding steady but Series A rounds ranging from €3 million to €93 million for top-performing founders.

-

Policy tailwinds give Nordic founders a structural edge, including expanded R&D tax deductions and talent incentives in Sweden that make it cheaper to hire global engineers and scale technical teams.

-

The Nordic VC landscape combines large, pan-European funds like EQT Ventures and Creandum with specialist investors in climate, AI, biotech, and impact, offering founders clear paths from pre-seed to growth capital.

-

This guide maps the full Nordic startup playbook for 2026, from the most active VCs and high-signal accelerators to the events and ecosystems where founders can shorten fundraising cycles and build category-defining companies.

The Nordics (Sweden, Denmark, Norway, Finland, Iceland) have long held the reputation of being Europe’s unicorn factory, producing more billion-dollar exits per capita than any other region outside Silicon Valley. But for founders raising capital in 2026, the playbook has changed. The days of easy Series A rounds based on pure growth metrics are gone, replaced by a market that prioritizes capital efficiency, deep tech innovation, and tangible impact.

The 2025 policy landscape has introduced critical advantages for local founders. For instance, Sweden’s 2025 Budget Bill lowered the salary threshold for the expert tax relief to SEK 85,950/month and increased R&D deduction rates to 108%, making it cheaper than ever to attract top global talent to Stockholm or Gothenburg.

If you're raising capital in 2026, the Nordics offer a unique combination of advantages: abundant capital, deep technical talent, a collaborative ecosystem, and a social structure that rewards risk-taking. The region is no longer a second choice to Silicon Valley. It's a first choice for founders building in deep tech, climate, biotech, and AI.

This guide is designed to help you navigate this landscape. It includes a curated list of the top active VCs with offices or headquarters in the Nordics, a detailed analysis of the local fundraising ecosystem, a guide to incubators and accelerators, and region-specific resources that can accelerate your fundraising timeline.

The Top Nordic VCs: Profiles & Investment Theses

Rather than exhaustively listing every fund, founders should understand the tiers of capital they will most likely interact with.

Large, Multi-Stage, and Pan-European Players with Deep Nordic Roots

These funds typically write larger checks from late seed to Series C and beyond. They often lead or co-lead larger seed and Series A rounds and expect clear international ambition and strong traction by the time you engage them.

EQT Ventures: A pan-European powerhouse with a strong Nordic footprint, backing globally ambitious tech companies from early to growth stages. Active in software, fintech, and increasingly climate and deep tech.

Creandum: Stockholm-born, now pan-European. Known for early bets on Spotify and Klarna. Focus: product-led, globally scalable software and consumer/SMB platforms.

Northzone: Longstanding European VC with Nordic DNA, backing companies like Spotify and iZettle. Invests from early to growth across fintech, SaaS, and consumer.

Specialist and Thematic Leaders

These funds typically invest from pre-seed to Series A, often with strong operator networks and value-add in go-to-market, hiring, and internationalization.

Norrsken VC: Impact and “tech for good” specialist. In 2025, Norrsken committed €300 million to an “AI for Good” strategy focused on climate, food, and health tech innovations, signaling a long-term bet on AI-native impact ventures.

Lifeline Ventures: Helsinki-based, known for early bets in healthtech, deep tech, and frontier technologies.

ByFounders: A community-powered early-stage fund investing across the “New Nordics” (Nordics + Baltics), with a strong emphasis on defensible tech and impact-aware founders. Their Shape of the New Nordics 2024 report has become a reference on funding dynamics and investor activity.

Nordic Founder Resources: Where to Build & Network in 2026

The Nordic ecosystem is dense with support structures, but quality varies significantly. In 2026, the best programs have shifted from generalist bootcamps to specialized deep tech and climate tracks. Below are the high-signal environments where you should actually spend your time.

Sweden

The Stockholm ecosystem remains the region's capital for deep tech and impact.

- Sting (Stockholm Innovation & Growth): The gold standard. They have also tightened their focus for 2026 with a specialized Bioeconomy track, hosting the BioEco Valley Summit in June 2026.

- SSE Business Lab: The accelerator of the Stockholm School of Economics. It is notorious for high admission standards but boasts an incredible alumni network (Klarna, Budbee). Look for their "Activate" and "Incubate" programs opening in early spring.

- Norrsken House: Less of an accelerator, more of a gravity well. If you are an impact founder, you need a desk here. Their 2026 calendar is packed with weekly investor office hours that are often unlisted elsewhere.

Finland

Helsinki has pivoted hard toward defence, deep tech, and university spinouts.

- Aalto Startup Center: The engine of Finnish innovation.

- Maria 01: Europe’s leading startup campus. It is currently expanding, and for 2026, the focus is on their "Journey" program for pre-seed teams.

- EUDIS Business Accelerator: A crucial new player for 2026. This defence-tech accelerator specifically targets dual-use startups in the EU and Norway.

Denmark

Copenhagen is moving beyond B2B SaaS into "hard tech" and quantum.

- Deep Tech Alliance: A heavy hitter for industrial partnerships. Their "Buildings 2026" program opens for applications in early 2026, targeting startups with TRL 5+ (Technology Readiness Level) ready for corporate pilots.

- CSE (Copenhagen School of Entrepreneurship): The entry point for academic founders. Their "OpenInnovation 2026" finals are set for February 26, 2026, which serves as a major scouting ground for Danish pre-seed investors.

- BioInnovation Institute (BII): If you are in life sciences, this is the only name that matters. They offer convertible loans of up to €1.3M for their "Venture Lab" program.

Norway

Oslo is the undisputed king of ocean, energy, and industrial tech.

- Startuplab: Located in Oslo Science Park. They invest directly and provide unmatched access to industrial heavyweights like Equinor and DNB.

- Katapult Ocean: A global leader in the blue economy. Their 2026 accelerator invests € 150k- € 500k in ocean-tech startups. They operate a hybrid model, so you don't need to relocate to Oslo full-time.

- TINC (Silicon Valley Bridge): Run by Nordic Innovation House. This is for scaleups ready for the US market.

Iceland

Reykjavik punches above its weight in energy and gaming.

- Startup SuperNova: Iceland’s premier accelerator, backed by Nova and Huawei. It typically runs in the summer/autumn, with 10 teams selected for a 6-week intensive sprint. It is the best on-ramp to the Icelandic funding ecosystem.

- KLAK - Icelandic Startups: The operator behind most major local programs. Keep an eye on their "Gulleggið" (Golden Egg) competition if you are at the idea stage; it is the traditional first step for Icelandic founders.

2026 Nordic Startup Events

Networking here is seasonal. The first half of the year is for building; the second half is for fundraising.

- Latitude59 (Tallinn, May 21-22, 2026): Technically Baltic, but a mandatory "season opener" for Nordic investors.

- TechBBQ (Copenhagen, Aug 26-27, 2026): The "hygge" alternative to Slush. Best for B2B founders seeking meaningful conversations.

- Oslo Innovation Week (Oct 19-23, 2026): A city-wide takeover focusing on energy and ocean tech.

- Slush (Helsinki, Nov 18-19, 2026): The year’s finale. If you are raising Series A, you must be here.

Why the Nordics Are the Best Place to Build and Fund a Startup in 2026

Ten years ago, raising one million euros in Copenhagen was a milestone. Today, the Nordics are producing billion-dollar companies like Lovable, which hit $200 million in revenue within its first year. This shift is not accidental. It reflects a fundamental change in how Nordic founders think about risk, ambition, and what's possible.

The Nordic startup ecosystem has evolved from a collection of regional hubs into a global powerhouse, officially crossing the $500 billion valuation mark in late 2025. While 2024 set a baseline with over $8 billion in total venture investments, the market has since accelerated: Q3 2025 alone saw $1.8 billion in deal flow, a seven-quarter high that signals a definitive recovery.

This resurgence is driven by the region's unique Impact Premium. Purpose-driven capital is no longer niche; it is the market standard. This shift was cemented in August 2025 when Norrsken VC launched its €57 million Evolve fund, explicitly targeting European resilience and deep tech.

What makes the Nordics different is not just capital availability. It's the structural advantages that allow founders to take the kinds of risks that build category-defining companies.

The Social Safety Net as a Competitive Advantage

The Nordic social model is often discussed in policy circles. For founders, it's a de facto subsidy on innovation. The region's robust welfare systems, comprehensive healthcare, unemployment benefits, and subsidized education create a unique psychological permission structure. Founders can take aggressive technical risks without the fear of personal financial ruin that paralyzes entrepreneurs elsewhere.

This matters more than it sounds. In the US, a failed startup can mean bankruptcy, medical debt, and years of financial recovery. In the Nordics, failure is survivable. This allows founders to swing for the fences. They can hire expensive talent, invest in R&D-heavy products, and pursue moonshot ideas that might take years to validate. The social safety net doesn't just protect founders, it accelerates innovation by removing the personal downside.

Deep Tech, Impact, and AI Dominance

The region now commands a significant impact premium, with over 36% of all venture capital flowing into impact startups, far outpacing the 22% European average. This trend has only accelerated in 2025, with climate tech and energy accounting for more than half of the record-breaking €650 million raised by impact startups last year

The region's universities, ETH Zurich's neighbors in the broader European context, plus world-class institutions in Sweden, Denmark, and Finland, provide a constant pipeline of technical talent and research-backed IP. Founders can spin out from universities with defensible technology, not just ideas. This creates a virtuous cycle: strong research institutions attract top talent, which attracts capital, which funds more ambitious companies.

AI is reshaping this landscape further. The region is becoming a hub for deep tech and AI, with founders using AI to unlock new opportunities in complex industries like climate tech, biotech, and industrial automation. The combination of technical depth and AI-driven efficiency is creating a new class of defensible startups.

The Collaborative Culture and High Social Trust

Nordic culture emphasizes flat hierarchies, transparency, and collaborative problem-solving. This translates directly into how the startup ecosystem operates. VCs co-invest frequently. Founders share knowledge. Competitors collaborate on industry standards. There's less of the zero-sum mentality that characterizes some other ecosystems.

This collaborative culture accelerates deal-making and knowledge transfer. A founder in Stockholm can tap into networks in Copenhagen, Helsinki, and Oslo without friction. Investors from different countries co-lead rounds. This creates a unified Nordic market that punches above its weight globally.

High social trust also means less time spent on legal disputes and more time spent building. Contracts are simpler. Negotiations move faster. The cultural assumption is that parties will act in good faith. This is a massive efficiency advantage that doesn't show up in spreadsheets but compounds over time.

The Funding Landscape is Maturing

The data tells a clear story: the Nordics are moving beyond SaaS and consumer apps into sectors that require defensibility. VCs are increasingly backing younger companies, with the median age at Series A dropping from 5.6 years to 4.2 years. This suggests either faster company maturation or greater investor appetite for early-stage risk, likely both.

VCs are also showing a clear preference for experienced founders, with 43% of rounds going to repeat founders, up from 37% the previous year. This is a sign of a maturing market where track record matters and capital is becoming more selective.

According to the Shape of New Nordics analysis released in late 2025, while median round sizes have held steady, €1 million at pre-seed, €3 million at seed, and €10 million at Series A, the market’s ceiling has shattered. The range for Series A rounds in 2025 fluctuated wildly between €3 million and €93 million, signaling a new era of mega-round potential for top performers. This data confirms a stark bifurcation: the most promising founders are accessing near-unlimited capital, while the middle tier faces a widening valley between seed and Series A.

Connect With Investors in the Nordics Using Visible

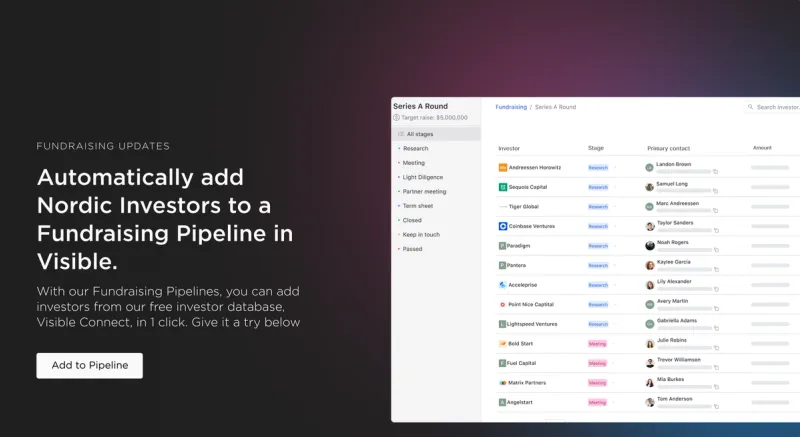

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of investors.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

Frequently Asked Questions

What makes the Nordics a strong place to raise venture capital in 2026?

The Nordics offer a rare combination of abundant venture capital, deep technical talent, and strong public support for innovation. In 2026, founders benefit from a maturing VC market, impact-focused capital, and policies that reward R&D, making the region highly competitive for startup fundraising.

Which industries attract the most Nordic venture capital funding?

Nordic venture capital in 2026 is concentrated in deep tech, climate tech, AI, biotech, and industrial innovation. Investors increasingly favor defensible technologies and research-backed startups over pure SaaS. Impact-driven companies now account for over a third of all venture capital deployed in the Nordic startup ecosystem.

How does fundraising in the Nordics differ from Silicon Valley?

Fundraising in the Nordics places greater emphasis on capital efficiency, technical depth, and long-term impact. Compared to Silicon Valley, Nordic investors are more selective but collaborative, often co-investing across borders. Founders also benefit from social safety nets that reduce personal risk while building ambitious startups.

What are the best Nordic countries for startup founders in 2026?

Sweden, Finland, Denmark, and Norway each lead in different sectors, from AI and climate tech to energy and industrial startups. Stockholm and Helsinki dominate early-stage fundraising, while Copenhagen and Oslo excel in hard tech and energy. Iceland offers a smaller but focused ecosystem for energy and gaming startups.

What funding stages are Nordic VCs most active in today?

Nordic VCs are active across pre-seed to Series A, with growing appetite for early-stage risk. While median round sizes remain stable, top startups can raise significantly larger rounds. In 2026, experienced founders and technically defensible companies have the strongest access to follow-on capital.