The story of venture capital in Crypto is one of dramatic cycles, bold bets, and constant reinvention. In the early 2010s, when Bitcoin was still a fringe experiment, only a handful of visionary investors dared to back blockchain startups. The first wave of Crypto VC funding was dominated by small seed rounds and a focus on core infrastructure—wallets, exchanges, and early protocols. As Ethereum launched in 2015 and the ICO boom of 2017 took off, the sector exploded, attracting billions in speculative capital and spawning a global ecosystem of startups. However, the subsequent “Crypto Winter” of 2018-2019 saw funding dry up, valuations plummet, and many projects disappear.

The next phase, from 2020 to 2022, was defined by the rise of DeFi, NFTs, and Web3, with venture capital pouring into new verticals and record-breaking rounds. Yet, this period also brought increased regulatory scrutiny and market volatility, culminating in a sharp correction in 2022. Many predicted a prolonged downturn, but the Crypto sector proved resilient. By 2024, institutional investors and sovereign wealth funds began to enter the space, drawn by maturing technology, clearer regulations, and the promise of real-world asset tokenization.

2025 marks a pivotal moment for Crypto startups and their investors. In the first half of the year alone, venture capital inflows into Crypto surged to over $10 billion—levels not seen since the last bull market—driven by landmark deals like the $2 billion investment into Binance by Abu Dhabi’s MGX, the largest single VC deal in Crypto history. Unlike previous cycles, today’s capital is flowing into both early-stage innovation and late-stage, revenue-generating companies, reflecting a maturing market where business fundamentals matter as much as vision.

Key factors driving this change:

- Regulatory Clarity: New, more supportive policies in the US, Europe, and Asia have reduced uncertainty and opened the door for institutional capital.

- Institutional Participation: Pension funds, family offices, and sovereign wealth funds are now active players, seeking exposure to blockchain infrastructure, DeFi, and tokenized real-world assets.

- Globalization: While the US remains the leading hub, Asia and Europe are rapidly gaining ground, with new projects and capital emerging from Japan, China, Malta, and beyond.

- Sector Maturation: The focus has shifted from speculative tokens to sustainable business models, with strong interest in CeFi, DeFi, blockchain infrastructure, and the intersection of AI and Crypto.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Crypto, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Crypto ecosystem.

Leading Crypto Venture Capital Firms 2025

Eden Block

About: We focus on the impact of emerging tech, particularly blockchain and AI, across three verticals: 1) Finance & Assets; 2) Privacy, data & security; and 3) Supply Chains & Distribution

Sweetspot check size: $ 1.50M

Thesis: Backing the builders of the Open Internet

Digital Currency Group

About: At Digital Currency Group, we build and support bitcoin and blockchain companies by leveraging our insights, network, and access to capital.

Sweetspot check size: $ 250K

Thesis: We invest in companies that are accelerating the creation and adoption of a better financial system using blockchain technology and cryptocurrency

Blue Yard Capital

About: BlueYard backs founders at the earliest stages building the interconnected elements that can become the fabric of our future. A future where markets are open and decentralized, where we have solved our largest planetary challenges, where knowledge and data is liberated and humanity can live long and prosper.

Thesis: BlueYard seeks to invest in founders with transforming ideas that decentralize markets.

BACKED

About: BACKED is a maverick VC fund backing a new spirit of entrepreneurship. With an emphasis on personal development and community strength, we back the exceptional founders building a future we want to share.

Sweetspot check size: $ 1M

AppWorks

About: Based in Taiwan, AppWorks is the largest startup accelerator in Greater Southeast Asia and one of the region's most active early-stage VCs.

Alchemy Ventures

About: At Alchemy, our mission is to provide developers with the fundamental building blocks they need to create the future of technology. Through Alchemy Ventures, we'll be accelerating this mission by dedicating financing and resources to the most promising teams growing the Web3 ecosystem.

Thesis: Alchemy Ventures invests in teams building revolutionary products for the web3 ecosystem.

Acrew Capital

About: Acrew Capital is a venture capital firm that provides investable assets for diverse angel investors to fund tomorrow's companies.

Sweetspot check size: $ 5M

Thesis: We engage in long-term partnerships with world-class teams that are uniquely suited to transform big challenges into bigger opportunities.

Pantera Capital

About: Pantera Capital is the first institutional investment firm focused exclusively on bitcoin, other digital currencies, and companies in the blockchain tech ecosystem.

Sweetspot check size: $ 5M

Andreessen Horowitz (a16z Crypto)

About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today's entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

Sweetspot check size: $ 25M

Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

Paradigm

About: Paradigm primarily invests in crypto-assets and businesses from the earliest stages of idea formation through to maturity.

Every once in a while, a new technology comes along that changes everything. The internet defined the past few decades of innovation. We believe crypto will define the next few decades.

Paradigm is an investment firm focused on supporting the crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and continue supporting our portfolio companies over time.

We take a deeply hands-on approach to help projects reach their full potential, from the technical (mechanism design, smart contract security, engineering) to the operational (recruiting, regulatory strategy).

Thesis: Paradigm is an investment firm focused on supporting the great crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and support our portfolio with additional capital over time.

Coinbase Ventures

About: Coinbase Ventures is an investment arm of Coinbase that aims to invest in early-stage cryptocurrency and blockchain startups.

Thesis: At Coinbase, we’re committed to creating an open financial system for the world. We can’t do it alone, and we’re eagerly rooting for the brightest minds in the crypto ecosystem to build empowering products for everyone.

Digital Currency Group (DCG)

About: At Digital Currency Group, we build and support bitcoin and blockchain companies by leveraging our insights, network, and access to capital.

Sweetspot check size: $ 250K

Thesis: We invest in companies that are accelerating the creation and adoption of a better financial system using blockchain technology and cryptocurrency

YZi Labs (Formerly Binance Labs)

About: YZi Labs manages over $10 billion assets globally. Our investment philosophy emphasizes impact first -- we believe that meaningful returns will naturally follow. We invest in ventures at every stage, prioritizing those with solid fundamentals in Web3, AI, and biotech.

YZi Labs’ portfolio covers over 300 projects from over 25 countries across six continents. More than 65 of YZi Labs’ portfolio companies have gone through our incubation programs. For more information, follow YZi Labs on X.

MGX

About: Born in the UAE, MGX is a leading AI and advanced technology investor. We are committed to accelerating responsible AI development and building one of the world’s most advanced AI ecosystems. MGX provides access to a global network of visionaries, entrepreneurs, and investors, all focused on shaping a prosperous and interconnected future.

Key Networking Opportunities, Accelerators, and Resources for Crypto Founders

Major Industry Events and Conferences

Attending top-tier events is one of the fastest ways to access VCs, corporate partners, and the latest industry insights. Some of the most influential Crypto and blockchain events in 2025 include:

- Consensus by CoinDesk (USA): The world’s largest and most influential Crypto conference, drawing VCs, founders, and policymakers from around the globe.

- Token2049 (Singapore & Dubai): Asia’s premier Crypto event, now with a major presence in the Middle East, attracting global investors and innovators.

- ETHGlobal (Global): A series of hackathons and summits focused on Ethereum and Web3, with events in North America, Europe, and Asia.

- Paris Blockchain Week (France): Europe’s flagship event for blockchain, DeFi, and Web3, with a strong VC and institutional presence.

- Web Summit (Portugal): While broader than just Crypto, Web Summit’s Crypto and Web3 tracks are a magnet for global investors and founders.

Tip: Many VCs now host private side events, pitch competitions, and office hours at these conferences. Apply early and leverage your network for introductions.

Leading Crypto Accelerators and Incubators

Accelerators and incubators remain a powerful launchpad for Crypto startups, offering funding, mentorship, and direct access to top-tier investors. The most respected programs are increasingly global and sector-specific:

- YZi Labs (Binance’s Incubation Program): Backing early-stage Crypto projects worldwide, with a focus on infrastructure, DeFi, and Web3.

- a16z Crypto Startup School: Andreessen Horowitz’s intensive program for Web3 founders, offering mentorship from industry leaders and direct VC access.

- Outlier Ventures Base Camp: A leading Web3 accelerator with a global cohort, focusing on DeFi, NFTs, and the open metaverse.

- CV Labs Accelerator (Switzerland, Africa, Asia): Supporting blockchain startups with funding, workspace, and access to the Crypto Valley ecosystem.

- Techstars Web3 Accelerator: A global program for blockchain and Crypto startups, with a strong network of mentors and investors.

Tip: Acceptance into a top accelerator can significantly boost your credibility with VCs and open doors to global networks.

Regulatory and Legal Resources

- Global Digital Finance (GDF): Industry-led best practices and regulatory updates for digital assets.

- Coin Center: US-focused policy research and advocacy for Crypto founders.

- Blockchain Association: Advocacy and resources for navigating US and global Crypto regulation.

Cross-Border Funding Considerations

- Local Legal Counsel: Engage with law firms experienced in Crypto and cross-border fundraising.

- Jurisdictional Hubs: Consider the advantages of incorporating in Crypto-friendly jurisdictions like Switzerland, Singapore, Malta, or the UAE for regulatory clarity and investor access.

International Ecosystem Trends and Cross-Border Insights

- Asia’s Rise: Japan, Singapore, and Hong Kong are seeing a surge in new projects and VC activity, driven by regulatory clarity and government support.

- Europe’s Maturation: Switzerland and Malta remain top destinations for Crypto startups, with strong legal frameworks and access to EU capital.

- US Leadership, Global Competition: The US is still the largest market for Crypto VC, but founders are increasingly looking to raise from a global syndicate of investors.

- Africa and Latin America: These regions are emerging as innovation hotspots, especially in payments, DeFi, and real-world asset tokenization, with growing local VC and accelerator support.

Find an Investor for Crypto with Visible

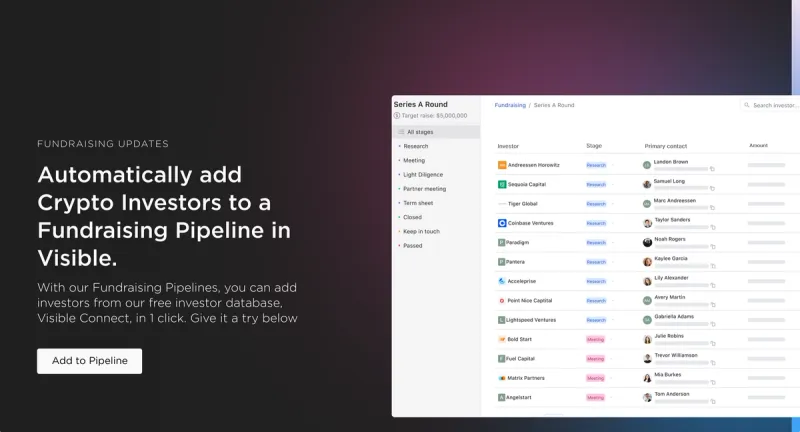

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Crypto here.

For Crypto startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Crypto sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.