Key Takeaways

-

Discover why the Bay Area captured over $122 billion in AI funding in the last year and remains the undisputed global center for venture capital investment.

-

Learn how the shift to Cerebral Valley and physical density in Hayes Valley and SoMa is redefining the fundraising landscape for early-stage founders.

-

Access a curated list of top active venture capital firms, including Khosla Ventures and Sequoia Capital, with their specific investment mandates for 2026.

-

Understand the new Series A metrics triad of growth velocity, capital efficiency, and net revenue retention required to secure funding in a competitive market.

-

Gain unfair advantages with insider details on region-specific resources like the Prop M tax exemption and specialized accelerators for AI and deep tech.

If you're a founder looking to raise capital, the Bay Area isn't just another option, it's the epicenter of venture funding. In 2025, the Bay Area captured over $122 billion in AI funding alone, representing more than 75% of all U.S. AI investment. San Francisco maintains its position as the world's top startup ecosystem, outpacing London, New York, and Beijing in both capital availability and exit opportunities.

This capital concentration has driven a return to physical density, specifically in the Hayes Valley and SoMa neighborhoods now dubbed Cerebral Valley. Remote work may serve established teams, but for founders in the 0-to-1 phase, physical presence here has become non-negotiable. Investors are once again prioritizing teams that share the same zip code, viewing proximity as a proxy for commitment and speed.

However, the bar for that capital has shifted dramatically. Raising capital in the Bay Area in 2026 looks fundamentally different from what it did even two years ago. The era of growth-at-all-costs is over. Investors are writing fewer checks, but those checks are bigger, and they're going to founders who can demonstrate capital efficiency and a clear path to profitability. The median deal size has increased while the total number of deals has contracted, creating a more competitive but potentially more rewarding fundraising environment.

This guide exists to give you an unfair advantage. Whether you're pre-seed or Series B, whether you're building in AI, biotech, fintech, or consumer, you need to understand not just who the investors are, but how the Bay Area's unique ecosystem can accelerate your fundraising timeline and improve your terms.

The Top Active VC Firms in the Bay Area

We have curated this list based on recent VC activity. Select investors based on their current specific mandates, not their historical reputation.

Category 1: The AI Supernova Hunters

These firms are deploying the largest checks for companies with incumbent-killing potential. They are currently looking for velocity: startups that can reach $100M ARR in under 24 months.

Khosla Ventures

Sweet Spot: Early-stage Deep Tech & AI

Vinod Khosla is explicitly targeting Vertical AI that replaces labor rather than just augmenting it. They are funding high-risk, regulation-heavy ideas in healthcare and robotics that can lead to improbable breakthroughs.

Sequoia Capital

Sweet Spot: Seed to IPO

Moving beyond the Arc program, Sequoia is doubling down on the AI Application Layer. They are actively looking for founders who can demonstrate a data moat that prevents their wrapper from being sherlocked by OpenAI or Google.

Andreessen Horowitz/ a16z

Sweet Spot: Stage Agnostic

Signal: The American Dynamism thesis is central. They are heavily funding defense, aerospace, and manufacturing startups in the Bay Area that solve national interest problems, alongside their massive compute-infrastructure bets.

Lightspeed Venture Partners

Sweet Spot: Series A to Growth

Signal: Actively funding Agentic Workflows. They are looking for platforms where AI agents autonomously complete complex enterprise tasks (like supply chain negotiation) rather than just generating text or code.

Accel

Sweet Spot: Series A & B

Signal: Focused on the Modern Data Stack 2.0. As AI models become commodities, Accel is funding the infrastructure that cleans, pipes, and governs the data feeding those models.

Category 2: The First Believers

These firms specialize in inception investing. They are often the first check and willing to back a founder before the metrics exist, focusing on the quality of the insight.

Benchmark

Sweet Spot: Early Stage (Series A focused)

Signal: Remains the anti-hype firm. They are looking for contrarian consumer social apps and marketplaces that leverage AI to create new behaviors, rather than just enterprise productivity tools.

Greylock

Sweet Spot: Seed & Series A

Signal: The Reasoning Revolution is their current core thesis. They are funding Service-as-Software models where the startup sells the outcome of the work (e.g., a completed marketing audit) rather than the tool to do it.

Floodgate

Sweet Spot: Pre-Seed & Seed

Signal: Mike Maples Jr. is hunting for Prime Movers—founders who are redefining the rules of a category rather than improving an existing one. They are particularly active in crypto-consumer intersections and non-consensus AI plays.

Pear VC

Sweet Spot: Pre-Seed & Seed

Signal: Their PearX accelerator has become a feeder for top Series A rounds. They are currently heavy on Simulation Layers for robotics and physical industries, funding companies that build digital twins for manufacturing and logistics.

NFX

Sweet Spot: Seed

Signal: Focused on Network Effects in the Age of AI. They are looking for startups where the AI gets smarter not just by data volume, but by the number of users interacting with it, creating a defensible lock-in.

Category 3: The Thesis-Driven Scalers

These firms bring specific operational machinery to help you scale from $1M to $10M ARR. They often have proprietary software or teams to assist with recruiting and sales.

SignalFire

Sweet Spot: Seed to Series B

Signal: With their $1B fund, they are deploying their Beacon AI data platform to source talent for portfolio companies. They are aggressively funding Generalist Engineer tools that allow smaller teams to build massive systems.

Menlo Ventures

Sweet Spot: Series A to Growth

Signal: The Modern AI Stack. They are actively distinguishing between tourist AI adoption and native adoption in the enterprise. They are heavy investors in clinical documentation and back-office automation for healthcare.

Bessemer Venture Partners

Sweet Spot: Early to Growth

Signal: Their Roadmap is focused on Industrial AI. They are looking for founders digitizing pen and paper industries like construction, logistics, and agriculture with vertical-specific LLMs.

Founders Fund

Sweet Spot: Stage Agnostic

Signal: Hard Tech remains the priority. They are one of the few firms actively seeking capital-intensive projects in energy (nuclear/fusion), space, and bio-manufacturing that other software investors avoid.

Felicis

Sweet Spot: Seed & Series A

Signal: Fresh off their $900M Fund X close in mid-2025, they are treating AI Infrastructure as Railways. They are funding the picks and shovels (security, observability, evaluation) required to run reliable AI agents in production.

Bay Area Founder Resources: Accelerators, Communities & Events

The Top Accelerators for 2026

While Y Combinator is the default, it is not always the optimal fit. In 2026, specialized accelerators are offering higher valuations, specialized compute resources, and distinct networks that may better align with your model.

For The Hardcore Engineer: HF0 (Hacker Fellowship Zero)

- The Vibe: This is currently the highest-signal residency for pure technical talent. It is not about pitch decks; it is about shipping code.

- The Deal: They operate on Container Theory, isolating you from all distractions (cooking, cleaning, errands) for 12 weeks so you can reach flow state.

- 2026 Signal: Their alumni (like ACE Studio) are hitting massive revenue velocity. If you are a technical founder who finds YC too noisy, this is your home.

For The Sci-Fi Builder: Boost VC

- The Focus: Deep Tech, Crypto, VR, and Space. They fund things that sound impossible.

- The Deal: They write a $500k check and are famously long on volatility. Led by Adam Draper, they are often the first check into markets other VCs are scared of (like nuclear or intense crypto-infra).

- 2026 Signal: They are actively looking for Coordinate startups; companies that help organize human activity on a massive scale (AI agents, crypto-governance).

For The Consumer & Gaming Founder: a16z Speedrun

- The Focus: Not just for games, but for any gamified consumer app or interactive tech.

- The Deal: This is arguably the most lucrative standard deal in the market: up to $1M (via SAFE + potential follow-on) and direct access to the a16z Games infrastructure.

- 2026 Schedule: The SR006 cohort runs January – April 2026 in San Francisco. If you missed this window, watch for the Fall cycle.

For The Enterprise (B2B) Founder: Alchemist Accelerator

- The Focus: Startups that monetize from enterprises, not consumers.

- The Deal: A longer, 6-month program designed specifically for the slow, painful sales cycles of the Fortune 500. They have the best mentors for Sales Engineering in the valley.

- 2026 Signal: Their Class 36 and beyond are heavily focused on Agentic Enterprise, using AI to automate entire B2B workflows, not just assist them.

For The Academic/Deep Tech Founder: Berkeley SkyDeck

- The Focus: Connecting university-grade research with venture capital.

- The Deal: $200k investment for cohort companies, plus access to the massive UC Berkeley talent pipeline (interns, PhDs, labs).

- 2026 Schedule: Applications for Batch 22 opened in Jan 2026 for a May start. This is the best path if your moat is a patent or complex IP.

For The Next Gen Leader: Neo

- The Focus: Identifying the absolute best young engineers and connecting them with mentors like the founders of Notion and Figma.

- The Deal: $600k uncapped SAFE with a $10M valuation floor. It functions less like a class and more like an elite alumni network.

- 2026 Signal: They run a Semester in SF that is a prime feeder for technical founders who might still be in (or recently out of) top CS programs.

Where the Deals Happen: High-Signal Networking

In 2026, the who you know game has moved from general mixers to tribal communities. You need to be in the room where your specific peers are debating code, not just exchanging business cards.

- GenAI Collective

- The Tribe: The grassroots hacker community.

- The Vibe: Famous for their Living Room meetups and Builders Nights. This is where the actual builders hang out to demo half-finished projects before they hit Product Hunt. It is low ego, high technical depth.

- Latent Space

- The Tribe: The new AI Engineer class, software engineers shifting from full-stack to model orchestration.

- The Event: Hosted by Swyx and Alessio, their AI Engineer World’s Fair (June 2026) is the defining technical conference of the year. If you are recruiting top-tier talent, you must be here.

- SF Hardware Meetup

- The Tribe: Robotics, wearables, and industrial tech founders.

- The Vibe: Often hosted at Studio 45 or large warehouses, this is the largest gathering of hardware geeks in the world. You will see demos of exoskeletons and drones, not SaaS dashboards.

- Luma

- Pro Tip: In the Bay Area, Eventbrite is dead. If an event isn't on Luma, it effectively doesn't exist for the tech crowd. Create a profile, subscribe to the San Francisco Tech calendar, and vet events by who else is attending.

Co-Working

Since many teams are distributed or hybrid, these Third Spaces have effectively become the living room of the SF startup ecosystem. The selection below categorizes them by tribe, so you can find the room where your specific peers (and investors) are actually sitting.

- The Commons (Hayes Valley)

- The Tribe: Early-stage GenAI founders, hackers, and creatives.

- The Vibe: It feels like a university common room for adults. It is the physical heart of Cerebral Valley.

- 9Zero (Financial District)

- The Tribe: Climate Tech & Sustainability founders.

- The Vibe: This is a dedicated Climate Innovation Hub at 350 California St. If you are building in energy, carbon capture, or ag-tech, this is where you find your partners.

- Studio 45 (Bernal Heights/Mission)

- The Tribe: Hardware, Robotics, and Hard Tech engineers.

- The Vibe: A clubhouse for people building physical things. It offers CNC machines, 3D printers, and electronics labs alongside desks. If you are building a robot, you don’t go to a cafe; you go here.

- Groundfloor (Mission)

- The Tribe: Social-first founders and the post-tech crowd.

- The Vibe: Part social club, part workspace. It creates a moody, lounge-like atmosphere that prioritizes community connection over silent productivity.

- Canopy (Jackson Square)

- The Tribe: Series B+ founders and VCs.

- The Vibe: High-end, quiet, and privacy-focused. Located near the major VC offices, this is where you go when you need to focus or host a serious board meeting, not a hackathon.

- Shack15 (Ferry Building)

- The Tribe: The general Davos crowd of SF tech.

- The Vibe: A high-end social club located in the Ferry Building. It is the preferred spot for investor meetings and casual co-working for established founders.

The Ecosystem: Series A Readiness & The Talent War

The era of "growth at all costs" has been replaced by "efficient velocity." Investors have tightened the benchmarks for Series A rounds. You cannot just show top-line growth; you must prove unit economics are sound before you scale.

Series A Readiness: The Metric Triad

- Growth Velocity: Top-quartile performers are growing 50%+ Year-over-Year, while the median has settled closer to 26%. If you are pitching an "AI Supernova" trajectory, investors expect you to double revenue yearly for the first 2-3 years.

- Efficiency (The Burn Multiple): A Burn Multiple of <2.0 is the safe zone. Investors now expect your ARR per Employee to be $150k-$250k, punishing startups that bloat headcount to solve technical problems.

- Retention (The Floor): Net Revenue Retention (NRR) must be above 106%, but best-in-class companies are hitting 120-130%. In a market saturated with wrapper apps, high churn is the fastest way to get a no.

The Talent War: Generalists vs. Specialists

The hiring market has bifurcated. Generalist software engineering roles are softening as AI coding agents increase productivity, but the war for specialized AI talent is driving costs to record highs.

- The Specialist Premium: Roles requiring specific AI skills (e.g., computer vision, model fine-tuning) now command a 25% salary premium over standard engineering roles.

- Cost of Competition: Be prepared for sticker shock. Top-tier AI engineers in the Bay Area are frequently seeing total compensation packages (base + equity). The median Total Compensation for AI Engineers in the San Francisco Bay Area is $329,000, with 75th percentile and top-tier roles (OpenAI, Anthropic, Meta) easily clearing $400k - $600k.

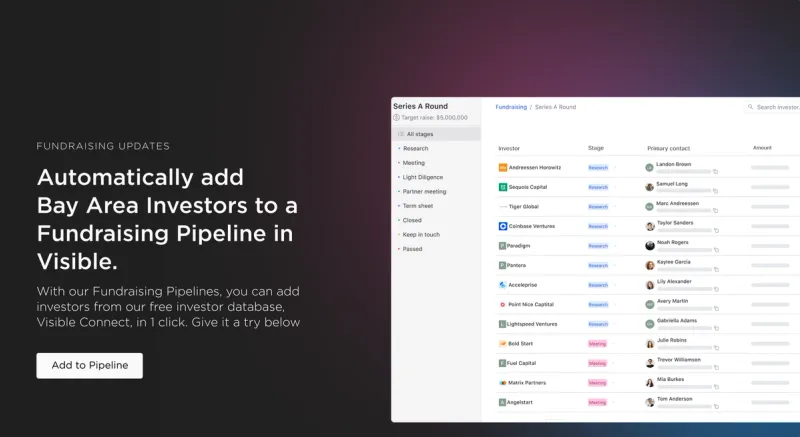

Connect With Investors in the Bay Area Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of investors.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

Frequently Asked Questions

Do I need to be in San Francisco to raise venture capital?

While remote work is possible, data indicates a significant advantage for founders physically present in the Bay Area, particularly for pre-seed and seed rounds. Investors in neighborhoods like Cerebral Valley prioritize proximity for speed of execution. Being local provides easier access to the 75% of US AI capital concentrated in the region.

What metrics are required for a Series A round in 2026?

Investors currently demand efficient velocity rather than growth at all costs. To raise a competitive Series A in the Bay Area, startups should aim for year-over-year growth of 50% or higher and a burn multiple under 2.0. Best-in-class companies also demonstrate net revenue retention above 120% to prove they have a defensible moat.

Which San Francisco accelerators are best for AI startups?

Beyond Y Combinator, accelerators like HF0, AI Grant, and Berkeley SkyDeck are currently the highest-signal options for AI founders. These programs offer specialized compute resources and technical mentorship that generalist programs lack. HF0 is particularly noted for its residency model that isolates founders to focus purely on shipping code.

Where can founders find high-signal networking events in San Francisco?

Generic happy hours are out; tribal communities are in. The most valuable interactions happen at specific builder events found on Luma, which has replaced Eventbrite for the tech crowd. Prioritize technical gatherings like SF Tech Week, GenAI Collective meetups, and hackathons where the focus is on shipping code rather than transactional networking.