Key Takeaways

-

Discover who’s actively investing in Alabama’s startups today, from seed to growth rounds.

-

Learn exactly what Alabama investors look for and a clear path to scale beyond state borders.

-

See how state-backed programs like Innovate Alabama and InvestAL are injecting new capital and changing how founders tap into non-dilutive and early-stage funding.

-

Get a mapped overview of key incubators, accelerators, university programs, and coworking labs across Birmingham, Huntsville, Mobile, and Montgomery to boost your access to support and investors.

Alabama’s startup scene is gaining momentum across sectors. Founders are finding more local capital, stronger university ties, and steady support from incubators and state programs. But raising capital in Alabama still differs from doing so in major tech hubs. Investors here often expect strong ties to regional markets, domain alignment with dominant state industries (like defense, aerospace, advanced manufacturing, agritech, health IT), and clarity on how a startup can scale beyond state borders.

At the same time, funding sources are diversifying: many founders are combining self-funding, grants, loans, or revenue-based models alongside traditional venture capital. New public-private initiatives, such as Innovate Alabama’s launch of a state-backed venture studio in partnership with Harmony Venture Labs, indicate a shift in how the state supports high-growth ventures.

This guide helps founders raising in Alabama map the local funding landscape. You will learn which investors are active, what they look for, and how to approach them. You will also find practical tips, local funding trends, and examples of what works. Finally, we list accelerators, programs, co-working hubs, and events that can speed up your raise.

Active Alabama VC Firms

New Capital Partners

About: New Capital Partners is an Alabama-based private equity firm that manages private equity and economic development funds.

Measured Capital

About: Measured Capital is an early-stage venture capital firm focused on investing in innovative companies beyond major tech hubs that are transforming how we live, work, and retire. By leveraging a data-driven, hands-on approach to working with the founders we invest in, we offer more than just funding.

Eastside Partners

About: Eastside Partners makes growth-equity investments in Healthcare and Information Technology companies based in the southeastern United States. They build relationships with talented entrepreneurs to grow companies of significant value.

AIM Group

About: Collective Capital Ventures is a unique self-directed venture capital model that enables you to build an automatically diversified portfolio while gaining access to 30+ vetted investment opportunities in high-growth technology companies. We provide the venture capital experience with flexibility for the individual investor.

Collective Capital Ventures

About: Collective Capital Ventures is a unique self-directed venture capital model that enables you to build an automatically diversified portfolio while gaining access to 30+ vetted investment opportunities in high-growth technology companies. We provide the venture capital experience with flexibility for the individual investor.

Innovation Depot

About: Our vision is for Innovation Depot to be recognized as one of the best incubators in the country, where entrepreneurs pursue their startup dreams, build dynamic teams, and contribute to the growth of Birmingham. We aim to be the go-to destination for every tech enthusiast in the city, fostering a vibrant community of founders, startup employees, investors, and supporters. We want our building to feel like home, a place where countless hours are spent turning ideas into reality, and where everyone feels welcomed and valued. This is the place to be for innovation, collaboration, and success.

Alabama Futures Fund

About: Our Fund seeks to be the first significant investment in an early-stage venture that can reach attainable milestones leading to series A financing within 12-24 months. Our sweet spot is companies that have adaptable and coachable founding teams who have identified a significant customer problem and are working towards product market fit. This includes companies at the minimum viable product, pre-revenue and early revenue stages. Because of the risks involved in investing this early, our preference is to stage capital relative to milestones achieved. Therefore, we reserve significant capital for follow-on investments in our most promising companies.

Founder Resources, Programs, and Networking in Alabama

Incubators and Accelerators

These programs offer structure, mentorship, and connections.

- Innovation Depot (Birmingham): This hub provides programs, mentors, and access to capital. It is a central point for tech startups in the region.

- Bronze Valley (Birmingham): This organization focuses on inclusive founder support and pathways to venture capital.

- Auburn New Venture Accelerator (Auburn): This program supports student and faculty ventures, leveraging the university's alumni network.

- Huntsville programs: These initiatives focus on defense, aerospace, and dual-use commercialization, often tied to federal contracts.

- Gener8tor and regional partners: These accelerators run programs in Alabama, bringing national networks and capital.

University Resources

Alabama universities offer deep resources for founders.

- UAB (University of Alabama at Birmingham): Strong in tech transfer, clinical pilots, and biotech resources, especially for health tech.

- UAH (University of Alabama in Huntsville): Connects to defense and aerospace research, with support for SBIR applications.

- Auburn University: Offers resources in engineering, agtech, and industry collaboration, often with corporate partners.

Government and Public Programs

These programs provide grants, visibility, and strategic support.

- Alabama Launchpad: This program offers grant competitions and increases investor visibility for winning startups.

- SBIR/STTR support: Federal programs like AFWERX, NASA, and Army provide non-dilutive capital for dual-use technologies.

- Launchpad (EDPA) – Pitch competition awarding non-dilutive capital up to $100K per cycle.

Co-working and Lab

- Birmingham: Innovation Depot and Forge provide co-working and shared lab facilities.

- Huntsville: HudsonAlpha Institute for Biotechnology offers specialized labs, and research parks have various options.

- Mobile: Fuse Project’s The Grounds, a collaborative coworking and event space that supports local entrepreneurs, nonprofits, and early-stage startups with community programming and resources.

- Montgomery: The Lab on Dexter is a state-backed innovation hub offering workspace, mentorship, and technology training to help minority and small-business founders launch and scale their ventures.

Events, Pitch Nights, and Communities

- Alabama Launchpad: Attend milestone events and finals to see top startups and meet investors.

- Innovation Depot: Demo days and regular meetups connect founders with mentors and peers.

- Alabama Launchpad Competitions

- Startup Grind in Birmingham / Huntsville / Mobile Chapters

- TechBirmingham Events

- Sloss Tech conference

- University Demo Days (HudsonAlpha, Auburn, and UA)

Alabama’s Fundraising Landscape

Birmingham, Huntsville, and Mobile are the most active startup cities in the state. Birmingham centers around Innovation Depot and its partner programs, which provide a strong support system for founders. Huntsville combines federal assets with research parks and a growing set of defense and agtech accelerators. Mobile builds on the port to drive logistics, maritime, and supply chain innovation.

In 2025, Innovate Alabama awarded over $3.3 million in SBIR/STTR supplemental grants to 20 Alabama companies to help bridge R&D to commercialization, deepen roots in the state, and stimulate follow-on investment.

Also, Innovate Alabama deployed new capital via its InvestAL program, investing in regional VC firms such as gener8tor Alabama and Measured Capital to expand early-stage venture funding in the state.

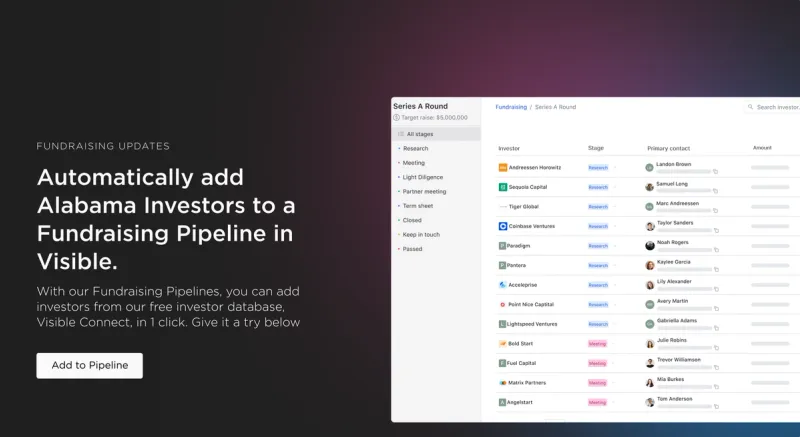

Connect With Investors in Alabama Using Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect and find a filtered list of Alabama's investors here.

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try here.

Frequently Asked Questions

What defines a "top Alabama VC" and how can founders identify them?

Top Alabama VCs are those actively deploying capital in the state, with clear investment theses, repeat deal flow, and strong networks. Look for firms investing across seed to growth stages, especially in sectors like aerospace, agritech, health IT, or defense, and check their track record in Alabama.

What is InvestAL and how do I apply for investment from it?

InvestAL is Alabama’s state-managed capital program, allocating up to $98 million (with $25 million earmarked for VC) to fund high-growth startups. Its check sizes range from $5,000 to $1,000,000. The application process (pitch deck, cap table, SEC/ASC registration, etc.) takes about 45 days.

Which fundraising strategies work best when targeting Alabama venture capitalists?

Start with local validation, launch pilots or gain traction in Alabama markets, and secure warm introductions through regional accelerators, universities, or portfolio founders. Tailor your pitch to each VC’s industry focus and clearly outline a scalable growth path beyond the state’s borders.

Are there alternatives to VC in Alabama’s startup ecosystem?

Yes. Many Alabama founders now combine self-funding, revenue, grants, or debt with traditional VC capital. This hybrid approach is rising in popularity as VCs narrow their sector focus (e.g., toward AI), making diversified capital strategies a more resilient path.

What types of startups attract the most venture capital in Alabama?

Alabama VCs typically focus on startups in aerospace, defense, agritech, advanced manufacturing, and health technology. These sectors align with the state’s industrial strengths and research universities, making them attractive to both local investors and national venture funds looking for early traction in high-growth markets.

How can early-stage founders in Alabama connect with investors?

Founders can connect with Alabama venture capitalists through pitch events, accelerators, and programs like Innovate Alabama, the Alabama Launchpad, and Birmingham’s Innovation Depot. Using platforms like Visible can also help organize investor outreach and track fundraising metrics for more effective relationship-building.

What role do universities play in Alabama’s startup ecosystem?

Universities such as the University of Alabama at Birmingham and Auburn University serve as vital startup hubs, offering research partnerships, incubator programs, and angel investment networks. Many Alabama VCs monitor these institutions for early innovations and founder talent, creating a steady pipeline of investable startups statewide.