Key Takeaways

-

The top 15 venture capital firms in Salt Lake City, including their investment focus, typical check sizes, and portfolio highlights

-

How the fundraising climate in Salt Lake City differs from coastal markets, and what that means for founders preparing to raise

-

Actionable advice for pitching Utah investors, building credibility, and avoiding common mistakes

-

The most important networking events, community hubs, and accelerators that can connect you with investors and advisors

-

University funds, angel groups, and government programs that provide early-stage capital and support

-

Current trends shaping Utah’s venture ecosystem, including sector hotspots and valuation norms

-

Practical steps founders can take to position themselves for long-term fundraising success in the region

Salt Lake City is a growing center for innovation and entrepreneurship. This city offers a dynamic environment for founders building new companies. For those actively raising capital, understanding the local landscape is key.

The region has seen increasing momentum in venture funding and investor presence. This article provides a practical resource for navigating this ecosystem. It includes an up-to-date list of the top 15 venture capital firms in Salt Lake City.

Founders will find actionable insights on these VC firms. The article also covers current ecosystem trends and key networking opportunities. It details geography-specific resources available to help startups thrive in Salt Lake City.

Top Venture Capital Firms in Salt Lake City Backing Startups

For founders raising money in Salt Lake City, it pays to know the investors who are close to the action. Local venture capital firms provide more than funding. They bring access to regional networks, introductions to potential customers, and experience with the challenges that founders in Utah face. While many out-of-state investors are active in Utah, proximity can mean faster decisions and better alignment.

Signal Peak Ventures

About: Signal Peak is a private equity and venture capital firm with more than $500 million of committed capital under management. The firm focuses on making equity investments in early-stage technology companies in emerging markets. Signal Peak is typically a SaaS investor targeting companies with differentiated and disruptive business models, exceptional management teams, and large addressable markets.

EPIC Ventures

About: EPIC Ventures is a Salt Lake City based early-stage venture capital firm.

Peterson Ventures

About: We provide seed funding to exceptional entrepreneurs looking for a partner to help solve the challenges that accompany rapid growth.

Cross Creek

About: Cross Creek seeks to invest in later stage companies through its direct and fund investment strategy.

Mercato Partners

About: For over 15 years we have had the privilege of partnering with visionary entrepreneurs and teams as they build transformational companies. While much has changed since we opened our doors in 2007, our commitment to fund the extraordinary has not wavered. We are more energized than ever to seek out the next generation of great American companies that will disrupt their industries and forever change how we learn, work and live—for the better.

Pelion Venture Partners

About: Since 1986, Pelion Venture Partners has been helping entrepreneurs turn early-stage concepts into tomorrow’s industry-leading companies. The Pelion team has deep and diverse industry and investment experience. We are hands-on in our approach and work collaboratively on each portfolio company over the life of an investment. Our company partners benefit from our insights and our abilities to focus strategically and tactically on success. We can tap into and leverage a vast network of technology executives in all corners of the IT industry to help our companies achieve success.

RenewableTech Ventures

About: RenewableTech Ventures is an early and growth stage venture fund investing in renewable energy, clean technology, energy conservation, green materials and other technologies.

Peterson Partners

About: Peterson Partners is an independent investment management firm with assets under management across a variety of alternative asset classes.

Kickstart

About: Kickstart Fund is a seed-stage venture capital firm based in Salt Lake City, UT. Kickstart’s mission is to fuel the best companies in the Mountain West by providing smart capital, a connected community, and expert guidance. Since raising its first fund in 2008, Kickstart has invested in more than 150 companies.

Album VC

About: Album VC is a venture capital firm that invests in early-stage technology ventures, shaping the future of technology and culture.

Zetta Venture Partners

About: Zetta Venture Partners is the first focused fund committed to delivering exceptional returns from the high-growth analytics market.

Fundraising in Salt Lake City

Salt Lake City has firmly established itself as the capital of Utah’s “Silicon Slopes,” attracting both homegrown venture funds and a growing number of outside investors. But raising here is not the same as raising in San Francisco or New York. Founders who succeed understand how the local ecosystem operates and adapt their approach accordingly.

Understand How Local VCs Deploy Capital

Founders often misjudge the check sizes and risk tolerance of Utah-based investors. Firms like Kickstart are synonymous with seed rounds and will often deploy $250,000 to $2 million, but they look for capital-efficient models that can scale. Later-stage investors such as Mercato Partners or Pelion Ventures expect traction and disciplined financial controls before writing checks.

This means founders should sequence their fundraising strategy: build early credibility with regional seed funds, hit meaningful traction milestones, and then re-engage Utah’s growth-stage firms once you have measurable ARR or strong retention.

Balance Local Relational Culture With National Standards

While relationships play a crucial role in Utah’s deal flow, especially with firms like Signal Peak Ventures, Peterson Ventures, and Album VC, founders can significantly increase their chances by securing a warm introduction. Connecting through portfolio companies, university networks, or community hubs such as Silicon Slopes often helps open the door and start the conversation on the right foot.

At the same time, investors are used to competing against coastal firms. Pitches still need to meet the high bar of clear market sizing, growth metrics, and defensible product advantages. Relationships open doors, but preparation turns interest into term sheets.

Show More Than Just a “Vision”

Unlike in the Bay Area, where story-driven raises can happen at the idea stage, Utah investors want to see clear proof points before committing. These include:

- Early paying customers or pilots, even if revenues are modest

- Strong customer retention or word-of-mouth virality

- Demonstrated ability to stretch limited capital

- Founders with Mountain West networks or vertical experience

According to Peterson Ventures, their focus is on helping seed-stage founders build disciplined businesses with strong metrics that can progress to Series A. This emphasis on operating discipline has become a hallmark of venture investing in Utah’s startup ecosystem.

Leverage the Unique Mix of Funding Sources

Utah’s fundraising ecosystem is broader than many founders realize. In addition to traditional venture firms, the state has a robust web of angel groups and corporate venture partners:

- Park City Angels is one of the most active angel syndicates in the state.

- University Growth Fund is the largest student-run fund in the country and often backs promising seed startups.

Founders who diversify their outreach often find faster momentum by tapping these non-traditional players, rather than relying exclusively on VC firms.

Practical Steps to Improve Fundraising Odds in Salt Lake City

- Start networking at least six months before your raise, prioritizing community hubs and portfolio introductions.

- Prepare for moderate valuations relative to the coast, but expect a more collaborative and long-term investor relationship.

- Use university accelerators or competitions for validation and visibility.

- Sequence fundraising into stages: angels and student-led funds for validation, seed VCs like Kickstart or Convoi, and later-stage firms like Signal Peak once you hit MRR and growth benchmarks.

- Always show traction. Even ten committed customers or an early enterprise pilot can be more persuasive in Utah than a 20-slide vision deck.

Key Resources to Help Founders Prepare

A growing network of organizations and communities exists to support early-stage founders across Utah. These include:

- Silicon Slopes, the central hub for local technology events, networking, and community growth.

- Kiln, a co-working space network designed for startup collaboration.

- RevRoad, an accelerator that provides investment along with operational support services.

- University of Utah and Brigham Young University programs that give founders access to pitch competitions, mentorship, and investor introductions.

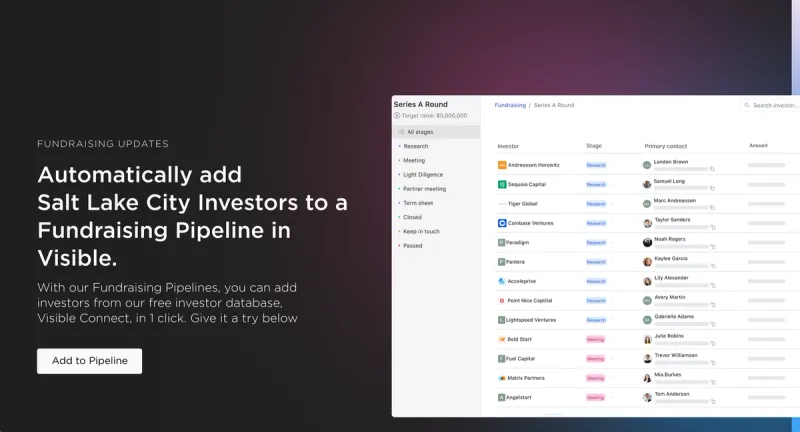

Find investors in Salt Lake City with Visible

We often compare a venture capital fundraise to a traditional sales and marketing funnel. Just as a sales and marketing team has dedicated tools, shouldn’t a founder manage their investors?

With Visible you can manage every part of your fundraising funnel:

- Find investors with Visible Connect, our free investor database, at the top of your funnel

- Track your conversations with our Fundraising CRM

- Nurture them with our Pitch Deck sharing tool

- Work through due diligence with our Data Room tool

- Delight them with regular investor Updates

Give Visible a free try here →

FAQ

How does fundraising in Salt Lake City differ from Silicon Valley?

Fundraising in Salt Lake City emphasizes capital efficiency and early traction. Local investors often prefer startups with paying customers and clear unit economics before investing. In contrast, Silicon Valley VCs may prioritize rapid growth and vision. Founders in Utah benefit from building relationships and demonstrating disciplined execution before approaching larger funding rounds.

What industries attract the most venture capital in Salt Lake City?

The strongest industries for venture capital in Salt Lake City include SaaS and B2B software. Fintech, health tech, and consumer products have also attracted significant funding in recent years. Startups in these sectors with proven product–market fit are most likely to secure investment from local and national firms active in the region.

Are there angel investor groups in Salt Lake City for early-stage startups?

Yes. Angel groups such as Park City Angels and Salt Lake City Angels are active in funding early-stage startups. These groups often invest in seed rounds and provide mentorship in addition to capital. They are valuable entry points for founders raising before approaching traditional venture capital firms in Utah.

What are the best events to meet venture capitalists in Salt Lake City?

The Silicon Slopes Summit is the premier event for networking with Salt Lake City investors and startup leaders. Additional opportunities include RevRoad demo days, and pitch competitions at BYU and the University of Utah. Attending these events helps founders gain warm introductions and build relationships with local venture capital firms.

Can out-of-state founders raise venture capital in Salt Lake City?

Yes. While most venture capital firms in Salt Lake City prioritize Utah and Mountain West startups, they also invest in companies across the United States. Founders outside the region improve their chances if they demonstrate traction, align with Utah’s capital-efficient culture, or have strong connections within the state’s entrepreneurial ecosystem.

Frequently Asked Questions

How does fundraising in Salt Lake City differ from Silicon Valley?

Fundraising in Salt Lake City emphasizes capital efficiency and early traction. Local investors often prefer startups with paying customers and clear unit economics before investing. In contrast, Silicon Valley VCs may prioritize rapid growth and vision. Founders in Utah benefit from building relationships and demonstrating disciplined execution before approaching larger funding rounds.

What industries attract the most venture capital in Salt Lake City?

The strongest industries for venture capital in Salt Lake City include SaaS and B2B software. Fintech, health tech, and consumer products have also attracted significant funding in recent years. Startups in these sectors with proven product–market fit are most likely to secure investment from local and national firms active in the region.

Are there angel investor groups in Salt Lake City for early-stage startups?

Yes. Angel groups such as Park City Angels and Salt Lake City Angels are active in funding early-stage startups. These groups often invest in seed rounds and provide mentorship in addition to capital. They are valuable entry points for founders raising before approaching traditional venture capital firms in Utah.

What are the best events to meet venture capitalists in Salt Lake City?

The Silicon Slopes Summit is the premier event for networking with Salt Lake City investors and startup leaders. Additional opportunities include RevRoad demo days, and pitch competitions at BYU and the University of Utah. Attending these events helps founders gain warm introductions and build relationships with local venture capital firms.

Can out-of-state founders raise venture capital in Salt Lake City?

Yes. While most venture capital firms in Salt Lake City prioritize Utah and Mountain West startups, they also invest in companies across the United States. Founders outside the region improve their chances if they demonstrate traction, align with Utah’s capital-efficient culture, or have strong connections within the state’s entrepreneurial ecosystem.