Key Takeaways

-

Discover why Sacramento is becoming a fast-growing hub for startups seeking venture capital outside the Bay Area, with lower costs and a strong community focus.

-

Learn how Sacramento’s venture capital firms prioritize capital-efficient growth, regional impact, and founder relationships over rapid scaling.

-

Explore the top venture capital firms in Sacramento and what they look for when investing in early-stage startups.

-

Uncover the best startup resources in Sacramento, including accelerators, co-working spaces, and government-backed funding programs that support founders.

-

Get practical fundraising tips for building investor relationships, pitching effectively, and leveraging Sacramento’s proximity to the Bay Area for broader capital access.

Sacramento has become a growing hub for startups that want access to capital without relocating to the Bay Area. The city offers a mix of local venture firms, angel networks, and an expanding base of support organizations that make it an attractive place for founders. While the ecosystem is smaller than San Francisco or Los Angeles, its community-driven nature and lower operating costs help early-stage companies move further with less capital.

For founders, this means there are unique opportunities and challenges when it comes to raising money in Sacramento. Investors here often look for businesses with strong fundamentals, clear market potential, and ties to the regional economy. Understanding these expectations is the key to standing out.

This guide will walk you through the top venture capital firms active in Sacramento, highlight what makes the fundraising landscape distinct, and point to the most valuable resources and networks available. By the end, you will have a clear roadmap for navigating capital raising in Sacramento with greater confidence and focus.

Why Local Sacramento Investors Matter

Raising capital in Sacramento is as much about relationships as it is about metrics. The local venture community may be smaller than the Bay Area, but its focus on accessibility, sustainability, and regional alignment makes it an attractive option for founders committed to scaling here.

Regional Advantage

Working with investors based in Sacramento provides unique benefits. Founders gain easier access to meetings, stronger community ties, and introductions across the local professional network. Many investors here look for startups that will grow within the region, adding long-term value to Sacramento’s economy.

A Different Investment Perspective

Sacramento investors often bring a different lens compared to coastal firms. While Bay Area funds chase aggressive scale, Sacramento-based investors typically emphasize capital-efficient growth and proven fundamentals. They value startups that can stretch every investment dollar while showing traction and profitability.

Network Multipliers

Local investors are also connectors. By partnering with them, founders unlock access to other funding sources, regional accelerators, co-working spaces, corporates, and government-backed resources. Warm introductions from trusted local investors carry more weight than cold outreach, making it easier to grow support.

Practical Tips for Founders

For founders raising in Sacramento, relationship-building matters just as much as pitch decks. Attend local pitch nights, join incubators, and seek introductions through community-driven events. Founders who show commitment to Sacramento and actively participate in the ecosystem tend to attract more attention from local investors.

Top Venture Capital Firms in Sacramento

Sacramento’s investor community has grown steadily in the past decade, supported by its proximity to the Bay Area and its role as a policy and education hub.

Sacramento’s venture capital ecosystem is still young and still growing, but its strength lies in community-oriented investors who know the region well. While many Northern California startups immediately pitch in San Francisco, staying local first offers advantages: investors familiar with Sacramento’s business climate, lower barriers to relationship building, and a growing track record of successful deals in certain sectors.

Sacramento Angels

About: The Sacramento Angels is a group of individuals who invest in early-stage companies throughout Northern California and beyond.

Impact Venture Capital

About: Impact Venture Capital is a Silicon Valley-based venture capital firm that invests alongside corporate venture groups and top-tier investors in seed-stage technology startups with a focus on artificial intelligence applied to cybersecurity, robotics, drones, autonomous vehicles, digital health, and other fast-growing industry sectors.

Moneta Ventures

About: Moneta Ventures is a venture capital firm that invests in promising early-stage companies in underserved markets. Most of our investments reflect the background of the investment team: B2B software companies selling to enterprise customers. We are sector and vertical-agnostic, invest in California and Texas, and write $1M to $5M initial checks in Seed and Series A companies. We are value-add investors who bring our operational experience to the table to help our portfolio companies scale.

Growth Factory Ventures

About: We help early-stage startups rapidly progress from minimum viable product (MVP) to product market fit. Then, we work with them to build the funding case and leadership capacity to attract the capital and team needed to support scaling a high-growth company. Now we’re gearing up for Fund II, launching in Q4 2025. Alongside direct investments in exceptional founders, Fund II will introduce a new layer of value: our in-house venture studio- designed to build from zero and co-create the next wave of transformational startups.

Blacktop Capital

About: Blacktop Capital is a seed-stage venture capital firm. With offices in Sacramento, Los Angeles, and many connections in Silicon Valley, Blacktop is well positioned to invest across California.

Black Star Fund

About: Black Star Fund is an early stage innovation fund focusing primarily in the United States & Africa. We invest in the innovators – those who see new enterprise as the gateway to a world that is more abundant, balanced and productive.

Founder Resources and Startup Support in Sacramento

Beyond direct investment, Sacramento offers a robust ecosystem of resources designed to help founders build, grow, and secure capital. From structured accelerator programs to collaborative co-working spaces and government initiatives, these support systems are crucial for navigating the startup journey.

Incubators and Accelerators

Sacramento’s incubators and accelerators provide structured programs, mentorship, and often initial funding.

- Growth Factory: A prominent program offering mentorship, workshops, and connections to investors, focusing on high-growth potential startups.

- UC Davis Venture Catalyst: Supports UC Davis-affiliated startups with resources, mentorship, and access to seed funding through its various programs and networks.

- AgStart: Located in Woodland, this incubator specifically targets agtech and food tech startups, providing specialized resources and industry connections.

- Carlsen Center for Innovation & Entrepreneurship: Based at Sacramento State, it offers programs, workshops, and a community for student and regional entrepreneurs.

Co-Working Spaces and Innovation Hubs

These spaces offer more than just desks; they are community hubs where founders can connect, collaborate, and find resources.

- The Urban Hive: Sacramento’s largest coworking community, The Urban Hive offers shared workspaces, private offices, and meeting rooms. With a vibrant network of over 1,300 professionals, it’s a hub for collaboration and networking in the heart of downtown.

- Bloom Workspaces: A community-focused coworking space in Midtown Sacramento, Bloom Workspaces offers flexible memberships and a variety of office setups. It’s ideal for startups and small teams looking for a supportive, creative environment.

- Aggie Square: Aggie Square is UC Davis’ $1.1 billion innovation district, connecting university research with private-sector startups. The hub fosters cutting-edge innovation, entrepreneurial collaboration, and community-driven growth.

- Capsity: Offers co-working and private office options, fostering a diverse community of entrepreneurs and small businesses.

- University-Affiliated Hubs: Both UC Davis and Sacramento State have innovation centers and partnerships that provide co-working and lab access for affiliated startups.

Government and Nonprofit Support Programs

Various public and nonprofit initiatives offer funding, grants, and advisory services to local businesses.

- City of Sacramento Economic Development Grants & Loans: The City of Sacramento’s Office of Economic Development administers several programs supporting small businesses and startups, including façade improvement grants, small business loans, and forgivable grants for job creation and retention.

- California Capital Access Program (CalCAP): Helps small businesses obtain financing by providing loan loss reserve coverage to lenders.

- Greater Sacramento Economic Council: Works to attract and grow businesses in the region, often connecting startups with resources, incentives, and strategic partners.

- Small Business Development Centers (SBDCs): Provide free business consulting and training to help startups and small businesses launch and grow.

Pitch Events and Networking Opportunities

Regular events are vital for founders to practice their pitch, gain visibility, and meet potential investors or mentors.

- Startup Grind Sacramento: Hosts monthly events featuring successful founders, investors, and industry leaders, offering networking and learning opportunities.

- 1 Million Cups Sacramento: A weekly event where two early-stage startups present their businesses to a diverse audience for feedback and connections.

- Kings Capitalize Contest: An annual pitch competition hosted by the Sacramento Kings, offering significant prizes and exposure for local startups.

The Fundraising Landscape in Sacramento

Current Trends in Sacramento Fundraising

Over the past decade, Sacramento has seen a steady increase in venture activity. Investment trends show a growing focus on sectors that align with the region’s economic strengths, including agtech, clean energy, SaaS, and health innovation. There’s also a notable trend of mixed funding rounds, where local investors often co-invest with Bay Area or national venture capital firms, providing startups with broader access to capital and expertise.

Strengths of the Local Ecosystem

One of Sacramento’s primary strengths is its emphasis on capital efficiency. Startups can operate with lower overhead costs compared to the Bay Area, allowing them to extend their runway and achieve more with less funding. The ecosystem also benefits from a collaborative community and an accessible investor base, making it easier for founders to build relationships. Strong universities like UC Davis and Sacramento State contribute to a pipeline of research-based ventures, while established government, healthcare, and agriculture sectors provide consistent themes for innovation.

Challenges Founders Should Expect

Despite its growth, Sacramento’s fundraising environment presents specific challenges. The number of local institutional investors is smaller compared to major tech hubs, which can mean fewer large-scale funding opportunities. Fund sizes are often more modest, potentially requiring founders to raise capital in multiple tranches. The region also receives less media coverage, which can impact visibility. Founders must demonstrate strong traction early to secure local capital, as investors often seek tangible proof points before committing.

What Makes Sacramento Fundraising Unique

Fundraising in Sacramento is inherently relationship-driven. Investors prioritize trust and community, often preferring grounded, capital-efficient business models over speculative, hyper-growth plays. For many founders, the optimal strategy involves building a dual footprint: establishing a strong base in Sacramento while strategically leveraging its proximity to the Bay Area for additional capital and market access. This approach allows startups to benefit from local support while tapping into broader venture networks.

Find investors in Sacramento with Visible

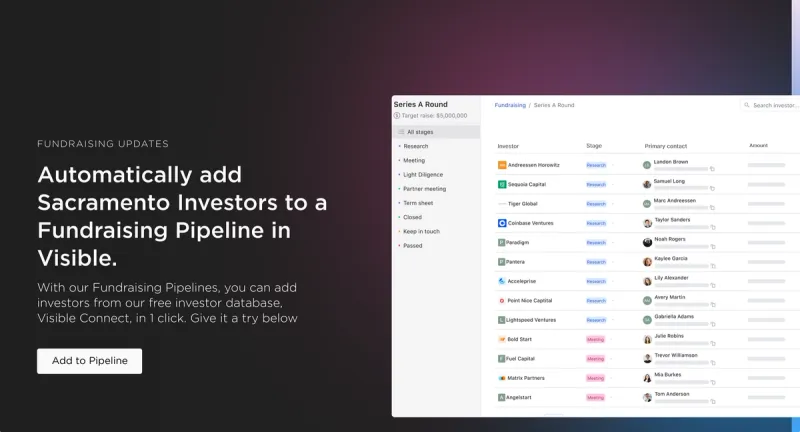

As we previously mentioned, a venture fundraise oftentimes mirrors a traditional B2B sales and marketing funnel. Just as sales and marketing teams have dedicated tools to track their funnel, shouldn’t founders have dedicated tools to manage their most important asset – equity?

With Visible, you can track and manage every part of your fundraising funnel.

- Find investors at the top of your funnel with Visible Connect, our free investor database

- Add them directly to your fundraising pipeline directly in Visible

- Share your pitch deck and data room with investors in your pipeline

- Send updates to current and potential investors to keep them engaged with the progress of your business.

Take your investor relations to the next level with Visible. Give Visible a try for free.

Frequently Asked Questions

What makes Sacramento a good place for startup fundraising?

Sacramento offers a growing investor ecosystem with lower operating costs and strong local support, making it attractive for founders raising capital. Because the community is smaller and relationship-driven, founders can gain better access to meetings and mentorship, especially if they show regional commitment.

How should founders approach raising capital in Sacramento’s startup ecosystem?

Founders should emphasise building genuine relationships with local investors and show clear traction, fundamentals and regional relevance. Unlike high-growth coastal funds, Sacramento investors often look for capital-efficient models and established proof points before funding.

What types of funding and support are available to startups in Sacramento?

Startups in Sacramento can tap into angel groups, seed/VC firms, accelerators, incubators and government-backed grants. The region’s ecosystem also offers co-working hubs and mentorship programmes that help early-stage companies prepare for investment.

What are the main challenges founders face when raising capital in Sacramento?

The main challenges include a smaller number of institutional investors and smaller fund sizes compared with major tech hubs, and less media visibility. Startups must demonstrate traction early and often raise capital in multiple rounds to reach scale.

How can a founder stand out to Sacramento-based investors?

To stand out, a founder should present a well-defined business model, strong regional alignment, and evidence of capital-efficient growth. Engaging in local pitch events, joining accelerators and showing active participation in Sacramento’s ecosystem boosts credibility.

Should founders based in Sacramento also target Bay Area investors?

Yes, starting locally in Sacramento helps build relationships and access resources, while also leveraging proximity to the Bay Area to tap into larger capital and tech networks. A dual-footprint strategy can maximise both local advantages and broader funding possibilities.