Key Takeaways

-

Learn what a virtual data room is and why online data room software has become a standard expectation for VC-backed founders during fundraising, diligence, and ongoing investor communication.

-

Understand what is a data room for investors and how a clear, well-structured setup can reduce diligence timelines, cut down on follow-up questions, and build investor confidence.

-

See practical data room examples, including a simple virtual data room example, to understand how founders organize legal, financial, and operational documents in a way investors expect.

-

Get clarity on free and paid options, including free virtual data room tradeoffs and virtual data room pricing considerations, so you can choose the right setup for your startup stage.

-

Learn how founders evaluate virtual data room providers, including what matters most to startups, how investor expectations shape decisions, and why preparation matters before fundraising or M&A conversations.

Online Data Room Software Explained for VC-Backed Founders

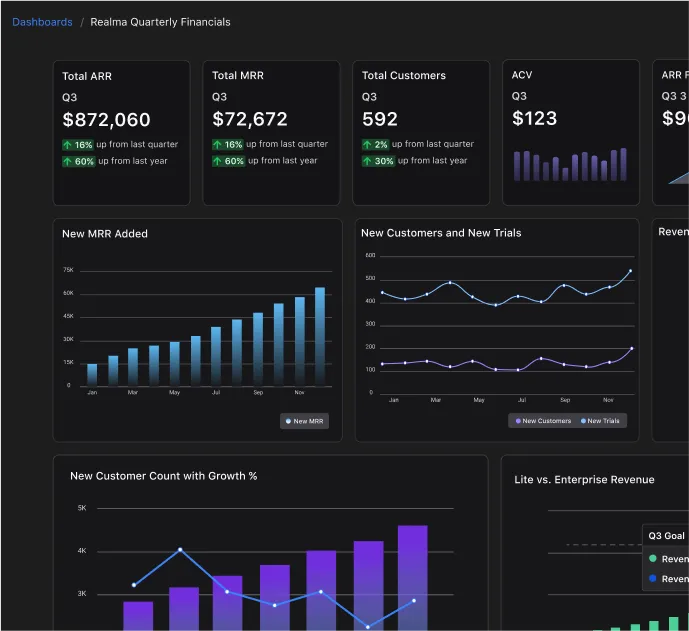

Founders of VC-backed businesses are expected to share sensitive information early and often. Fundraising, diligence, and ongoing investor communication all require clear organization and controlled access. Online data room software helps founders meet these expectations without slowing down their team or creating unnecessary risk.

This guide explains how data rooms work, why investors expect them, and how founders can think about setup, cost, and structure. It is written for founders who want a practical understanding before choosing an approach.

What Is a Virtual Data Room

Many founders ask what is virtual data room when preparing for their first institutional round. A virtual data room is a secure digital space used to store and share confidential company documents with controlled access. Founders use it to manage financials, legal documents, and internal reporting during high-stakes moments.

Unlike shared folders or email attachments, this type of setup allows founders to manage permissions, track access, and keep documents organized in one place. As companies scale, this structure becomes essential to avoid errors and miscommunication.

What Is a Data Room for Investors

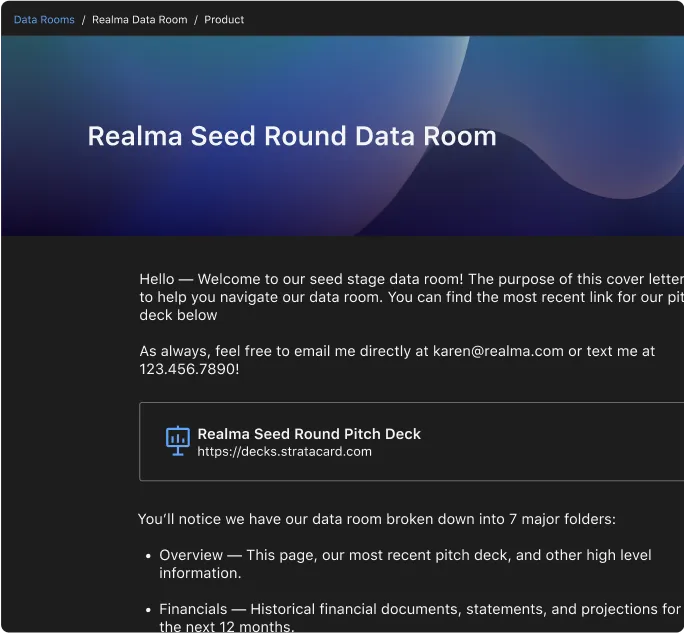

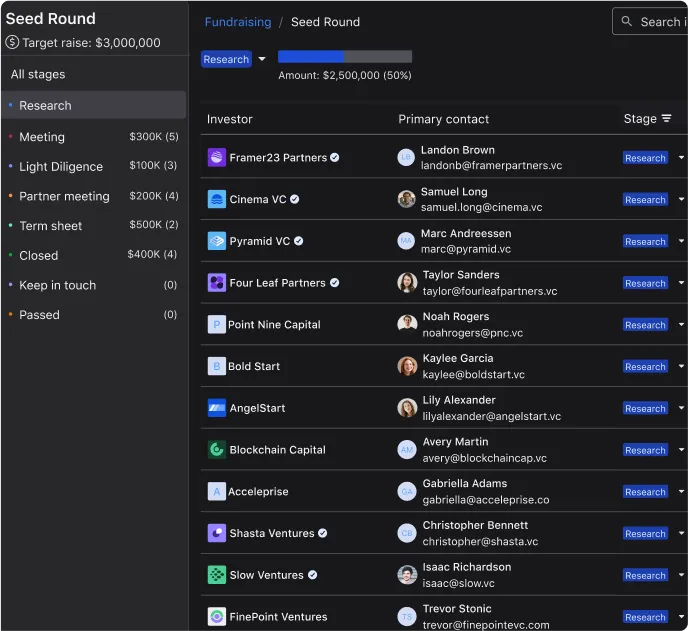

When investors request materials, they are often looking for more than a pitch deck. Understanding what is a data room for investors helps founders prepare information in a way that matches how investors evaluate risk and opportunity.

Investors expect clarity, consistency, and easy navigation. A well-prepared data room reduces friction, shortens diligence timelines, and helps investors focus on decision-making rather than document hunting.

Why Founders Rely on Online Data Room Software

Online data room software gives founders a single source of truth during fundraising and diligence. It reduces back-and-forth by centralizing documents and setting clear access rules.

For VC-backed companies managing multiple stakeholders, this approach limits confusion and prevents outdated files from circulating. It also creates accountability by making it clear which materials are current and approved for sharing.

Common Data Room Examples Founders Should Know

There are many data room examples that founders can learn from, even without copying a specific setup. Most follow a similar structure that includes company formation documents, financial statements, product information, and customer metrics.

Understanding these patterns helps founders anticipate investor questions and prepare materials in advance. It also makes it easier to reuse the same structure across multiple rounds.

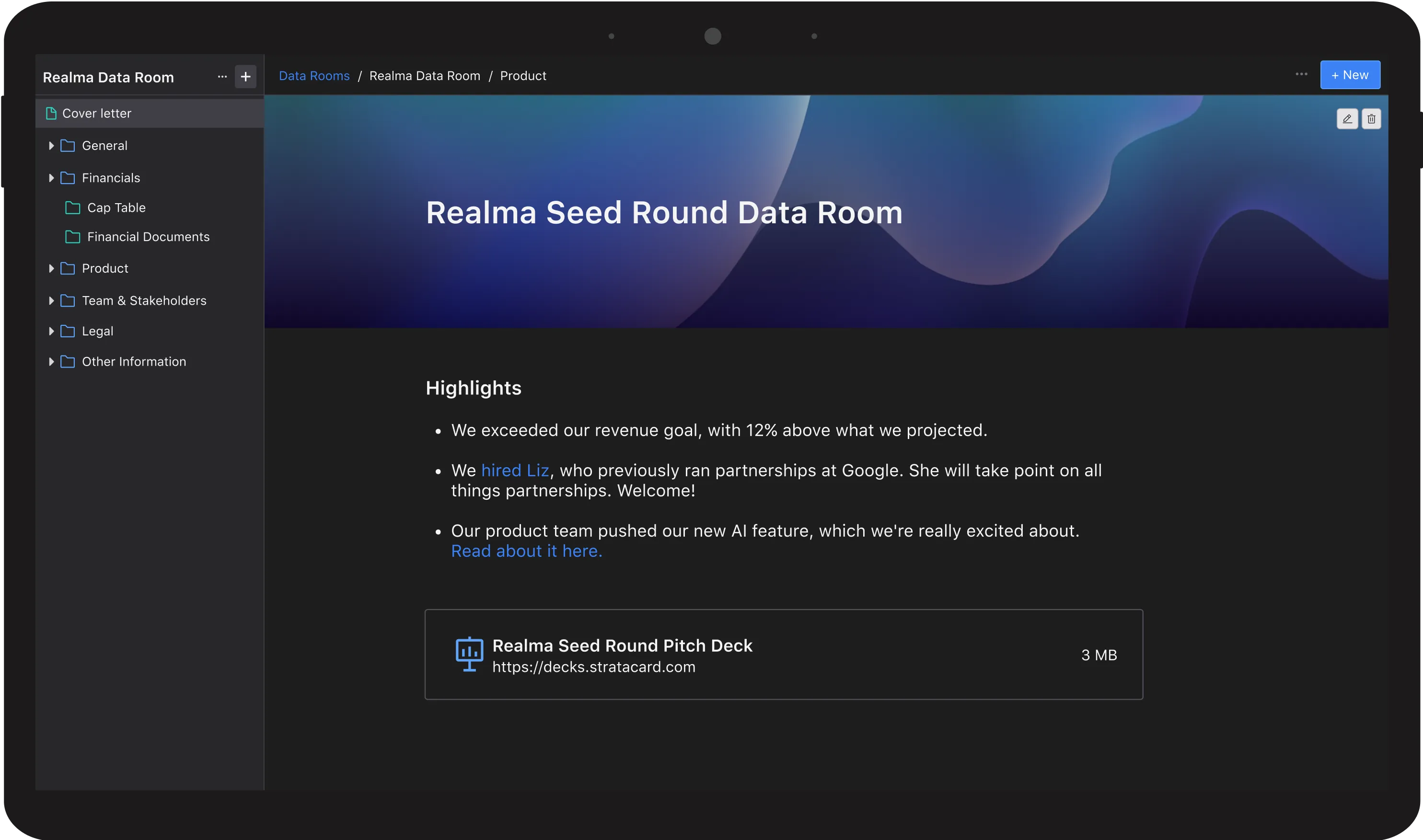

A Simple Virtual Data Room Example for a Growing Startup

A basic virtual data room example for a growing startup might include folders for legal, finance, product, and go-to-market materials. Each folder contains current documents with clear file names and restricted access.

This structure makes it easy for investors to find what they need without guidance from the founder. Internally, it also helps teams stay aligned on which documents are investor-ready.

Free Options and Early-Stage Tradeoffs

Some founders explore a free data room for startups when preparing for early conversations. A free virtual data room can work when the document set is small and access needs are limited.

A free virtual data room example might rely on manual organization and limited controls. While this can be sufficient early on, founders should plan for a transition as investor interest increases.

When Cost Becomes a Factor

As companies grow, founders start to compare options based on virtual data room pricing. Costs often scale with usage, security requirements, and the number of external viewers.

Some teams search for the cheapest virtual data room, but this approach can overlook hidden costs such as manual work, version confusion, or delays during diligence. The right choice balances cost with operational efficiency.

Choosing the Right Setup for a Startup

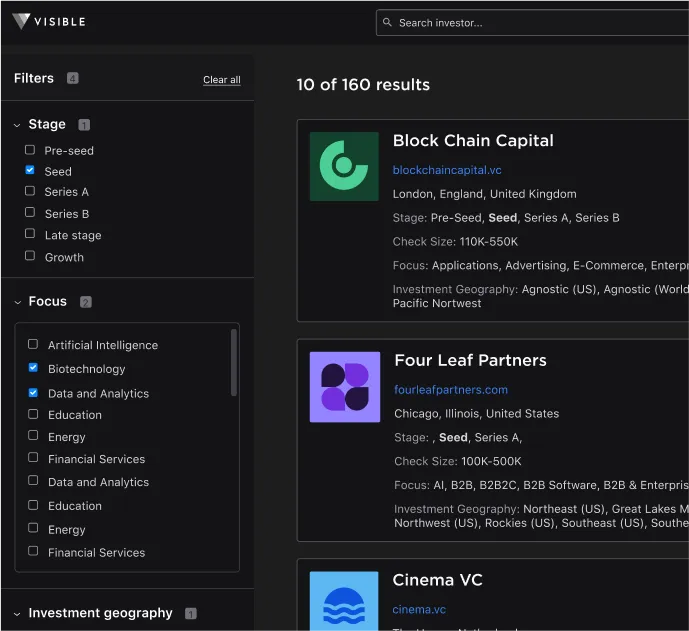

There is no single best data room for startups. The right choice depends on company stage, fundraising goals, and how frequently sensitive materials are shared.

Founders should focus on solutions that are easy to maintain. A simple system that stays up to date is more valuable than a complex one that falls behind.

How Founders Evaluate Providers

Founders often research best virtual data room providers by asking peers or reading community discussions. Searches like best online data room software reddit reflect a desire for candid feedback from other founders.

Others narrow their options based on regulatory needs or location, leading them to review virtual data room providers in usa alongside broader virtual data room providers. The evaluation process often evolves as the company matures.

Using a Data Room for Investor Diligence

A clear data room for investors checklist helps founders stay organized and reduces delays. Common checklist items include ownership details, historical financials, forecasts, and key agreements.

Using a checklist creates consistency and reduces stress. It also makes it easier to respond quickly when investors request additional information.

Preparing the Team for Data Room Requests

As fundraising approaches, founders should align their internal team on who owns each section of the data room. Assigning clear responsibility helps ensure documents stay current and accurate.

This preparation reduces last-minute scrambles and prevents conflicting information from being shared. It also helps newer team members understand what information investors care about most.

How Data Rooms Support Ongoing Investor Relationships

Data rooms are not limited to fundraising. Many founders continue using them to share quarterly updates, board materials, and long-term planning documents.

This approach creates a predictable rhythm for information sharing. Investors know where to find updates, and founders spend less time responding to one-off requests.

Specialized Use Cases to Consider

Some founders look for online data room software free m&a options when exploring acquisition conversations. These scenarios often require fast turnaround and strict confidentiality.

Having a prepared system in place allows founders to focus on strategic decisions rather than document logistics.

Final Takeaways for VC-Backed Founders

A virtual data room for startups is not just a fundraising tool. It supports better internal organization, smoother diligence, and stronger investor relationships over time.

By understanding how virtual data room software works and what investors expect, founders can approach high-stakes moments with confidence and clarity.

Frequently Asked Questions

What is online data room software and why do startups use it?

Online data room software is a secure way for startups to store and share sensitive documents with investors and other stakeholders. Founders use it to manage fundraising, diligence, and reporting in one place while controlling access, reducing confusion, and keeping information current.

What is a virtual data room and how is it different from cloud storage?

A virtual data room is designed specifically for sharing confidential business information. Unlike general cloud storage, it offers permission controls, audit trails, and structured organization that investors expect. This makes it better suited for fundraising, acquisitions, and ongoing investor communication.

What should founders include in a data room for investors?

A data room for investors typically includes company formation documents, cap tables, financial statements, forecasts, customer metrics, and key contracts. The goal is to answer common diligence questions upfront and make it easy for investors to review materials without repeated follow-ups.

Are free virtual data rooms a good option for early-stage startups?

A free virtual data room can work for early-stage startups with a small number of documents and limited investor access. However, founders should be aware that free options often lack advanced permissions and organization features, which can become limiting as fundraising activity increases.

How should founders think about virtual data room pricing?

Virtual data room pricing usually depends on factors like storage, number of users, and security features. Founders should look beyond the cheapest option and consider how much time and risk a well-organized data room can save during diligence and investor conversations.

How do startups choose the right virtual data room for their stage?

Choosing a virtual data room for startups depends on fundraising goals, company complexity, and how often sensitive information is shared. Early-stage founders may prioritize simplicity, while later-stage teams often need stronger controls and reporting to meet investor expectations.