The General Partner (GP) and Limited Partner (LP) relationship is built on trust. The best way to establish trust with LPs is through transparency, authenticity, and regular communication. When LP reporting is done well, LPs should easily be able to understand how both the fund and the fund manager are performing and be able to use this information to inform their investment strategies in the future.

The best GPs view sending LP Updates as a relationship-building activity and as a fundraising tool — not as a way to simply check off a requirement from their LPA’s.

For emerging managers, your relationships with initial LPs are of critical importance for your reputation as a fund manager and future fundraising. This rapport forms the basis of the fund manager’s credibility and will surface again when future LPs are doing diligence on the emerging manager. First-time fund managers will need to have clean data to support their track record and positive relationships with current LPs to set themselves up for success in raising additional funds.

The Weekend Fund recently wrote a thoughtful article on How to Write LP Updates with four main takeaways:

- Send LP updates consistently

- Go beyond the basics

- Be authentic

- Don’t share sensitive information without portfolio founders’ sign-off

We’ve translated this guidance into actionable steps that can be streamlined with Visible’s Portfolio Monitoring and Reporting tools below.

1. Send LP updates consistently.

Weekend Fund Advice — “One of the biggest mistakes new fund managers can make is not sending LP updates consistently. Most send quarterly updates. At Weekend Fund we send updates approximately every two months. Regular, detailed, and transparent updates builds trust with your LPs, which is particularly important if you want them to write a check into your next fund.”

Visible provides fund managers with tools to make sending updates to LPs on a regular basis easier.

To start, you can Upload Your LP Contacts (including custom contact fields) via CSV within seconds. Then you can create Custom Lists to organize your contacts. We suggest organizing your LPs by Fund and also by whether they’re a current LP or a potential LP.

This means within minutes you have all your contacts organized into custom segments that are useful to you. You can then simply choose which list you want to send an Update to in the future.

Visible also streamlines the creation of your LP Update content by letting you choose from an Update Template Library. You can easily pull a template into your account, further customize it as needed, and save it as your own template to use for future updates.

2. Go beyond the basics.

Weekend Fund Advice — “Of course, you should introduce new investments, share updates from the portfolio, report performance metrics, and other key updates from the fund, but the best updates go a step further to educate and inform LPs. This might include your analysis on the market, perspective on emerging trends, or learnings from experiments.”

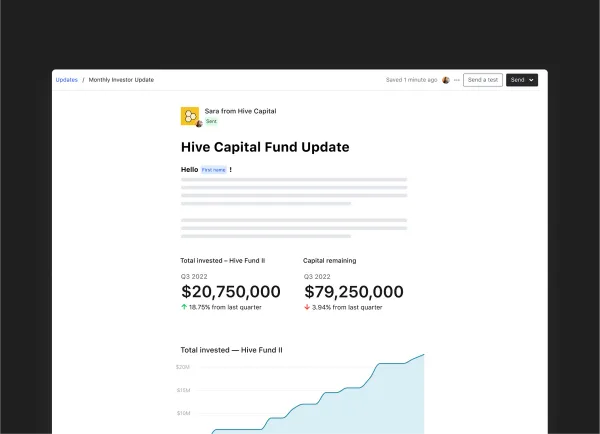

Visible’s LP Update editor supports rich text, videos, images, files, and perhaps best of all — custom data visualizations. This means you can visualize your custom fund analytics that will resonate with your LPs and embed them directly into your Update. The data is derived from data hosted within your Visible account and updates your charts in real time.

It’s also a great idea to include a market overview section at the top of your update to shed light on how you’re evaluating and staying ahead of the curve in the markets in which you invest. This is a great way to continue to instill LP confidence in you as the steward of their capital. On top of that, it’s important to remember that “many LPs invest in funds as a learning opportunity. The updates are the primary artifact to support that learning.” (Source)

You can also stand out to LPs by getting creative and embedding a video recording of your recent portfolio updates directly into your Updates. Open the update below to view an example of how a Visible customer incorporates video into their updates —

—> View Update Example with Video Embed

3. Be authentic.

Weekend Fund Advice — In general, people gravitate toward authenticity. Writing with personality is more engaging and magnetic. LP updates are an opportunity to share your unique voice and build your fund’s brand.

The Weekend Fund incorporates authenticity in their updates through their narrative updates and transparency, but also by including personal photos.

Visible lets you embed personal photos directly into your Update in two clicks.

—> View the Weekend Fund’s Update Template

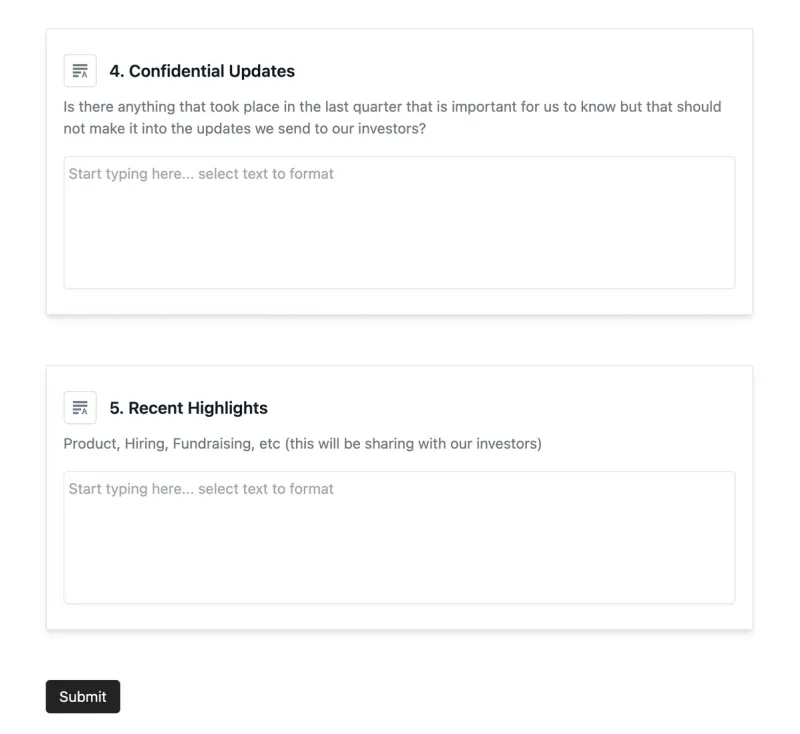

4. Don’t share sensitive information without portfolio founders’ sign-off.

Weekend Fund Advice — “Fund managers often have inside knowledge into how a company is doing. Some founders are extremely sensitive to information shared about their company, even when the news is positive. It’s prudent to get approval for any non-public information shared with LPs.”

Visible recommends explicitly asking for portfolio company’s permission to share information with LPs. One way to do this is by incorporating it into the descriptions of your Request blocks. (How to Build a Request in Visible).

Here’s an example below —

It’s important to remember that as a GP you’re not only competing with other GPs for LP capital but also with every other asset class. So it’s to your advantage to use every tool in your toolkit to stand out and impress LPs.

Over 400+ VC funds are using Visible to streamline their portfolio monitoring and reporting processes.