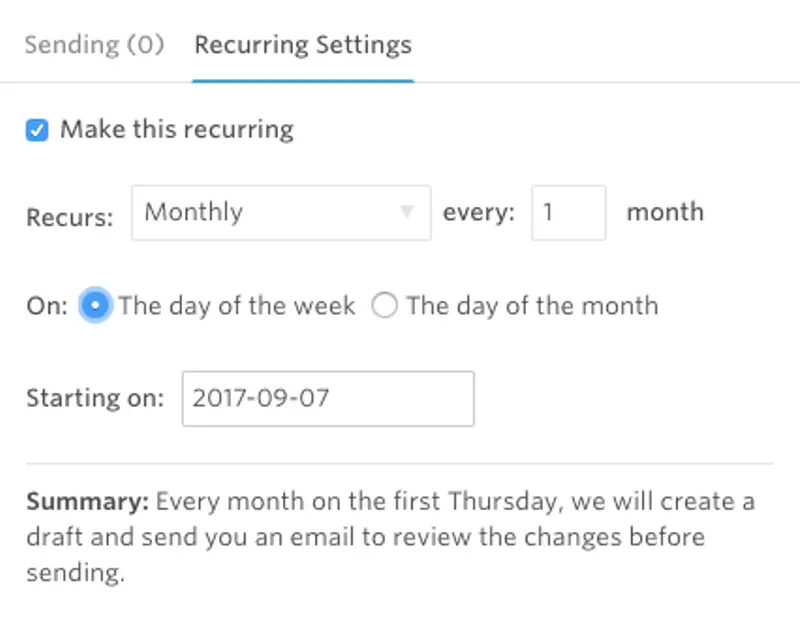

Last week, we broke down the most popular days to send your investor updates. Check out the charts and data below for a quick refresher:

The least popular date is the 30th of the month. When the page turns on the past month and updates/reports start flooding VC inboxes how do they view you?

The Clockwork CEO

The favorite CEO among investors (when it comes to monthly Updates ;). The “Clockwork CEO” has the same time on the same day set aside every month to sit down and crank out their stakeholder updates. The Clockwork CEO has likely created a rhythmic cadence with their investors and give them a “story” to look forward to on a monthly basis.

The Weekend Warrior CEO

The rare breed of CEO personas (We’re looking at you R.J. Taylor) the Weekend Warrior is one and the same as the Clockwork CEO. Setting aside their Saturday or Sunday morning to sit down and reflect on the past month likely before heading out with the family for the weekend.

The Good Times CEO

The “Good Times CEO” leaves investors feeling great about the company… until the next month when they receive no updates or news from the founders. After a big win or great product improvement the Good Times CEO Update will land in their investors inbox the next morning. Don’t get us wrong – we like to let the good times roll just as much as The Cars but investor’s offer their most value when you are struggling and have specific asks/issues from the previous period.

The Non-Comparable CEO

The “Non-Comparable CEO” sends over structured Updates on a regular basis but still leaves a big question mark in the mind of their investors. Switching, changing, and manipulating metrics on a monthly basis leaves everyone involved scratching their head as the next set of data comes rolling in. So how do you avoid misleading numbers?

The Buzzer Beater CEO

The “Buzzer Beater CEO” leaves their investors on the edge of their seats and always get their Updates across; even if it is the last second. As end of month tasks pile up, the dreaded investor update takes a back seat and is often missing major details and leaves dots for the investor to connect.

The Missing in Action CEO

The “MIA CEO” is the one that keeps their investors up at night. After the initial enthusiasm that comes with new investors, you find yourself in the “trough of sorrow” and have yet to send an Update after that first polished and optimistic Update. Believe it or not, most investors have made it through the “struggle” and are an integral piece in helping your company bounce back to that initial enthusiasm.