Last week in a post about hitting revenue milestones to prepare for a Series A, I mentioned the importance of achieving true growth rates and avoiding false indicators of success. The problem for many founders comes when they try too hard to show exciting growth numbers at the expense of a clearer picture of the company’s performance.

Avoid Misleading Metrics

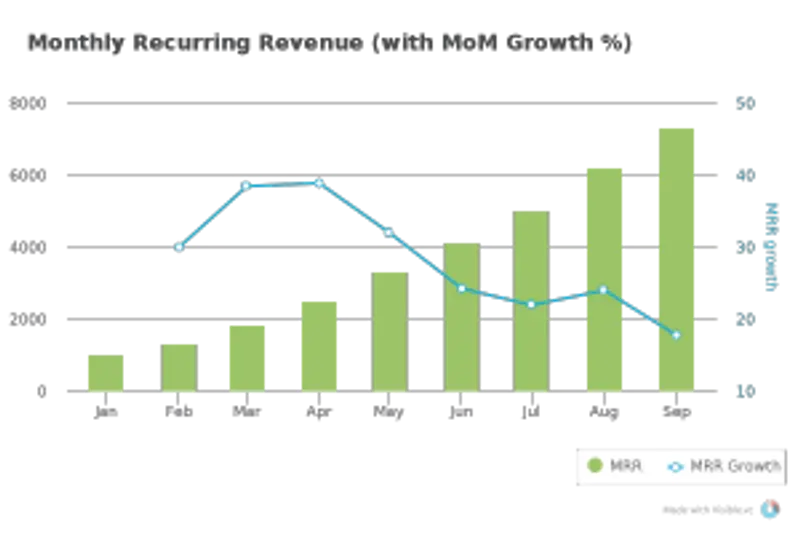

You don’t want to look like an idiot in front of your investors. At the same time, you want to excite your backers with some of the new accomplishments that are adding to the bottom line. So how do you avoid misleading numbers? Be honest with the size of monthly recurring revenue (MRR) numbers and your month over month growth (MoM) percentage. Your investors are likely assessing revenue figures from a number of portfolio companies, which means they know where to find weak spots. Don’t look unprepared. Here are some of the most popular mistakes–according to Amplitude–that founders make when outlining revenue growth figures:

Don’t pass off big growth rates on small numbers

If you’re still gaining traction as a startup, your month over month numbers may be tiny. So boasting mega percentages in MoM growth will be laughable to seasoned investors if you’re passing the rate off as sustainable growth at scale.

January February March April May June July August September MRR 1000 1300 1800 2500 3300 4100 5000 6200 7300 MoM Growth Rate 30.00% 38.46% 38.89% 32.00% 24.24% 21.95% 24.00% 17.74%

Don’t hide MoM fluctuation It isn’t sustainable unless you can show a detailed strategy for sales and market growth. An early stage startup with 30 percent growth MoM may not wow new investors, but it is a sign that you’re moving at a strong pace. That’s only a problem if you’re passing off your big digit percentage as a large MMR number.

Your numbers can fluctuate. That’s perfectly normal. Especially over the course of quarter, a SaaS company can often begin their first two months hitting only 50 percent of its mark, but rally for more than 50 percent in the final month on the back of the groundwork down in the beginning. Make sure your founders now how your numbers may fluctuate from month-to-month. Showing the chart below and claiming a steady 15 percent growth rate over the course of nine months is inaccurate, even though the company hits that average over time.

January February March April May June July August September MRR 10000 13000 14000 18000 20000 22000 26000 31000 32000 MoM Growth Rate 30.00% 7.69% 28.57% 11.11% 10.00% 18.18% 19.23% 3.23%

Instead, show your investors a list of your monthly numbers and explain the factors that cause the fluctuations. If you’d like to calculate your compound monthly growth rate to have the metric on hand, use the following formula:

Compound Monthly Growth Rate = (Last month/First month)^(1/Number of months difference) – 1

Don’t disguise declining growth rates

Using the compound growth rate (CMGR), the following chart shows a 15 percent average over the course of nine months:

January February March April May June July August September MRR 10000 13000 16000 19000 21500 24000 26500 28500 30500 MoM Growth Rate 30.00% 23.08% 18.75% 13.16% 11.63% 10.42% 7.55% 7.02%

But as you can also see, as this startups numbers continue to climb, the growth rate is slipping. That’s not always a red flag. Sometimes scaling your MRR is going to come at the cost of maintaining your growth rate. However, you don’t want to lead with your CMRG during the period without discussing the difficulty of holding that percentage moving forward.

In the long run, it’s only going to benefit you to share any bad news with investors, invite their help and be as transparent as possible to get everyone on board for the future. As Archana Madhavan said, distorting your company’s revenue picture can really damage your reputation moving forward. “When you fudge your growth models, you’re not just deluding yourself and your team,” he wrote. “You’re not just giving potential investors the signal that you don’t know what you’re doing.”

Be clear about your MoM goals and how they impact your company’s long-term success strategy. Your month-to-month performance isn’t going to be the only indicator of your company’s growth, especially if you’re sacrificing in the short-term to improve product or reformat with your team. Nevertheless, discuss these numbers with regular updates to investors in order to allow for the necessary information to be shared and everyone to feel confident in the future direction of the business.