Building a startup is challenging. On top of building a product, hiring a team, and scaling revenue — founders are responsible for securing capital for their business.

For many startups, this comes in the form of venture capital. Learn more about the different funding stages and venture capital rounds below.

What Are Startup Funding Stages?

There are multiple stages of startup funding: Seed, Series A, Series B, Series C, and so forth. Startups should be conscientious about the funding rounds that they will go through, which are generally based on the current maturity and development of the company. Here’s an overview of the major startup stages.

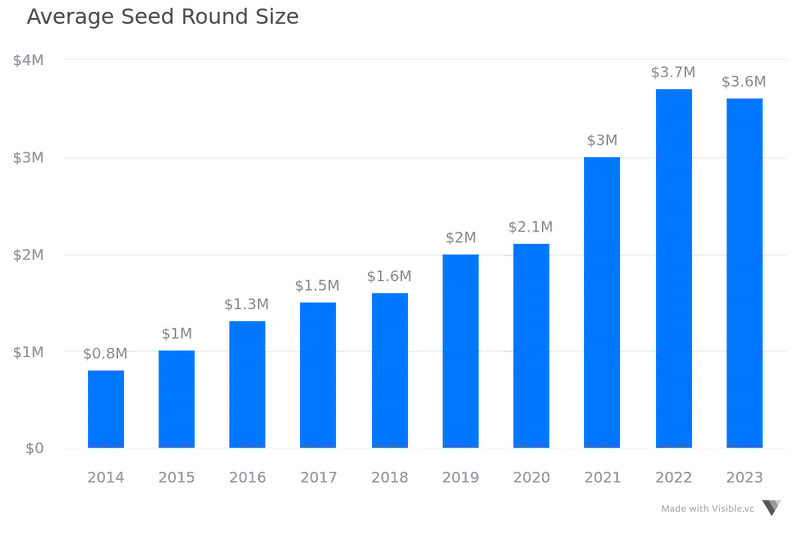

As of 2023. Source Crunchbase

Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders. An early-stage startup may also look for funding through bank loans, but angel investments are usually preferred. Seed funding is used to start the company itself, and consequently, it’s a fairly high risk: the company has not yet proven itself within the market. There are many angel investors that specifically focus on seed funding opportunities because it allows them to purchase a part of the company’s equity when the company is at its lowest valuation.

Related Reading: Valuing Startups: 10 Popular Methods

The next stage of the startup funding process is Series A funding. This is when the company (usually still pre-revenue) opens itself up to further investments. Series A funding is generally much more significant than the funding procured through angel investors, with funds of more than $10 million usually being procured. Series A funding is often acquired to help a startup launch. The business will publicize itself as being open to Series A investors and will need to provide an appropriate valuation. Finally, there’s Series B, C, D, and beyond funding. Later stage funding is sought by companies that have already become successful and are trying to expand that success.

Each stage of the startup funding process operates very similarly, despite the different stages the business might be in. During the startup funding process, the company has to be able to establish it’s valuation and will need to have clear plans for how it is planning to use the money it procures. Each round of funding will also, by necessity, dilute the company’s equity. Also regardless of stage, it's important to leverage a startup fundraising platform like Visible in order to save time and close quickly.

Related resource: The Ultimate Guide to Startup Funding StagesPre-Seed Funding

Over the last few years, a new funding stage has emerged, pre-seed funding. A pre-seed round is a round of venture capital that is generally the first round of institutional capital that a startup raises. A pre-seed round generally allows a founding team to find product-market fit, hire early employees, and test go-to-market models.

As a general rule of thumb, funding should last somewhere between 12 and 18 months. It should be enough capital to allow you to comfortably hit your goals and the forecast you laid out during your pitching and fundraising process.

Related Reading: What is Pre-Seed?

Average Pre-Seed Funding Amount

The size of pre-seed rounds varies quite a bit from company to company. There is no cut and dry amount. Research shows that round sizes can range anywhere from $100,000 to $5M at the pre-seed round. At the end of the day, you will want to weigh your business needs when setting valuations and determining how much to raise.

How to Acquire Pre-Seed Funding?

Raising a pre-seed round mirrors a traditional B2B sales process. You will be talking and adding investors to the top of your funnel, pitching and negotiating in the middle of the funnel, and hopefully closing them at the bottom of the funnel. Learn more about building a fundraising process in our guide, “All-Encompassing Startup Fundraising Guide.”

We sat down with Jonathan Gandolf, CEO of The Juice, every week during his pre-seed raise to breakdown what he was learning along the way. We boiled down the conversations into 8 episodes. Give it a listen below:

Who Invests in Pre-Seed Rounds?

One of the plus side of a pre-seed round is that it opens up more types of investors as the check sizes are generally smaller:

- Angel Investors — A common place to start for a pre-seed round. Angel investors are individuals that can write checks that are anywhere from a few thousand dollars to $500,000+

- Accelerators/Incubators — Many accelerator programs will take place in tandem with a pre-seed or will potentially write follow-on checks after completing their program to help fund your pre-seed round.

Related resource: Accelerator vs. Incubator: Key Differences and Choosing the Best Fit for Your Startup

- Dedicated VC Funds — Over the last few years, many dedicated pre-seed funds have popped up and become a staple in the space. More traditional and larger firms are also making their way into pre-seed rounds.

Related Resource: How Rolling Funds Will Impact Fundraising

Active Pre-Seed Stage Investors

As we mentioned, there are many dedicated pre-seed funds that are popping up in the space. Check out a few of our favorites below:

- Hustle Fund

- Forum Ventures

- Bessemer Venture Partners

- Boldstart Ventures

- Connetic Ventures

- Expa

- Kima Ventures

- LongJump

- M25

- Mucker Capital

- Starting Line

- TheVentureCity

Find more pre-seed investors in our investor database, Visible Connect, here.

Related Resource: What is Pre-Revenue Funding?

Related Resource: 12 Venture Capital Investors to Know

Seed Funding

As we mentioned earlier, “Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders.” More investors have become keen on being early investor into a startup so they have access to invest again at later stages.

Raising seed-stage funding is a major accomplishment for a startup. Seed stage funding is the initial surge of capital into the business. At this point, a startup is largely an idea and will have little to no revenue. This stage is generally when a product and go-to-market strategy are being built and developed.

Over the past couple of years, seed-stage funding has exploded in round size. What used to be regarded as a few small checks from family and friends has turned into a multimillion-dollar round. Check it out:

How to Acquire Seed Funding

There are generally a few ways founders can approach a seed round. First things first, founders need to find a list of investors that are relevant for their business. Not every investor will say “yes” so it is important to have a list of 50+ investors to target.

From here, founders will need to reach out to potential investors, sit meetings, and share their pitch deck and vision to garner interest. Next, founders will work through due diligence with the hopes of adding new investors to their cap table.

Related Reading: Seed Funding for Startups: A 101 Guide

Related Reading: A Quick Overview on VC Fund Structure

Related Resource: An Essential Guide on Capital Raising Software

Series A Funding

After raising a Seed Round it’s time for a company to advance to a later round of venture capital financing, which means Series A funding. Series A is a significant stage in a company's lifecycle and is a monumental moment in a startup's funding journey. A Series A startup typically has found some success, has found product market fit, and is ready to scale.

At the time of Series A funding, the company has to be valued and priced. Thought must go into previous investments, as prior investors will have also purchased the business at a specific valuation. If an angel investor purchased into the company at a valuation of $100,000 just months ago, then new investors may balk at purchasing at a $10,000,000 valuation today.

Once the funding round has been completed, the company will usually have working capital for 6 to 18 months. From there, the company may either be able to move to market or may instead progress to another series of funding. Series A, B, and C funding rounds are all based on stages that the company goes through during its development.

It is important to remember that when raising your Series A you are setting goals and objectives for what that capital will do to your business. You need to raise enough capital to help you achieve these goals so you can go on to raise a Series B or future round of capital.

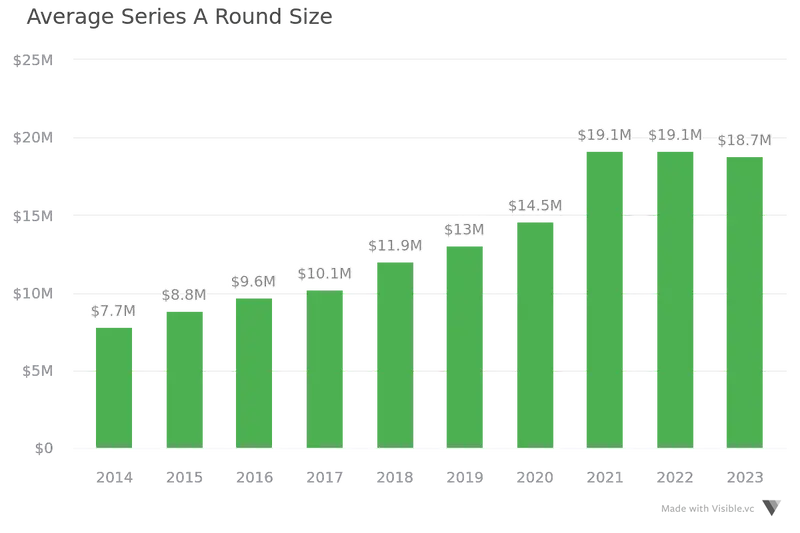

Average Series A Funding Amount

As of 2024, the average Series A funding amount is $18.7 million. A Series A valuation calculator can be used to get close to the number that you should value your company at, though you will also need to thoroughly justify your valuation.

How to Acquire Series A Funding?

A company’s valuation will be impacted by a number of factors, including the company’s management, size, track record, risk, and potential for growth. Analysts can be called in for a professional valuation of the business. During a Series A funding round, a business usually will not yet have a proven track record, and may have a higher level of risk.

During a Series A round, investors will usually be able to purchase from 10% to 30% of the business. Series A investments are generally used to grow the business, often in preparation for entering into the market. The company itself will be able to decide how much it wants to sell during its Series A round, and may want to retain as much of the company control as possible.

Let’s start out with a hard truth: sometimes revenue doesn’t matter much in a successful Series A raise. If you’re a seasoned SaaS entrepreneur with a strong team, raising your next round will be much easier than for a first-time founder. Many VCs will place the greatest emphasis on past success for the best indicator of future results—whether or not a company’s unit economics are solid or if they’ve reached the proper revenue benchmarks. Jason Lemkin claims he’d comfortably invest in a pre-launch SaaS company with $0 in ARR if the team is strong and experienced and the market and opportunity are huge. “This makes sense as in many cases, SaaS is an execution play,” Lemkin wrote on Quora. “Put the best team into a strong, upcoming (or disruptable, large market), and that’s a good bet to make.”

Related Resource: 23 Top VC Investors Actively Funding SaaS Startups

Related Resource: Who Funds SaaS Startups?

Related Resource: 20 Best SaaS Tools for Startups

Related Resource: 13 Generative AI Startups to Look out for

But if you haven’t birthed any unicorns or shepherded any startups to 10x exits already, your benchmarks may be a little more concrete. In the same response, Lemkin wrote that he looks for unproven, bootstrapped startups to hit about $2 million in ARR. In an interview with SaaStr, Tomasz Tunguz estimated a lower mark. Tunguz said most of the founders he speaks with are looking to hit somewhere between $75,000 to $125,000 (or $900,000 to $1.5 million in ARR) in MRR before making their Series A pitch. Despite the wide range, it seems pretty tough for any new founder to conduct a strong Series A round without revenue nearing $1 million ARR in today’s fundraising environment. Without that, you’re going to have to lean more heavily on pitching your market opportunity or product superiority.

Related Resource: 7 Startup Growth Strategies

Recommended Reading: How to Write the Perfect Investment Memo

Recommended Reading: How to Pitch a Series A Round (With Template)

Series B Funding

Once a business has been launched and established, it may need to acquire Series B funding. A business will only acquire Series B funding after it has started its operations and proven its business model. Series B funding is generally less risky than Series A funding, and consequently, there are usually more interested investors.

As with Series A funding, the company begins with a valuation. From there, it publicizes the fact that it’s looking for Series B funding. The company will be selling its equity at the valuation that is settled upon, and investors are free to make offers regarding this valuation. A startup that gets to Series B funding is already more successful than many startups, which will not go beyond their initial seed capital.

Once Series B funding has been procured, the business will need to use this money to further stabilize, improve its operations, and grow. At this point, the startup should be in a good position. If the startup needs further money after it develops, to grow and expand, it may need to embark upon a Series C funding round.

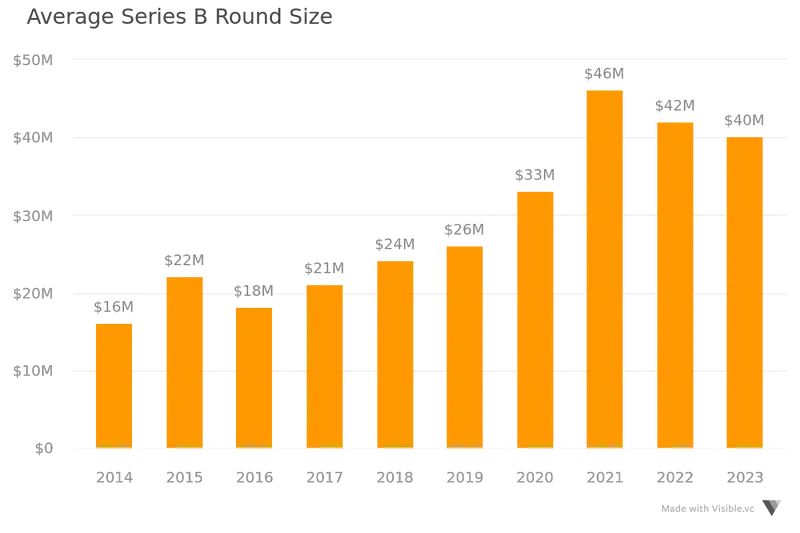

Average Series B Funding Amount

On average, Series B startups will usually get $30M or more. The bulk of the heavy lifting will already have been done by seed capital and Series A funding. Series B funding will simply be used to grow the business further and improve upon it.

How to Acquire Series B Funding?

Sometimes Series B funding will come from the same investors who initially offered Series A funding. Other times, Series B funding may come from additional investors, or from firms that specialize in investing. Either way, investors are usually going to be paying more for less equity than investors did in prior funding rounds, because the company’s valuation will have scaled. A Series B funding valuation will need to consider the company’s current performance and its future potential for growth.

Analysts can be used to price a company looking for Series B funding. However, it should also be noted that the company itself has more negotiating power as a Series B company, as it has proven itself to be successful.

Related Reading: How to Pitch a Perfect Series B Round

Series C Funding

Series C funding is meant for companies that have already proven themselves as a business model but need more capital for expansion. Like Series B funding, Series C investors will often be entrepreneurs and individuals who have already invested in the company in the past. A startup may connect with their angel investors and Series A and Series B investors first when trying to procure Series C funding.

If a business has made it to Series C funding they are already quite successful. Whereas earlier stage rounds are used to help a startup find traction and grow, by the time a startup raises their Series C they are already established and growing. By raising a Series C a business will be able to make strategic investments. This could mean investing in market expansion, new products, or even acquiring other companies.

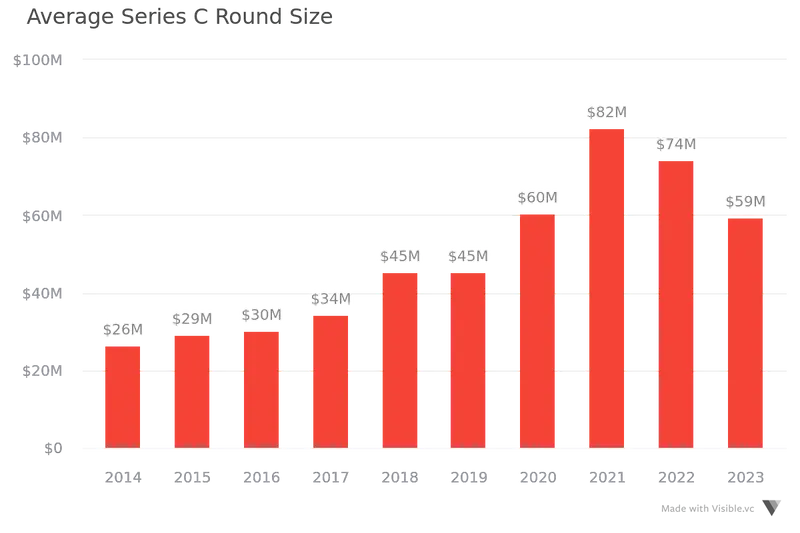

Average Series C Funding Amount

A Series C funding amount is generally between $30 and $100M settling on an average round of $50M. At this point, a startup’s valuation is likely over $100M and they are on a national radar looking to expand internationally.

How to Acquire Series C funding?

When approaching a Series C, the strategy will likely change from earlier rounds. As we mentioned, the average is around $50M. This means that your investors cutting checks between $1 and $5M from earlier rounds are no longer likely to lead a round. Previous investors may be keen to invest in your Series C but startups will need to fill out the remainder of the round from other investors.

When approaching a Series C valuation, your company likely speaks for itself and will have more inbound requests from investors. These investors will likely be later-stage VC funds, private equity firms, and banks.

Later Startup Funding Stages

Depending on the business strategy, a Series C round may be the end of the road in terms of venture capital financing. At this point, the company is likely headed in a strong direction and owns a large % of an addressable market. However, some companies go on to raise their Series D, Series E, Series F, and even Series G.

Series D Funding

A Series D funding round may occur if the company was not able to raise enough money through its Series C. This often has implications for the business. Series D funding occurs when the business was not able to meet its targets with its Series C, and consequently it can mean that the business is now at a lower valuation. Being priced at a lower valuation is usually very negative for a business.

If Series D funding is necessary, due to challenges that the company is facing, then it may be the only way for the startup to survive. However, it generally devalues the company, and may shake future investor faith.

Series E Funding

Series E funding may be necessary if Series D funding isn’t able to meet the company’s needs for capital. This is, again, a very bad sign, and very few companies are going to survive to Series E funding. Series E funding will only occur if the business still hasn’t been able to make up its own capital but the business is still struggling to remain active and private.

Series F Funding

Beyond Series E funding comes Series F funding. Very few companies will make it to Series F funding. This is many years into a company's lifecycle. Series F funding is largely used for capital-intensive businesses that need to fuel their next stage of growth, an IPO, an acquisition, or expansion.

Series G Funding

Next comes Series G funding. Even fewer companies will make it to a Series G. Like Series E or F funding, a Series G round is typically used for companies that are on to their next stage of growth, gearing up for an IPO or acquisition, or expansion into a new market.

Related resource: Emerging Giants: An Overview of 20 Promising AI Startups

Initial Public Offering (IPO): Accessing Public Markets for Funding

An IPO has traditionally been the pinnacle of a startup’s success story. As put by the team at Investopedia, “An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors.” For startup founders and early employees, an IPO is an opportunity to cash out.

Track Your Startup’s Fundraise With Visible

No matter the series, size, or timing of your round, Visible is here to help. With Visible, you can manage every stage of your fundraising pipeline:

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related resources:

- Strategic Pivots in Startups: Deciding When, Understanding Why, and Executing How

- Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

- Navigating the Valley of Death: Essential Survival Strategies for Startups

- Top 18 Revolutionary EdTech Startups Redefining Education

- Top Creator Economy Startups and the VCs That Fund Them

- Business Venture vs Startup: Key Similarities and Differences

- The Top 9 Social Media Startups

- Exploring Canada’s Emerging Tech Hubs: Where Innovation is Thriving