Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Relatively speaking, venture capital is a fairly new asset class. Innovations have been consistent since Y Combinator came to market in the early 2000s. Since then there have been countless innovations that are creating more funding options for startup founders. The most recent innovation has been rolling funds. Learn more about rolling funds and what they means for startup founders below:

What are Rolling Funds?

Pioneered by Angelist, a rolling fund is a new VC fund structure that allows funds to raise money on a continuous basis – creating a new fund structure as quickly as every quarter. These funds can also be publicly marketed under Rule 506(c). While rolling funds are still relatively new, there have been early benefits and signs of more innovation to come. To learn more about rolling funds and their impact on startup founders and investors, read more below:

What are the benefits of Rolling Funds

Rolling funds have the opportunity to transform the venture capital space. As we begin to scratch the surface on rolling funds and how they fit into the space, there have been some clear benefits so far.

1. Attract New Types of Investors

These funds also lower the barrier of entry into VC for aspiring investors by allowing them to get started with less up front capital. Angelist can manage most of the legal and administrative aspects of rolling funds too, further lowering the overall amount of knowledge and capital needed to get started. Because of this, rolling funds may create many new types of investors.

2. Provides More Funding Options for Founders

More investors means more funding options for startup founders. As we mentioned above, rolling funds will lower the barrier to entry for emerging VCs, in turn creating more funding options for startups. As more competition pops up in the space, the more competitive it will become to get on a startup’s cap table. Because of this, funds will have to create more resources and terms for startups.

Related Resource: The Understandable Guide to Startup Funding Stages

3. Continual Limited Partner Fundraising

Rolling funds allow VC’s to continue to raise money from limited partners on a regular basis, essentially turning the process of LP investing into a quarterly subscription-based model. If an LP decides that they don’t want to continue backing an investor, they can stop allocating resources to them immediately. On the other hand, if they see that a given investor is making good bets, they can invest more money in them very quickly. This is especially useful for VC’s who would like to fundraise opportunistically in the case of portfolio markups.

4. Shortened Feedback Loops

This new structure will shorten feedback loops for venture capitalists. Startups take a long time to reach full maturity, but they still have clear milestones throughout their journey. If an investor has several companies in their portfolio that succeed in securing future funding or obtaining product market fit, they can be rewarded instantly by raising more money during the next quarter. This is good for LP’s too, as they can make small, periodic investments in rolling funds based on the real time performance of the investor. This is quite different from having to write very large checks every 10 years. It opens up LP investing to smaller funds and individuals – rather than just institutions.

How are Rolling Funds Structured?

As we mentioned, rolling funds will allow more people to become VC’s. Because companies like Angelist will allow these small investors to outsource many fund management responsibilities, more people with A+ networks and good judgment can get into the game.

For example, a star employee at Stripe or AirBnB might have access to many startup deals and the judgment needed to allocate capital effectively. Traditionally, if they wanted to get into VC, they would have needed to slowly work their way into an established fund or quit their job to start their own. If they didn’t want to do this, then they could angel invest, but then may not have hit the threshold needed to be an accredited investor (and even then they were confined to only investing their own money). Rolling funds allow them to start investing part time, and without needing to hit accredited investor requirements (although LP’s do need to be accredited). These new operator investors will be able to attract LP investment from many different sources, such as their managers, successful friends, and others who are impressed by their network and experience.

Maybe you, a current founder, have always thought that you’d be a good VC and wish you could allocate capital into your other founder friends’ deals. With rolling funds, you can start a fund as a side hustle. This enables you to capitalize on your access and judgement by investing in other founders.

506(c) Funds

Rolling funds are structured as a 506(c) offering. According to the SEC:

“Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that:

- all purchasers in the offering are accredited investors

- the issuer takes reasonable steps to verify purchasers’ accredited investor status and

- certain other conditions in Regulation D are satisfied”

Put simply, a 506(c) requires that all LPs are accredited investors. As Investopedia puts it, “An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.”

LP Subscriptions

Accredited LPs, limited partners, are the investors behind a rolling fund. As the name implies, rolling funds are raised on a rolling basis.

Quarterly Funds

As the team at Rolling Fund News puts it, ‘A rolling fund is structured as a series of limited partnerships: at the end of each quarterly investment period, a new fund is offered on substantially the same terms, for as long as the rolling fund continues to operate. With this fund structure, rolling funds are publicly marketable and remain open to new investors.”

Contributions

The fund managers are responsible for deciding what the contribution minimum or maximums are for LPs. Currently on the AngelList rolling fund marketplace the quarterly minimums range anywhere from $2,500 to $50,000.

Fee Structure

Like any venture capital fund, there are fees associated with a rolling fund.

Admin Fee

For all rolling funds on AngelList there is a 0.15% admin fee. The fee is similar to more traditional funds and syndicates offered through AngelList.

Management Fees

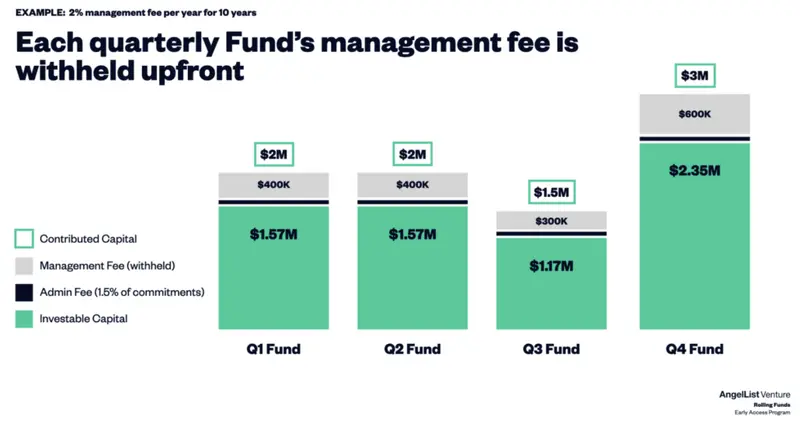

There are also management fees associated with rolling funds. Most management fees are 2% but can generally range anywhere from 0% to 3%. As defined by AngelList, “Each fund will pay the fund manager a customary management fee. Management fees generally accrue over the first ten years of each fund’s life and are typically payable in advance over four years. Like a traditional fund, GPs can waive fees on an LP-by-LP basis.”

Check out an example from AngelList below:

How to Get Involved with Rolling Funds?

The rolling fund structure opens up VC investing to many people who would have otherwise had a difficult time getting started. For example, imagine a fund built entirely around an independent media creator with a strong brand. High quality tech bloggers or university professors with a deep understanding of startups and a large audience can raise funding quickly on top of their brand and expertise. It could create an additional income stream for these individuals and allow them to build wealth through venture investing.

Networking

A common thread is that rolling funds will open up the opportunity to create a VC fund to anyone with a great network, access to deals, and good judgement around startups. Whether it’s an elite tech blogger, current founder looking to invest on the side, or startup executives who wants to benefit from their understanding and access to early stage companies – there will be new players in the VC game that might be different than the typical venture investor.

Exploring

Since launching rolling funds, AngelList has launched a marketplace where anyone can peruse and check out different funds that are currently raising. You’ll be able to check out the different funds (and their managers) to get an idea of who is in the space. Check it out here.

Invest

With lower investment minimums and more availability, rolling funds are becoming a feasible investment for non-traditional investors. Founders particularly are beginning to invest in rolling funds to invest in other founders. Of course this is an incredibly risky investment and should seek advice before investing.

How Rolling Funds Could Impact Fundraising

As we previously discussed, rolling funds have created more funding options for startups. Because of this it has the opportunity to impact the current VC fundraising process.

Related Resource: All Encompassing Startup Fundraising Guide

Increase in Total Number of VCs

Rolling funds will lead to an increase in the total number of VC’s. More entrants into the VC business will lead to pressure on the traditional players in the ecosystem and more competition for deals. This competition will lead to better prices for founders raising capital. Would you rather take money from your long time friend’s rolling fund or a Sand Hill Road VC during your Seed round? These options may be real in the next 5-10 years.

Rise in Early Stage Investing

At first, rolling funds will primarily impact early stage investing. Most of these new funds have raised relatively modest amounts of money compared to large VC’s. Due to the large amounts of capital needed to play at later stage investing, rolling funds might not have an impact there just yet. However, due to the nature of compounding, some rolling funds might grow much larger than expected. VC is dominated by power laws, and the most successful rolling funds might find themselves with LP’s begging to get into future rounds. A rolling fund with a few smash hit successes can instantly raise additional LP capital. Traditional VC’s would have to wait longer to do so. One can even expect large VC’s to adopt the rolling fund model in the future.

Easing Exit Pressure

A final way that rolling funds will help founders is by easing exit pressure. All VC investors (including those who run rolling funds), will want your company to swing for the fences and seek to be a massive outlier. Traditional VC funds, however, need to show returns to LP’s on a roughly 10 year time horizon so that they have the momentum necessary to raise additional funding. This sometimes gives VC’s an incentive to push your company to exit or IPO within a specific time frame. LP’s want to see returns on set schedules. If your company’s exit would help show better returns, your VC’s might pressure you into selling your company prematurely. With rolling funds, this is not as much of an issue, as they can raise funding from LP’s on a continuous basis, vs having to raise a giant new fund every 10 years.

Rolling Fund FAQs

Because rolling funds are fairly new to most founders and investors – check out a few common questions below:

Can You Market a Rolling Fund?

One of the unique factors of a rolling fund are that the general partners behind them are allowed to market them to the general public. As AngelList writes, “Unlike most traditional venture funds, managers of Rolling Funds (known as general partners or “GPs”) can publicly advertise their offerings to grow their investor network and raise money.”

Because of this, GPs of a rolling fund can attract LPs from different walks of life. More individuals are beginning to invest in rolling funds which means that startup founders will have a more diverse network of investors with more resources and connections available.

What is the Difference Between a Syndicate and a Fund?

As put by the team at AbstractOps, “A startup syndicate – or an investment syndicate – is a special purpose vehicle (SPV) created for the sole purpose of making one investment. Although syndicate investors are typically high-risk (high-reward) investors, through syndicates, they can invest in more deals with small amounts of capital, as little as $1,000 per syndicate. ” This means that a syndicate is only investing in a single company. On the flip side, a fund is dedicated to making investments across many companies.

Related Resource: Accredited Investor vs Qualified Purchaser

Is There a Minimum Investment for a Rolling Fund?

The minimum investment for a rolling fund varies from fund to fund. The list of Rolling Funds currently raising on AngelList varies anywhere from a minimum of $2.5K a quarter to $167K a quarter.

Checkout Visible’s Investor Database To Find the Perfect Investor

Early signs show that rolling funds are here to stay and can be transformational for both venture capitalists and startup founders. If you’re a founder looking to raise capital, check out Visible Connect, our investor database, here. We maintain the database with firsthand data and will continue to add new funds and data as it becomes available.