The Traditional “Fundraising Funnel”

In the past, we’ve discussed how one can easily draw parallels between fundraising and a traditional sales & marketing funnel. Just as a sales & marketing funnel can take different forms, so can your fundraising funnel.

Generally, we’ve laid out the “fundraising funnel” in 3 simple steps:

- Attracting and adding investors (leads) to your top of the funnel on a regular basis.

- Nurturing and moving those investors through the funnel with the goal of adding them as investors (customers) or engaging them for a future round.

- Building strong relations with your investors to convert them to promoters, evangelists, or future funders (customer success).

Since “Account Based Marketing” has taken over marketing blogs, events, and discussions we’ve laid out how to apply ABM to your fundraising efforts.

What is Account Based Marketing

Account Based Marketing, according to Marketo, is “An alternative B2B strategy that concentrates sales and marketing resources on a clearly defined set of target accounts within a market and employs personalized campaigns designed to resonate with each account.”

In the sales & marketing world, implementing ABM tends to be a costly endeavor, but there are also countless benefits: clear ROI, focus on key accounts, personal and optimized, sales alignment.

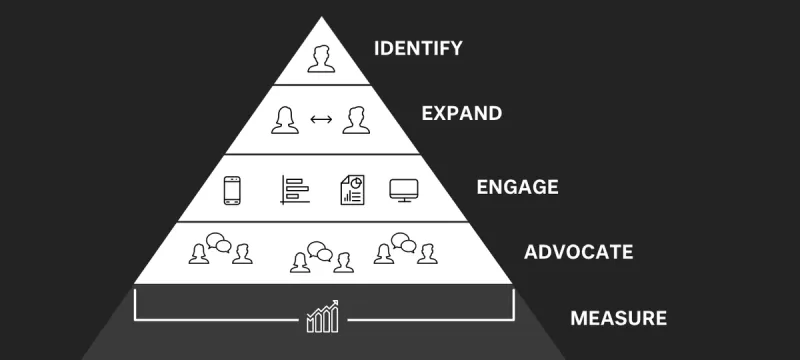

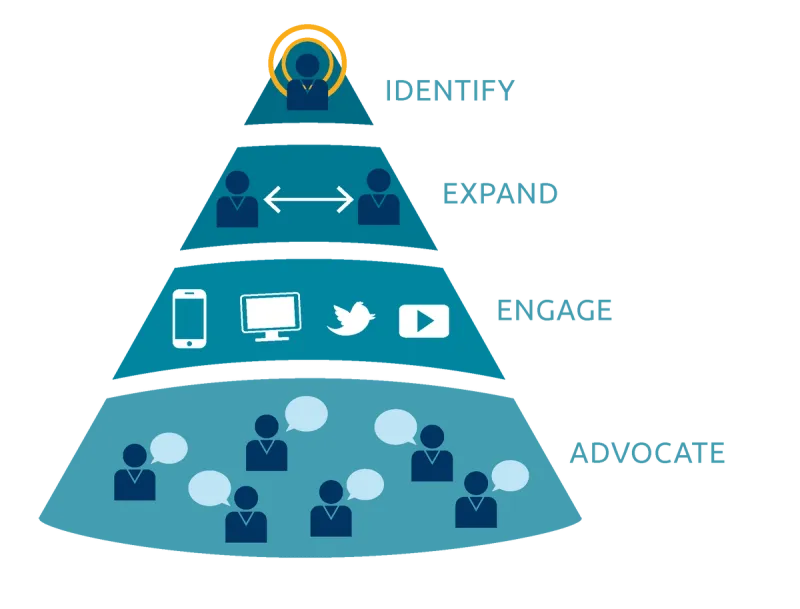

Terminus, a leader in ABM software and originators of #FlipMyFunnel, use ABM to flip a traditional funnel on its head like so:

Terminus defines the 4 stages of the flipped funnel below:

- Identify – Start with the best-fit. Generally guided by an ICP; Ideal Customer Profile.

- Expand – Focus on people in the same roles. Find contacts within the companies that you’ll engage during the sales & marketing process.

- Engage – Right content, right channel. Use the most engaging and targeted form of content to target your contacts and accounts.

- Advocate – Turn customers into fans. Your marketing team should do everything in its power to ensure customer success by retaining accounts and keeping them happy.

How to Apply it for #AccountBasedFundraising

We were fortunate enough to pick Sangram Vajre’s, Chief Evangelist at Terminus, mind about using a flipped funnel approach to fundraising. When asked how a founder might apply ABM to fundraising, Sangram said, “The flip my funnel approach can be applied so many more ways than an account-based marketing approach. From a fundraising perspective, lets say your a B2B company in the marketing space. Start by looking at the top 10 companies that have raised money in the last 12 months and who they have raised from and start building your list from here. By starting with a priority list of targeted VCs you won’t have to explain the market and field unqualified inbound interest. As long as you know who your target audience it will really help you solidify where to spend your time.”

As a founder himself, Sangram used the flipped funnel approach when fundraising. At Terminus, Sangram and the team had a list of over 100 investors and were flooded with inbound interest from angels and other firms. By limiting the list to ~10 investors they were able to do in-depth research and make sure their visions aligned when they set out to fundraise. Finding the right VC firm can be an integral part of your company’s success and can be started by defining your values and narrowing your list of investors by their visions, experience, and portfolio. In the words of Sangram, “Finding a VC firm is almost like finding a co-founder. Any due diligence that you would do to add a co-founder you should when adding a VC partner.”

Identify

Start your fundraising process by identifying key “accounts” (read: investors) that are strategic fits for you business. Keep in mind things like location, industry focus, stage focus, other investments, and deal velocity. We suggest developing an “Ideal Investor Profile” to define what investors you’ll want to target during the fundraising process.

Expand

Find the exact partner or decisionmaker you’ll want to communicate with during your fundraise. Larger firms often have different partners that handle different stages, industries, etc. If there is an advocate and thought leader for your industry within a firm, make sure to add them to your list as well.

Unlike the sales & marketing “expand” stage, you’ll likely be able to expand externally from the investment firm as well. Firms decide to pass for a number of reasons, but they also offer a large network. They may be able to make intros to other investors in a similar position, and those investors may be ready to pull the trigger on an investment.

Engage

Dripping content to your targeted potential investors during the fundraise process is critical. Even if you’re not trying to actively close capital, you should constantly be nurturing and engaging potential investors. We have found it best to send out a short update on the state of the business and industry on a monthly basis. Share a promising metric or two showing strong growth in the business and highlight any significant wins/improvements.

Advocate

Once you’ve landed an investor, it is vital to form a strong relationship and turn them into your company’s biggest champion. Just as you use customer success to keep your customers happy, you should be intentional about building relationships with your investors and keep them happy, too. Your investors should be your company’s biggest advocate, but that will only be true if you’re top-of-mind for them. Make sure that relationship is strong, and good things will follow.

By turning your current investors into advocates you’ll be able to call on them to help fill the top of your funnel with qualified investors from their network. Or better yet, they’re the first people you can go to when you need more capital in your business.

There is no definitively correct way to run a fundraising process, so flipping the traditional funnel on its head and using an “account based” approach can be an interesting strategy. If you’re ready to start engaging potential investors and turning them into advocates, sign up for a free trial of Visible here.