As we invest in rapidly changing technologies that impact people and the planet, it’s of the utmost importance to consider the unintended consequences—even at the early stage. As the world felt the effects of several major crises in recent times, Environmental, Social, and Governance (ESG) principles have rightfully risen to the spotlight in the venture capital industry and now play a critical role in investment decision-making.

Investors hold a responsibility to guide their portfolio companies in ESG practices, not just because the world is watching—but because companies that are as concerned with their impact as they are with building their products are proven to perform better in the long run.

Visible recently hosted an ESG for Venture Capital webinar with Tracy Barba, Head of ESG at 500 Startups and Director at ESG4VC, where she answered the common questions about establishing ESG reporting practices at VC firms. We’ve shared answers to some of those questions below as well as guidance on using Visible for ESG portfolio monitoring.

What is ESG for Venture Capital?

ESG policies and practices help investors and companies manage their environmental, social, and governance risk and identify opportunities for value creation. VCs—including 500 Startups—are widely embracing the shift. In the 2020 ESG Annual Report spearheaded by Tracy Barba, 500 Startups said their policies include:

- Environmental criteria to examine how a company performs as a steward of nature.

- Social criteria to consider a company’s relationship with its employees, suppliers, customers, and communities where it operates.

- Governance criteria to review a company’s leadership, shareholder rights, executive pay, audits, and internal controls.

VC firms can and should provide an ESG framework as startup companies grow. It’s never too early to care—as we’ve seen in the news, large tech companies have found themselves in legal and ethical trouble over issues that could have been resolved in the earlier stages.

In How Venture Capital Can Join the ESG Revolution, Stanford’s Social Innovation Review pointed out that eventually, ESG should not be understood as an “add-on” but a core value in a VC leading to better investments and companies. Ethical and legal considerations should not be ignored in the service of achieving rapid growth and swift time to market. As a VC firm, there is a risk in your ownership percentage if a portfolio company were to face legal battles, public scrutiny, and other risks that could have been prevented if they were identified earlier.

ESG as a term is often used interchangeably with impact investing. As Tracy Barba points out, impact investing is thinking about the end goal and the impact of the companies you’re investing in. Having a strategy around water or climate is an example of an impact strategy, so you’re filtering deals based on that. ESG is a screening for every company, regardless of the type, measuring their environmental, social, and governance criteria.

It’s hard for an early-stage company to know their impact, such as environmental waste, if they don’t have a product yet. That’s why it’s important to map ESG to relevant stages of a company’s development. At an early stage, the goal is to start to have a conversation. It’s much easier to think about how a company affects the environment from the beginning and address any issues upfront rather than fix or replace already-established processes in the future. At later stages, more detailed discussions will be appropriate.

Founders overwhelmingly do care and want to consider ESG, but many don’t know when or how to get started. As an investor, you can help them start to think through ESG by adding it as an agenda item on your monthly or quarterly check-ins. An example question is: “Are you tracking your carbon footprint?” Their answer might simply be “Yes”, or it might be, “No we aren’t, but we’d like to. How can we get started?”

Why is ESG Becoming More Common in Venture Capital?

There is a growing understanding that ESG policies help with customer loyalty, retaining talent, and attracting more investors. It’s beneficial if a company directs time and energy towards making sure they’re operating responsibly.

In venture capital, some topics are gaining momentum:

Diversity – there are demonstrated benefits to having culturally diverse teams and boards.

Gender equality – supporting more women and as founders and funders.

Data protection & privacy of users – startups are not exempt from laws such as the GDPR and CCPA which protect the personal data privacy of consumers.

Environmental impact trends – caring about carbon emissions, ethical sourcing of materials, waste management, etc.

It’s important to be mindful of regulations and how they can change over time. The Sustainable Finance Disclosure Regulation (SFDR) in Europe aims to prevent greenwashing and to increase transparency around sustainability claims (source: Eurosif). While the SEC currently only recommends ESG disclosure, it may also create firm rules in the future. Companies may start measuring and reporting their ESG progress in preparation for new regulations.

More than ever, founders care about being backed by VCs they align with. VCs can drive a positive shift by integrating ESG into their own operations. Showing that you care as an investor is integral in instilling ESG policies into your portfolio.

How To Monitor ESG Metrics Across your VC Portfolio

You can start tracking ESG metrics across your portfolio by sending them an annual questionnaire. 500 Startups, for example, collects their founder diversity info on a quarterly basis, measuring their progress over time and benchmarking to the VC industry.

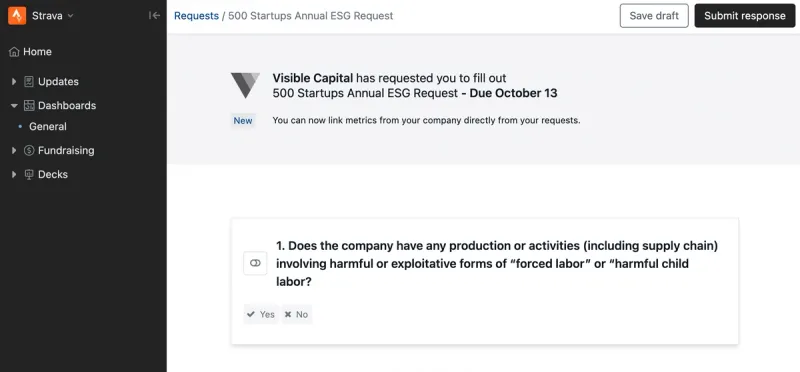

Founders already get asked for a lot of information, so to encourage their participation in your ESG questionnaires, ask fewer questions and use simple yes/no answers whenever possible. With Visible, you can fully customize your ESG reporting questions using Requests.

Preview of an ESG Request in Visible below —

View best practices for collecting metrics with Visible below:

You can track answers and hold founders accountable for how they are going to implement best practices, how they are going to hire, etc.

ESG questionnaires are not meant to penalize startups, but to get a sense of where they currently are—they may only just be starting to think about tracking and monitoring their water usage or diversity, for example. Once they gain customers, the questions you ask them will grow more detailed.

If an early-stage company feels they do not have the resources or bandwidth to manage ESG concerns, you can help them get started by simply putting an employee manual or non-discrimination policy on the agenda for your next check-in. Remember, it’s going to be more expensive if they wait longer to implement those practices.

Tips for ESG Fund Reporting

External consultants can help VC firms evaluate their policies and processes across recruitment, HR, and deal flow, and recommend ways to improve. Since external consultants collect data across venture capital firms, they can educate them about best practices and compare how they are doing relative to the entire industry.

Tracy Barba, Head of ESG at 500 Startups, reported that working with external consultants like Diversity VC was helpful in providing them with an external validation point. This type of industry benchmarking is now growing as a field and becoming more common practice.

Resource: How to increase Diversity at your VC Fund

How to Incorporate ESG Into Your Portfolio Support

Now that you’ve gathered ESG data from your portfolio companies and identified opportunities for improvement, what’s next? VC firms can take the initiative to provide education, tools, training, and resources for their companies—whether in-house or through outside service providers and consultants.

500 Startups provides a vast array of ESG resources for their founders and the public, including webinars, which are available on their website: ESG for Early-Stage.

Resource: Portfolio Support Best Practices for Venture Capital Investors

Tracy Barba’s nonprofit ESG4VC aims to provide education, office hours, and research for venture capital firms to help establish standards and encourage movement in a positive direction across the industry.

It’s been said that we can’t fix what we can’t measure. When it comes to improving the impact business has on the environment, workers, and communities, investors can be proactive in incorporating ESG policies at the very early stages so that everyone can benefit.

View Examples of How to Request Metrics in Visible below: