Venture Capital funds dedicate a lot of time and resources to optimizing their pipeline processes. However, not all VCs apply the same level of intention and effort to their post-investment processes. This is why portfolio support is not only considered an important differentiator for funds but also a critical part of the success of the fund and its portfolio companies.

Value-add portfolio support can help with everything from attracting better deal flow (don’t forget founders talk to each other!), improving brand recognition, raising capital from LPs, and most importantly, helping companies succeed.

What is Portfolio Support?

Portfolio support is a post-investment process that is intended to help portfolio companies perform, grow, and overcome potential hurdles. This typically includes some combination of the following:

- New company onboardings

- Hiring and recruiting

- Marketing and promotional support

- Future fundraising support

- Events

Why is Portfolio Support Important?

In the early days of venture, capital alone was enough to be a differentiator. As the venture capital market has evolved so have the expectations for VC funds.

Formalized post-investment support for portfolio companies has become a differentiator for VC firms — it helps with brand recognition, portfolio company performance, and ultimately improves a firm's odds of increasing returns and raising a future fund.

Who Owns Portfolio Support?

Portfolio company support is typically owned by the person running a firm's platform. For larger funds, this might be a dedicated person or team (e.g. Head of Platform, Platform Manager, etc.). At a smaller fund, this likely falls on the shoulders of a partner.

Related resource: VC Fund Performance Metrics 101

How Do Portfolio Companies Request Support?

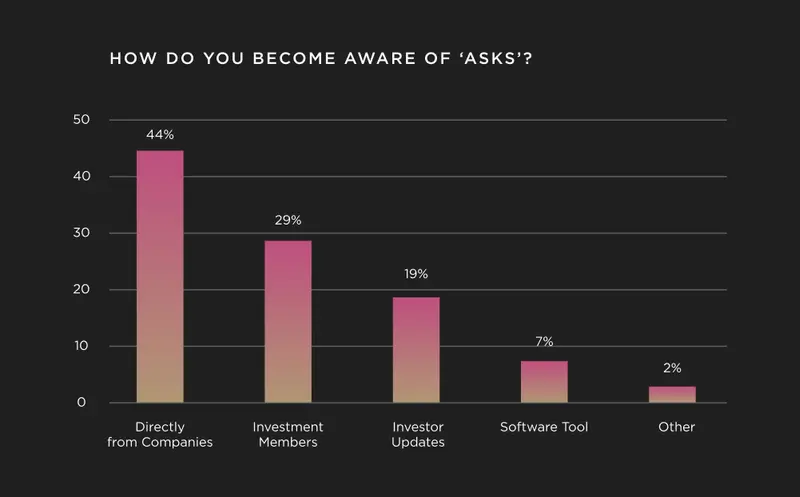

In Visible’s survey taken by VC Portfolio Operators, respondents shared that they are made aware of support needs from companies in a variety of different ways. The most common is directly from companies (44%) but also from investment team members (29%) and in third place, from Investor Updates from companies.

From this data, it’s clear portfolio support requests are being shared in myriad ways with different team members at a fund. This highlights the importance of having open and transparent communication across your fund team so that portfolio support requests can be triaged quickly and by the right person.

Getting Started With Portfolio Support Best Practices

This guide is created for VC investors and operators who want to level up their portfolio support. The content of this guide is derived from Visible’s 2022 Portfolio Support Survey, Visible’s July 2022 Webinar on Building Scalable Portfolio Support, and the industry experience Visible has gained through supporting hundreds of investors around the world to improve their portfolio monitoring and management processes.

Contents of the Guide:

- What is Post-Investment Support

- Who Owns Post-Investment Support

- How to Best Scale Your Post Investment Support

- Most Common Portfolio Support Requests + Resources

- Advice for First-Time Platform Managers

Ready to take your support to the next level? Learn how Visible can help you with your portfolio management and reporting here.