Key Takeaways

-

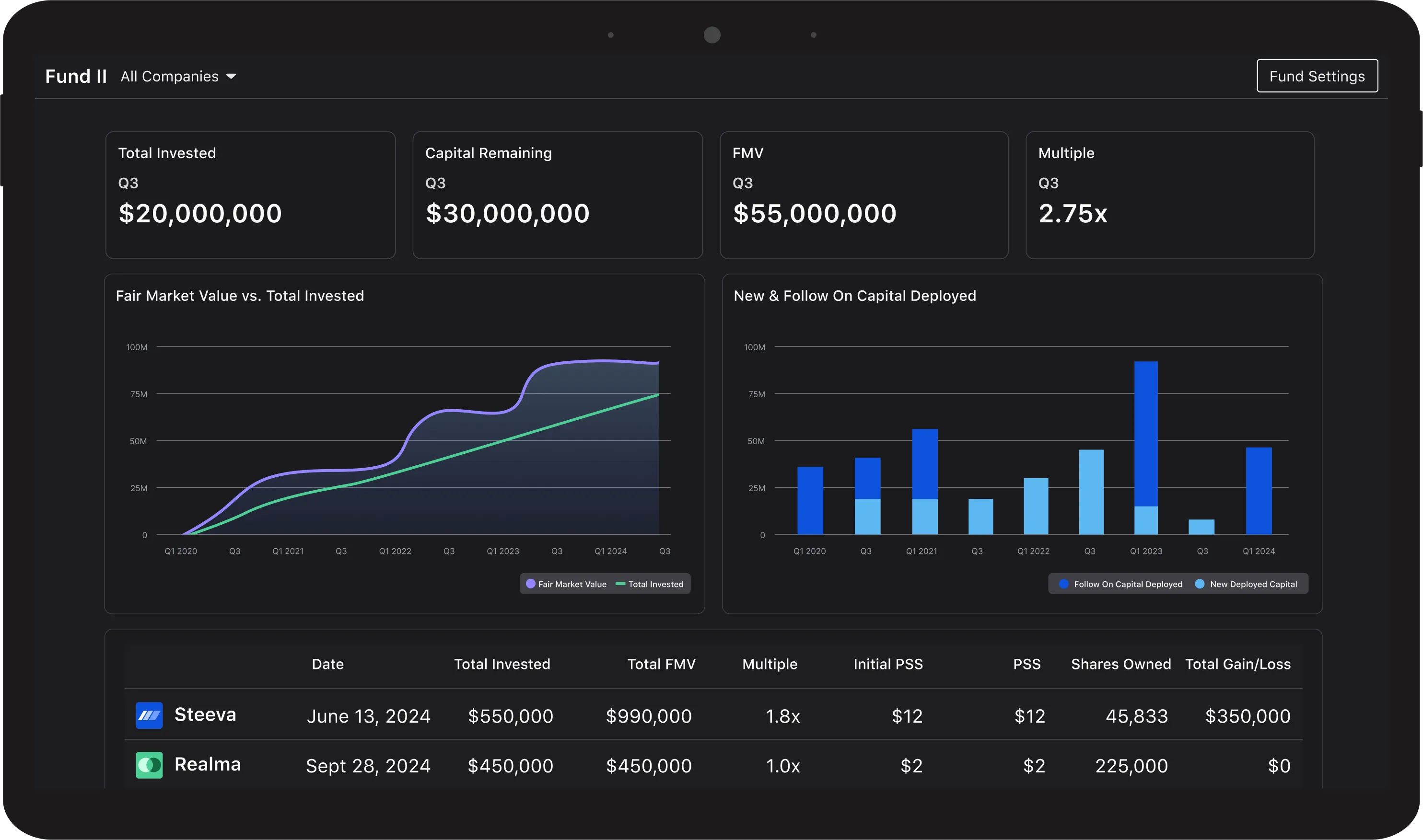

Learn how venture capital investors use vc portfolio management software to gain clearer visibility into portfolio performance, improve decision making, and reduce manual reporting as portfolios scale.

-

Understand the practical differences between portfolio monitoring software built for venture capital versus private equity, including how private equity portfolio monitoring requirements differ from venture workflows.

-

Discover what investors should look for when evaluating the best vc portfolio management providers, from vc data quality and reporting consistency to how tools fit into a modern vc stack.

-

Get actionable guidance on when free tools fall short and why many firms eventually upgrade from vc portfolio management software free options to more robust venture capital software.

-

See how startup portfolio management, relationship tracking, and crm for venture capital systems work together to support better founder communication and long term portfolio oversight.

Best VC Portfolio Management Providers

Managing investments becomes more complex as a venture capital portfolio grows. Investors need clear data, consistent reporting, and reliable workflows to make informed decisions over time. As funds deploy more capital across more companies, portfolio management becomes an operational discipline rather than an afterthought. This guide explains how portfolio management tools support venture capital investors and the benefits they provide as firms scale.

What Venture Capital Portfolio Management Involves

Venture capital portfolio management refers to how investors track performance, collect company updates, and evaluate progress across their investments. It includes both quantitative metrics and qualitative context that help investors understand how companies are operating between funding events. Effective startup portfolio management gives investors a structured way to monitor traction, identify risks, and support founders without becoming overly reactive.

For most firms, this process evolves over time. Early on, portfolio management may rely on informal check-ins and spreadsheets. As portfolios mature, the need for repeatable systems becomes more obvious, especially when multiple partners or team members need access to the same information.

Why Portfolio Monitoring Gets Hard as Portfolios Grow

As portfolios expand, manual tracking systems quickly become inefficient. Spreadsheets and inbox-driven workflows make it difficult to compare companies or identify risks early. Important updates get buried, data formats vary widely, and institutional knowledge often lives with one person rather than the entire team.

This challenge often pushes investors to explore portfolio monitoring software as a way to centralize information. A single system for updates, metrics, and notes reduces reliance on memory and makes portfolio discussions more productive.

Core Benefits of VC Portfolio Management Software

The primary benefit of vc portfolio management software is visibility. Investors gain faster access to standardized data, more consistent reporting across companies, and fewer gaps between updates. This visibility supports better pattern recognition across the portfolio.

Another benefit is efficiency. When reporting processes are standardized, founders spend less time formatting updates and investors spend less time chasing information. Over time, this operational leverage compounds, especially for lean teams managing many active investments.

How Portfolio Tools Fit Into a Modern VC Stack

Portfolio management tools typically operate as part of a broader vc stack. Investors rely on multiple systems to manage deals, relationships, and reporting workflows. When these tools are disconnected, data fragmentation becomes a problem.

A well designed vc toolkit allows information to flow across systems without constant manual entry. This creates a shared source of truth that supports internal reviews, partner meetings, and long term fund analysis.

Portfolio Monitoring in Venture Capital Versus Private Equity

Venture capital and private equity firms approach portfolio oversight differently. Private equity portfolio monitoring often emphasizes control, operational metrics, and frequent intervention, while venture capital focuses more on growth signals and long term potential.

Because of these differences, portfolio monitoring software private equity and private equity portfolio monitoring tools are built to support different use cases. Understanding these distinctions helps venture investors avoid adopting systems that are overly rigid or misaligned with their investment style.

Evaluating Portfolio Monitoring Software for Private Equity Contexts

Some venture investors research adjacent asset classes to better understand tooling options. Searches for best portfolio monitoring software private equity or portfolio monitoring software private equity often surface evaluation frameworks that emphasize data depth, governance, and reporting rigor.

While not all of these criteria apply directly to venture capital, they can help investors clarify what level of structure they want as their funds grow and mature.

The Role of Relationships and CRM in Portfolio Oversight

Metrics alone rarely tell the full story of a portfolio company. Many investors rely on a crm for venture capital to track conversations, commitments, and historical context alongside performance data. This relationship layer helps explain why metrics change and what founders are prioritizing.

Strong relationship tracking also improves continuity when team members change or responsibilities shift. Context that lives in a system rather than an inbox is easier to maintain over time.

Free Versus Paid Portfolio Management Tools

Early stage firms sometimes begin with lightweight solutions before adopting more robust systems. While vc portfolio management software free options can support basic tracking, they often require manual work and lack customization.

As portfolios grow, paid tools typically offer better automation, reporting flexibility, and data integrity. The decision to upgrade often coincides with a fund closing, a larger team, or an increase in portfolio complexity.

How Investors Review and Compare Portfolio Tools

Before selecting a system, investors often evaluate usability, reporting depth, and data reliability. Reading a vc portfolio management software review can help teams understand how different approaches perform in real workflows.

Beyond feature sets, investors should consider how easily a tool fits into existing processes. Adoption matters as much as functionality, especially when founders are responsible for providing data.

Portfolio Management Across the Investment Lifecycle

Portfolio management plays a role throughout the life of an investment. Venture capital portfolio management supports onboarding after a check is written, ongoing monitoring during the growth phase, and preparation for future rounds or exits.

Effective venture capital software helps investors maintain continuity across these stages. This continuity improves internal decision-making and external communication with limited partners.

Where Data Quality Makes the Biggest Difference

High quality vc data improves decision-making at both the company and fund level. Clean and consistent inputs allow investors to identify trends earlier, benchmark performance, and allocate time more effectively.

Over time, strong data practices support more disciplined investing and clearer portfolio narratives.

Common Misconceptions About Venture Capital Software

Some investors assume the best venture capital software is only necessary for large funds with complex structures. In practice, smaller teams often benefit the most from systems that reduce manual work and create consistency.

Another misconception is that software replaces judgment. In reality, tools support better judgment by providing clearer inputs and historical context.

Choosing the Right Portfolio Management Approach

There is no single venture capital software list that works for every firm. Investors should focus on alignment with their strategy, reporting needs, and team structure.

Selecting the right venture capital investment tracker supports long term portfolio visibility while allowing firms to evolve their processes over time.

Final Thoughts on Portfolio Management Providers

The best vc portfolio management providers help investors maintain clarity and consistency as portfolios grow. Strong systems support better conversations with founders, more informed internal discussions, and clearer reporting.

A thoughtful approach to visible portfolio management concepts allows teams to stay informed without being overwhelmed as their portfolios scale.

Frequently Asked Questions

What are the best VC portfolio management providers used by venture capital investors?

The best VC portfolio management providers offer tools that help investors track performance, collect updates, and analyze vc data in one place. These systems focus on venture capital portfolio management needs such as growth metrics, reporting cadence, and collaboration rather than operational control.

How does VC portfolio management software differ from private equity portfolio monitoring software?

VC portfolio management software is designed for high growth, minority ownership investments and lighter reporting structures. Portfolio monitoring software private equity typically supports deeper operational oversight, control, and governance. Understanding this difference helps investors choose tools aligned with venture capital investment workflows.

Why do venture capital firms need portfolio monitoring software as they scale?

As portfolios grow, manual tracking becomes inefficient and error prone. Portfolio monitoring software helps venture capital investors centralize updates, standardize reporting, and improve visibility across investments. This leads to better internal decision making and more consistent communication with founders and stakeholders.

Is free VC portfolio management software enough for early stage funds?

VC portfolio management software free options can work for very small portfolios or early experimentation. However, most firms outgrow them quickly due to limited automation, reporting flexibility, and data consistency. As complexity increases, paid venture capital software often provides better long term value.

How does CRM for venture capital support portfolio management?

A crm for venture capital helps investors track relationships, conversations, and historical context alongside metrics. This qualitative information complements vc data and supports stronger startup portfolio management by helping teams understand why performance changes and how founders are prioritizing their time.

What should investors look for when reviewing VC portfolio management software?

When conducting a vc portfolio management software review, investors should focus on data quality, ease of use, reporting consistency, and how well the tool fits into their vc stack. The right solution supports venture capital portfolio management without adding unnecessary operational complexity.