This year Visible made it even easier for investors to collect important information from their portfolio companies, transform it into meaningful insights, and share engaging updates with their teams and stakeholders.

2023 by the numbers

- 8k+ - The number of portfolio companies actively monitored on Visible

- 92k+ - The number of reminder emails investors didn't have to send

- 12k+ - The number of LP Updates sent to investors

Check out Visible's highlighted 2023 product updates below.

Updates to getting data into Visible

Over 350+ VC funds are using Visible to streamline the way they collect and centralize data from their portfolio companies. Here's how the recent product updates make this process even easier.

- Automatically import KPI data with Visible’s Portfolio metric import tool. (Learn more)

- Request information from portfolio companies based on conditional logic. (Learn more)

- Easily collect 6 periods of historical and forecast data from your companies. (Learn more)

- Schedule a One-time Request to collect any data on a one-off basis. (Learn more)

- Ask for property information in Requests to keep company profiles up to date. (Learn more)

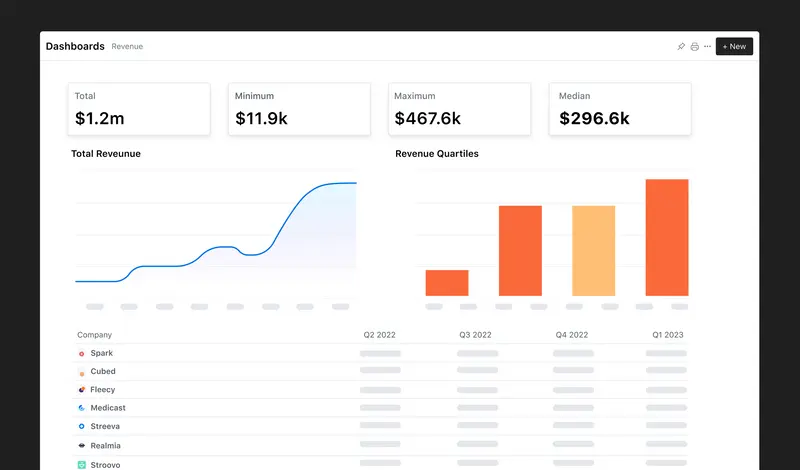

Updates to transforming data into meaningful insights

To get the most value out of portfolio data, investors need tools that make it easy to transform the data into portfolio intelligence. Visible's data analysis tools help investors unlock insights to improve the way they provide support and inform investment decisions.

- Compare performance across your portfolio with Portfolio metric dashboards. (Learn more)

- Customize and scale your LP reporting with Tear sheets. (Learn more)

- Slice and dice portfolio data with Segment metrics. (Learn more)

- Save time by applying a Dashboard template to all your companies. (Learn more)

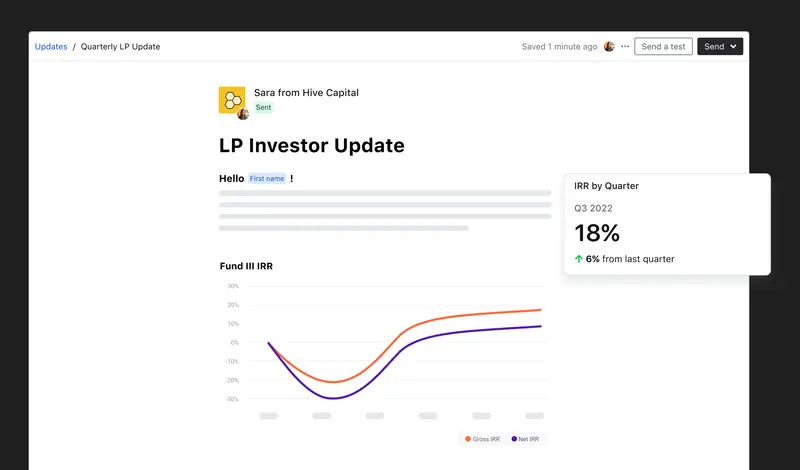

Updates to communicating portfolio information with stakeholders

The most valuable types of insights are the ones that are easiest to communicate and share with others. Keep reading to learn how Visible made it even easier for investors to keep key stakeholders up to date.

- Integrate qualitative responses from companies directly into your Tear Sheets and Dashboards. Learn more.

- Track, visualize, and share 25+ fund metrics including IRR, MOIC, TVPI, DPI and more. Learn more.

- Portfolio companies can turn responses to Requests into narrative updates using Visible AI. Learn more.

Join a community of over 350+ VCs streamlining their portfolio monitoring and reporting with Visible.