The world has been consumed by data and metrics — startups are no exception. Founders need to leverage their key data and KPIs to fuel growth, build products, create interest from potential investors, and more.

At Visible, we have a tool built for VC funds to collect data from their portfolio companies and enable GPs to report to their investors (LPs). In order to better help founders determine what metrics they should be tracking, we analyzed our data and found the most common metrics VCs are collecting from their portfolio companies. Check them out below.

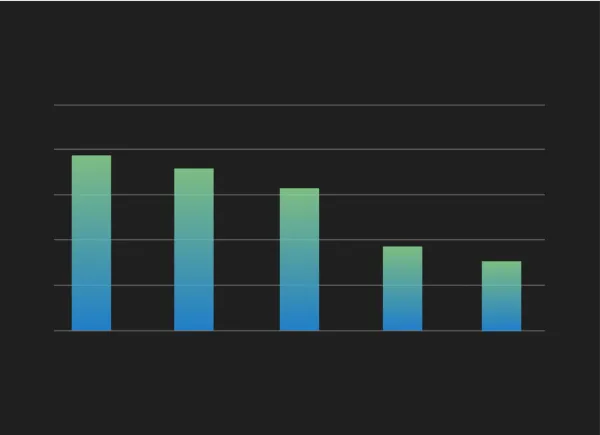

The Most Common Metrics

- Revenue

- Cash

- Headcount

- Customers / Users

- Total Operating Expenses

The 5 metrics above are high level metrics that might sound obvious. However, great founders are able to recall them at anytime. Not knowing your key operating metrics is a ????. These can be used as the backbone for investor updates, board meetings, and determining more granular metrics to track.

P.S. 75% of investors are collecting anywhere between 1 and 10 metrics so chances are your own investor updates should land in the same range.

Reading List

Key Insights from High Alpha’s Finance Leaders

The team at High Alpha shares key takeaways from the finance leaders in their portfolio — they share why efficiency metrics are key in the current market, how data storytelling can be a differentiator, and more. Read more

Time to Refine Your Metrics: Defining Growth and Success at a PLG Company

Mikaela Gluck of OpenView Ventures highlights the key metrics that product-led companies should be tracking. Read more

6 Metrics Every Startup Founder Should Track

On the Visible Blog, we share 6 basic metrics that every founder be tracking and sharing with their stakeholders. Read more