We surveyed founders in our community and asked, “How likely are you to refer your current lead investor(s) to fellow founders?” (AKA — NPS score).

The results were shocking with an NPS score of 23. An NPS score of 23 falls below the average for the airline industry. Not a great industry to be compared to in terms of customer satisfaction scores.

As the venture space continues to grow and mature, the importance of investor’s adding value and opportunities is higher than ever. In order to better help investors support their portfolio (and hopefully move that NPS score up) we’ve put together 3 tips below:

Systemize your data collection

As Peter Drucker put it, “if you can’t measure it, you can’t improve it.” In order to best help the founders in your portfolio, you need to have a system in place to collect data, quantitative and qualitative, so you can jump in and help when needed.

Setting up a system requires a fine balance between being beneficial for your fund and being efficient and easy on the founder. With that said, it is important you only collect what is absolutely necessary (for founders who are already taking the time to send investor updates you want to make sure they are not duplicating efforts). What we suggest requesting from a founder to start:

With Visible for Investors, founders can fill out simple Update Requests from their investors (like the example above) and use their data to fuel future investor Updates. Learn more about Visible for Investors here.

Take action on the data

Collecting portfolio company data is only half the battle. Once you have the data in hand (qualitative or quantitative) you need to make sure you are closing the loop.

Keep an eye on qualitative data

As we displayed in our example request above, best-in-class investors are specifically requesting a “Where can we help/problems” section.

Being sure you can track and manage this data over time will improve your ability to take action. By setting up a view in Visible or exporting answered requests, you can keep your eye on where your companies stand and where your help is needed.

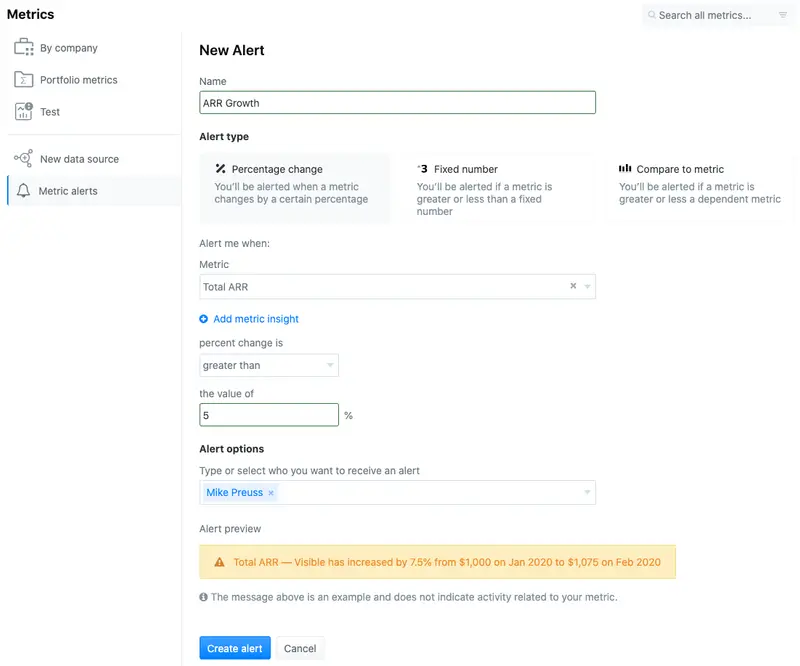

Metric alerts and benchmarking

When collecting metrics and data from your companies on a recurring basis, you’ll be able to uncover trends for individual companies and your portfolio as a whole.

If you notice a core metric for a specific company is slipping month over month, it might be a good time to intervene and see if they need a hand to tackle a problem.

Fundraising and Introductions

Startups are in constant competition for 2 resources — capital and talent. As an investor, you will oftentimes see founders need help with 1 (or both) of those 2 areas. Being able to make an introduction to a potential investor or new hire can have a huge impact on a startup’s growth.

Being able to open up your rolodex will be a huge win in the eyes of your founders.

On the flip side, you can use the data from your portfolio as a whole to help benchmark and uncover new trends to the rest of your portfolio. For example, if you see a go-to-market strategy picking up steam with a few companies, it can be a good time to introduce the ideas to other companies that might benefit from the strategy.

Learn more about how you can use Visible for Investors to better support your portfolio companies here.

Make the most of it

Setting up a system to collect data from your portfolio companies is no easy feat so you’ll want to make sure you are getting the most value out of the data as possible. Outside of helping your portfolio companies, you do have your own set of investors you need to report to.

Having a strong system to collect portfolio data is a natural backbone to power your next LP report. Building strong rapport with your LPs is a surefire way to make sure your next fundraise goes smoothly.

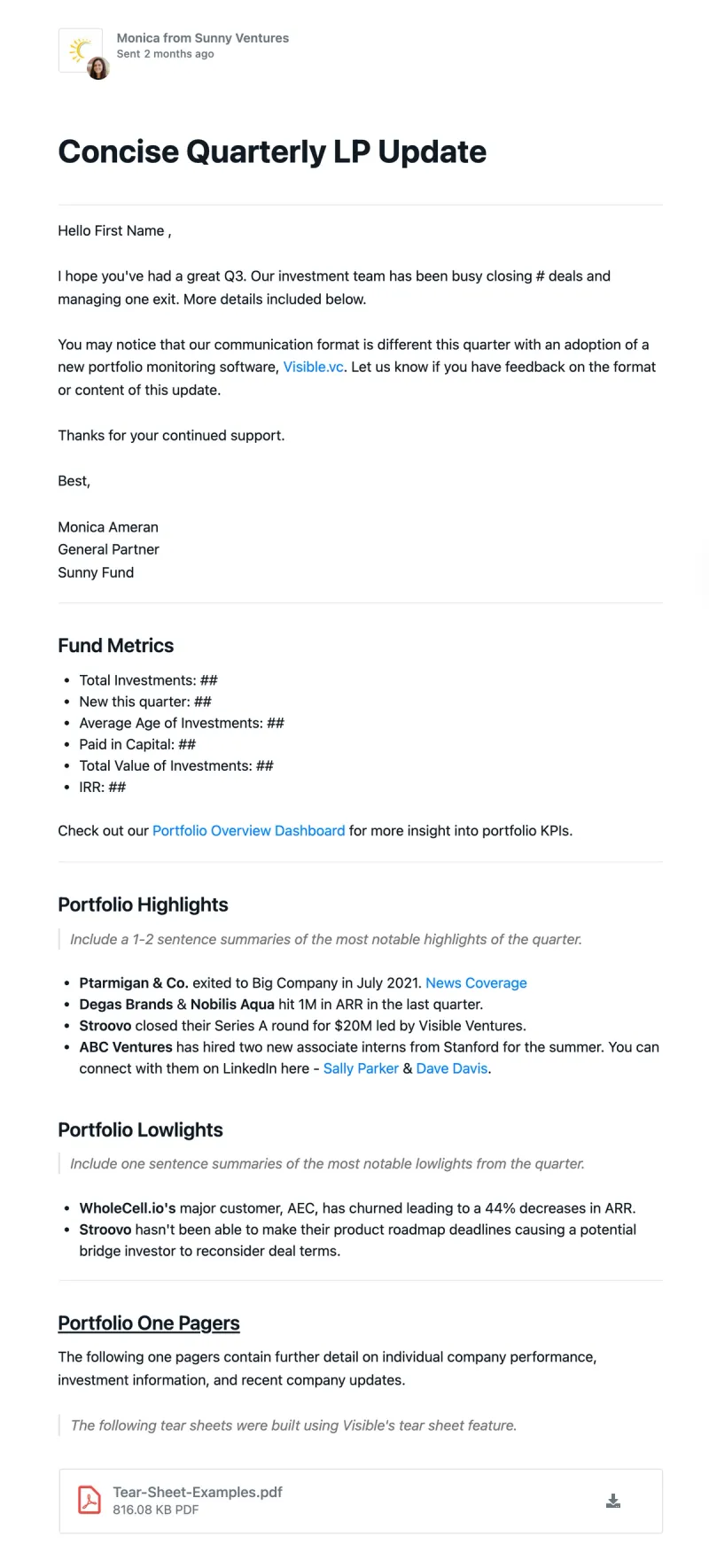

Using Visible, you can roll up your data and use Updates to report to your LPs. No exporting or additional data needed. Simply take the data from your portfolio, add in any necessary fund/investment data, and keep your LPs in the loop. Check out an example report here.

Check out more LP update templates here.

Learn more about using Visible for Investors to report with your LPs here.

Stay engaged with your founders right from your pocket. Monitor your portfolio and be the value-add investor you want to be with Visible for Investors. Schedule a demo to learn more here.