At Visible, we believe that a venture capital fundraise often mirrors a traditional B2B sales and marketing funnel. At the top of your funnel, you are adding new investors, nurturing them throughout the middle of the funnel with email and meetings, and hopefully cashing a check from them at the bottom of the funnel.

Related Resource: All-Encompassing Startup Fundraising Guide

Luckily, there are tips, resources, and tricks that will help you build momentum in your fundraising efforts so you can focus on building your business. Learn more about how you can create a fundraising strategy and build a more efficient fundraise with our guide below:

Startup Fundraising: How It Works

Just how a sales and marketing process might differ from business to business, so will a fundraising process. The ideas and systems behind the process might stay the same but there will be subtle changes when it comes to approach, communication, and more as a business grows. A couple of different stages that we will hit on in this post:

- Pre-seed

- Seed

- Series A, B, and C

How should startup founders prepare for these funding rounds? Check out our breakdowns for each stage below:

Pre-Seed Funding

As we put in our post, The Understandable Guide to Startup Funding Stages, “A pre-seed round is a round of venture capital that is generally the first round of institutional capital that a startup raises. A pre-seed round generally allows a founding team to find product-market fit, hire early employees, and test go-to-market models.”

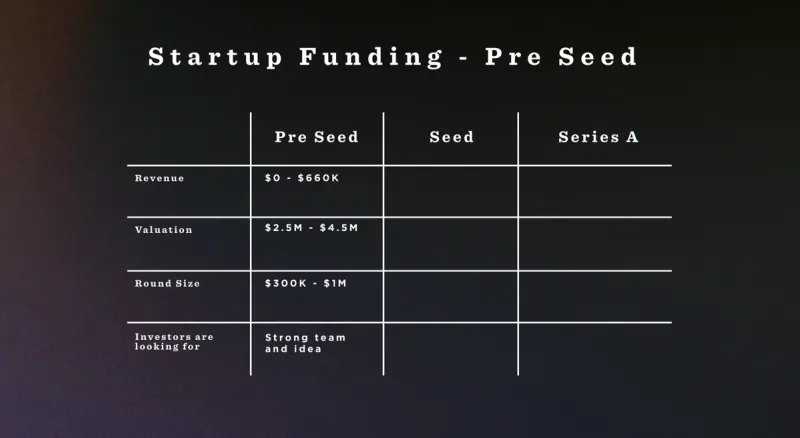

Pre-seed funding rounds have become more common over the past few years and have turned into a powerful resource to help founders get their idea and business off the ground. The purpose is to give founders the capital they need to see their product through. Investors are largely betting on the team and idea as revenue is little to none.

Pre-seed rounds greatly vary in size but generally fall in the $300K to $1M size. However, we’ve seen pre-seed rounds get close to $5M. Typically, valuations might be in the $2M to $5M range.

Seed Funding

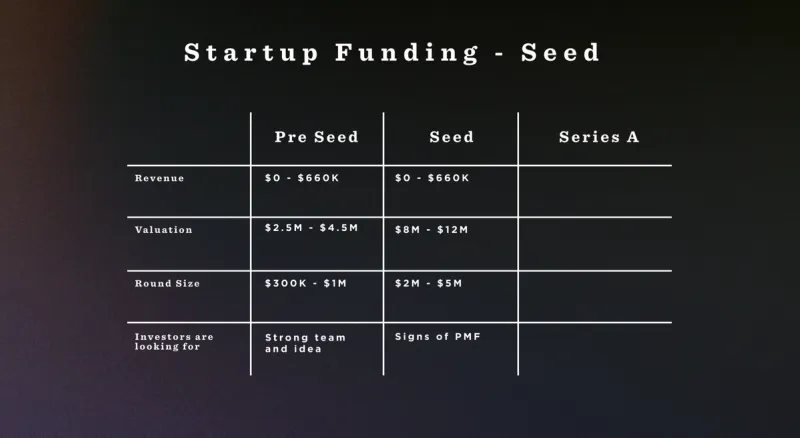

As we wrote in our post, Seed Funding for Startups 101: A Complete Guide, “Seed funding is a startup’s earliest funding stage. Often, seed funding comes from angel investors, friends and family members, and the original company founders. An early-stage startup may also look for funding through bank loans, but angel investments are usually preferred. Seed funding is used to start the company itself, and consequently, it is a fairly high risk: the company has not yet proven itself within the market. There are many angel investors that specifically focus on seed funding opportunities because it allows them to purchase a part of the company’s equity when the company is at its lowest valuation.”

At this point, a startup likely has some sign of product-market fit and is ready to scale its go-to-market efforts. At the seed stage, rounders are typically in the $2M to $5M range (but like pre-seed funding can often be much larger than this). Valuations typically sit around the $8M – $12M range.

Series A, B, and C Funding

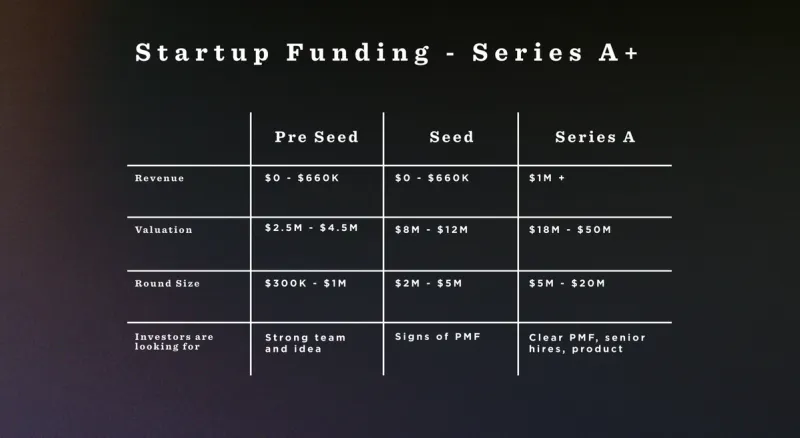

Beyond a seed round comes Series A and beyond (Series B, C, D, etc.). At the point of a Series A round, a startup generally has demonstrated product-market fit, is making senior hires, has a strong product, and is executing new releases at a high level.

Once you get beyond a Series A, the same ideas hold true but an investor is likely more focused on the numbers behind a business. They’ll want to make sure that the business can efficiently grow into a huge company.

Typically a Series A round is anywhere between $5M and $20M. This is a large range but we still occasionally see companies raise much larger amounts. Revenue is like in the $1M to $5M range and all signs point to that number continuing to grow quickly.

How to Create a Startup Fundraising Strategy

As we said earlier in the post, approaching a fundraise with a strategy and system in place is a great way to build momentum in your fundraise. Founders are being pulled in a hundred different directions and a fundraise is a part of that. By having a system in place, you will be able to focus on the other aspects of your business.

There is no right or wrong way to approach a fundraise but as long as you have a strong system and cadence in place you are already ahead of the curve. We recommend treating a strategy like a sales and marketing funnel. Find investors to fill the top of the funnel, both warm and cold “leads,” communicate and nurture them with email Updates throughout the middle of the funnel, and hopefully close them as a new investor at the bottom of the funnel.

Check out a few tips to help you get started with your fundraising strategy and system below:

Getting Started: Ask the Right Questions

Outline some of the basic questions that a fundraising strategy should address. When getting started with your fundraising strategy it is important to understand why you’re raising, who are you raising from, and the financials of your round. Check out a few example questions below:

- Why is your startup raising capital?

- Who is your startup reaching out to for financing?

- How much capital will your startup raise – now and in the future?

- When is your startup raising capital?

- What is your startup’s process for raising capital?

Before even building out the rest of your fundraising strategy you need to be able to properly answer the questions above. You may learn that venture capital is not the right financing option for your startup, which is totally fine! (Related Read: Checking Out Venture Capital Funding Alternatives)

Related Reading: How to Write a Problem Statement [Startup Edition]

Undergo a Valuation of Your Startup

Of course, a major aspect of raising capital is the valuation of your company. Setting a valuation is generally a mix of art and science, especially at the early stages.

As the team at Silicon Valley Bank puts it, “The most basic valuation method borrows from the playbook used by realtors, who assess the value of a home by looking at “comps,” or comparable homes. Mendelson recommends establishing a startup’s valuation that is “on scale” with those of other early-stage companies. The more similar the startup — be it its sector, location or potential market size — the better.” As your company grows and raises later-stage financing, setting a valuation will be based more on the data and metrics from the companies history.

This is a great starting point and can be enhanced by adding in other factors like a founding team’s management experience, proven track record, market size, risk, etc.

Related Resource: Valuing Startups: 10 Popular Methods

Set Milestones

Setting clear, specific, achievable, measurable, and time-bound goals is invaluable to creating an effective fundraising strategy. Naturally, investors are incentivized to hold off on investing as long as possible. Why? They want to collect as many data points as possible and see how activity looks with other investors.

It is your job as a founder to build momentum and incentivize investors to move quickly. Having set milestones is a great way to wrap your head around a timeline and give you an idea of when you want investors to be moving along by. Brett Brohl of Bread & Butter Ventures estimates that most early-stage companies should estimate 5 months to complete a raise. He breaks it down using the 1-3-1 rule:

- 1 month — Preparation. Creating a deck, materials, and investor lists to kick off your raise.

- 3 months — Pitching. Actually out pitching and taking meetings with investors.

- 1 month — Closing. Finishing up due diligence and legal work to close new investors.

Research Your Investors

Once a term sheet is signed there is no turning back. With the average founder + VC relationship being 8-10 years it is important to make sure founders are bringing on the right investors. There are different factors and things you should look for in a potential investor. As we put in our post, Building Your Ideal Investor Persona:

Location – Where are you located? Do you need local investors? Or maybe you are looking for connections and networks in strategic geographies.

Industry Focus – What type of company are you? Where should your future investors/partners be focused? e.g. If you’re a B2B SaaS company don’t waste your time with marketplace-focused investors. Mark Suster suggests that it is best to prioritize investors with companies in your space.

Stage Focus – What size check/round are you raising? e.g. If you’re raising a $1M seed round avoid a firm with $2B AUM. If you’re raising a $30M round avoid a firm with $75M AUM.

Current Portfolio – What type of companies should be a signal to you that they’re a good fit? Is there a high likelihood they’ve invested in one of your competitors? If so, best to avoid as they likely won’t double down their bet with a competitor to a portfolio co.

Motivators – What do want to get out of your investors and what do they want to get out of you? Do they need to match your values and culture?

Deal Velocity – Are you in need of capital as soon as possible? Or are you taking your time and looking for strategic investors? Varying investors have different philosophies for the velocity they’re making deals. Point Nine Capital and Kima ventures are both regarded as top firms in Europe. However, Point Nine makes ~10 investments a year whereas Kima makes 1-2 investments a week.”

Finding the right investors for your business can be tricky. Using Visible Connect, filter investors by different categories (like stage, check size, geography, focus, and more) to find the right investors for your business. Give it a try here →

Determine How Much Capital You Want to Raise

Determining how much to raise can also be a daunting task. You need to base this on facts and realistic assumptions around your business. As a starting point, forecast where you’d like your business to be in 12-24 months.

From here, you can backfill what resources and hires you’ll need to make to hit those goals. This can be a great starting point for determining how much to raise. From here you can tweak it with interest from investors, the current markets, and more.

Related Resource: Building A Startup Financial Model That Works

Build Out Your Fundraising Strategy

Of course, you can take all of the individual aspects from above and still have a disjointed raise. You can tie them all together to create a fundraising strategy. The above points are a great starting point but need to make sure you have everything in place to reach out to investors. A couple of things to keep in mind:

- Where will you track your conversations with potential investors? Check out our Fundraising CRM to keep tabs on potential investors (Pro tip: You can add investors directly from Visible Connect, our investor database, to our Fundraising CRM).

- What data will you need? Do you have clean metrics and financials in place? Having a place to easily pull your key metrics and share them with potential investors will be a huge help.

- What assets do you need? Do you have a pitch deck ready to go and a plan to make tweaks if needed? Read more: Tips for Creating an Investor Pitch Deck

- How do you communicate with investors after a meeting? Nurturing potential investors with Visible Updates is a great way to keep them in the loop with the developments of your round.

- How do you share your pitch deck? Having a great way to share and understand how investors are engaging with your pitch deck and materials is important. Check out our pitch deck sharing tool to learn how it can help with your raise.

Remember: Your Strategy Will Stay the Same, But Your Pitch Won’t

The idea is that your strategy will stay the same throughout a round. The mechanics, financials, and pitch will vary but the strategy will stay the same. Being thoughtful with your strategy will pay dividends in the long run as your fundraise gets underway.

Startup Fundraising Strategy Pitfalls

Just like any strategy or process, there are pitfalls that can arise. Luckily, there are thousands of founders that have done it before so there are pitfalls and things you can look out for below:

Not Understanding Your Fundraising Stage

One of the more common (and avoidable) pitfalls of a fundraise are not being clear with your stage and aspirations. Pitching any investor that lands in your vision can be dangerous. You want to make sure that you are pitching investors that are the correct stage, not too early or late.

Focusing Solely on Fundraising

As we mentioned earlier, founders are being pulled in a hundred different directions. On top of hiring new employees, retaining current employees, building products, and communicating with stakeholders, founders are responsible for finding financing for the business. Being able to balance the day-to-day as a founder with the pressures of financing is a must.

Related Reading: The 23 Best Books for Startup Founders at Any Stage

Failing to Provide an Accurate Total Addressable Market (TAM) Analysis

At the end of the day, investors want to invest in companies that can turn into massive companies. Modeling your total addressable market and demonstrating how you can turn into a large company is a great way to pique the interest of investors.

Learn more to properly model your addressable market in our post, How to Model Total Addressable Market (Template Included).

Related Resource: Down Round: Understanding Down Round Funding and How to Avoid It

Related Resource: Navigating the Valley of Death: Essential Survival Strategies for Startups

What Are Some Other Ways to Obtain Funding?

After reading this post you may be thinking that venture capital is not the right financing option for your business. Over the past few years, there has been an explosion of alternative financing options. Check them out below:

Related Resource: 6 Types of Investors Startup Founders Need to Know About

Accelerators or Incubators

Accelerators and incubators are a great way to get your business off the ground. If you find you are too early to raise a seed round, an accelerator or incubator are a great way to wrinkle out your business plan and hit the ground running to find customers and determine if VC is right for you in the future.

Crowdfunding

Crowdfunding has become increasingly popular as more options become available. The crowdfunding instruments have become easy to manage for founders and more widely accepted across the industry.

Related Resources:

Loans

As the team at U.S. Small Business Administration puts it, “If you want to retain complete control of your business, but don’t have enough funds to start, consider a small business loan.

To increase your chances of securing a loan, you should have a business plan, expense sheet, and financial projections for the next five years. These tools will give you an idea of how much you’ll need to ask for, and will help the bank know they’re making a smart choice by giving you a loan.”

Business Plan Competitions

Business plan competitions are common at universities and for startups that have potentially not made any progress on developing a product or building a team. The competitions generally reward entrepreneurs with a small check or capital to get started and pursue their vision.

Related Reading: How to Write a Business Plan For Your Startup

Streamline Your Fundraise with Visible

Being able to tie everything together and build a strategy for your fundraise will be an integral part of your fundraising success. Check out how Visible can help you every step of the way below:

Visible Connect — Finding the right investors for your business can be tricky. Using Visible Connect, filter investors by different categories (like stage, check size, geography, focus, and more) to find the right investors for your business. Give it a try here.

Pitch Deck Sharing — Once you’ve built out your target list of investors, you can start sharing your pitch deck with them directly from Visible. You can customize your sharing settings (like email gated, password gated, etc.) and even add your own domain. Give it a try here.

Fundraising CRM — Our Fundraising CRM brings all of your data together. Set up tailored stages, custom fields, take notes, and track activity for different investors to help you build momentum in your raise. We’ll show how each individual investor is engaging with your Updates, Decks, and Dashboards. Give it a try here.

Related resource: Top 18 Revolutionary EdTech Startups Redefining Education