About Fuel Ventures

Fuel Ventures is a UK-based venture capital firm founded by Mark Pearson in 2014. Today, Fuel Ventures manages over £350 million in assets and has a portfolio of over 160 investments. Fuel is considered one of the most active early and growth-stage investors in the UK.

Fuel Ventures invests at the pre-seed and seed stage of globally scalable marketplaces, platforms, and SaaS companies. Fuel takes an active board role at all their companies and commits to supporting companies throughout their journeys. Learn more about Fuel Ventures.

Fuel Ventures joined Visible in October of 2022. This case study includes feedback and insight from Oli Hammond and Mike Stevenson.

Data disaggregation before Visible

Before using Visible, Fuel Ventures' portfolio information was disaggregated in multiple Google solutions. Investment data was tracked in a master Google sheet file, qualitative information about companies was manually updated and saved to Google documents, and all of this information was stored in various Google Drive folders.

As the Fuel Ventures portfolio grew, the master spreadsheet became harder to maintain. The team also found it cumbersome to have portfolio information stored in several different locations.

“We felt we needed a solution where all portfolio information was stored in one place as Fuel’s single source of truth.” - Oli Hammond, Partner at Fuel Ventures

Why Fuel Ventures chose Visible

The Fuel Ventures team began researching the market for potential solutions that would meet their portfolio monitoring and reporting requirements.

The Fuel Ventures' decision-making criteria included:

- A provider with a straightforward onboarding

- The ability to upload all of their historical data

- A solution that was at least 5x better (faster, more efficient, more accurate) than their current process

- Built-in flexibility to accommodate the details of their investments

- A solution with a justifiable return on investment

The team at Fuel Ventures sat a tailored demo with Visible in the summer of 2022. Fuel chose Visible as the best solution to help their team better manage Fuel's portfolio and fund performance.

Implementing Visible at Fuel Ventures

Visible provided a hands-on onboarding experience to Fuel Ventures who needed to upload investment details for approximately 130 investments.

“The Visible team was there to support us throughout the entire onboarding experience.” - Oli Hammond, Partner at Fuel Ventures

When asked about what the learning curve was like for the team at Fuel Ventures, Oli Hammond commented, “It was easy. The team took to the platform really quickly.”

How Fuel is using Visible today

Adopting Visible significantly impacted the way Fuel Ventures monitors their portfolio companies.

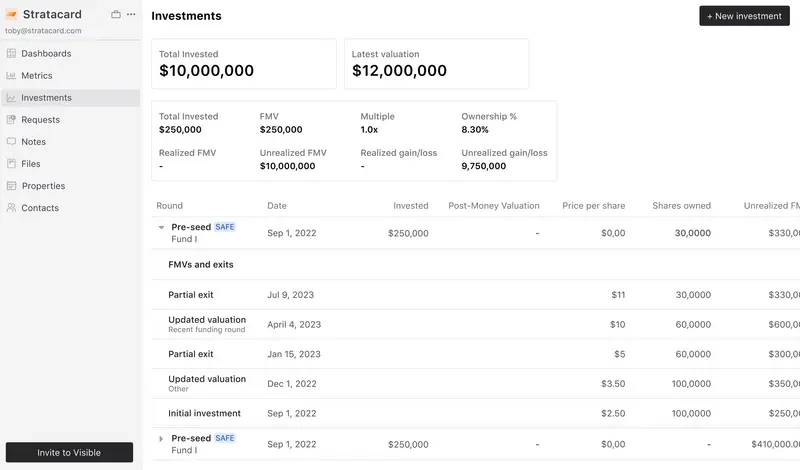

Visible provides the 20+ person team at Fuel with one centralized place for investment information, notes, and qualitative updates about portfolio companies. For Fuel Ventures, Visible’s investment tracking solution is especially beneficial because their team now has granular visibility into investments round by round and fund by fund which is something they had difficulty tracking in a master spreadsheet in the past.

Visible also provides Fuel with a centralized place to store notes and company updates. This means the team at Fuel can now click into a company's profile on Visible and see a clear overview of initial investments, subsequent funding rounds, and narrative updates all in one place instead of having to dig through separate platforms.

“Visible is our one source of truth for the wider team to find relevant company information instead of having to dig through various Google Drive folders.” - Oli Hammond, Partner

Finally, the team at Fuel shared that Visible significantly improved the way they create bi-annual reporting for their Limited Partners.

Minna from Fuel Ventures commented, “It’s now much easier to format the Tear Sheets we compile for our investor reporting. We really like that the Tear Sheets are automatically updated with live numbers instead of having to make updates in Word.”

View more examples of tear sheets in Visible.

Advice for other funds considering Visible

Oli Hammond, Partner at Fuel shared "Visible is a great choice for funds who are looking to move away from fragmented systems and methodology (Word, Google Drive, spreadsheets) to one source of truth.”