Back in April we partnered with OpenView to share our free Total Addressable Market template. With an overwhelming positive response and some inspiration from Point Nine Capital’s “5 Ways to Build a $100 Million Business [Infographic]” we wanted to build a new forecasting template on how SaaS businesses can get to $100 million in annual recurring revenue.

For this template we partnered with our friends at Foresight & OpenView to provide 4 distinct forecasting models on how a business can grow to $100 million in ARR. You can get the template here!

Getting to $100 million in annual recurring revenue is one of those SaaS benchmarks you’ll hear about frequently. It’s a line in the sand that investors have drawn to deem your business “venture-backable” or not. I’m sure many have asked or received the follow question, “That’s great, but how does this get to $100mil in ARR?”

Click here to get the free SaaS forecasting template

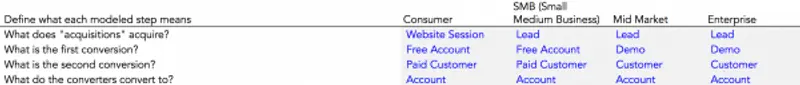

No two paths are the same but there are some commonalities with different go-to-market strategies that can help frame your business. We’ll break down the following markets and their respective distinct metrics:

- Consumer

- SMB

- Mid-Market

- Enterprise

You’ll be able to define your customer acquisition channels, Average Revenue Per Account, contract lengths, growth assumptions, cost assumptions and more!

We hope you enjoy! You can find the post in full at Opeview and Foresight. Integrate the Google Sheet template directly with your Visible Account as well!