Getting regular, high quality, and actionable data from portfolio companies is important. It allows you to make better decisions, support your portfolio, share insights with portfolio company founders, report to LPs and more.

This practice should also be highly valuable for founders. They should be able to share wins, challenges and get help from you, their stakeholder. It should only take them 3 minutes to complete (if not, either something may be wrong with the request or structurally wrong with the company).

Below are some best practices to make sure you get:

- Timely information (e.g. 100% completion)

- Structured data(comparing apples to apples)

- Actionable insights (how can we help companies)

Timing & Cadence

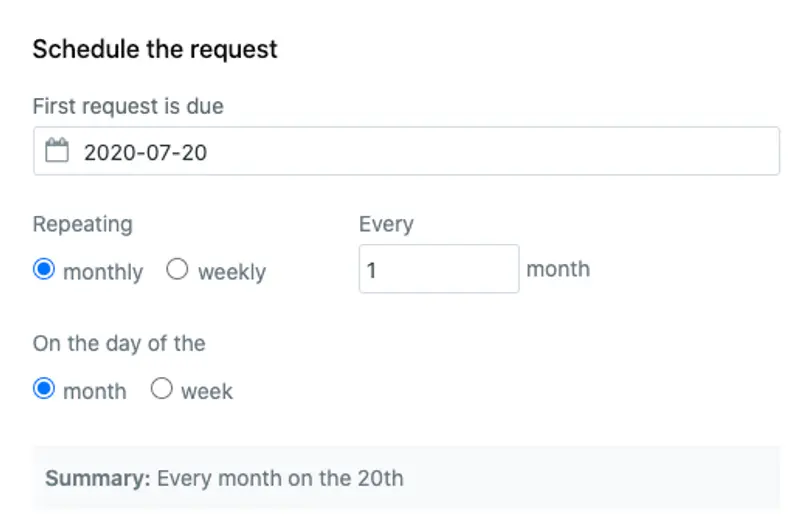

Same time every period

Set the expectation that you will be sending a request the same time every month. e.g. your request will be due the 20th post month or quarter end. Don’t randomly switch between the 10th, the 30th, etc. Founders will not have an expectation and know they can submit whenever they want.

Luckily Visible makes this easy for you. You’ll be to set you schedule and we take care of all emails, due dates and reminders.

Appropriate Cadence

We recommend the following cadences. This is 100% customizable as every fund is different.

- Weekly – Accelerators in Cohort

- Monthly – Pre-Seed, Seed, Series A

- Quarterly – Series B & later

Request Content

Less is more.

Don’t send a request asking for every metric under the sun. Only get the information you truly need. If you are truly providing value back to the founders, then start small, get a rhythm and expand the data.

Metrics

5-15 Metrics.

Depending how closely you work with companies, ask for 5-15 metrics and no more.

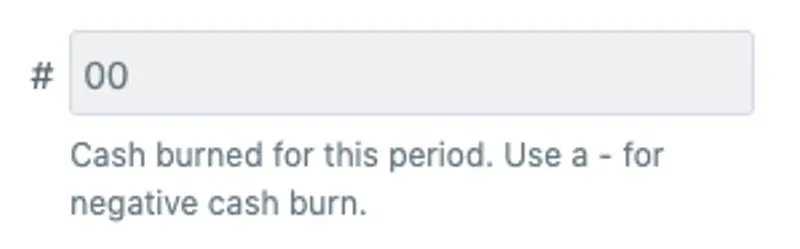

Use a metric description!

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or current month? Should it include financing? Be descriptive about what you want. **Here is our Metric Library** that has some helpful descriptions.

Qualitative Info

How can you help?

Always make sure to use a qualitative section to see how you can best help the portfolio. Also let the founder share their wins and challenges if it makes sense!

Rollout

Let your current (and new) portfolio companies know to expect a regular request from you and what to expect.

Intro Template

- Feel free to use our Intro Copy Template if you need some inspiration.

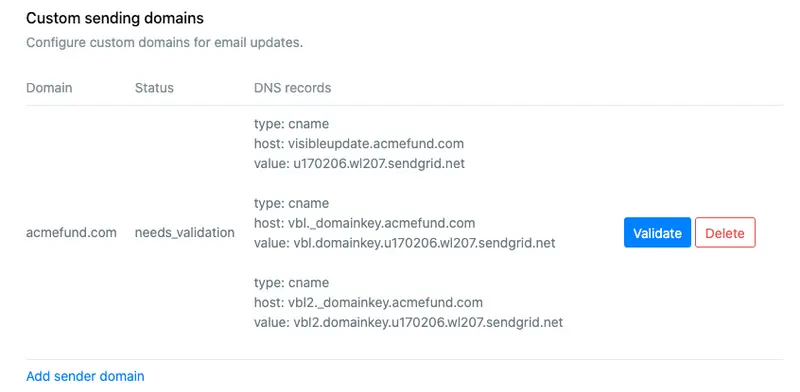

Custom Domain

All of your requests will come from you. However, with Visible you can fully white label the request emails so they come from your email and domain.