Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Product Updates

New in Visible: AI File Uploads for Faster Reporting

Strong investor–founder relationships rely on clear, timely, and accurate data. We’ve rolled out a series of updates designed to make reporting smoother, smarter, and faster for everyone involved.

From AI-powered file uploads that eliminate manual entry to a refined inbox that handles complex formats with ease, these improvements are built to help you stay connected to your portfolio without the friction. Check out our recent improvements below:

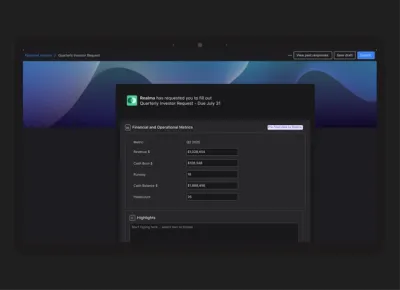

Introducing AI File Uploads in Requests

We just made it easier for your portfolio companies to complete Requests.

Founders can now upload up to 3 files (valuations, P&Ls, governance docs, and more), and Visible AI will extract the data and auto-fill their request, eliminating the need for manual entry. You’ll still receive structured, reviewable data with full visibility into what’s AI-generated.

See how your founders can leverage AI File Uploads below:

Clearer Visibility Into Request Status

We’ve made it easier to track how your portfolio companies are interacting with your data requests. You’ll now see more consistent and detailed delivery insights. This includes a clearer status for requests as well as proactive alerts when a request email bounces.

Improve Workflows with Pre-filled Requests

As more data flows into your account via AI Inbox and metric imports, you can now pre-fill Requests with existing metrics for each portfolio company. Founders simply log in, review the data, and submit—no duplicate work required.

Other Improvements

Seamlessly switch between portfolio companies

A cleaner view for portfolio company notes

You can now preview files directly everywhere in the app

Set the currency for each metric at the portfolio company level in a request

Check out the improvements yourself by starting a Visible trial. Optimize your fund's portfolio management, data collection, reporting, and analysis. Try it free for 14 days.

founders

Fundraising

Lead With Your Strengths with Jonah Midanik

On the seventh episode of the Thrive Through Connection Podcast, we welcome Jonah Midanik of Forum Ventures. Jonah is the Managing Partner at Forum Ventures, the leading early-stage fund, program, and community for B2B SaaS startups. Jonah joins Mike, the CEO and Founder of Visible, to discuss how early-stage founders can best run a fundraising process.

About Jonah

Before joining Forum Ventures, Jonah had a career as a founder and marketing leader. With a portfolio of 400+ companies, Jonah has seen the ins and outs of what works with a fundraising process, specifically at the pre-seed and seed stages. Jonah shares his tips for startup founders looking to raise an early-stage round of capital.

What You Can Expect to Learn from Jonah

How pre-seed founders can build a fundraising process

Why the person at a firm matters more than the organization

How to leverage storytelling to raise capital

Why leading with your strengths is a key storytelling tactic

Want more stories like this? Head to the Thrive Through Connection Hub for every past and upcoming episode.

investors

Customer Stories

Turning Portfolio Data Into an Advantage: Inside Emergence Capital’s Workflow

When Andrew Crinnion joined Emergence Capital as Director of Portfolio Analysis, he stepped into a role that required more than crunching numbers. As a Series A investor in B2B SaaS companies, Emergence prides itself on being data-driven, but that only works when the correct data is accessible, consistent, and actionable.

The challenge? Their portfolio was growing fast, but performance tracking lived in scattered spreadsheets and inboxes. "Before Visible, it was Excel Sheets and lots of manual emails," Andrew explained. "We were a pretty data-driven firm, which gave me a good foundation. But we needed a better way to scale."

A Central Source of Truth

Andrew was tasked with finding a portfolio monitoring solution that could grow with their fund and simplify performance data management. After evaluating platforms like iLevel, Dynamo, and Standard Metrics, he ultimately chose Visible.

What stood out?

"Flexibility," he said. "The ability to build dashboards and calculate our own metrics was huge. Before, I'd ask for something like burn rate and NDR, and I wasn’t always sure how it was being calculated. So being able to calculate it within the system was a big help."

The transition was smooth. After merging their existing data into a more structured format, onboarding to Visible was seamless. “It was real smooth to load that into Visible and move forward.”

Driving Better Decisions

With Visible in place, Andrew can surface insights faster and share them more effectively with the general partners.

"Once a company responds to our Visible Request, it graphs it out. I can see if burn rate increases or if runway is dropping off, and it prompts me to ask the right questions to the GPs. It keeps us aligned."

The dashboards are a core part of portfolio reviews and one-off requests alike. "They don’t really see how it’s getting made,” he said, “but it makes it a lot easier for me to answer their questions.”

Better Data = Stronger LP Relationships

When communicating with LPs, the value of Visible became even more clear. When LPs are digging into performance, portfolio metrics, and fund-level questions, the Emergence team is ready.

"Visible helps me quickly respond to all our LP requests. I have a repository of data that makes it easy to pull what they need. It also helps GPs answer LP questions faster, with more confidence."

By having a centralized system to rely on, Emergence offers transparency and builds trust with its limited partners, a key ingredient in any relationship.

Turning Internal Value Into External Impact

As Emergence’s data infrastructure matured, Andrew saw an opportunity to scale the value of what they were learning. Portfolio companies were coming to him with questions like, “What should my CAC payback be?” and “How much should I be spending on R&D?”

Thanks to the insights they’d built internally with Visible, Emergence launched the Beyond Benchmark report, an external study based on data from over 560 companies. What began as a tool for internal alignment became a valuable resource for the broader SaaS community.

Support That Scales With You

Throughout the process, Visible’s Customer Success team remained a key part of the experience. “They’ve been great. I’ve shared product feedback, and it’s been implemented. They’re responsive and invested in helping us succeed.”

Emergence Capital didn’t just choose Visible, they built a system around it.

For funds building out platform or investor relations teams, he recommends investing early in the right metrics and infrastructure. The payoff? Faster answers, stronger LP conversations, and the confidence to scale with clarity.

Check out how you can join Emergence Capital and leverage Visible for your portfolio monitoring and reporting here.

founders

Fundraising

Raise Capital for Your Finance Startup: Top VCs and Fundraising Resources

The global finance industry, a cornerstone of economies everywhere, is undergoing rapid transformation. Today’s Finance startups are innovating not only across traditional sectors like asset management, insurance, lending, accounting, and financial advisory, but also within newer markets such as crypto, digital assets, and decentralized finance (DeFi). This expanding landscape is redefining how capital is raised, managed, and distributed—blending established financial practices with cutting-edge technologies and alternative asset classes. For founders in this diverse sector, the current global climate presents both significant challenges and unprecedented opportunities, demanding a nuanced understanding of investor expectations and market dynamics.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Finance, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Finance ecosystem.

Top VC Funding Finance Startups

Anthemis Group

About: Our deep understanding of markets and models, passion for emerging technology and values inspire everything we do. By creating fertile ground for a diverse group of startups, investors, entrepreneurs, institutions, academics, and visionaries to converge, we believe we can solve the financial services world’s most pressing challenges faster, better and for the benefit of all.

Thesis: Invests in startups that leverage technology to significantly impact the financial system.

VEF

Sweetspot check size: $ 10M

Thesis: VEF is an investment company listed on Nasdaq Stockholm’s Main Market under the ticker VEFAB. We invest in growth stage private fintech companies across the emerging world. We take minority stakes and are active investors with board representation in each of our portfolio holdings. We respect the macro, but are firm believers that the secular growth trend of EM fintech, outweighs all the macro uncertainty and volatility that we and our portfolio companies will invariably live through. A digital financial world is the end game and the best companies always come out of pockets of macro and market turbulence in a stronger relative position.

UNIQA Ventures

About: We invest in outstanding founder teams in InsurTech, FinTech und Digital Health

Sweetspot check size: $ 2M

The Fintech Fund

About: An early-stage venture fund supporting the best fintech and defi teams.

Sweetspot check size: $ 350K

Thesis: The Fintech Fund is a $25M venture fund investing in the top 1% of fintech and decentralized finance startups globally. Our focus is split between more established fintech markets in the US and Europe – for which picks-and-shovels SaaS and infrastructure builders will sell into a growing market of buyers – and emerging markets, where opportunities exist for consumer fintechs to dominate winner-take-all markets.

.The Aventures

Sweetspot check size: $ 300K

Thesis: We're a specialized tech-focused fund with a focus on transformative sectors such as Blockchain, SaaS, AI, Web3, Gaming, Fintech & Insurtech, Quantum Technology, and Marketplaces.

Revo Capital

About: Established in 2013, Revo Capital is Turkey’s largest and one of its pioneering venture capital firms, dedicated to empowering the startup ecosystem across Turkey and Central Eastern Europe (CEE).

Sweetspot check size: $ 2M

Thesis: With its third fund, Revo Capital is strategically focused on six sectors: B2B SaaS and enterprise software, financial technology, health technology, cybersecurity and cloud solutions, energy, and gaming. The firm emphasizes investments in companies leveraging AI to drive growth and transformation, aiming to scale these innovations in both regional and global markets.

Mitsubishi UFJ CapitalShizuoka Capital

About: Mitsubishi UFJ Capital is a venture capital firm focusing on life science, ICT and high technology investments.

Lotux

Sweetspot check size: $ 50K

Traction metrics requirements: We would like to see some early validation but can invest in pre-revenue stage if we are bullish on the team and the opportunity.

Thesis: Lotux focuses on partnering with mission-driven founders building software-based companies in the pre-seed stage that will improve the lives of the 99% in Latin America.

Knight Ventures

Sweetspot check size: $ 100K

Traction metrics requirements: Deal flow through our Knight Ventures Accelerator and Investment Platform

Thesis: OurVC is launching a $5MM pre-seed fund in United States to back West African FinTech and Digital Infrastructure startups powered by our market-fit focused accelerator

Kadan Capital

Sweetspot check size: $ 1M

Traction metrics requirements: Post-revenue

Thesis: Kadan Capital is an early-stage VC firm investing proprietary capital in industry-defining startups in Fintech and AI in Asia and beyond.

INCA Ventures

Sweetspot check size: $ 100K

Traction metrics requirements: No

Thesis: Investing in fintech & related sectors in the Andean region (Peru, Colombia, Bolivia, & Ecuador) with a focus on underrepresented founders.

QED Investors

About: QED Investors is a leading venture capital firm based in Alexandria, Virginia. We are focused on investing in disruptive financial services companies in the U.S., the U.K. and Europe, Latin America, India and Southeast Asia and Africa.

QED Investors is dedicated to building great businesses and uses a unique, hands-on approach that leverages its partners’ decades of entrepreneurial and operational experience, helping companies achieve breakthrough growth.

Nyca Partners

About: Nyca Partners is a venture capital and advisory firm exclusively focused on applying innovation in financial services into the global financial system. Our rich experience and deep connections in both finance and technology give us a unique perspective and facility to help entrepreneurs transform payments, credit models, digital advice, and financial infrastructure. We strive to form truly collaborative partnerships, offering our own money and expert advice.

Vestigo Ventures

About: Vestigo Ventures is a Northeast-based early-stage venture capital firm focused on accelerating the AI age in financial services. We partner with visionary entrepreneurs to build transformative companies at the intersection of FinTech, AI, and B2B SaaS.

SixThirty

About: SixThirty is a global venture capital firm focused on investing in late seed stage FinTech, InsurTech and Cyber Security companies

Sweetspot check size: $ 500K

Traction metrics requirements: We invest in companies that have a working product, market traction, and in most instances, recurring revenue.

Fundraising Insights for Finance Startups: Trends, Challenges, and Opportunities

The financial services sector is experiencing rapid transformation, driven by the rise of decentralized finance (DeFi) and integrated fintech solutions. These advancements are reshaping traditional banking by introducing new models such as blockchain-based peer-to-peer lending and embedded finance options like Buy Now, Pay Later (BNPL). With increasing venture capital investment in fintech, the pace of change and disruption within the finance industry is faster than ever before.

Current Global Trends in Finance Startup Fundraising

In 2025, the finance startup fundraising landscape is marked by a strong rebound in capital deployment, especially in fintech and digital finance. According to TechCrunch, global fintech startups raised $10.3 billion in Q1 2025—the highest level since early 2023—with average deal sizes also reaching a four-year high. This surge is driven by renewed investor appetite for both established and emerging financial services, including payments, banking, asset management, and even crypto-related ventures.

Unique Challenges Facing Finance Startups

Despite the influx of capital, finance startups face significant hurdles. Regulatory complexity remains a top concern, with compliance requirements varying widely across regions and often demanding substantial resources. Startups must be prepared to address licensing, data privacy, anti-money laundering (AML), and other compliance issues early in the fundraising process.

Building trust and credibility is another major challenge. As Gravyty notes, trust is now one of the most important barometers of success in fundraising. Investors and customers in the finance sector are especially risk-averse, making it essential for startups to demonstrate strong risk management, security, and transparency. Additionally, competing with established incumbents and overcoming legacy systems requires innovative go-to-market strategies and, often, strategic partnerships.

Access to specialized talent—such as regulatory experts and experienced finance professionals—can also be a limiting factor, particularly for startups operating in highly regulated or technical niches.

Opportunities for Finance Founders

Amid these challenges, there are abundant opportunities. Investors are showing heightened interest in alternative assets, ESG (Environmental, Social, and Governance) and sustainable finance, and the digital transformation of traditional financial services. Emerging niches such as SME finance, embedded finance, regtech, wealthtech, and insurtech are attracting increasing attention. Startups that can address underserved markets or offer solutions that streamline compliance, improve transparency, or enhance customer experience are well-positioned for growth.

Partnerships with established financial institutions can provide credibility, distribution, and access to resources that accelerate growth. The rise of digital-first and hybrid business models is opening new avenues for innovation in areas like lending, payments, and asset management. Additionally, the growing focus on sustainable and impact finance is creating opportunities for startups that can align financial returns with positive social and environmental outcomes.

Practical Tips for Pitching to Finance-Focused VCs

When pitching to finance-focused VCs, founders should:

Demonstrate clear traction—user growth, revenue, or strategic partnerships are key proof points.

Articulate a robust regulatory and compliance strategy—be ready to discuss licensing, AML, and data privacy in detail.

Highlight your team’s expertise in both finance and technology, and your approach to risk management.

Tailor your pitch to the specific interests of the VC: traditional finance investors may prioritize compliance and scalability, while those interested in emerging markets like DeFi or embedded finance may focus more on innovation and market potential.

Leverage data, case studies, and industry benchmarks to back up your claims and show you understand the competitive landscape.

Emphasize defensibility—whether through proprietary technology, regulatory moats, or unique partnerships—and be transparent about both your challenges and your plan to overcome them.

Networking, Accelerators, and Resources for Finance Founders

Global Finance-Focused Accelerators and Incubators

Fintech Innovation Lab: A highly competitive 12-week program based in New York, London, and Asia-Pacific, the Fintech Innovation Lab is designed specifically for early- to growth-stage companies in financial services. It offers mentorship from top financial institutions and access to senior executives in banking, insurance, and asset management.

MassChallenge: MassChallenge FinTech is a zero-equity accelerator that connects startups with leading financial services partners. The program focuses on solving real-world challenges in banking, insurance, asset management, and payments, and is based in Boston.

Startupbootcamp: With locations in London, Singapore, and Mexico City, Startupbootcamp FinTech is a global accelerator dedicated to financial innovation. The program provides mentorship, funding, and direct access to a network of industry partners, investors, and financial institutions.

Plug and Play: Plug and Play Fintech, headquartered in Silicon Valley, runs regular accelerator batches focused on financial services, payments, insurtech, and regtech. The program connects startups with over 70 corporate partners, including major banks and insurance companies.

SixThirty: Based in St. Louis, SixThirty is a global accelerator that invests in and supports early-stage fintech, insurtech, and cybersecurity startups. The program offers funding, mentorship, and access to a network of financial services partners.

Major Industry Events and Conferences

Attending global finance and fintech events is one of the most effective ways for founders to network, learn, and pitch their startups.

Money20/20: is widely regarded as the premier event for payments and financial services, drawing thousands of investors, executives, and innovators each year.

Singapore FinTech Festival: is the world’s largest fintech event, offering unparalleled access to the Asian and global finance ecosystem.

Finovate: is known for its rapid-fire startup demos.

Insurtech Connect: the leading event for insurance innovation.

Cross-Border Funding and International Ecosystem Trends

Raising capital internationally presents unique opportunities and challenges. Founders must navigate varying regulatory, legal, and cultural factors when seeking cross-border investment. Cross-border syndicates and global VC networks are increasingly common, enabling startups to access capital and expertise from multiple regions.

Successful international fundraising often involves working with legal advisors experienced in cross-border deals and leveraging government programs that support global expansion. Notable trends include the rise of global accelerators, increased interest in emerging markets, and the importance of demonstrating compliance with international standards.

Find an Investor for Finance with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Finance here.

For Finance startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Finance sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

investors

Operations

Reporting

Webinar Recording: How Top Platform Teams Accelerate Portco Hiring & Fundraising

Supporting portfolio companies with hiring and fundraising is table stakes for VC firms in 2025. Relationships and networks have never been more important as human-to-human connection becomes an even more essential differentiator in the age of AI.

Evan Walden, CEO of Getro, and Toni Alejandria of Preface Ventures joined us for a webinar to cover the ins and outs of how best-in-class VC funds leverage their networks to help portfolio companies hire top talent and raise capital. You can check out the recording below:

We cover topics like:

How best-in-class teams scale their platform function

How to balance consistency and customization

How to help companies source top talent

How to leverage network effects to support fundraising

Want more great insights? Check out Thrive Through Connection, our podcast about the power of founder and investor relationships.

founders

Fundraising

Raising Capital for Hardware: Top VCs, Trends & Global Resources

In the dynamic world of startups, hardware ventures stand apart. Unlike their software counterparts, hardware companies grapple with a distinct set of challenges that significantly impact their fundraising journey. From extended development cycles and substantial upfront capital expenditures for prototyping and manufacturing, to complex supply chain management and inventory risks, the path to market for a physical product is inherently more intricate and capital-intensive. This often means a longer runway is needed, and the traditional metrics VCs use for software (like rapid user growth or low customer acquisition costs) don't always translate directly. Finding the right venture capital partners who truly understand these nuances, and are patient with the unique growth trajectory of a hardware business, is critical for survival and scale.

Despite these hurdles, we are witnessing a remarkable global resurgence in hardware innovation. The past few years have seen an explosion of groundbreaking advancements across various sectors. From the pervasive integration of IoT and sophisticated robotics transforming industries, to the urgent demand for cleantech solutions, revolutionary medtech devices, and the evolution of advanced manufacturing techniques, hardware is at the forefront of solving some of the world's most pressing problems.

This renewed wave of innovation has not gone unnoticed by the venture capital community. VCs are increasingly recognizing the immense market opportunities and the potential for defensible moats that well-executed hardware solutions can create, leading to a significant uptick in investment in the sector. This trend is truly global, with innovation hubs emerging and connecting across continents, fostering an international ecosystem for hardware investment.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Hardware, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Hardware ecosystem.

Top VCs Investing in Hardware Startups

HCVC

About: HCVC is the first global venture capital fund dedicated to full-stack and hardtech startups.

Sweetspot check size: $ 525K

Thesis: We are looking for outstanding founders, building game-changing products or technologies and targeting large potential markets

Elephants & Ventures

About: Elephants&Ventures is an early-stage venture boutique for hardware & software companies.

ff Venture Capital

About: ff Venture Capital is one of the best performing seed- and early-stage venture capital firms investing in some of the strongest growth areas to date, including cybersecurity, artificial intelligence, machine learning, drones, enterprise cloud software, and crowdfunding.

Mitsubishi UFJ CapitalShizuoka Capital

About: Mitsubishi UFJ Capital is a venture capital firm focusing on life science, ICT and high technology investments.

Monozukuri Ventures

About: Monozukuri Ventures provides investment, mentorship, prototyping know-how and manufacturing expertise for hardware startups.

Sweetspot check size: $ 250K

Thesis: Monozukuri Ventures is focused on funding hardware startups in the fastest growing industries: robotics, AI, clean energy, wearables, space tech, IoT, healthcare, smart home and more. We invest in 10-15 hardware startups per year, with a typical check ranging from USD 150K to 300K at first, with a chance to follow investment up to USD 1M accumulate.

Powerhouse Ventures

About: Powerhouse Ventures backs seed-stage startups developing innovative software across energy, mobility, and industry. We are backed by some of the world’s largest corporations in energy, utilities, automotive, finance, and tech—including Constellation, American Electric Power, Microsoft, UBS, Toyota, TotalEnergies, and more.

Reinforced Ventures

About: Reinforced Ventures brings together experienced technologists & investors to empower entrepreneurs building the next generation of autonomous systems, robotics, and biotechnology. Our focus is on overlooked areas of deep tech. We are based out of Pittsburgh, PA but invest globally.

Sumeru Equity Partners

About: Sumeru Equity Partners is a technology-focused private equity firm that invests $50-$250 million in leading mid-market software, technology enabled services, and hardware companies with a focus on growth. Sumeru was founded by an experienced team from Silver Lake Sumeru with significant first-hand operating experience. Our strategy and operating experience enables us to take a flexible approach to deal types and investment structures including growth funding, founder transitions, buyouts, take-privates, recapitalizations, and corporate divestitures.

Thesis: Sumeru’s engagement model centers on partnering with management teams and investing in go-to-market, product, and operations to drive growth and strategic positioning.

Wilbe Capital

Sweetspot check size: $ 300K

Traction metrics requirements: Scientist founders and science companies only!

Thesis: We are a venture firm for entrepreneurial scientists. We educate, build, invest and provide lab space to scientist founders solving some of the biggest problems we face this century.

The Company Lab

About: CO.LAB is a 501c3 nonprofit based in Chattanooga, TN that accelerates early-stage startups in the sustainable mobility space.

Sweetspot check size: $ 20K

Traction metrics requirements: Startup must be post-revenue

Tenacious Ventures

About: Tenacious Ventures is a venture capital firm that supports early-stage agri-food innovators.

Sweetspot check size: $ 750K

Thesis: We are a high conviction, low-volume, high-support early stage investor in agri-food innovation.

Networking, Accelerators, and Global Resources for Hardware Founders

The Importance of Global Networking for Hardware Startups

For hardware startups, global networking isn’t just a “nice to have”—it’s a strategic necessity. Unlike software, hardware ventures often depend on international supply chains, manufacturing partners, and distribution networks. Building relationships across borders can unlock access to specialized prototyping facilities, lower-cost manufacturing, and new markets. Cross-border connections can also help founders tap into diverse pools of investors, mentors, and technical talent, accelerating both product development and go-to-market strategies.

Leading Hardware Accelerators and Incubators Worldwide

Joining a top-tier hardware accelerator can be transformative for early-stage founders. These programs offer not just capital, but also hands-on support with prototyping, manufacturing, and business development.

HAX: With locations in Shenzhen and Newark, HAX is the world’s leading hardware accelerator, providing up to $250,000 in funding, deep prototyping resources, and direct access to Asian manufacturing.

Brinc: Based in Hong Kong and expanding globally, Brinc specializes in IoT, robotics, and climate tech, offering investment, mentorship, and supply chain support.

Hardware Club (HCVC): A global community and venture fund for hardware founders, HCVC connects startups with a curated network of manufacturers, distributors, and investors.

AlphaLab Gear: Based in Pittsburgh, AlphaLab Gear supports hardware, IoT, and robotics startups with funding, mentorship, and access to a robust regional ecosystem.

MassRobotics: A Boston-based innovation hub for robotics startups, offering workspace, prototyping labs, and industry connections.

Key Industry Events and Conferences for Hardware Founders

Attending major industry events is one of the fastest ways to build your network, meet investors, and stay ahead of market trends. To maximize ROI, plan meetings in advance, participate in pitch competitions, and leverage event networking platforms to connect with investors and partners.

CES (Las Vegas): The world’s largest consumer electronics show, a must-attend for product launches and investor meetings.

Hannover Messe (Germany): The leading global trade fair for industrial technology and advanced manufacturing.

TechCrunch Disrupt: A premier event for startups and VCs, with a growing focus on hardware and deep tech.

Hardware Pioneers Max (UK): Europe’s top event for hardware, IoT, and embedded systems.

Maker Faire: A global series of events celebrating innovation in hardware, prototyping, and maker culture.

Slush (Finland): A leading European tech event with strong hardware and deep tech representation.

Online Communities, Networks, and Founder Resources

Element14 and Hackster.io: Online platforms for prototyping, technical support, and community-driven hardware projects.

Indie Hackers Hardware: A sub-community focused on indie hardware projects and bootstrapped startups.

Open-Source Hardware Resources: Platforms like GitHub and OSHWA (Open Source Hardware Association) provide access to open designs and collaborative projects.

Cross-Border Funding and International Ecosystem Trends

Legal and Regulatory Compliance: Understand export controls, IP protection, and local regulations in your target markets.

Emerging Hardware Hubs: Beyond Silicon Valley and Shenzhen, regions like Israel, Southeast Asia, India, and parts of Africa and Latin America are rapidly growing as hardware innovation centers.

Government and International Programs: Leverage programs like the EU’s EIC Accelerator, Singapore’s EDB, and the US SBIR/STTR grants for non-dilutive funding and market entry support.

Cross-Border Tariffs and Supply Chain Risks: Stay agile and diversify suppliers to mitigate risks from trade disputes and tariffs.

Actionable Fundraising Insights for Hardware Startups

Current Global Trends in Hardware Fundraising

The hardware startup fundraising landscape in 2025 is marked by both opportunity and volatility. According to Crunchbase, global venture funding reached $113 billion in Q1 2025, the strongest quarter since 2022, but this was heavily skewed by a handful of mega-deals—most notably OpenAI’s $40 billion round. For hardware startups, the most notable trend is the surge in late-stage and M&A activity, while early-stage and seed funding have declined, making it more challenging for new hardware ventures to secure their first rounds.

AI and robotics hardware remain hot sectors, with investors pouring billions into companies building next-generation chips, sensors, and automation platforms. For example, EnCharge AI, a hardware startup, raised a $100 million Series B in early 2025, led by Tiger Global and joined by Samsung Ventures and RTX Ventures. However, global economic uncertainty, trade tensions, and rising tariffs are creating headwinds, especially for startups reliant on international supply chains.

Unique Challenges Facing Hardware Startups

Hardware founders face several persistent and emerging challenges:

Capital Intensity and Long Development Cycles: With early-stage funding down 14% year-over-year, hardware startups must work harder to prove traction before raising significant capital.

Supply Chain and Tariff Risks: Ongoing global trade disputes and tariffs are increasing material costs and creating uncertainty for hardware companies, making flexible, globally distributed supply chains more important than ever.

Regulatory and Certification Barriers: Sectors like medtech and IoT still require extensive compliance work, which can slow down time-to-market.

Scaling from Prototype to Production: The transition from prototype to mass production remains a major stumbling block, with many startups underestimating the operational complexity.

Opportunities and Differentiators in the Hardware Sector

Despite these challenges, several opportunities are driving hardware innovation and investment:

AI-Driven Hardware: The intersection of AI and hardware is attracting record investment, with startups building custom chips, edge devices, and robotics platforms seeing strong demand.

Defensible IP and Barriers to Entry: Hardware startups with strong patents and proprietary technology continue to attract premium valuations.

Sustainability and Cleantech: Investors are prioritizing hardware solutions that address energy efficiency, climate resilience, and circular economy models.

Hardware-as-a-Service (HaaS): Subscription and leasing models are gaining traction, providing recurring revenue and reducing customer friction.

Global Manufacturing Innovation: Startups leveraging digital supply chain management and distributed manufacturing are better positioned to navigate geopolitical risks.

Practical Tips for Pitching Hardware Startups to VCs

Showcase De-Risking Milestones: Clearly communicate technical and operational risks, and demonstrate how you’ve de-risked each stage (e.g., working prototypes, pilot customers, regulatory progress).

Highlight Market Validation: Even in early stages, evidence of customer demand—such as pre-orders, LOIs, or pilot deployments—can make a big difference.

Present a Robust Go-to-Market and Supply Chain Plan: Investors want to see a clear path from prototype to scalable production, including manufacturing partners and logistics strategies.

Emphasize Team and Advisory Strength: Highlight experience in engineering, manufacturing, and operations, as well as any strategic advisors or partners.

Prepare for Rigorous Due Diligence: Be ready to share detailed documentation, including your bill of materials (BOM), supply chain partners, and regulatory plans.

Tailor Your Pitch: For hardware-savvy VCs, dive deep into technical details; for generalist VCs, focus on market opportunity, defensibility, and risk management.

Find an Investor for Hardware with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Hardware here.

For Hardware startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Hardware sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

founders

Operations

Hiring & Talent

Metrics and data

Storyselling with Kristian Andersen of High Alpha

On the sixth episode of the Thrive Through Connection Podcast, we welcome Kristian Andersen of High Alpha. Kristian is a co-founder and partner at High Alpha, an Indianapolis-based venture capital firm that helps founders and the companies they lead reach their full potential. Kristian joins us to discuss how best-in-class leaders use storytelling to sharpen all facets of their business.

About Kristian

Before founding High Alpha, Kristian founded Studio Science, a leading design firm, and Gravity Ventures, a seed-stage venture fund. Throughout his career in design and investing, Kristian has had a front row seat to the importance of brand, storytelling, and founder selling.

Mike, our CEO, had an opportunity to sit down and chat with Kristian. You can give the full episode a listen below:

Spotify Link

Apple Link

What You Can Expect to Learn from Kristian

The responsibilities and roles of a CEO

The similarities between selling and storytelling

Why the ability to tell stories across an institution is a competitive advantage

What he looks for when it comes to a pitch meeting and deck

How founders should think about benchmarking their business

Stay up to date with the Thrive Through Connection Podcast by subscribing wherever you listen to podcasts. You can find links to your favorite podcast hosts below:

YouTube

Spotify

Apple

founders

Fundraising

Global Crypto Funding: Guide to Top VCs, Trends & Opportunities

The story of venture capital in Crypto is one of dramatic cycles, bold bets, and constant reinvention. In the early 2010s, when Bitcoin was still a fringe experiment, only a handful of visionary investors dared to back blockchain startups. The first wave of Crypto VC funding was dominated by small seed rounds and a focus on core infrastructure—wallets, exchanges, and early protocols. As Ethereum launched in 2015 and the ICO boom of 2017 took off, the sector exploded, attracting billions in speculative capital and spawning a global ecosystem of startups. However, the subsequent “Crypto Winter” of 2018-2019 saw funding dry up, valuations plummet, and many projects disappear.

The next phase, from 2020 to 2022, was defined by the rise of DeFi, NFTs, and Web3, with venture capital pouring into new verticals and record-breaking rounds. Yet, this period also brought increased regulatory scrutiny and market volatility, culminating in a sharp correction in 2022. Many predicted a prolonged downturn, but the Crypto sector proved resilient. By 2024, institutional investors and sovereign wealth funds began to enter the space, drawn by maturing technology, clearer regulations, and the promise of real-world asset tokenization.

2025 marks a pivotal moment for Crypto startups and their investors. In the first half of the year alone, venture capital inflows into Crypto surged to over $10 billion—levels not seen since the last bull market—driven by landmark deals like the $2 billion investment into Binance by Abu Dhabi’s MGX, the largest single VC deal in Crypto history. Unlike previous cycles, today’s capital is flowing into both early-stage innovation and late-stage, revenue-generating companies, reflecting a maturing market where business fundamentals matter as much as vision.

Key factors driving this change:

Regulatory Clarity: New, more supportive policies in the US, Europe, and Asia have reduced uncertainty and opened the door for institutional capital.

Institutional Participation: Pension funds, family offices, and sovereign wealth funds are now active players, seeking exposure to blockchain infrastructure, DeFi, and tokenized real-world assets.

Globalization: While the US remains the leading hub, Asia and Europe are rapidly gaining ground, with new projects and capital emerging from Japan, China, Malta, and beyond.

Sector Maturation: The focus has shifted from speculative tokens to sustainable business models, with strong interest in CeFi, DeFi, blockchain infrastructure, and the intersection of AI and Crypto.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Crypto, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Crypto ecosystem.

Leading Crypto Venture Capital Firms 2025

Eden Block

About: We focus on the impact of emerging tech, particularly blockchain and AI, across three verticals: 1) Finance & Assets; 2) Privacy, data & security; and 3) Supply Chains & Distribution

Sweetspot check size: $ 1.50M

Thesis: Backing the builders of the Open Internet

Digital Currency Group

About: At Digital Currency Group, we build and support bitcoin and blockchain companies by leveraging our insights, network, and access to capital.

Sweetspot check size: $ 250K

Thesis: We invest in companies that are accelerating the creation and adoption of a better financial system using blockchain technology and cryptocurrency

Blue Yard Capital

About: BlueYard backs founders at the earliest stages building the interconnected elements that can become the fabric of our future. A future where markets are open and decentralized, where we have solved our largest planetary challenges, where knowledge and data is liberated and humanity can live long and prosper.

Thesis: BlueYard seeks to invest in founders with transforming ideas that decentralize markets.

BACKED

About: BACKED is a maverick VC fund backing a new spirit of entrepreneurship. With an emphasis on personal development and community strength, we back the exceptional founders building a future we want to share.

Sweetspot check size: $ 1M

AppWorks

About: Based in Taiwan, AppWorks is the largest startup accelerator in Greater Southeast Asia and one of the region's most active early-stage VCs.

Alchemy Ventures

About: At Alchemy, our mission is to provide developers with the fundamental building blocks they need to create the future of technology. Through Alchemy Ventures, we'll be accelerating this mission by dedicating financing and resources to the most promising teams growing the Web3 ecosystem.

Thesis: Alchemy Ventures invests in teams building revolutionary products for the web3 ecosystem.

Acrew Capital

About: Acrew Capital is a venture capital firm that provides investable assets for diverse angel investors to fund tomorrow's companies.

Sweetspot check size: $ 5M

Thesis: We engage in long-term partnerships with world-class teams that are uniquely suited to transform big challenges into bigger opportunities.

Pantera Capital

About: Pantera Capital is the first institutional investment firm focused exclusively on bitcoin, other digital currencies, and companies in the blockchain tech ecosystem.

Sweetspot check size: $ 5M

Andreessen Horowitz (a16z Crypto)

About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today's entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

Sweetspot check size: $ 25M

Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

Paradigm

About: Paradigm primarily invests in crypto-assets and businesses from the earliest stages of idea formation through to maturity.

Every once in a while, a new technology comes along that changes everything. The internet defined the past few decades of innovation. We believe crypto will define the next few decades.

Paradigm is an investment firm focused on supporting the crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and continue supporting our portfolio companies over time.

We take a deeply hands-on approach to help projects reach their full potential, from the technical (mechanism design, smart contract security, engineering) to the operational (recruiting, regulatory strategy).

Thesis: Paradigm is an investment firm focused on supporting the great crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and support our portfolio with additional capital over time.

Coinbase Ventures

About: Coinbase Ventures is an investment arm of Coinbase that aims to invest in early-stage cryptocurrency and blockchain startups.

Thesis: At Coinbase, we’re committed to creating an open financial system for the world. We can’t do it alone, and we’re eagerly rooting for the brightest minds in the crypto ecosystem to build empowering products for everyone.

Digital Currency Group (DCG)

About: At Digital Currency Group, we build and support bitcoin and blockchain companies by leveraging our insights, network, and access to capital.

Sweetspot check size: $ 250K

Thesis: We invest in companies that are accelerating the creation and adoption of a better financial system using blockchain technology and cryptocurrency

YZi Labs (Formerly Binance Labs)

About: YZi Labs manages over $10 billion assets globally. Our investment philosophy emphasizes impact first -- we believe that meaningful returns will naturally follow. We invest in ventures at every stage, prioritizing those with solid fundamentals in Web3, AI, and biotech.

YZi Labs’ portfolio covers over 300 projects from over 25 countries across six continents. More than 65 of YZi Labs’ portfolio companies have gone through our incubation programs. For more information, follow YZi Labs on X.

MGX

About: Born in the UAE, MGX is a leading AI and advanced technology investor. We are committed to accelerating responsible AI development and building one of the world’s most advanced AI ecosystems. MGX provides access to a global network of visionaries, entrepreneurs, and investors, all focused on shaping a prosperous and interconnected future.

Key Networking Opportunities, Accelerators, and Resources for Crypto Founders

Major Industry Events and Conferences

Attending top-tier events is one of the fastest ways to access VCs, corporate partners, and the latest industry insights. Some of the most influential Crypto and blockchain events in 2025 include:

Consensus by CoinDesk (USA): The world’s largest and most influential Crypto conference, drawing VCs, founders, and policymakers from around the globe.

Token2049 (Singapore & Dubai): Asia’s premier Crypto event, now with a major presence in the Middle East, attracting global investors and innovators.

ETHGlobal (Global): A series of hackathons and summits focused on Ethereum and Web3, with events in North America, Europe, and Asia.

Paris Blockchain Week (France): Europe’s flagship event for blockchain, DeFi, and Web3, with a strong VC and institutional presence.

Web Summit (Portugal): While broader than just Crypto, Web Summit’s Crypto and Web3 tracks are a magnet for global investors and founders.

Tip: Many VCs now host private side events, pitch competitions, and office hours at these conferences. Apply early and leverage your network for introductions.

Leading Crypto Accelerators and Incubators

Accelerators and incubators remain a powerful launchpad for Crypto startups, offering funding, mentorship, and direct access to top-tier investors. The most respected programs are increasingly global and sector-specific:

YZi Labs (Binance’s Incubation Program): Backing early-stage Crypto projects worldwide, with a focus on infrastructure, DeFi, and Web3.

a16z Crypto Startup School: Andreessen Horowitz’s intensive program for Web3 founders, offering mentorship from industry leaders and direct VC access.

Outlier Ventures Base Camp: A leading Web3 accelerator with a global cohort, focusing on DeFi, NFTs, and the open metaverse.

CV Labs Accelerator (Switzerland, Africa, Asia): Supporting blockchain startups with funding, workspace, and access to the Crypto Valley ecosystem.

Techstars Web3 Accelerator: A global program for blockchain and Crypto startups, with a strong network of mentors and investors.

Tip: Acceptance into a top accelerator can significantly boost your credibility with VCs and open doors to global networks.

Regulatory and Legal Resources

Global Digital Finance (GDF): Industry-led best practices and regulatory updates for digital assets.

Coin Center: US-focused policy research and advocacy for Crypto founders.

Blockchain Association: Advocacy and resources for navigating US and global Crypto regulation.

Cross-Border Funding Considerations

Local Legal Counsel: Engage with law firms experienced in Crypto and cross-border fundraising.

Jurisdictional Hubs: Consider the advantages of incorporating in Crypto-friendly jurisdictions like Switzerland, Singapore, Malta, or the UAE for regulatory clarity and investor access.

International Ecosystem Trends and Cross-Border Insights

Asia’s Rise: Japan, Singapore, and Hong Kong are seeing a surge in new projects and VC activity, driven by regulatory clarity and government support.

Europe’s Maturation: Switzerland and Malta remain top destinations for Crypto startups, with strong legal frameworks and access to EU capital.

US Leadership, Global Competition: The US is still the largest market for Crypto VC, but founders are increasingly looking to raise from a global syndicate of investors.

Africa and Latin America: These regions are emerging as innovation hotspots, especially in payments, DeFi, and real-world asset tokenization, with growing local VC and accelerator support.

Find an Investor for Crypto with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Crypto here.

For Crypto startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Crypto sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

Real Estate Startup Funding: A Founder's Guide to VCs, Accelerators & Global Trends

Raising venture capital as a Real Estate startup founder is a unique journey—one that demands a deep understanding of both the property sector and the fast-evolving world of technology investment. The Real Estate industry, long known for its complexity and capital intensity, is now at the forefront of innovation, with PropTech, smart buildings, and digital marketplaces transforming how we buy, sell, manage, and experience property worldwide.

Yet, securing the right investment partners in this space is far from straightforward. Real Estate startups face distinct challenges, including navigating regulatory hurdles, managing lengthy sales cycles, and proving value in a sector where disruption is both necessary and challenging. At the same time, global trends—such as the rise of sustainable development, the integration of AI and IoT, and the growing appetite for cross-border deals—are creating unprecedented opportunities for founders who know where to look and how to pitch.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Real Estate, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Real Estate ecosystem.

Top Real Estate VCs

Moderne Ventures

About: Moderne Ventures is a venture fund that invests in tech real estate, mortgage, finance, insurance, and home service companies.

Sweetspot check size: $ 5M

M7 Structura

About: Real Estate/PropTech Seed to Series A European-focused VC firm.

Sweetspot check size: $ 700K

Traction metrics requirements: Revenue or other clear commercial traction

Thesis: We invest in companies developing technology solutions to improve and create efficiencies through the real estate lifecycle and built environment.

GoEx Venture Capital

Sweetspot check size: $ 250K

Thesis: GoEx is a $5MM pre-seed fund in Nashville, TN, focusing on real estate technology companies across the U.S.

Alate Partners

About: Alate Partners is the result of a partnership built between Dream, one of Canada’s largest real estate companies, and Relay Ventures, an established early stage venture capital fund.

Sweetspot check size: $ 3M

Thesis: Alate Partners empowers entrepreneurs who are rethinking real estate.

Fifth Wall

About: At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

Sweetspot check size: $ 10M

MetaProp

About: MetaProp is a New York-based venture capital firm focused on the real estate technology (“PropTech”) industry. Founded in 2015, MetaProp’s investment team has invested in 175+ technology companies across the real estate value chain. The firm manages multiple funds for both financial and strategic real estate investors that represent a pilot- and test-ready sandbox of 20+ billion square feet across every real estate asset type and global market. The firm’s investment activities are complemented by pioneering community leadership including the PropTech Place innovation hub, MetaProp Accelerator at Columbia University programs, global events including NYC Real Estate Tech Week, and publications Global PropTech Confidence Index and PropTech 101.

Camber Creek

About: Camber Creek is a venture capital firm providing strategic value and capital to operating technology companies focused on the real estate market.

Thesis: Focused on the real estate market

Alate Partners

About: Alate Partners is the result of a partnership built between Dream, one of Canada’s largest real estate companies, and Relay Ventures, an established early stage venture capital fund.

Sweetspot check size: $ 3M

Thesis: Alate Partners empowers entrepreneurs who are rethinking real estate.

JLL Spark

About: JLL Spark has invested more than $380 million in more than 45 early-stage PropTech startups—from IoT sensors to investment platforms and more.

Thesis: Spark believes that no one company can produce all the innovation required to serve today’s clients, so we invest and partner with the brightest startups that share our vision and values and are dedicated to bringing positive change to the real estate industry globally.

Second Century Ventures

About: Second Century Ventures (SCV) is a venture capital fund focused on promoting innovation in the real estate industry.

Traction metrics requirements: We are round-agnostic, favoring investments in organizations with strong market traction and proof of product market fit.

Thesis: Second Century Ventures invests in strong teams and technologies with the potential to serve multiple industries.

Fundraising Insights, Trends, and Practical Tips for Real Estate Startups

Current Global Trends in Real Estate Venture Funding

The Real Estate technology (PropTech) sector remains a focal point for innovation and investment in 2025, though overall venture capital funding has moderated compared to the record highs of previous years. According to the Center for Real Estate Technology & Innovation (CRETI), global PropTech venture capital funding totaled $615 million in January 2025, with the U.S. accounting for nearly half of that activity. This reflects a more disciplined and strategic investment environment following a cautious 2023, when global PropTech VC deals reached just $2.2 billion through May.

North America and Europe continue to lead in deal volume and capital deployed, but Asia-Pacific and the Middle East are emerging as fast-growing hubs, particularly in areas like smart cities, green building, and digital infrastructure. Investors are prioritizing startups that address climate risk, energy efficiency, and regulatory compliance—trends accelerated by tightening regulations and growing demand for sustainable solutions.

The integration of AI, IoT, and advanced data analytics is now a baseline expectation for new PropTech entrants. Solutions that enable remote property management, digital transactions, and enhanced tenant experiences are in high demand. Notably, cross-sector convergence is accelerating: innovations from agtech and foodtech—such as vertical farming and urban agriculture—are drawing Real Estate investors interested in mixed-use, sustainable developments.

Unique Challenges Facing Real Estate Startups

Raising capital in Real Estate comes with sector-specific hurdles. Sales cycles are often lengthy, as enterprise clients and institutional landlords require extensive due diligence and pilot programs before fully adopting the solution. Regulatory complexity is another major challenge, with zoning, building codes, and data privacy laws varying widely across regions.

Additionally, Real Estate is a capital-intensive industry. Startups must often demonstrate not just product-market fit, but also the ability to scale operations, manage physical assets, and navigate conservative industry mindsets. Building trust and credibility—through partnerships, pilot projects, and a strong advisory board—is essential for overcoming skepticism and unlocking larger funding rounds.

Opportunities for Innovation and Differentiation

Despite these challenges, 2025 presents unprecedented opportunities for Real Estate founders. Sustainability and ESG (Environmental, Social, and Governance) are now top priorities for both investors and property owners. Startups offering solutions for energy management, carbon tracking, and green construction are seeing increased interest and premium valuations.

AI-powered analytics, predictive maintenance, and digital twin technologies are enabling smarter asset management and operational efficiency. In emerging markets, there is growing demand for affordable housing, modular construction, and digital marketplaces that connect buyers, sellers, and renters in new ways. Fractional ownership and tokenization of real assets are also gaining traction, opening up Real Estate investment to a broader audience.

Real Estate-Specific Due Diligence: What VCs Look For

Venture capitalists in Real Estate are particularly focused on:

Market Size and Growth Potential: Is your target market large and expanding?

Regulatory Compliance: Are you prepared for local and international legal requirements?

Technology Differentiation: How defensible and scalable is your tech?

Team and Industry Expertise: Do you have the right mix of technical and Real Estate experience?

Proof of Concept: Have you demonstrated your solution in real-world settings?

Networking, Accelerators, and Global Resources for Real Estate Founders

Key Networking Opportunities and Industry Events

MIPIM (Cannes, France): The world’s leading Real Estate event, attracting 20,000+ industry leaders, VCs, and innovators. MIPIM 2025 will focus on sustainability, smart cities, and PropTech.

CREtech New York & London: Premier PropTech conferences featuring top VCs, founders, and corporates. CREtech’s 2025 agenda includes panels on AI, ESG, and cross-border investment.

PropTech Connect (London): Europe’s largest PropTech gathering, with a strong focus on networking and deal-making.

EXPO REAL (Munich, Germany): Europe’s largest Real Estate and investment trade fair, with a growing PropTech pavilion.

Leading Accelerators and Incubators for Real Estate Startups

MetaProp Accelerator (New York): The world’s leading PropTech accelerator, offering investment, mentorship, and access to a global network of Real Estate corporates.

REACH by Second Century Ventures (Global): Operates in North America, Australia, UK, and Latin America, focusing on scaling Real Estate innovation.

Pi Labs (London): Europe’s first PropTech VC and accelerator, supporting early-stage startups with funding and industry access.

Plug and Play Real Estate & Construction (Silicon Valley, Global): Connects startups with major Real Estate and construction corporates worldwide.

Online Communities, Networks, and Founder Resources

PropTech Collective: A global community for PropTech founders, investors, and professionals, offering events, Slack channels, and curated content.

CREtech Community: Online forums, webinars, and networking for Real Estate tech innovators.

Newsletters & Podcasts:

Propmodo, PlaceTech, and The PropTech Podcast deliver news, trends, and founder stories.

Government and NGO Resources:

Startup Genome provides global ecosystem reports and benchmarking.

The World Bank and local innovation hubs offer grants, regulatory guidance, and support for market entry.

Find an Investor for Real Estate with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Real Estate here.

For Real Estate startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Real Estate sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

Top VCs & Fundraising Strategies for Manufacturing Startups

The global manufacturing sector is experiencing a transformation, driven by advancements in automation, AI, sustainable practices, and resilient supply chains. This resurgence has not gone unnoticed by the venture capital community. Following the supply chain disruptions of the early 2020s, investors are increasingly recognizing the critical importance and immense potential of innovative manufacturing startups. From advanced robotics and additive manufacturing to smart factories and circular economy solutions, the landscape is ripe with opportunities for founders who are building the future of production. However, securing venture capital in this specialized domain requires a nuanced understanding of the market, the right connections, and a compelling narrative that resonates with investors focused on industrial innovation.

Unlike software or consumer tech ventures, manufacturing startups often face distinct challenges and capital requirements. These include longer research and development cycles, significant upfront capital expenditure for machinery and facilities, complex supply chain management, and the need for deep industry expertise. Traditional venture capital firms, accustomed to rapid scaling and lower capital intensity, may not fully grasp these unique dynamics. This is why specialized venture capital firms, with their deep industry knowledge, patient capital, and strategic networks within the manufacturing ecosystem, are crucial partners for founders in this space. They understand the intricacies of bringing physical products to market and can provide invaluable support beyond just funding.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Manufacturing, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Manufacturing ecosystem.

Top Manufacturing VCs

22 Fund

About: The 22 Fund invests in women/BIPOC-led, tech-based manufacturing companies in the USA to increase their export capacity.

Traction metrics requirements: Positive EBIDTA

Thesis: Investing in tech based, export oriented manufacturing companies, to create clean jobs of the future in underserved and LMI communities, intentionally including women and POC (people of color) led firms to deliver both high ROI and social/economic impact.

Building Ventures

About: Building Ventures invests in companies that are reshaping the way we design, build, operate and experience our built environment.

We partner with visionary entrepreneurs who will have a profound effect on how and where we live as humans on our planet.

Monozukuri Ventures

About: Monozukuri Ventures provides investment, mentorship, prototyping know-how and manufacturing expertise for hardware startups.

Sweetspot check size: $ 250K

Thesis: Monozukuri Ventures is focused on funding hardware startups in the fastest growing industries: robotics, AI, clean energy, wearables, space tech, IoT, healthcare, smart home and more. We invest in 10-15 hardware startups per year, with a typical check ranging from USD 150K to 300K at first, with a chance to follow investment up to USD 1M accumulate.

Construct Capital

About: Construct Capital invests in extraordinary founders building technology to transform the most foundational industries of our economy.

Thesis: We invest in extraordinary founders building technology to transform the most foundational industries of our economy.

HAX

About: HAX is SOSV's pre-seed program for hard tech. Startups apply to HAX with an initial prototype, customer insight, and vision. We then invest and build alongside our founders, fundamentally inflecting their technical progress with our team of engineers and investment partners. Founders should think of HAX as an extension of their engineering, business development, fundraising, design, and marketing teams.

As startups reach critical milestones, we support fundraising strategy and investor introductions. We also continue to invest, to the tune of over $25 million USD per year globally, and just raised an additional $100M in capital to support the later stage growth of our startups.

The most valuable part of HAX (that is often understated) is engagement with a globally diverse community of HAX founders. Many have been successful, all have learned hard lessons, and everyone is excited to help each other succeed. Our community has grown to include a curated group of mentors, experts and partners that give our hard tech startups the best edge.

Sweetspot check size: $ 250K

Traction metrics requirements: Prototype, market knowledge.

Thesis: Anything with circuits in it => automation, robotics, IIOT, health

Eclipse Ventures

About: Eclipse Ventures specializes in early- and growth-stage investments in industrial automation, advanced manufacturing, and supply chain technology. We help entrepreneurs build companies that will boldly transform the industries that define and propel economies.

Thesis: Eclipse Ventures helps entrepreneurs build companies to boldly transform the industries that define and propel economies.

Anzu Partners

About: Anzu Partners is a venture capital and private equity firm that invests in breakthrough industrial technologies. We team with entrepreneurs to develop and commercialize technological innovations by providing capital and deep expertise in business development, market positioning, global connectivity, and operations. Anzu Partners has a strong track record of investing since its founding in 2014, and we have developed a robust team of investment professionals, technical specialists and operational support to drive results for our investors and portfolio companies. In 2016, we launched Anzu Industrial Capital Partners, L.P., our fund, to invest in North American-based private industrial technology companies. Anzu’s principals have 60+ years of combined experience as global industrial consultants and investors, and have built an advantaged commercial support network spanning key industrial markets across the globe.

Applied Ventures

About: Applied Ventures is the venture capital fund of Applied Materials, the global leader in nano-manufacturing technology solutions for the electronics industry with a broad portfolio of innovative equipment, service, and software products. Applied Ventures invests in early-stage technology companies that promise to deliver high growth and exceptional returns.

Brick & Mortar Ventures

About: Brick & Mortar Ventures identifies, backs, enables emerging companies developing innovative software hardware solutions for the industries.

Aavishkaar Venture Capital

About: Aavishkaar Venture Capital provides private equity and microfinance solutions for early stage startups.

Thesis: Aavishkaar Capital’s investment thesis is to leverage the confluence of consumption, financial inclusion and technology across emerging low and middle income populations to build sustainable, impactful and highly scalable businesses, which can create significant value for both the investors and the society.

Actionable Fundraising Insights for Manufacturing Startups

Manufacturing founders in 2025 must be strategic, data-driven, and sector-savvy to stand out in a competitive fundraising environment. By targeting the right investors, crafting compelling, risk-aware pitches, and leveraging global opportunities, startups can secure the capital and partnerships needed to scale.

Global Fundraising Trends in Manufacturing

In 2025, global venture funding has rebounded, with Q1 alone seeing $113 billion invested—marking the strongest quarter since 2022. However, this growth is uneven: late-stage and large, established startups are capturing the lion’s share of capital, while early-stage and seed funding have declined. For manufacturing startups, this means competition for early capital is fierce, and founders must be prepared to demonstrate traction and scalability early on. Notably, AI and automation remain top investment themes, with manufacturing innovation closely tied to these trends. North America continues to dominate funding, while Asia and Europe have seen investment plateau or decline, and Latin America’s early-stage ecosystem is showing resilience despite overall lower volumes.

Unique Fundraising Challenges for Manufacturing Startups

Manufacturing startups face several sector-specific hurdles. Capital intensity is high, with significant upfront investment required for prototyping, equipment, and scaling production. Long development cycles and complex supply chains add risk, making it harder to attract traditional VCs who are used to faster returns from software ventures. Additionally, global economic uncertainty, trade tensions, and regulatory hurdles—such as tariffs and compliance standards—can impact both fundraising and growth prospects. Founders must be ready to address these risks transparently in their pitch and show a clear path to de-risking their business model.

Opportunities for Manufacturing Startups

Despite the challenges, several opportunities are emerging. Industry 4.0, IoT, and smart factory solutions are in high demand as manufacturers seek to modernize and automate. Sustainability and circular economy initiatives are attracting both VC and corporate venture interest, especially as ESG (Environmental, Social, and Governance) criteria become more central to investment decisions. The trend toward onshoring and regionalizing supply chains is also creating new markets for startups that can offer efficiency, resilience, or green solutions.

Practical Tips for Pitching Manufacturing Startups to VCs

Target the Right Investors: Focus on VCs with a track record in manufacturing, deep tech, or industrial innovation. Use AI-powered tools to identify aligned investors and avoid “blind” networking.

Craft a Sector-Specific Pitch Deck: Highlight your team’s industry expertise, technical feasibility, and clear milestones for de-risking. Demonstrate how your solution addresses a real pain point in manufacturing, and back it up with pilot results, customer traction, or proof-of-concept data.

Showcase Scalability and Partnerships: VCs want to see a path to scale—whether through strategic partnerships, channel sales, or global supply chain integration. Highlight any collaborations with established manufacturers or industry leaders.

Address Risk and Resilience: Be upfront about capital needs, regulatory risks, and supply chain dependencies. Outline your strategies for risk mitigation, such as diversified suppliers, IP protection, or compliance certifications.

Leverage Industry Events and Accelerators: Participate in global manufacturing and VC events to build relationships and gain visibility. Consider accelerators which specialize in hardware and manufacturing startups.

Key Networking Opportunities, Accelerators, and Resources for Manufacturing Founders

Global Manufacturing and Venture Capital Events

Hannover Messe (Germany): The world’s leading industrial technology fair, attracting thousands of manufacturing innovators, corporates, and VCs.

TechCrunch Disrupt (San Francisco, USA): Features a robust hardware and industrial tech track, with top-tier VCs and corporate partners in attendance.

Industry 4.0 Summit (Portugal): Focuses on bringing together industry leaders and manufacturing experts from around the globe to share ideas and connect about the Industry 4.0.

Leading Accelerators and Incubators for Manufacturing Startups

HAX (SOSV): The world’s premier hardware and manufacturing accelerator, with locations in Shenzhen and Newark. HAX provides hands-on support from prototype to scale, plus access to a global investor network.

Plug and Play (USA, Germany, China): Their Supply Chain & Logistics and Industry 4.0 programs connect startups with leading corporates and VCs.

MassRobotics (USA): A hub for robotics and advanced manufacturing startups, offering workspace, mentorship, and investor introductions.

Cross-Border Funding and International Ecosystem Trends

Manufacturing is inherently global, and cross-border funding is increasingly common. Founders should be aware of:

Legal and Regulatory Considerations: Understand export controls, IP protection, and local compliance requirements when raising international capital.

Cultural Nuances: Tailor your pitch and business model to resonate with investors from different regions.

Global Supply Chain Innovation: Startups that can demonstrate resilience and adaptability in their supply chains are especially attractive to international investors.

Case studies, such as European startups expanding into North America or Asian founders raising from US and European VCs, highlight the importance of building a diverse investor base and leveraging global networks.