In the dynamic world of startups, hardware ventures stand apart. Unlike their software counterparts, hardware companies grapple with a distinct set of challenges that significantly impact their fundraising journey. From extended development cycles and substantial upfront capital expenditures for prototyping and manufacturing, to complex supply chain management and inventory risks, the path to market for a physical product is inherently more intricate and capital-intensive. This often means a longer runway is needed, and the traditional metrics VCs use for software (like rapid user growth or low customer acquisition costs) don't always translate directly. Finding the right venture capital partners who truly understand these nuances, and are patient with the unique growth trajectory of a hardware business, is critical for survival and scale.

Despite these hurdles, we are witnessing a remarkable global resurgence in hardware innovation. The past few years have seen an explosion of groundbreaking advancements across various sectors. From the pervasive integration of IoT and sophisticated robotics transforming industries, to the urgent demand for cleantech solutions, revolutionary medtech devices, and the evolution of advanced manufacturing techniques, hardware is at the forefront of solving some of the world's most pressing problems.

This renewed wave of innovation has not gone unnoticed by the venture capital community. VCs are increasingly recognizing the immense market opportunities and the potential for defensible moats that well-executed hardware solutions can create, leading to a significant uptick in investment in the sector. This trend is truly global, with innovation hubs emerging and connecting across continents, fostering an international ecosystem for hardware investment.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Hardware, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Hardware ecosystem.

Top VCs Investing in Hardware Startups

HCVC

About: HCVC is the first global venture capital fund dedicated to full-stack and hardtech startups.

Sweetspot check size: $ 525K

Thesis: We are looking for outstanding founders, building game-changing products or technologies and targeting large potential markets

Elephants & Ventures

About: Elephants&Ventures is an early-stage venture boutique for hardware & software companies.

ff Venture Capital

About: ff Venture Capital is one of the best performing seed- and early-stage venture capital firms investing in some of the strongest growth areas to date, including cybersecurity, artificial intelligence, machine learning, drones, enterprise cloud software, and crowdfunding.

Mitsubishi UFJ CapitalShizuoka Capital

About: Mitsubishi UFJ Capital is a venture capital firm focusing on life science, ICT and high technology investments.

Monozukuri Ventures

About: Monozukuri Ventures provides investment, mentorship, prototyping know-how and manufacturing expertise for hardware startups.

Sweetspot check size: $ 250K

Thesis: Monozukuri Ventures is focused on funding hardware startups in the fastest growing industries: robotics, AI, clean energy, wearables, space tech, IoT, healthcare, smart home and more. We invest in 10-15 hardware startups per year, with a typical check ranging from USD 150K to 300K at first, with a chance to follow investment up to USD 1M accumulate.

Powerhouse Ventures

About: Powerhouse Ventures backs seed-stage startups developing innovative software across energy, mobility, and industry. We are backed by some of the world’s largest corporations in energy, utilities, automotive, finance, and tech—including Constellation, American Electric Power, Microsoft, UBS, Toyota, TotalEnergies, and more.

Reinforced Ventures

About: Reinforced Ventures brings together experienced technologists & investors to empower entrepreneurs building the next generation of autonomous systems, robotics, and biotechnology. Our focus is on overlooked areas of deep tech. We are based out of Pittsburgh, PA but invest globally.

Sumeru Equity Partners

About: Sumeru Equity Partners is a technology-focused private equity firm that invests $50-$250 million in leading mid-market software, technology enabled services, and hardware companies with a focus on growth. Sumeru was founded by an experienced team from Silver Lake Sumeru with significant first-hand operating experience. Our strategy and operating experience enables us to take a flexible approach to deal types and investment structures including growth funding, founder transitions, buyouts, take-privates, recapitalizations, and corporate divestitures.

Thesis: Sumeru’s engagement model centers on partnering with management teams and investing in go-to-market, product, and operations to drive growth and strategic positioning.

Wilbe Capital

Sweetspot check size: $ 300K

Traction metrics requirements: Scientist founders and science companies only!

Thesis: We are a venture firm for entrepreneurial scientists. We educate, build, invest and provide lab space to scientist founders solving some of the biggest problems we face this century.

The Company Lab

About: CO.LAB is a 501c3 nonprofit based in Chattanooga, TN that accelerates early-stage startups in the sustainable mobility space.

Sweetspot check size: $ 20K

Traction metrics requirements: Startup must be post-revenue

Tenacious Ventures

About: Tenacious Ventures is a venture capital firm that supports early-stage agri-food innovators.

Sweetspot check size: $ 750K

Thesis: We are a high conviction, low-volume, high-support early stage investor in agri-food innovation.

Networking, Accelerators, and Global Resources for Hardware Founders

The Importance of Global Networking for Hardware Startups

For hardware startups, global networking isn’t just a “nice to have”—it’s a strategic necessity. Unlike software, hardware ventures often depend on international supply chains, manufacturing partners, and distribution networks. Building relationships across borders can unlock access to specialized prototyping facilities, lower-cost manufacturing, and new markets. Cross-border connections can also help founders tap into diverse pools of investors, mentors, and technical talent, accelerating both product development and go-to-market strategies.

Leading Hardware Accelerators and Incubators Worldwide

Joining a top-tier hardware accelerator can be transformative for early-stage founders. These programs offer not just capital, but also hands-on support with prototyping, manufacturing, and business development.

- HAX: With locations in Shenzhen and Newark, HAX is the world’s leading hardware accelerator, providing up to $250,000 in funding, deep prototyping resources, and direct access to Asian manufacturing.

- Brinc: Based in Hong Kong and expanding globally, Brinc specializes in IoT, robotics, and climate tech, offering investment, mentorship, and supply chain support.

- Hardware Club (HCVC): A global community and venture fund for hardware founders, HCVC connects startups with a curated network of manufacturers, distributors, and investors.

- AlphaLab Gear: Based in Pittsburgh, AlphaLab Gear supports hardware, IoT, and robotics startups with funding, mentorship, and access to a robust regional ecosystem.

- MassRobotics: A Boston-based innovation hub for robotics startups, offering workspace, prototyping labs, and industry connections.

Key Industry Events and Conferences for Hardware Founders

Attending major industry events is one of the fastest ways to build your network, meet investors, and stay ahead of market trends. To maximize ROI, plan meetings in advance, participate in pitch competitions, and leverage event networking platforms to connect with investors and partners.

- CES (Las Vegas): The world’s largest consumer electronics show, a must-attend for product launches and investor meetings.

- Hannover Messe (Germany): The leading global trade fair for industrial technology and advanced manufacturing.

- TechCrunch Disrupt: A premier event for startups and VCs, with a growing focus on hardware and deep tech.

- Hardware Pioneers Max (UK): Europe’s top event for hardware, IoT, and embedded systems.

- Maker Faire: A global series of events celebrating innovation in hardware, prototyping, and maker culture.

- Slush (Finland): A leading European tech event with strong hardware and deep tech representation.

Online Communities, Networks, and Founder Resources

- Element14 and Hackster.io: Online platforms for prototyping, technical support, and community-driven hardware projects.

- Indie Hackers Hardware: A sub-community focused on indie hardware projects and bootstrapped startups.

- Open-Source Hardware Resources: Platforms like GitHub and OSHWA (Open Source Hardware Association) provide access to open designs and collaborative projects.

Cross-Border Funding and International Ecosystem Trends

- Legal and Regulatory Compliance: Understand export controls, IP protection, and local regulations in your target markets.

- Emerging Hardware Hubs: Beyond Silicon Valley and Shenzhen, regions like Israel, Southeast Asia, India, and parts of Africa and Latin America are rapidly growing as hardware innovation centers.

- Government and International Programs: Leverage programs like the EU’s EIC Accelerator, Singapore’s EDB, and the US SBIR/STTR grants for non-dilutive funding and market entry support.

- Cross-Border Tariffs and Supply Chain Risks: Stay agile and diversify suppliers to mitigate risks from trade disputes and tariffs.

Actionable Fundraising Insights for Hardware Startups

Current Global Trends in Hardware Fundraising

The hardware startup fundraising landscape in 2025 is marked by both opportunity and volatility. According to Crunchbase, global venture funding reached $113 billion in Q1 2025, the strongest quarter since 2022, but this was heavily skewed by a handful of mega-deals—most notably OpenAI’s $40 billion round. For hardware startups, the most notable trend is the surge in late-stage and M&A activity, while early-stage and seed funding have declined, making it more challenging for new hardware ventures to secure their first rounds.

AI and robotics hardware remain hot sectors, with investors pouring billions into companies building next-generation chips, sensors, and automation platforms. For example, EnCharge AI, a hardware startup, raised a $100 million Series B in early 2025, led by Tiger Global and joined by Samsung Ventures and RTX Ventures. However, global economic uncertainty, trade tensions, and rising tariffs are creating headwinds, especially for startups reliant on international supply chains.

Unique Challenges Facing Hardware Startups

Hardware founders face several persistent and emerging challenges:

- Capital Intensity and Long Development Cycles: With early-stage funding down 14% year-over-year, hardware startups must work harder to prove traction before raising significant capital.

- Supply Chain and Tariff Risks: Ongoing global trade disputes and tariffs are increasing material costs and creating uncertainty for hardware companies, making flexible, globally distributed supply chains more important than ever.

- Regulatory and Certification Barriers: Sectors like medtech and IoT still require extensive compliance work, which can slow down time-to-market.

- Scaling from Prototype to Production: The transition from prototype to mass production remains a major stumbling block, with many startups underestimating the operational complexity.

Opportunities and Differentiators in the Hardware Sector

Despite these challenges, several opportunities are driving hardware innovation and investment:

- AI-Driven Hardware: The intersection of AI and hardware is attracting record investment, with startups building custom chips, edge devices, and robotics platforms seeing strong demand.

- Defensible IP and Barriers to Entry: Hardware startups with strong patents and proprietary technology continue to attract premium valuations.

- Sustainability and Cleantech: Investors are prioritizing hardware solutions that address energy efficiency, climate resilience, and circular economy models.

- Hardware-as-a-Service (HaaS): Subscription and leasing models are gaining traction, providing recurring revenue and reducing customer friction.

- Global Manufacturing Innovation: Startups leveraging digital supply chain management and distributed manufacturing are better positioned to navigate geopolitical risks.

Practical Tips for Pitching Hardware Startups to VCs

- Showcase De-Risking Milestones: Clearly communicate technical and operational risks, and demonstrate how you’ve de-risked each stage (e.g., working prototypes, pilot customers, regulatory progress).

- Highlight Market Validation: Even in early stages, evidence of customer demand—such as pre-orders, LOIs, or pilot deployments—can make a big difference.

- Present a Robust Go-to-Market and Supply Chain Plan: Investors want to see a clear path from prototype to scalable production, including manufacturing partners and logistics strategies.

- Emphasize Team and Advisory Strength: Highlight experience in engineering, manufacturing, and operations, as well as any strategic advisors or partners.

- Prepare for Rigorous Due Diligence: Be ready to share detailed documentation, including your bill of materials (BOM), supply chain partners, and regulatory plans.

- Tailor Your Pitch: For hardware-savvy VCs, dive deep into technical details; for generalist VCs, focus on market opportunity, defensibility, and risk management.

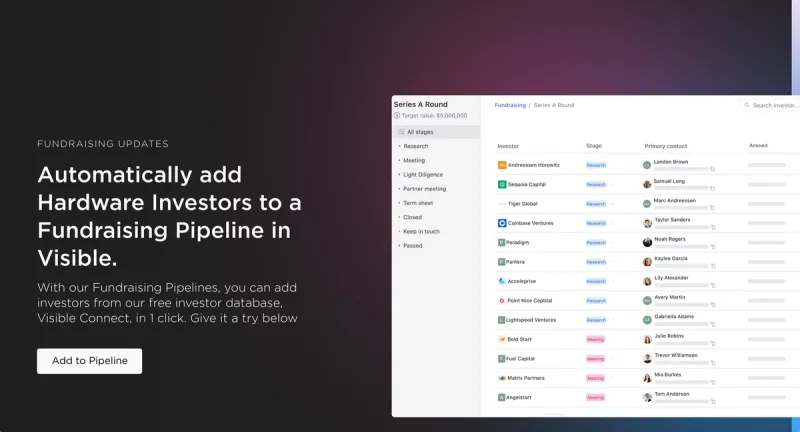

Find an Investor for Hardware with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Hardware here.

For Hardware startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Hardware sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.