The global manufacturing sector is experiencing a transformation, driven by advancements in automation, AI, sustainable practices, and resilient supply chains. This resurgence has not gone unnoticed by the venture capital community. Following the supply chain disruptions of the early 2020s, investors are increasingly recognizing the critical importance and immense potential of innovative manufacturing startups. From advanced robotics and additive manufacturing to smart factories and circular economy solutions, the landscape is ripe with opportunities for founders who are building the future of production. However, securing venture capital in this specialized domain requires a nuanced understanding of the market, the right connections, and a compelling narrative that resonates with investors focused on industrial innovation.

Unlike software or consumer tech ventures, manufacturing startups often face distinct challenges and capital requirements. These include longer research and development cycles, significant upfront capital expenditure for machinery and facilities, complex supply chain management, and the need for deep industry expertise. Traditional venture capital firms, accustomed to rapid scaling and lower capital intensity, may not fully grasp these unique dynamics. This is why specialized venture capital firms, with their deep industry knowledge, patient capital, and strategic networks within the manufacturing ecosystem, are crucial partners for founders in this space. They understand the intricacies of bringing physical products to market and can provide invaluable support beyond just funding.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Manufacturing, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Manufacturing ecosystem.

Top Manufacturing VCs

22 Fund

About: The 22 Fund invests in women/BIPOC-led, tech-based manufacturing companies in the USA to increase their export capacity.

Traction metrics requirements: Positive EBIDTA

Thesis: Investing in tech based, export oriented manufacturing companies, to create clean jobs of the future in underserved and LMI communities, intentionally including women and POC (people of color) led firms to deliver both high ROI and social/economic impact.

Building Ventures

About: Building Ventures invests in companies that are reshaping the way we design, build, operate and experience our built environment.

We partner with visionary entrepreneurs who will have a profound effect on how and where we live as humans on our planet.

Monozukuri Ventures

About: Monozukuri Ventures provides investment, mentorship, prototyping know-how and manufacturing expertise for hardware startups.

Sweetspot check size: $ 250K

Thesis: Monozukuri Ventures is focused on funding hardware startups in the fastest growing industries: robotics, AI, clean energy, wearables, space tech, IoT, healthcare, smart home and more. We invest in 10-15 hardware startups per year, with a typical check ranging from USD 150K to 300K at first, with a chance to follow investment up to USD 1M accumulate.

Construct Capital

About: Construct Capital invests in extraordinary founders building technology to transform the most foundational industries of our economy.

Thesis: We invest in extraordinary founders building technology to transform the most foundational industries of our economy.

HAX

About: HAX is SOSV's pre-seed program for hard tech. Startups apply to HAX with an initial prototype, customer insight, and vision. We then invest and build alongside our founders, fundamentally inflecting their technical progress with our team of engineers and investment partners. Founders should think of HAX as an extension of their engineering, business development, fundraising, design, and marketing teams.

As startups reach critical milestones, we support fundraising strategy and investor introductions. We also continue to invest, to the tune of over $25 million USD per year globally, and just raised an additional $100M in capital to support the later stage growth of our startups.

The most valuable part of HAX (that is often understated) is engagement with a globally diverse community of HAX founders. Many have been successful, all have learned hard lessons, and everyone is excited to help each other succeed. Our community has grown to include a curated group of mentors, experts and partners that give our hard tech startups the best edge.

Sweetspot check size: $ 250K

Traction metrics requirements: Prototype, market knowledge.

Thesis: Anything with circuits in it => automation, robotics, IIOT, health

Eclipse Ventures

About: Eclipse Ventures specializes in early- and growth-stage investments in industrial automation, advanced manufacturing, and supply chain technology. We help entrepreneurs build companies that will boldly transform the industries that define and propel economies.

Thesis: Eclipse Ventures helps entrepreneurs build companies to boldly transform the industries that define and propel economies.

Anzu Partners

About: Anzu Partners is a venture capital and private equity firm that invests in breakthrough industrial technologies. We team with entrepreneurs to develop and commercialize technological innovations by providing capital and deep expertise in business development, market positioning, global connectivity, and operations. Anzu Partners has a strong track record of investing since its founding in 2014, and we have developed a robust team of investment professionals, technical specialists and operational support to drive results for our investors and portfolio companies. In 2016, we launched Anzu Industrial Capital Partners, L.P., our fund, to invest in North American-based private industrial technology companies. Anzu’s principals have 60+ years of combined experience as global industrial consultants and investors, and have built an advantaged commercial support network spanning key industrial markets across the globe.

Applied Ventures

About: Applied Ventures is the venture capital fund of Applied Materials, the global leader in nano-manufacturing technology solutions for the electronics industry with a broad portfolio of innovative equipment, service, and software products. Applied Ventures invests in early-stage technology companies that promise to deliver high growth and exceptional returns.

Brick & Mortar Ventures

About: Brick & Mortar Ventures identifies, backs, enables emerging companies developing innovative software hardware solutions for the industries.

Aavishkaar Venture Capital

About: Aavishkaar Venture Capital provides private equity and microfinance solutions for early stage startups.

Thesis: Aavishkaar Capital’s investment thesis is to leverage the confluence of consumption, financial inclusion and technology across emerging low and middle income populations to build sustainable, impactful and highly scalable businesses, which can create significant value for both the investors and the society.

Actionable Fundraising Insights for Manufacturing Startups

Manufacturing founders in 2025 must be strategic, data-driven, and sector-savvy to stand out in a competitive fundraising environment. By targeting the right investors, crafting compelling, risk-aware pitches, and leveraging global opportunities, startups can secure the capital and partnerships needed to scale.

Global Fundraising Trends in Manufacturing

In 2025, global venture funding has rebounded, with Q1 alone seeing $113 billion invested—marking the strongest quarter since 2022. However, this growth is uneven: late-stage and large, established startups are capturing the lion’s share of capital, while early-stage and seed funding have declined. For manufacturing startups, this means competition for early capital is fierce, and founders must be prepared to demonstrate traction and scalability early on. Notably, AI and automation remain top investment themes, with manufacturing innovation closely tied to these trends. North America continues to dominate funding, while Asia and Europe have seen investment plateau or decline, and Latin America’s early-stage ecosystem is showing resilience despite overall lower volumes.

Unique Fundraising Challenges for Manufacturing Startups

Manufacturing startups face several sector-specific hurdles. Capital intensity is high, with significant upfront investment required for prototyping, equipment, and scaling production. Long development cycles and complex supply chains add risk, making it harder to attract traditional VCs who are used to faster returns from software ventures. Additionally, global economic uncertainty, trade tensions, and regulatory hurdles—such as tariffs and compliance standards—can impact both fundraising and growth prospects. Founders must be ready to address these risks transparently in their pitch and show a clear path to de-risking their business model.

Opportunities for Manufacturing Startups

Despite the challenges, several opportunities are emerging. Industry 4.0, IoT, and smart factory solutions are in high demand as manufacturers seek to modernize and automate. Sustainability and circular economy initiatives are attracting both VC and corporate venture interest, especially as ESG (Environmental, Social, and Governance) criteria become more central to investment decisions. The trend toward onshoring and regionalizing supply chains is also creating new markets for startups that can offer efficiency, resilience, or green solutions.

Practical Tips for Pitching Manufacturing Startups to VCs

- Target the Right Investors: Focus on VCs with a track record in manufacturing, deep tech, or industrial innovation. Use AI-powered tools to identify aligned investors and avoid “blind” networking.

- Craft a Sector-Specific Pitch Deck: Highlight your team’s industry expertise, technical feasibility, and clear milestones for de-risking. Demonstrate how your solution addresses a real pain point in manufacturing, and back it up with pilot results, customer traction, or proof-of-concept data.

- Showcase Scalability and Partnerships: VCs want to see a path to scale—whether through strategic partnerships, channel sales, or global supply chain integration. Highlight any collaborations with established manufacturers or industry leaders.

- Address Risk and Resilience: Be upfront about capital needs, regulatory risks, and supply chain dependencies. Outline your strategies for risk mitigation, such as diversified suppliers, IP protection, or compliance certifications.

- Leverage Industry Events and Accelerators: Participate in global manufacturing and VC events to build relationships and gain visibility. Consider accelerators which specialize in hardware and manufacturing startups.

Key Networking Opportunities, Accelerators, and Resources for Manufacturing Founders

Global Manufacturing and Venture Capital Events

- Hannover Messe (Germany): The world’s leading industrial technology fair, attracting thousands of manufacturing innovators, corporates, and VCs.

- TechCrunch Disrupt (San Francisco, USA): Features a robust hardware and industrial tech track, with top-tier VCs and corporate partners in attendance.

- Industry 4.0 Summit (Portugal): Focuses on bringing together industry leaders and manufacturing experts from around the globe to share ideas and connect about the Industry 4.0.

Leading Accelerators and Incubators for Manufacturing Startups

- HAX (SOSV): The world’s premier hardware and manufacturing accelerator, with locations in Shenzhen and Newark. HAX provides hands-on support from prototype to scale, plus access to a global investor network.

- Plug and Play (USA, Germany, China): Their Supply Chain & Logistics and Industry 4.0 programs connect startups with leading corporates and VCs.

- MassRobotics (USA): A hub for robotics and advanced manufacturing startups, offering workspace, mentorship, and investor introductions.

Cross-Border Funding and International Ecosystem Trends

Manufacturing is inherently global, and cross-border funding is increasingly common. Founders should be aware of:

- Legal and Regulatory Considerations: Understand export controls, IP protection, and local compliance requirements when raising international capital.

- Cultural Nuances: Tailor your pitch and business model to resonate with investors from different regions.

- Global Supply Chain Innovation: Startups that can demonstrate resilience and adaptability in their supply chains are especially attractive to international investors.

Case studies, such as European startups expanding into North America or Asian founders raising from US and European VCs, highlight the importance of building a diverse investor base and leveraging global networks.

Find an Investor for Manufacturing with Visible

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Manufacturing here.

For Manufacturing startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Manufacturing sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

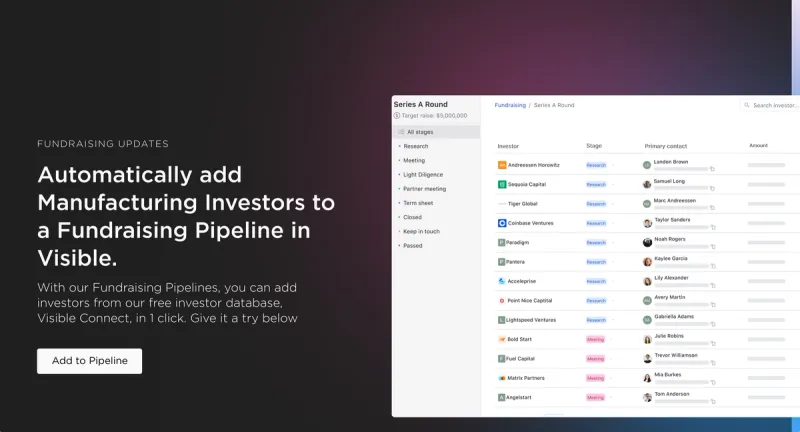

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.