Deep Tech startups—those leveraging advanced scientific and engineering breakthroughs in fields like artificial intelligence, robotics, quantum computing, agtech, and foodtech—are at the forefront of global innovation in 2025. The global Deep Tech market is projected to reach $714.6 billion by 2031, growing at a CAGR of 48.2%. This momentum is driven by the urgent need for transformative solutions to complex challenges, from food security and climate change to industrial automation and healthcare.

Unlike traditional software startups, Deep Tech ventures often require longer development cycles, significant R&D investment, and specialized talent. However, their potential for outsized impact and defensible IP makes them highly attractive to forward-thinking investors. As governments and corporates worldwide double down on innovation, Deep Tech founders are uniquely positioned to shape the future of entire industries.

In this guide, we will provide an up-to-date list of the top global VC firms investing in Deep Tech, actionable fundraising strategies, and a curated overview of key international networking opportunities, accelerators, and resources. Whether you're seeking capital or connections, this guide will equip you with the insights needed to succeed in the global Deep Tech ecosystem.

The Top Deep Tech Venture Capital Firms (2025)

Sandpiper Ventures

Sweetspot check size: $ 1.50M

Traction metrics requirements: Must have women founders or be majority controlled by women.

Must be located in Canada.

Thesis: Sandpiper invests in high-performing founders who traditional venture investors miss: Women. We invest exclusively in women-founded or women-majority controlled businesses.

Main Sequence Ventures

About: Backing the world's most ambitious founders who leverage public research to build the next set of global industries.

Fly Ventures

About: For outstanding teams building Enterprise and Deep Tech startups in Europe.

Thesis: We are a first check VC for technical founders solving hard problems

Upheaval Investments

About: Upheaval investments is a seed through growth stage venture firm that invests in groundbreaking technologies led by bold founder vision.

Act Venture Capital

About: ACT is Ireland's leading independent venture capital company and they have a very experienced and successful investment team. They provide capital to growth-oriented private companies in the range of €750K to €15M. Larger sums can be provided in syndication with their institutional investors. In December 2002, ACT closed its third fund at €170 million. ACT now manages €350 million through a number of venture capital funds.

Sweetspot check size: $ 1M

Thesis: We invest in talented founders, and support them to build exceptional companies.

Grove Ventures

About: Grove Ventures is an early-stage venture fund, focused on investing in cutting edge deep technology startups.

Thesis: Grove Ventures is an early-stage venture capital investment firm which places believes that the Deep Future is now and partners with exceptional Israeli entrepreneurs. With a quarter-billion dollars under management, Grove invests in leading startups developing hard-to-replicate solutions at the intersection of technology, science, and applicablemarket needs. The fund places significant emphasis on its core principles of putting people first, close cooperation, and value-creation.

Atlantic Bridge Ventures

About: Atlantic Bridge Ventures is a Pan European venture capital company with offices in Dublin and London. Atlantic Bridge focuses on making early and mid stage technology investments in semiconductors and software across Europe with a strong focus on a transatlantic business building and investment exit model. Atlantic Bridge brings together a unique team of technology entrepreneurs, corporate finance and investment experts.

Thesis: We invest in entrepreneurs with the ambition to create world-class companies of scale

Voima Ventures

About: Voima Ventures helps founders accelerate the growth of deep technology ventures to global markets. We shed light on the ideas and technology that require time and courage to build.

The way we work is simple: we combine science-driven innovation together with the Nordic serial entrepreneurial experience and a global mindset.

Riot Ventures

About: Riot Ventures invests in deep technology with a focus on intelligence, sensing and control, communications, mobility and security.

Good Growth Capital

About: Early-stage VC firm known for its exceptional expertise in finding, cultivating and assessing complex science and deep-tech start-ups.

Walden Catalyst

About: Walden Catalyst provides early-stage investments and operational expertise in data, deep tech, AI, cloud, and digital biology.

K9 Ventures

About: K9 Ventures is a technology focused Pre-Seed fund based in Palo Alto, California.

Sweetspot check size: $ 400K

Traction metrics requirements: We don’t look for traction, because at the stage at which we invest, by definition there isn’t any.

Thesis: We look for founders who are capable of building their own product and capable of leading the business.

Embark Ventures

About: Embark Ventures focuses on pre-seed and seed stage deep tech investments in sectors.

Deep Tech-Specific Fundraising Insights & Global Trends

Raising capital for Deep Tech startups is fundamentally different from traditional software or consumer ventures. Founders face a unique set of challenges, but also benefit from opportunities that can lead to outsized impact and returns.

Key Challenges

Deep Tech startups typically require longer R&D cycles and higher upfront capital, making early revenue generation and market validation difficult. The average time from founding to the first commercial product in Deep Tech is around 5-7 years, nearly double that of SaaS startups. This extended timeline means founders must convince investors to back not just an idea, but a vision that may take years to materialize.

Additionally, Deep Tech ventures often need to pass rigorous technical due diligence, requiring founders to clearly articulate both the science and the business case. Recruiting specialized talent—such as quantum engineers or synthetic biologists—remains a global bottleneck, with demand outpacing supply. Regulatory hurdles and the complexity of intellectual property (IP) protection add further layers of risk and complexity.

Key Opportunities

Despite these hurdles, Deep Tech offers high barriers to entry and strong defensibility through IP, making successful startups highly attractive to investors. There is also a growing appetite among VCs and corporates for “hard tech” solutions that address global challenges—especially in climate, food, and health.

Governments worldwide are increasing grant funding and non-dilutive support for Deep Tech, with the EU’s EIC Accelerator and the US Department of Energy’s ARPA-E program both expanding budgets in 2025. Strategic partnerships with corporations and research institutions can provide not just capital, but also access to infrastructure, expertise, and early customers.

Key Global Trends in Deep Tech (2025)

The Deep Tech landscape in 2025 is defined by rapid technological breakthroughs, increased global investment, and a growing recognition of the sector’s potential to address some of humanity’s most complex challenges. Here are the most important trends shaping Deep Tech innovation and fundraising worldwide:

- AI and Machine Learning as Deep Tech Catalysts: Artificial intelligence and machine learning remain at the core of Deep Tech innovation. In 2025, foundational AI models are not only powering software but are also accelerating advances in robotics, drug discovery, materials science, and autonomous systems. The convergence of AI with other Deep Tech domains—such as quantum computing and advanced manufacturing—enables startups to solve previously intractable problems and create defensible IP.

- Quantum Computing and Advanced Materials: Startups are developing quantum hardware, software, and cryptography solutions, while breakthroughs in materials science—such as next-generation semiconductors and nanomaterials—are enabling new applications in energy, electronics, and healthcare. These advances are attracting both private and public capital, as governments recognize the strategic importance of quantum and materials innovation.

- Climate and Industrial Tech: Deep Tech is playing a pivotal role in the global push for decarbonization and sustainable industry. Startups are developing advanced battery technologies, carbon capture solutions, and next-generation manufacturing processes. The intersection of Deep Tech and industrial innovation is also driving the adoption of robotics, IoT, and AI-powered automation in sectors like energy, logistics, and construction.

- Globalization and Cross-Border Collaboration: Deep Tech innovation is no longer confined to traditional hubs like Silicon Valley. Cities such as Shenzhen, Tel Aviv, Berlin, and Singapore have emerged as global Deep Tech centers, supported by strong university ecosystems, government incentives, and international VC activity. Cross-border investment and research partnerships are on the rise, enabling startups to access new markets, talent, and capital. This globalization is also driving the standardization of regulatory frameworks and IP protection, making it easier for Deep Tech founders to scale internationally.

- Government and Corporate Involvement: Governments worldwide are ramping up support for Deep Tech through grants, innovation programs, and public-private partnerships. The European Union’s Horizon Europe program and the US CHIPS Act are channeling billions into Deep Tech R&D and commercialization. At the same time, large corporates are launching or expanding their venture arms to invest in and partner with Deep Tech startups, accelerating technology transfer and market adoption.

- Deep Tech Commercialization and Exit Trends: The commercialization pathway for Deep Tech startups is becoming clearer, with more corporate acquisitions, IPOs, and late-stage funding rounds. Non-traditional investors, including sovereign wealth funds and family offices, are increasingly participating in Deep Tech deals, providing founders with more diverse funding options.

- Talent and Ecosystem Development: The global race for Deep Tech talent is intensifying, with startups, corporates, and governments competing for top scientists, engineers, and entrepreneurs. Specialized accelerators, incubators, and university spinouts are playing a critical role in nurturing early-stage Deep Tech ventures.

Crafting Your Deep Tech Pitch

1. Storytelling Your ScienceTranslate complex technology into a clear, compelling narrative. Investors want to understand not just how your solution works, but why it matters. Start with the problem, articulate your unique approach, and highlight the potential impact. Use analogies and visuals to make your science accessible without oversimplifying.

2. Demonstrating Technical ValidationShowcase your proof-of-concept, prototypes, and any early data. Highlight your team’s scientific credibility and track record. Be transparent about technical risks and your strategies for mitigation—investors appreciate honesty and a plan for overcoming obstacles.

3. Financial Projections & MilestonesSet realistic timelines for R&D, product development, and commercialization. Clearly outline how you will use the funds and what milestones you aim to achieve (e.g., prototype completion, regulatory approval, first customer pilots). Capital efficiency and a clear de-risking path are critical for Deep Tech VCs.

4. IP StrategyClearly explain your intellectual property position—patents, trade secrets, or exclusive licenses. Articulate how your IP creates a competitive moat and how you plan to defend it as you scale.

5. Team & AdvisorsHighlight the depth and diversity of your team’s expertise, including both technical and business acumen. Leverage advisors with industry connections and fundraising experience to build credibility and open doors.

6. Leverage Non-Dilutive FundingMany Deep Tech startups successfully combine VC funding with government grants, R&D tax credits, and corporate partnerships. This approach can extend your runway and reduce dilution, making your company more attractive to investors.

Related resource: Our Teaser Pitch Deck Template

Related resource: How To Build a Pitch Deck, Step by Step

Networking, Accelerators, and Incubators for Deep Tech Founders

Leading Deep Tech Accelerators and Incubators (2025)

Specialized accelerators and incubators play a pivotal role in nurturing Deep Tech startups, providing not just funding but also mentorship, lab access, and industry connections. Some of the most influential programs globally include:

- Y Combinator (US): While sector-agnostic, YC has a growing track record in Deep Tech, supporting startups in AI, robotics, and biotech.

- SOSV (US/Global): Through programs like IndieBio and HAX, SOSV is a leading backer of science-driven and hardware Deep Tech startups.

- DeepTech Labs (UK): A Cambridge-based accelerator focused exclusively on Deep Tech, offering a structured program and access to top-tier mentors [DeepTech Labs].

- Plug and Play Tech Center (US/Global): Runs verticals in IoT, energy, and health, connecting startups with corporate partners worldwide [Plug and Play].

- Hello Tomorrow (France/Global): Runs a global challenge and accelerator for science-based startups, with a strong focus on commercialization.

- Techstars (Global): Offers mentorship-driven programs in multiple Deep Tech verticals.

Major Industry Events and Conferences

Attending and pitching at major Deep Tech events is a proven way to gain visibility, connect with investors, and stay ahead of industry trends. The 2025 calendar features several must-attend conferences:

- Hello Tomorrow Global Summit (Paris): The world’s leading Deep Tech event, bringing together startups, investors, and corporates.

- Slush (Helsinki): A global gathering for tech founders, with a strong Deep Tech track and investor presence.

- Web Summit (Lisbon): Features a dedicated Deep Tech track and attracts a global audience.

- Deep Tech Atelier (Riga): Focused on commercialization and scaling of Deep Tech innovations in Europe.

- CES (Las Vegas): The world’s largest tech show, increasingly featuring Deep Tech hardware and AI.

- TechCrunch Disrupt (San Francisco): A launchpad for breakthrough technologies and investor connections.

Find an Investor for Deep Tech with Visible

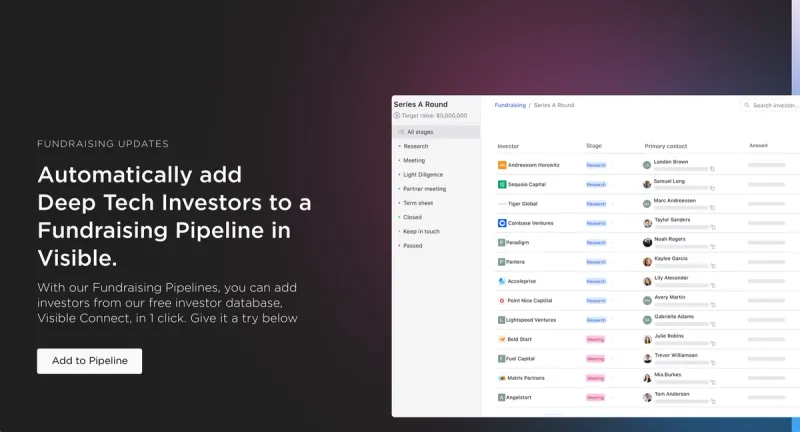

Visible helps founders connect with investors using our connect investor database, find VCs specifically investing in Deep Tech here.

For Deep Tech startups, securing the right investors is critical as it goes beyond mere funding. These investors bring specialized expertise and strategic insights specific to the Deep Tech sector, and their guidance is invaluable in navigating the unique challenges and opportunities within the space.

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.