When is the right time to raise a Series A round of funding?

You made it past your initial seed funding round which means you successfully raised money on a story that got your investors excited about you as a leader and the vision of what you were building. You then turned that capital into a solid customer base, consistent revenue, or are hitting other KPIs relevant to your company and now you’re thinking about raising your Series A. At this point, you may be wondering when to start the fundraising process, how investor expectations have changed, and how to get in front of the right investors.

You are right to be asking yourself all these questions and mentally preparing to transition to a full-time job of fundraising. The reality is, Series A financing is much harder to obtain than seed financing. First Round Capital shares a founder’s perspective, “Our seed round was super fast and hyper-competitive, and then we went into the A and started getting interrogated about our data. It was like graduating from elementary school and going straight into college.”

To better understand how investors are thinking about the A round, Andrew Chen of Andreessen Horowitz distilled the early-stage investment thesis into this:

- Pre-seed – Bet on the entrepreneur

- Seed – Bet on the team

- Series A – Bet on the traction

- Series B – Bet on the revenue

- Series C – Bet on the unit economics

There’s no getting around the fact that Series A are the new Series B and the heightened competition for capital at this stage means you need to go into the Series A fundraising process equipped with the knowledge and a level of preparedness that will set you apart from the others.

The right time to kick off your Series A fundraising process is… before you think. It’s a rare breed of founder that will tell you they closed a financing round in LESS time than they thought it would take.

Y Combinator suggests kicking off your fundraising when you have 9 months of runway left but you should be nurturing informal relationships with investors before then (view prospective Investor Update templates here). Additionally, you should always have a finger on the pulse of your burn rate and how it influences your runway. If you don’t know your key metrics cold, you’re not ready to fundraise.

Recommended Reading: The Understandable Guide to Startup Funding Stages

What if you’re running out of cash but still not hitting Series A benchmarks?

With the hurdles for Series A financing reaching new heights, it’s good to think about whether you’re really ready to set these types of expectations with investors. If not, it’s becoming more common for startups to raise seed extensions (Seed II, Seed Extension, Pre-A, etc) to supplement their growth until they are able to hit the milestones that Series A investors are looking for. If this sounds like you, be sure to know the difference between a bridge round and post-seed round.

The name of the financing round will attract different types of investors so be sure to consider this early on when developing your fundraising strategy.

What is the purpose of a Series A round?

To keep things straightforward, your seed-stage round was about achieving product-market fit. Your Series A round, typically between $2 million to $15 million, is about expanding your customer base and product offerings. Investors will also want to see you develop a strategy for generating long-term profit during this stage.

What types of investors are good for Series A?

It’s important to think strategically about what type of investors you want joining your cap table for your Series A, especially since the average investor + founder relationship is 8-10 years and investors’ brand, reputation, and resources can influence your chances of success.

To start narrowing in on what your potential investors will look like, check out this All Encompassing Fundraising Guide for Startups which includes an Ideal Investor Persona outline.

If you’re further along in the fundraising process and want to due diligence on an investor, here are some diligence questions to consider:

- What do other founders in their portfolio (funded or failed) have to say about what the investor was like to work with during hard times?

- What do your current investors think about this investor? Does this investor have a reputation for working well with others?

- Does this investor have deep pockets? Are they a potential source of follow-on funding?

- Do they have great brand recognition? Will being associated with their brand give you instant credibility?

- Do they provide support in areas you need to grow? (CEO forums, marketing resources, etc?)

- How available were they during the diligence process? (If they’re busy and hard to reach during diligence, this will likely remain the same or be worse after the deal closes.)

Do their ‘terms’ signal they’re in it for the long haul?

Avoid these Common Series A Mistakes

Being unclear about how much you’re raising

Ranges look indecisive and unresearched. Investors know that your numbers may change slightly but you should be raising the minimum amount needed to hit your Series B milestones. Y Combinator suggests this is typically ~3-5x your current numbers. Be sure to do your research in advance and have a specific ask.

Not learning from your investor meetings

You’re going to spend a lot of time talking with different investors but the truth is there is only a 1-10% chance that investor is going to give you money. This is why James Currier, General Partner at NFX, says it’s better to view meetings with investors as “an opportunity for you to build your company using the information you get from the VC, not just the money you might get. This will give you a higher return on your time.”

This means your pitch deck should be evolving over time as you meet with investors.

Not tailoring the deck to the investor

Just as you wouldn’t send the same resume and cover letter to different employers, you should be tailoring your Series A pitch deck to each investor.

Do some research in advance about their investment thesis, criteria, and current portfolio. Make sure you emphasize areas you know they care about.

LinkedIn can be a helpful tool to get to know more about an investor before your first meeting. For example, by taking a quick look at their profile you could learn they used to work for a potential customer of yours and then you can include their logo in your deck.

Wasting time on investors

You will certainly come across investors who will drag you along in the diligence process, keeping your hopes up, only to hear a ‘no’ for obvious reasons later on. Sometimes investors use the diligence process to do their own research on your sector even though they have no intention in investing.

To avoid this, listen for doubts during your first investor meeting. If they don’t think your market is big enough or don’t get excited about the problem you’re solving, pay attention to these signals.

You can also Automate your Investor Updates to keep relationships warm without wasting time.

Recommended Reading: How to Write the Perfect Investment Memo

Tips on Pitching a Series A Round

Before you start setting up meetings with potential investors it’s wise to invest ample time clarifying your fundraising narrative and creating a winning pitch deck.

Tip #1: Start brainstorming your Series A fundraising narrative in a word document before you even open PowerPoint. This will allow you to focus on the important parts of your story without getting distracted by slide formatting.

Once you feel confident about the fundraising narrative you’ve outlined in a document, it’s time to make it more digestible for investors.

Tip #2: Create a ‘listen to me’ version of your deck in PowerPoint with more visuals and less text (10-14 slides) and a ‘read me’/send away version with more detail (20-22 slides).

Here’s an overview of recommended slides to include in your Pitch Deck:

- Company Purpose

- Problem

- Solution

- Why Now

- Market Size

- Competition

- Product

- Traction

- Business Model

- Team

- Financials

- Ask

- Summary

- Back Pocket Slides

Tip #3: Practice your pitch with current investors, peers, friends/family. Your back pocket slides should include information that answers the most common questions people are asking.

Let’s break down what to include in your Series A Pitch Deck even more:

Company Purpose

This should be concise and can be displayed in a memorable, punchy sentence on your first slide.

Problem

The title of the slide should boldly communicate the problem you are solving. Consider including a graph/figure/image to demonstrate the gravity of the problem.

This is your chance to connect with the investor and get them to relate to what you’re trying to accomplish. Are there storytelling examples you can give? How can you make them ‘feel’ the problem?

Solution

This slide should focus on ONE solution and it should come across as clear and concise.

You should answer the questions — How are you solving the problem? What is your vision and strategy? How are you making the customer’s life better?

Feel free to highlight use cases.

Why Now

Emphasize why investors are joining you at the right moment in time. You can highlight the historical evolution of your industry and define recent trends that make your solution possible. It’s important to highlight growth trends in the market so as not to assume the market has already hit its peak.

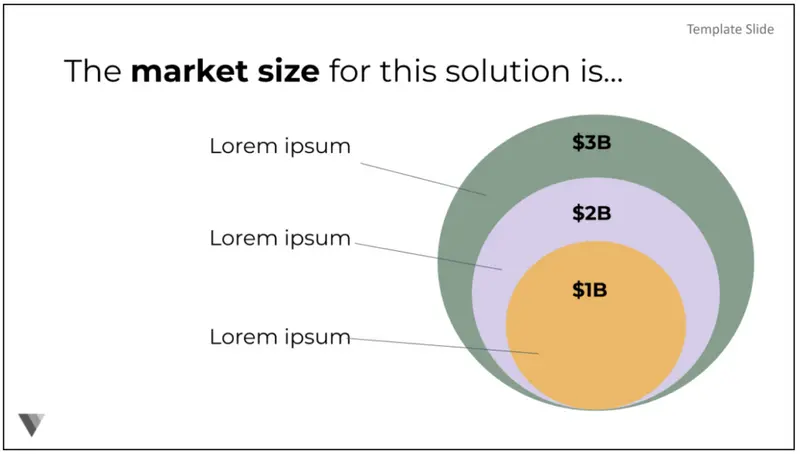

Market Size

Investors want to know you’re creating a solution for a BIG market because market size correlates to potential returns for an investor down the line. Be sure to tell them just how big the space is and your potential market share. To do this you can calculate the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

Competition

It’s never a good idea to talk bad about your competitors or say you’re the only solution on the market, both approaches make you seem naive. Instead, focus on how you are differentiated and solving a pain point keenly felt by the market.

Tip #4: If you don’t think you have competitors, you haven’t done your research. Crunchbase or Pitchbook are a good place to research other players in the space.

Product

Get investors excited about the state of your product but don’t spend too much time walking through all the hard work it’s taken you to get there. While reaching milestones on time demonstrates your ability to execute, investors care less about past work and more about where you’re headed.

In this slide you can highlight the product features, architecture, IP, etc. Be sure to also share your product roadmap.

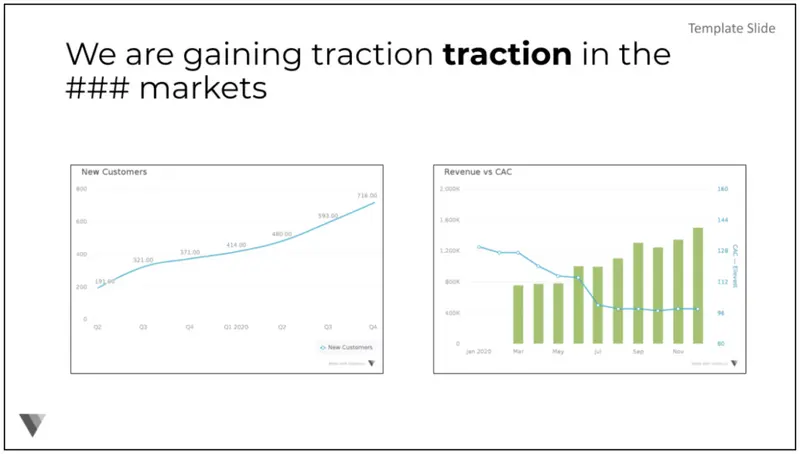

Traction

This is where you highlight your key metrics. This is arguably the most important slide because you’re showing the facts to back up your narrative.

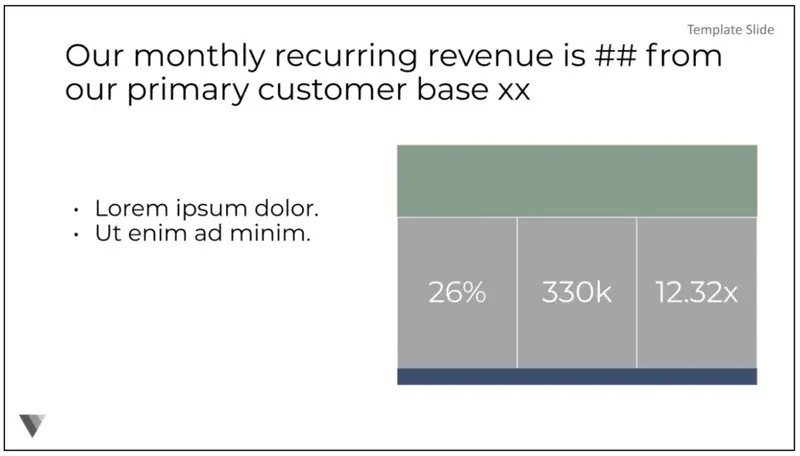

Business Model

This is where you describe how you are making money, your pricing strategy, margins, etc. If it makes sense, you can highlight your sales funnel or metrics such as average account size.

This slide should make your investors very confident in the future positive cash flow of your company.

Team

Just include your key team members and bullet point bios. Consider including logos from reputable past experiences if it makes sense. You can include a separate slide for Advisors.

Financials

Investors spend over 23% of their time reviewing this slide. Include just a summary on this slide and be sure to clearly communicate your numbers.

Be sure to include a more detailed overview of your P&L statements, balance sheet, cash flow, and cap table either in backup slides or another shareable format.

Asks

Outline your funding roadmap. What have you achieved with your funding to date? Clearly state how much you are asking for and what this capital is going to help you achieve.

Summary

This final slide tends to stay up on the screen for a while. Instead of including a ‘thank you’ slide, include a summary of your key points. This can spur a more robust Q&A and is an effective way to summarize the most poignant parts of your pitch.

Affordable ways to build a great looking Pitch Deck

If building attractive slides is not your strong suit, there are a lot of excellent pitch deck designers to be found online. However, if you’re looking to improve your deck design but not break the bank, consider looking for pitch deck designers on UpWork, Fiverr, or 24slides for a quick turnaround.

While it’s important to have professional looking slides that effectively communicate your fundraising narrative, remember, investors invest in teams not slides. Aim to be well-rehearsed, conversational, and treat your Q&A like an interview. In addition to evaluating your business’ potential, investors are using this time to assess you for coachability, credibility, and personability.

The Do’s and Don’ts of Creating your Series A Slide Deck

Do:

- Do brainstorm your pitch narrative in a Word document first so you can focus on the narrative before getting distracted by formatting. Make a copy of this framework to get started.

- Create a ‘listen to me’ version with more visuals and less text (10-14 slides) and a ‘read me’/send away version with more detail (20-22 slides)

- Aim to present it in 20 minutes

- Do use 34 point font for your ‘listen to me’ version

- Do include a one sentence summary at the top of each slide

Don’t:

- Exceed 25 words per slide

- Use acronyms

- Downplay your competitors

- Use animations or transitions

- Use photos without captions or titles

- Use excessive explanations or caveats

- Use excessive branding per slide

Recommended Reading: How to Write the Perfect Investment Memo

Download our Free Template

The process of raising your Series A may seem daunting, especially since only ~30% of founders who raised seed funding close a Series A round. This is all the more reason to make sure you’re equipped with the knowledge and resources you need to lead a successful Series A campaign.

Start by clarifying your Series A fundraising narrative before you even dive into your pitch deck. Then you can move onto creating your Series A Pitch Deck by using this template which you will want to iterate as you get feedback from investors.

Related Resource: Pitch Deck Design Cost Breakdown + Options

Next, you should curate a list of prospective investors. You can use Visible’s connect database to narrow in on your list and manage these contacts in a Fundraising CRM.

If you’re not already doing so, you should be sending out regular updates to keep in warm touch with potential investors. Companies you send out regular updates are 300% more likely to get funded. Check out Visible.vc’s library of Investor Update Templates to get started today.