Data Room Providers for Startups

For VC-backed startups, a well-structured data room can be a game-changer. Whether you’re raising capital, managing investor relations, or preparing for an M&A transaction, having an organized and secure space to store critical documents streamlines the process and increases investor confidence.

But with so many data room providers available, how do you choose the best one for your startup? Should you opt for a free data room or invest in a premium provider? This post breaks down everything founders need to know about virtual data rooms (VDRs), their use cases, features, costs, and best practices for setup and management.

1. What is a Virtual Data Room?

A virtual data room (VDR) is a secure online repository used for storing and sharing sensitive business documents. Unlike traditional cloud storage solutions, VDRs are designed specifically for high-stakes transactions like fundraising, mergers & acquisitions (M&A), and investor relations.

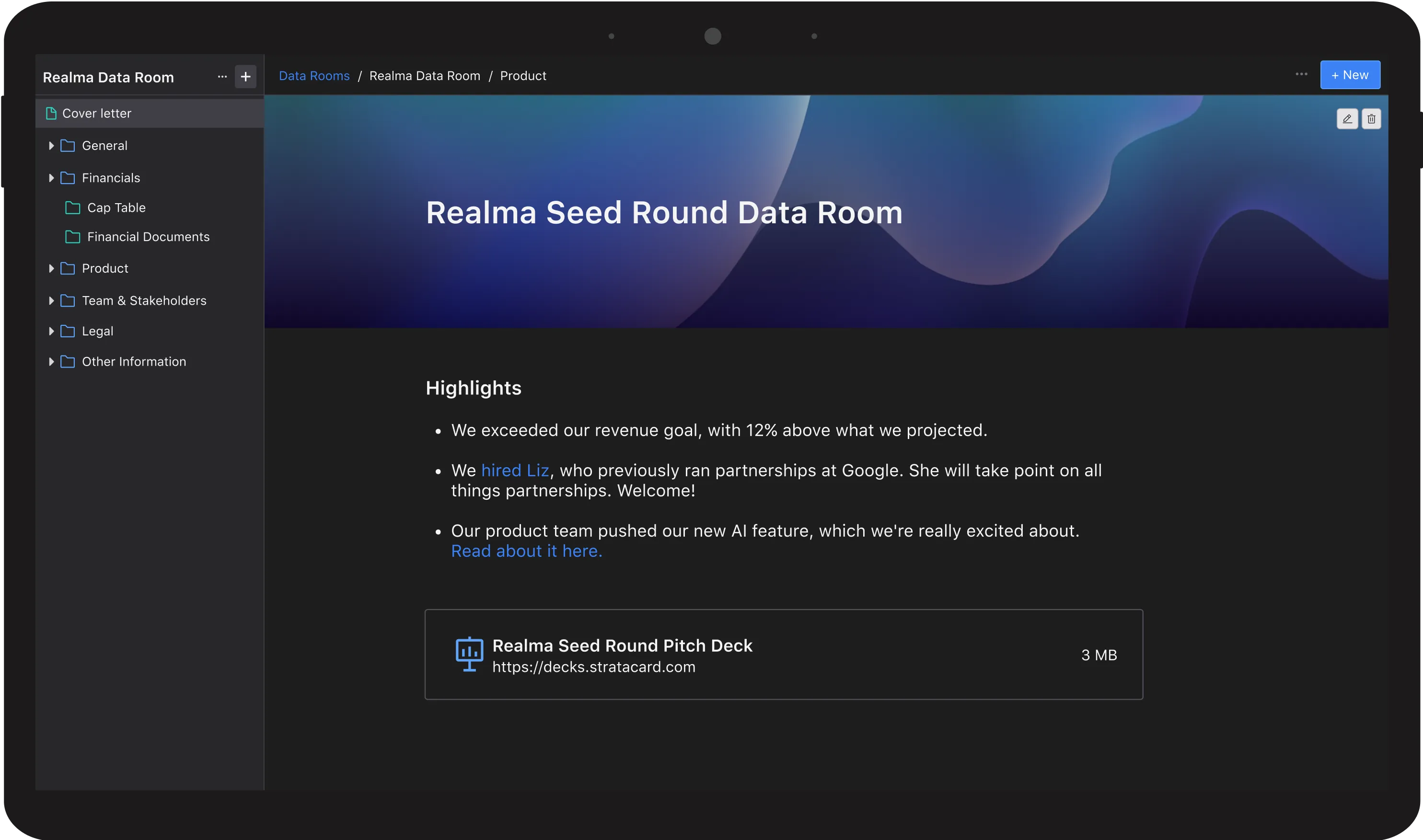

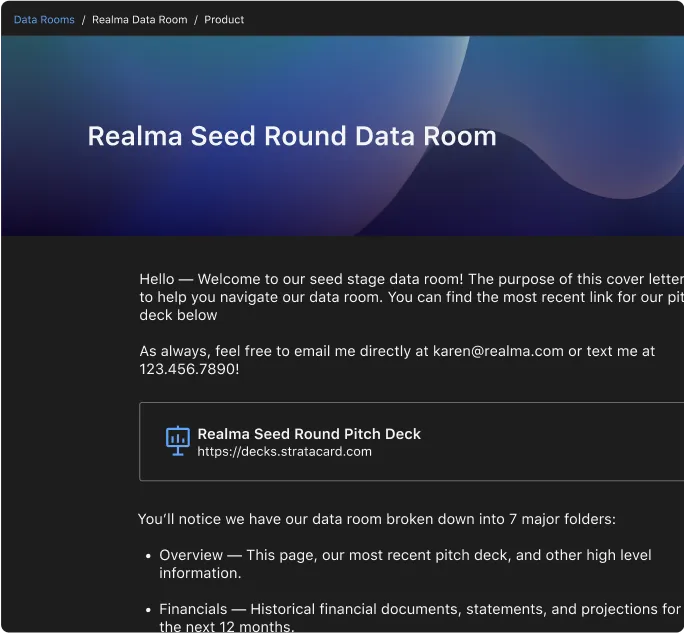

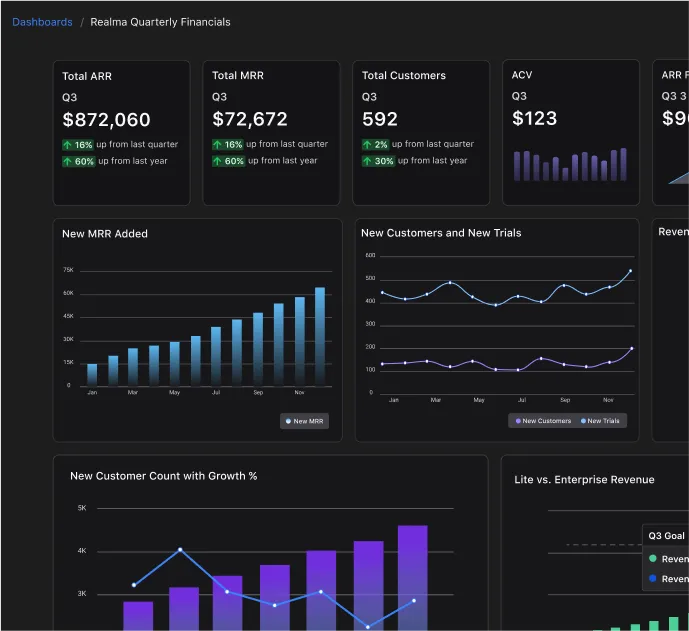

Startups use virtual data rooms in several ways. For fundraising, they help share financials, pitch decks, and legal documents with potential investors. In M&A transactions, they facilitate due diligence by providing acquirers with access to critical business information. They are also valuable for investor updates, helping current investors stay informed with organized, real-time reporting. Many founders initially use free data room providers before upgrading to a more robust platform as their startup grows.

Some of the best virtual data room providers offer industry-leading security, ease of use, and scalability. Whether you are looking for the best data room for startups for free or considering the best virtual data room for startups with paid options, it's essential to understand the trade-offs between free and premium platforms.

2. Why Founders Need a Data Room for Investors

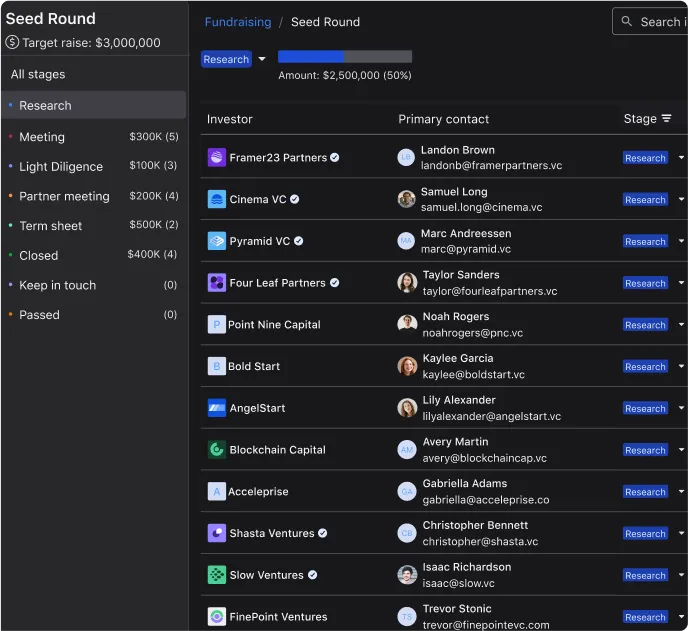

Investors expect startups to have a structured, well-organized data room when raising capital. A poorly maintained data room can slow down due diligence and even cost you an investment opportunity. A well-prepared data room accelerates due diligence, enhances credibility by signaling professionalism, and strengthens investor relationships by keeping them engaged and informed.

For a fundraising data room, certain documents are essential. These include the pitch deck, financial statements such as profit & loss, balance sheet, and cash flow reports, the cap table, key contracts and agreements, legal documents and compliance filings, and the product roadmap and metrics. The Series A data room checklist should also include detailed KPIs and revenue projections to give investors a clear financial picture. A well-structured data room reduces back-and-forth emails and ensures investors have what they need to make decisions quickly.

3. Features to Look for in the Best Data Room for Startups

Not all data room providers are created equal. Several key features distinguish the best options. Security and compliance should be a priority, with end-to-end encryption, role-based access controls, audit logs to track document access, and industry-standard virtual data room certification for data security compliance.

Ease of use is also critical. The best data room providers offer an intuitive setup with drag-and-drop uploads and integration with CRM and investor management tools. Cost and scalability are other important factors. While free virtual data room providers may work for early-stage startups, growing companies often require advanced features. It’s essential to look for flexible pricing plans that scale with business needs.

4. Free vs. Paid Data Room Providers: Which is Right for You?

Many founders look for a free data room for startups to save costs. While free options work in the early days, they often come with limitations such as restricted storage, lack of advanced security features like encryption and access controls, and limited branding or customization options. Some of the best free data room providers may offer basic functionality, but they may not be suitable for investor-ready due diligence processes. If you’re preparing for M&A, Series A fundraising, or investor due diligence, a premium data room provider may be worth the investment. For M&A transactions, it's important to consider the best data room providers for M&A, as they often include specialized features tailored to high-security transactions. Some M&A data room providers in the USA offer tools such as automated redaction and AI-driven analytics to enhance due diligence.

5. Best Data Room Providers for Different Use Cases

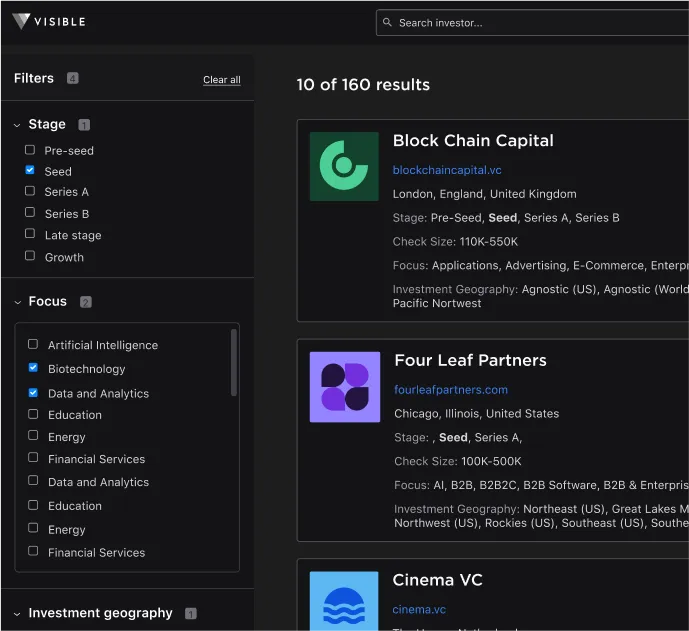

Different business needs require different types of data rooms. For fundraising and investor relations, a data room should be easy to navigate, secure, and shareable with multiple investors. Features like automatic investor tracking and permission controls are helpful. The data room for investors checklist should include all relevant documentation, from legal contracts to operational metrics.

For M&A transactions, data rooms require high-level security, advanced analytics, and audit trails to track document access. Some of the best M&A data room providers offer features that cater specifically to large-scale transactions. If you’re considering an acquisition, ensure your provider supports these needs. Free data room providers for M&A may be an option for smaller deals, but for complex transactions, advanced security and compliance features are critical.

Some startups also use data rooms for ongoing investor updates and portfolio management, providing quarterly updates and real-time reporting to keep existing investors engaged and informed. Virtual data room software can help automate these reports and provide insights on investor activity.

6. How to Set Up a Data Room

Setting up a data room requires careful planning. The first step is to choose the right provider based on security, usability, cost, and scalability. Once selected, structure the data room with clear folders for financials, legal documents, team details, and operations. Next, set user permissions to control who can view, edit, and download sensitive information. It’s crucial to keep the data room updated with the latest investor reports and metrics. Before sharing access, review the data room from an investor’s perspective to ensure everything is clear and accessible. Reviewing data room examples from successful fundraising rounds can help founders set up an optimized structure.

7. Frequently Asked Questions

How much does a virtual data room cost?

Costs vary based on platform functionality like analytics and security features as well as user limits. Some startups begin with a free virtual data room provider before upgrading. Virtual data room for startups cost considerations include the number of users, document storage needs, and advanced security features.

Can I use a free data room for fundraising?

Yes, but free data rooms may lack essential security features and storage capacity, making them less ideal for later-stage fundraising rounds. Free virtual data room providers may be a good starting point, but premium options offer better security and compliance.

What’s the difference between a virtual data room and a file-sharing service?

Unlike general cloud storage, virtual data rooms provide enhanced security, access controls, and compliance tracking, making them ideal for financial transactions.

Choosing the Right Data Room for Your Startup

A virtual data room is an essential tool for VC-backed startups, whether for fundraising, investor updates, or M&A transactions. Early-stage founders may benefit from a free data room provider, but scaling companies should consider investing in a secure, investor-ready solution. Organization and security are key, ensuring the data room is structured, accessible, and regularly updated. The right data room provider saves time, builds investor trust, and accelerates dealmaking. By setting up a well-structured and investor-ready data room, you position your startup for smoother fundraising and successful transactions.