With uncertainty in the VC industry, LPs are being more cautious and scrutinous than in previous years. Meanwhile, LP teams are often understaffed meaning they lack the bandwidth to spend time doing due diligence on the growing number of VC funds.

What does this mean for you as you kick off your next fundraise?

You need to make it as easy as possible for LPs to understand, analyze, and build conviction about you and your fund. A well-structured, thoughtful data room plays a major role in streamlining the VC fund diligence process.

This article highlights how to build a data room LPs will get excited about.

What is a Data Room for LPs?

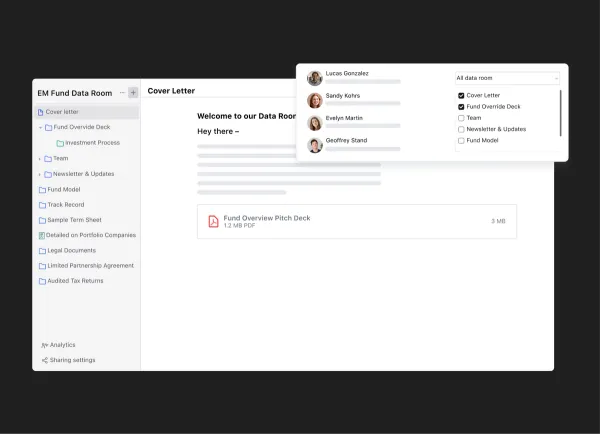

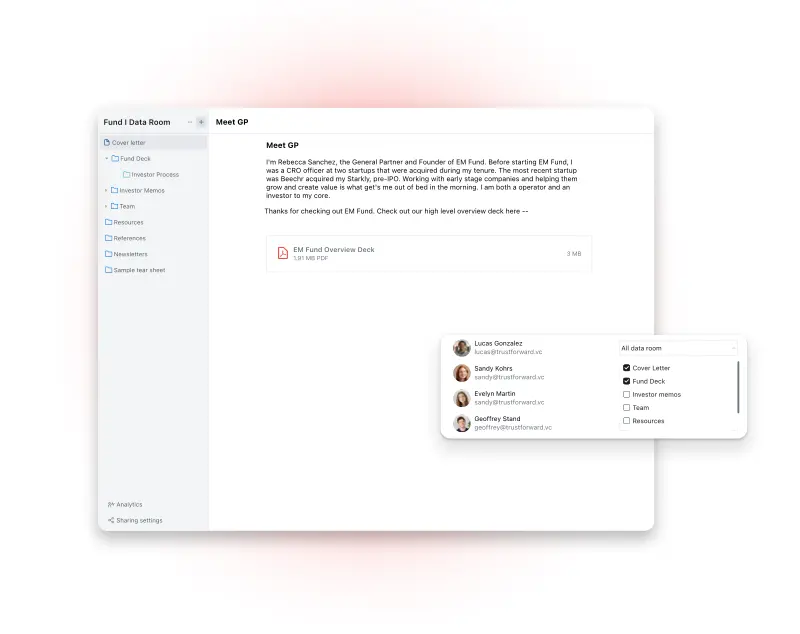

A Data Room is a repository comprised of folders, files, and pages created by potential fund managers to give their potential investors access to sensitive information about their team, fund, and track record. LPs use this to ensure a fund meets their own investment criteria. It’s in part a marketing tool, in part a legal requirement, and altogether a critical step in being able to raise capital from Limited Partners.

Learn more about Visible's fundraising tools for emerging managers.

When do I need to Create a Data Room for LPs?

You should start preparing your data room a month or two before officially kicking off your fundraise. At a minimum, you have a solid pitch deck in place and should be familiarizing yourself with an LP data room file checklist to start forming a plan around what content you’re going to need to get in order.

Download Visible’s LP Data Room Checklist to start preparing your Data Room.

What you need to avoid is having an LP ask for access to your data room and scrambling at the last second to put something together. That’s not the first impression you want to give when you’re trying to get someone to trust you with their money.

LP Data Room Pro Tips

- Include excel files instead of PDFs wherever relevant. Analysts at Limited Partners organizations are going to be extracting and analyzing any data you give them so share it in excel format to make it easier on them.

- Every LP is different so be prepared to share different Data Room views with different people.

- Share your initial Data Room with a few LPs you trust and get feedback and then update as needed.

- Consider sharing a table of contents first, and then asking what an LP needs access to, to save LPs from wasting time digging through all your folders to find what they need.

- Always keep your founders’ privacy in mind when including information on portfolio companies.

- Investors have limited bandwidth to spend on diligence. Focus on the quality, not the quantity, of the documents in your data room.

What should be included in my Data Room for LPs?

We’ve broken down our list below into two sections:

- Initial Interest Data Room which includes the information you’d want to share with LPs who are just getting familiar with your fund.

- In-Depth Data Room which includes more sensitive information that you’d want to share only when LPs have expressed serious interest in your fund.

Initial Interest Data Room for LPs

Cover Letter

A cover letter is a great way to add a personal touch to your data room (remember LPs are looking at hundreds of other data rooms) and should include high-level information about the GP and the fund.

Your cover letter can answer questions like why you’re starting this fund, why you’re uniquely qualified, and your contact information.

Table of Contents

Including a table of contents is a great way to quickly help investors navigate to the right place to help them find what they need.

Consider making your Cover Letter and Table of Contents public to pique the interest of LPs but make sure the rest of the folders are viewable only upon request.

Pitch Deck

Your pitch deck, especially if you’re an emerging manager, needs to shine. It is the main qualitative piece of content that LPs will use to vet your fund. If your deck doesn’t resonate or intruige an LP, they may immediately pass on viewing the rest of your data room.

The average fund deck is 15-20 pages in length and explains:

- Your Team — Who is on your team and what relevant experience do they bring.

- Sourcing Strategy — How are you uniquely positioned to find and attract deal flow.

- Competitive Advantage — Why will founders choose your fund? What’s your value add?

- Investment Focus — What are you investing in? Why do you know this market, sector better than anyone else?

- Track Record — How have previous angel, personal, and private capital investments performed?

- Fund Structure — What is the size of the fund, stage of investments, and the number of investments.

- Network — Who is in your corner? Who have you collaborated with that could vouch for you?

- Appendix — Additional materials for commonly asked questions.

The list above is inspired by Signature Block’s post on VC Fund Decks that Close LPs.

Investment Process

How are you going to find, attract, diligence, invest in, and support deals that are expected to yield a 10x+ return?

In this folder of your Data Room, compile content that demonstrates an understanding of your investment sector, market, how you will evaluate risk, and your decision-making framework.

Team

Don’t skimp out on this section by just including resumes. Especially if this is your first fund, you need to paint a compelling picture that answers ‘Why YOU?’.

What special experience and skills does your team exhibit? Why should an LP trust you with their capital and also want to engage with you on a regular basis for the next 10 years?

Newsletters or Monthly Updates

Your ability to communicate matters. LPs are investing not only for returns but also for insights. Are you able to analyze market trends, draw your own insights, and share them with stakeholders? Excellent! Include examples in this section.

Visible lets investors embed Updates directly into their Data Rooms.

Fund Model

This should be an Excel file forecast of your investment strategy in practice. It is critical to get the math in your model correct. Incorrect calculations in your model signal a poor understanding of VC fund management that will be hard to recover from.

Your fund model should include your fund size, average check size, management fees, carry, reserve for follow-on, average valuation, target ownership, etc, as it relates to your IRR goals.

To better understand portfolio construction at a high level check out this post.

Be sure to share your model in Excel, not PDF. LPs are going to use this file to stress test your model based on different assumptions.

Track Record

This should be an Excel file spreadsheet detailing your previous investments as well as a roll-up summary. The column headers should include the Company Name, Initial Investment Date, Initial Stage, Current Ownership, Realized Capital, Fair Market Value, Multiple of Capital, and IRR.

Ready to take the next steps with Visible?

If you’re raising your first fund and don’t have a fund track record, include examples of angel investments, SPVs, or personal investments. Be sure to specify how you found the deal and your specific involvement.

Read more about sharing your track record as an Emerging Manager.

Due Diligence Questionnaire (DDQ)

Think of this as a standardized FAQ that LPs will use to easily understand and compare your fund against other funds. This should be a living document and updated over time as you engage with different types of LPs.

No need to recreate the wheel for your DDQ. The Institutional Limited Partners Association (ILPA) has put together a standard template found here.

This concludes what should be in your ‘Initial Interest Data Room’. Keep reading to get a better idea of what LPs ask for once you’ve passed the initial stages of their diligence.

In-Depth Data Room for LPs

The content below is usually only shared when LPs are conducting more in-depth diligence on a fund. It’s not best practice to share these files from the start (unless asked) because investors only have limited attention and bandwidth.

In-Depth Data Room Content:

- References

- Sample Term Sheet

- Details on Portfolio Companies

- Case Studies

- Limited Partnership Agreement

If you’re on your 2+ fund you may also be required to show the following:

- Previous Investment Memos

- Audited Tax Returns

- ESG Policy

Conclusion

Creating a well-organized Data Room is an important step toward making a good impression on LPs during your fundraising process. Preparing your Data Room in advance will help you stand out in today’s competitive VC fundraising environment.

Interested in learning about Data Rooms for VC’s?