Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Reporting

Board Meeting Packet Template

With Q3 wrapping up in a few days, we put together a Pre-Board Meeting Update Template that you can share with your board to help you make the most of your meeting time. By sending over a quick packet before your next meeting it will allow everyone to have time to prepare and come ready to discuss the topics that truly matter to the business.

VIEW THE TEMPLATE HERE >>>

For the sake of simplicity, we broke our Update Template into 5 major sections:

Overview of Previous Quarter

A quick overview of the previous quarter. How did you track against your goals you set at your last meeting? Big Wins? Concerns going into Q3?

Key Metrics

A high level overview of the key metrics you have been sharing with your investors/board. Make sure to include any key events/descriptions for your data over the past period and leave time to discuss any questions at the start of your meeting.

Agenda

Preview the agenda and schedule for your upcoming meeting. Use input from previous meetings and 1-on-1s to set the agenda and make sure the time will be useful for everyone involved. We suggest checking out Sequoia’s template for a board meeting to get started.

Topics of Discussion

Offer an overview of the major issues you would like to tackle during your meeting; “working time”. Without throwing too much information at your investors give them the proper data, questions, asks, etc. that will allow them to ponder the issue beforehand and come to the meeting ready.

Meeting & Financial Documents

Include any necessary financial and meeting documents prior to the meeting. Always a good idea to include financial statements and documents/presentations for your meeting.

VIEW THE TEMPLATE HERE >>>

founders

Reporting

How to Get the Most Out of Your Next Board Meeting

As Q3 comes to an end, it is easy to get behind trying to close last seconds deals, make the right hires, or push product updates but it is vital to stay organized for your Q3 board meeting.

A board meeting is not something founders and CEOs should lose sleep over. If executed and prepared for properly board meetings can become an integral part of your company’s success. However, it is easy to lose focus and can easily turn into hours of tracking down data, reading bullet points off a slide, and losing grip of the conversation.

To help lighten the load of board meeting prep we’ve put together a short guide to help have your ducks in a row before your meeting:

Pre Board Meeting Reporting

Being the CEO presenting at a board meeting it can feel like all eyes and pressure are on you. With sending over a structured report before the meeting you can turn the tables and put the pressure on the board to come to the meeting prepared. You never want to spring any surprises during a board meeting, by sending out the packet ahead of time you’ll avoid said surprises and set the expectation that everyone should come prepared. This will also give everyone a chance to read through the packet, request any changes and avoid tedious discussions during the meeting.

“Sometimes, if someone asked about something and clearly hadn’t done their homework, I’d say, ‘Oh yeah, that’s in the board pack.’ That’s the most damning thing that can happen to a board member — realizing that all of their peers prepared for the meeting and they didn’t.” – Jeff Bonforte (Former CEO of Xobni)

With that being said, it is important that you supply the board with the correct information in a timely manner. Most founders/CEO have found it best to send over their pre-meeting report/packet at least 4 days in advance.

Make the report comprehensive and relevant. This can include financials, wins, losses, near term concerns, plus goals for the next quarter.

Putting together a pre-meeting report can be a long process (and probably should be) as you reflect on the past quarter and lay out your vision for the next quarter. Putting the time in will be worth it as it will save precious time and allow you to discuss what truly matters.

Be on the lookout for a pre-board meeting Visible Update template early next week!

Set an Agenda

Lets face it, getting a group of people in a room to stay focused is next to impossible. To make the most of your time, lay out an agenda and stick to it! We have found that most board meetings should last anywhere from 2-4 hours. Below you will find an example agenda from the team at Sequoia Capital:

Read Sequoia’s guide for preparing a board deck/agenda here.

Ideally, if you sent over your metrics and data beforehand you should be able to shorten the time needed to discuss specific metrics. This will allow to focus on what truly matters over the next quarter; fundraising, hiring, product improvements, etc. Not a bad idea to include your agenda when sending over your board report/packet as well as your board deck.

Related Resource: Crafting the Perfect SaaS Board Deck: Templates, Guidelines, and Best Practices

1-on-1 Meetings

If you are able to carve out time with each of your board members beforehand to discuss any topics one on one – do it! No need for a lengthy discussion but board members will appreciate being kept in the loop and offering input in setting the agenda. If you have any previous asks left hanging now would be a good time to address those. Additionally, this gives you an opportunity to feel out how certain members feel about different topics and votes so you can be prepared to answer any questions and avoid surprises.

Provide Solutions

Take a look back at the previous quarter and ponder your wins, losses, product updates, etc. and have answers ready to any questions you might face. Instead of an in-depth product review it might be most efficient to focus on any of the improvements you made over the last quarter and why you made them. This way you can avoid countless product requests being thrown around from people who are likely not even using your product.

If your sales were down in July, why was that? If your churn was high in August, why was that? While it’s never fun to look back at losses from the quarter it will make your life much easier to have an answer and solution moving forward.

founders

Reporting

How do Your Investors View You?

Last week, we broke down the most popular days to send your investor updates. Check out the charts and data below for a quick refresher:

The least popular date is the 30th of the month. When the page turns on the past month and updates/reports start flooding VC inboxes how do they view you?

The Clockwork CEO

The favorite CEO among investors (when it comes to monthly Updates ;). The “Clockwork CEO” has the same time on the same day set aside every month to sit down and crank out their stakeholder updates. The Clockwork CEO has likely created a rhythmic cadence with their investors and give them a “story” to look forward to on a monthly basis.

The Weekend Warrior CEO

The rare breed of CEO personas (We’re looking at you R.J. Taylor) the Weekend Warrior is one and the same as the Clockwork CEO. Setting aside their Saturday or Sunday morning to sit down and reflect on the past month likely before heading out with the family for the weekend.

The Good Times CEO

The “Good Times CEO” leaves investors feeling great about the company… until the next month when they receive no updates or news from the founders. After a big win or great product improvement the Good Times CEO Update will land in their investors inbox the next morning. Don’t get us wrong – we like to let the good times roll just as much as The Cars but investor’s offer their most value when you are struggling and have specific asks/issues from the previous period.

The Non-Comparable CEO

The “Non-Comparable CEO” sends over structured Updates on a regular basis but still leaves a big question mark in the mind of their investors. Switching, changing, and manipulating metrics on a monthly basis leaves everyone involved scratching their head as the next set of data comes rolling in. So how do you avoid misleading numbers?

The Buzzer Beater CEO

The “Buzzer Beater CEO” leaves their investors on the edge of their seats and always get their Updates across; even if it is the last second. As end of month tasks pile up, the dreaded investor update takes a back seat and is often missing major details and leaves dots for the investor to connect.

The Missing in Action CEO

The “MIA CEO” is the one that keeps their investors up at night. After the initial enthusiasm that comes with new investors, you find yourself in the “trough of sorrow” and have yet to send an Update after that first polished and optimistic Update. Believe it or not, most investors have made it through the “struggle” and are an integral piece in helping your company bounce back to that initial enthusiasm.

founders

Metrics and data

6 Free Google Sheet Templates to Jumpstart Your Startup Reporting

As the old adage goes, “you can’t improve what you don’t measure.” When building a startup, it is incredibly important to keep tabs on the metrics, data, and financials that keep your business headed in the right direction. Building your own templates and tracking resources can be time-consuming for a busy founder. Thankfully, there are countless free templates and resources to help you get started in just a few minutes.

Check out a few of our favorite free Google Sheet templates to help you better your startup reporting below:

An Open Sourced Financial Model for SaaS Startups

In the 5th iteration of his SaaS Financial Model, Mike Simmons, the CEO of CredSimple, offers an open sourced Google Sheet template with explanations and resources for the components in the model; ranging from hiring, fundraising, and growth plans. From Mike himself:

“I decided to create an open source template so that other founders can benefit from the work that we’ve done. In this project, I have tried to thread the needle between robust and not too complicated or specific. It has been tested by several investors and MBA interns and has proven to work well. But it is up to you to adapt it for your own needs.” Read more here.

Runway and Cash Forecasting Tool

From the original post by Taylor Davidson of Foresight.is:

“This tool is used for forecast your cash and runway. It’s intended to be a simple model with easy inputs for expenses, revenues, and external funding, so that you can get a handle on burn, cash and runway quickly and easily. Input your revenues and costs, and the model will automatically create charts of your burn and runway (over 36 months), a summary of your operating expenses, and an optional sources and uses chart.”

Ecommerce Google Sheet Template

Dave Ambrose of Steadfast Capital lays out what they have found to be their most important Ecommerce metrics. A few of the major points in the template are the source for customer additions as well as the Contribution Profit (you can read Dave’s original twitter thread here). Read more on the model here.

Related Reading: Our Guide to E-Commerce Metrics (with Google Sheet Template)

Customer Lifetime Value Template

There’s a reason why many experts insist Customer Lifetime Value (we’ll use LTV for short) is the most important metric for your startup. The data points you gather for the LTV formula can help assess the overall health of your company. Not only does LTV provide insight into the long-term trajectory of your startup, but it also gives immediate insight into specific areas that need improvement. Knowing how valuable it is to gain each customer is essential.

We created a Google Sheets template that will allow you to plug in your unique numbers to calculate both your LTV and CAC. Read more here.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Inside Sales KPI Template

Every company should also know the progress of their sales team, the goals they need to hit and make sure management understands the return. Don’t forget about the intangibles either. Conner Burt, Chief Operating Officer at Lesson.ly, said the long-term prospects for sales reps can often be about more than just filling a funnel.

“Your building a bench that you can use to promote sales reps to quota bearing sales people. That’s an intangible benefit.”

With this in mind, we built a simple Inside Sales KPIs template for sales teams in Google Sheets. It is flexible so you can remove any irrelevant info, manipulate it or add anything missing that fits your process. Read more here.

Key SaaS Metrics Template

For SaaS companies, finding, tracking, and measuring your key metrics is key to success. In order to help you get started with the key metrics, we’ve put together a free Google Sheet template. Our SaaS Metrics Template automatically calculates your key SaaS metrics like MRR, ACV, churn, CAC, payback period, and more. Simply enter in your new customer data and the template will handle the rest.

Related Reading: Our Ultimate Guide to SaaS Metrics

Let Visible Help with Your Reporting

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Product Updates

Zapier + Visible

We’re thrilled to be launching our Zapier integration out of beta and to bring the power of over 700+ applications to our customer base.

Even better is you can utilize Zapier’s multi-step workflows and add on the Visible trigger to your existing apps.

Not familiar with Zapier? Zapier connects all of the apps you use to automate your workflows. When something happens in a particular application an action is triggered in another. Check out some examples below to understand how you can automate your stakeholder reporting with Zapier and Visible.

Send Sales and Marketing data directly to Visible Metrics.

Send KPIs from Pipedrive, Intercom, Mailchimp or any supported CRM and marketing tool directly to Visible metrics.

Connect to your database!

Want to automatically update Daily Active Users, Transactions Processed or other important KPIs from your own database? Simply setup a query in Zapier and pass along to Visible.

Automate all the things.

Zaps can be simple, complex and tailored to your every need. You can always fine more in our knowledge base and feel free to reach out anytime to support at visible dot vc. We are standing by and ready to help take your stakeholder reporting to the next level.

founders

Reporting

Most Popular Times to Send Your Investor Update

When should I send my investor updates?

We often get asked questions from customers and prospects ranging from:

When should I send my investor update?

How long should my investor update be?

What should I include in my investor update?

While there is no hard and fast rule there are some best practices. (Our first piece of advice is don’t overthink it and just send it! Check out our Techstars presentation for more best practices on Investing in Investor Updates)

We have a meaningful dataset at our fingers tip so we brushed up on our SQL query skills to break out some insights with how our customers are using Investor Updates.

On average, Visible users are sending investor updates out to ~12 recipients and including ~4.5 charts. Fun fact: The most recipients for a given update is 130 and most charts coming in at 40 (alert: information overload).

Here is a breakdown of investor recipients. This is a count for the past quarter and is truncated to show 5 to 20 recipients.

Finally, we wanted to see the most popular day of the week investor updates are sent. Unsurprisingly, Monday is the most popular day of the week followed up by Tuesday and Friday.

The least popular day of the work week is Thursday with Saturday being the least popular across all days. I also took a look to see the date of the month that are most popular for sending updates. The Top 3 are:

3rd – 5.32%

20th – 5.02%

10th – 4.28%

The least popular date is the 30th of the month. Want to learn more? Check out our guide, “How To Write the Perfect Investor Update (Tips and Templates).”

Stay tuned for a follow up post with the best days to increase engagement around your investor updates!

founders

Reporting

What is Your Investor Net Promoter Score?

This is an updated post from our original “What is Your Investor Net Promoter Score?” from May 2015.

It is not a secret that we love Net Promoter Score at Visible. The term “Net Promoter Score” has a corporate ring to it, making it seem like something that startups don’t need to worry about until they “grow up”. In reality, implementing a customer happiness metric like NPS is one of the most important (and easiest) things your startup can do once you begin to acquire customers. An accurate NPS helps you gain an understanding of how loyal your customers will be over the long term and what kind of word of mouth growth you can expect. But it isn’t just the happiness of your customers you should be worried about.

Investor Net Promoter Score for Startups

As a founder and executive team, part of the job description is keeping all of your key stakeholders engaged in the business and customers are just one of the groups you need to be attentive to. Your investors are another, which is why your Investor Net Promoter Score – the percentage of your investors who would recommend you to potential customers, key hires, distribution partners or follow on investors minus the percentage who wouldn’t – is also key to the long term success of your fledgling business.

In theory, your Investor Net Promoter Score should be 100. Why wouldn’t an investor recommend your product or your company culture to someone from the outside? If you close an important sale, bring on a talented engineer or find a new market for your product, your investor’s stake is worth more money, right?

In the real world, it isn’t that cut and dry. Investors, like startups, have resource constraints. More importantly, they have a reputation to protect. And while they want all of their companies to find success, their motivations change over time based on how engaged they remain in each of their portfolio companies.

The question is, if your Investor NPS is not 100 how do you get there?

How to Improve Your Investor NPS

1. Invest in investor updates. Build a regular cadence with your stakeholders.

Build a cadence and keep updates succinct as well as comparable. Consistent communication builds trust and keeps you on top of mind for your investors. Make sure to keep your metrics and format comparable from update to update. Ask for tips and preferences to tailor your updates to a format that is best for both you and your investors.

Take a walk in your investor’s shoes. When an investor comes across a great designer looking to join a startup, who do you think she will recommend? The company she hasn’t heard from since wiring the money, or the one that comes to her each month with a quick overview on how things are going and how she can help?

“The CEO is the investor’s user interface into the business” – Dharmesh Shah

2. Create a culture of candor.

While driving an internal culture of candor results in better decisions, execution and output, the same can be said when communicating with your external stakeholders. Don’t be afraid to share bad news. You are not alone, even though it might feel like it. Be frank about the state of the business and make the appropriate asks. At the end of the day, your investors have been in the same situation and are there to help you through “the struggle” or better yet, help you get to the next stage in your business.

“Investors can only help if you are transparent all the time, not just in good times.” – First Round Capital

3. Respect their time

As touched on before, investors are busy people. Whether they are investing on behalf of a fund or as an individual angel, it is likely that they have other portfolio companies and business ventures that they are dealing with on a daily basis.

Your goal should be to give your investors the ability to make the largest impact on your business with the least amount of exertion. When you are seeking advice or introductions, be specific. By doing this, you increase the probability that your investor will take you up on your request, helping to increase their engagement in your business and start a virtuous cycle of “Investor Success”.

founders

Metrics and data

4 Ways to get to $100 Million in ARR

Back in April we partnered with OpenView to share our free Total Addressable Market template. With an overwhelming positive response and some inspiration from Point Nine Capital’s “5 Ways to Build a $100 Million Business [Infographic]” we wanted to build a new forecasting template on how SaaS businesses can get to $100 million in annual recurring revenue.

For this template we partnered with our friends at Foresight & OpenView to provide 4 distinct forecasting models on how a business can grow to $100 million in ARR. You can get the template here!

Getting to $100 million in annual recurring revenue is one of those SaaS benchmarks you’ll hear about frequently. It’s a line in the sand that investors have drawn to deem your business “venture-backable” or not. I’m sure many have asked or received the follow question, “That’s great, but how does this get to $100mil in ARR?”

Click here to get the free SaaS forecasting template

No two paths are the same but there are some commonalities with different go-to-market strategies that can help frame your business. We’ll break down the following markets and their respective distinct metrics:

Consumer

SMB

Mid-Market

Enterprise

You’ll be able to define your customer acquisition channels, Average Revenue Per Account, contract lengths, growth assumptions, cost assumptions and more!

We hope you enjoy! You can find the post in full at Opeview and Foresight. Integrate the Google Sheet template directly with your Visible Account as well!

Get the free forecasting SaaS template here!

founders

Product Updates

Product Update: Filtering & Bulk Editing

We recently pushed some great improvements to the Data section on Visible to make it easy to search, filter and edit your respective metrics. We also make some speed improvements so the data section should load faster as well!

Filtering & Sorting

You can now sort and filter by categories & data sources. Simply click the filter icon and select your respective fields to filter the data table.

Bulk Editing

Select multiple metrics and quickly edit many metrics at once. You can quickly assign a new category and metric type with the new bulk editor as well as delete metrics you no longer need.

Be on the look out for even more improvements in the future. We hope you enjoy!

founders

Metrics and data

Ultimate Report Part 3 of 4: ARR Movements

Welcome to part 3 of 4 of our Ultimate Report series. When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target.

Part 1: Pacing

Part 2: Cadence & Operational Metrics

Part 3: ARR Movements

Part 4: Coming on July 12th

This week, our ultimate report is ARR Metrics. For any SaaS business, the movements in your recurring revenue are crucial to making decisions, hiring and resource allocation. What makes SaaS metrics great are that they are fairly easy to benchmark across industries.

Tracking Your ARR Movements

This report focuses on 4 key recurring revenue movements.

New Business ARR: When a lead converts to a customer (for the first time)

Expansion ARR: When an existing customers increases their recurring spend with you (more seats, better package, etc)

Contraction ARR: When an existing customers decreases their recurring spend with you (less seats, downgrade plan, etc)

Churn ARR: When a customer cancels their subscription and doesn’t renew.

If you want to dig into more SaaS metrics and definitions we recommend checking out our friends at ChartMogul and their SaaS Metrics Cheat Sheet. P.s. we have an awesome integration with them!

founders

Metrics and data

Ultimate Report Part 2: Cadence & Operational Metrics

Your Ultimate Report: Sharing Operational Metrics

Welcome to part 2 of 4 of our Ultimate Report series. When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target.

Part 1: Pacing

Part 2: Cadence & Operational Metrics

This week we want to touch on two key parts of the reporting process every company should be doing.

Operational Metrics

Developing a cadence for stakeholder reporting

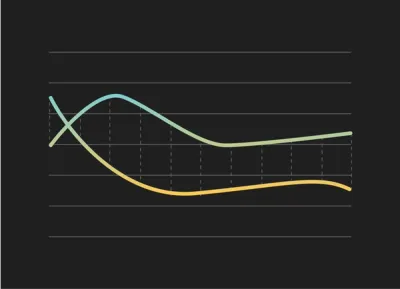

The below chart is a common one that most VCs love & one that you’ll see in just about every “Investor Update” template post online.

The goal here is to quickly see:

How fast is your top line growing?

How much cash is in the bank?

Is burn under control?

What does headcount look like?

With Visible, this is incredibly easy to visualize and automate through our different data integrations. Putting this together should take no more than a couple minutes.

The other key to great reporting is not doing it just once but building a repeatable cadence that is timely.

According to Peter Drucker, the key to building a successful company is about how well you attract and retain both talent and capital. Attracting capital (read: investors) is one thing; but how do you handle the added pressure of putting someone else’s capital to work? Regular communication.

While we spend most of our day talking with founders and operators we also spend a good amount of time speaking with stakeholders and those “consuming” reports. The one component they look for more than certain metrics, wins, losses, or other sections? Regular communication. With some back of the envelope math we have found companies that regularly communicate with their investors are twice as likely to raise follow on funding.

Consistent communication builds trust and helps keep you top of mind for your investors. It also creates accountability on both sides of the table. When an investor comes across a great designer looking to join a startup, who do you think she will recommend? The company she hasn’t heard from since wiring the money, or the one that comes to her each month with a quick overview on how things are going and how she can help?

But what is “regular communication”? That is something that should be answered by your, your team, and your stakeholders. Find a cadence that works best for both you and your stakeholders. One of our favorite cadences we see companies use is similar to the one below:

Weekly – Short, data heavy Updates sent to the entire team. Highlight big wins, losses, and your “North Stars” for individual departments

Monthly – A more qualitative focused Update sent to all Investors and stakeholders highlighting all important wins, losses, and questions from the month.

Quarterly – the “friends and family” Update. Send to any of your stakeholders that have interest in the business with a quick update on the state of the business while keeping potential investors in the loop.

Make sure to check our recurring templates in Visible to help automate your cadence.

founders

Product Updates

Xero Tracking Categories

Introducing Xero Tracking Categories

We recently launched additional improvements to our Xero integration that all of our customers can start taking advantage of today.

In addition to getting financial metrics and chart of accounts metrics from Xero, you can now filter any of your metrics your respective Xero tracking categories.

It’s as simple as selecting a metric and then clicking the drop down to apply the tracking category. You can add as many of the same metrics as you’d like. E.g. if you wanted Revenue across all of your sales regions you can bring those in!

Protip: Transform your Xero Tracking Categories with our formula builder.

You can read more about the Xero tracking categories in this knowledge base article. Questions? Send us an email.

Up & to the right,

-The Visible Team

founders

Reporting

What is Your Ultimate Report? Part 1: Pacing

When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target. Through this we’ve learned a ton and want to share the learnings with our audience through a 4 part series.

Part 1 of 4: Pacing

Today is Part 1 of the series, pacing. Pacing is a great way to apply weights to different periods throughout a range. E.g. You may close 40% of your deals in the last month of the quarter as reps have more urgency. Pacing should let you know if you are on track or not.The above chart is an example of pacing. This one in particular related to recurring revenue businesses by day but you can apply it to any business and timeframe. The goal is to be pacing 100% to your goal (the dotted line) throughout a period.

The inspiration for this came from David Skok’s SaaS 2.0 post, specifically from the Hubspot example.

Through a period of time the Hubspot team wanted to know how they were pacing towards their monthly goal this way they could make any adjustments on the fly to hit their goal.

As you can see, the end of a period for SaaS sales may be weighted higher as there is more urgency for a rep to close a deal but you weights could vary depending on seasonality, buying cycles, business models, etc. Another view could be: This chart is showing we are pacing above where we should be relative to our Q4 target.

I love pacing because it helps make adjustments but gets the team aligned on where you should be. You might be only 2 weeks into a quarter but you want to know where you are compared to where you are supposed to end up. Being 10% to your Quarter target may be acceptable and makes sure the entire team and stakeholders are aligned while understanding the health of particular KPIs.

What is your ultimate report?

Want us to create it in Visible for you?

Want access to the Google Sheet template that powered this post? Drop us a note.

Up & to the right,

-The Visible Team

founders

Metrics and data

Product Updates

Video: Formula Builder (Customer Acquisition Cost)

How to Calculate Customer Acquisition Cost in Visible

Check out the video above to get a glimpse of our formula builder. In this example we calculate customer acquisition cost by combining data from Salesforce and Google Sheets!

founders

Metrics and data

Why We Love Net Promoter Score (NPS)

We’re huge fans of the NPS (Net Promoter Score) at Visible. This article is all about NPS & is broken down into 4 sections.

What NPS is?

Why we love it!

How we implement it.

Do unanswered NPS surveys correlate to churn? (This question was the original idea for writing this post)

What is NPS?

If you’re not familiar with NPS, it is used to gauge the loyalty of a firm’s relationships. It is used by more than 2/3 of the Fortune 1000 and it can measure a company, employer or another entity. You have likely received an NPS survey yourself. It’s a score of 1 to 10 usually with a question of “How likely are you to recommend X to your friend or colleague?”

X could be your company, your customer support experience, an event, etc. If you answer 1 to 6 you are considered a detractor and at risk of customer churn, 7 & 8 are considered passives and 9 & 10 are considered promoters. To get your score take % Promoters – % Detractors. This creates a scale ranging from -100 to 100. 0 to 49 is considered good, 50 to 70 is Excellent and 70+ is World Class.

To give you an idea for the 4 Major Airline Carriers in the US the scores are as follows:

American: 3

Delta: 36

Southwest: 62

United: 10

On the other hand of the spectrum Apple clocks in at 89. (*note these are rough estimates from free online resources).

At Visible our NPS is a 75 and we are incredibly proud of that!

Why We Love NPS

We love NPS for a number of reasons but all of them are related to being a signal that is reported directly from our customers. We have written about NPS before in “How to measure customer experience better”.

With NPS we can identify problems we didn’t know about. Here is a real example… it looked like we have an incredibly active customer that loves our product but they recently answered our NPS survey with a 2 stating our pricing didn’t make sense for our business. This allowed us an opportunity to start a conversation on how we could better price our product for a particular customer prior to them churning.

A strong NPS is a great sales tool as well. It is something we can speak to with our customers, investors, potential hires, etc. Not only can we point to company logos as customers but we can prove that they love using the product. It’s also great for motivating the team internally as it touches all parts of the business.

NPS qualitative feedback is also amazing. The score is great but understanding why they scored the way they did is gold. At Visible we hear two things over and over again. 1) It’s simple and 2) great customer support. We always think about these two main pieces of feedback as we build the product and talk to our customers. We want to make sure we don’t overcomplicate the product and continue to serve the customer the best we can.

Finally, NPS is a great signal for early stage companies to use as an early identified or product-market fit before they have metrics at scale.

How Visible Implements NPS

We use NPS for all of our customer relationships. We’ve tried using NPS for free trial users or if customers used a particular feature but found that data didn’t yield any insightful data. We care most about the customers who providing us with their credit card in exchange for our service.

We use Promoter.io to handle the surveying, scoring and all things related to our NPS. There are a bunch of providers in the market but found that Promoter works best for our needs. Once a new customer signs up on Visible we then tag them as customer in Intercom. This then adds that customer to a queue in Promoter where we set a 20 day delay before the first survey is sent.

Why 20? We don’t want to survey right away as we want them to get all the benefits of the product, have a customer success interaction and fully dive into our offering. With a 20 day delay we also give ourselves 10 days to address any problematic issues with a customer that may be paying us monthly to avoid churn. From there the customer gets surveyed automatically 60, 90 and 180 days after the most recent survey. Each survey has an auto-reminder 3 days after an initial send if they haven’t responded.

Do unanswered NPS surveys correlate to churn?

There is a solid argument to make that detractor NPS scores (0 to 6) correlate to revenue churn; however, what about customers that don’t respond to NPS surveys? My hypothesis was that if customers don’t care enough to answer a simple survey that just takes one click to answer, do they really care about the solution?

Of our customers that churned in the past 6 months, 43% of them responded to the NPS survey. That response rate falls in line with our active customer base. Of those that answered, all of them were promoters (answered with 9 or 10)! This was actually quite perplexing and something I don’t have a great answer to (yet). If you do, we’d love to hear from you! I wish I had an amazing, ground-breaking takeaway for this last point but the reality is we are still in first inning of our NPS journey. As we get more data, more experience and learnings we’ll make sure to update it!

Questions, thoughts, comments? Email hi at visible dot vc. Want to share your NPS with your team and stakeholders? Sign up for Visible!

Up & to the right,

-The Visible Team

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial