We’re huge fans of the NPS (Net Promoter Score) at Visible. This article is all about NPS & is broken down into 4 sections.

- What NPS is?

- Why we love it!

- How we implement it.

- Do unanswered NPS surveys correlate to churn? (This question was the original idea for writing this post)

What is NPS?

If you’re not familiar with NPS, it is used to gauge the loyalty of a firm’s relationships. It is used by more than 2/3 of the Fortune 1000 and it can measure a company, employer or another entity. You have likely received an NPS survey yourself. It’s a score of 1 to 10 usually with a question of “How likely are you to recommend X to your friend or colleague?”

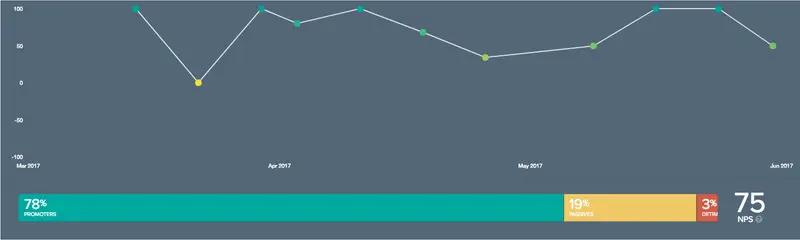

X could be your company, your customer support experience, an event, etc. If you answer 1 to 6 you are considered a detractor and at risk of customer churn, 7 & 8 are considered passives and 9 & 10 are considered promoters. To get your score take % Promoters – % Detractors. This creates a scale ranging from -100 to 100. 0 to 49 is considered good, 50 to 70 is Excellent and 70+ is World Class.

To give you an idea for the 4 Major Airline Carriers in the US the scores are as follows:

- American: 3

- Delta: 36

- Southwest: 62

- United: 10

On the other hand of the spectrum Apple clocks in at 89. (*note these are rough estimates from free online resources).

At Visible our NPS is a 75 and we are incredibly proud of that!

Why We Love NPS

We love NPS for a number of reasons but all of them are related to being a signal that is reported directly from our customers. We have written about NPS before in “How to measure customer experience better”.

With NPS we can identify problems we didn’t know about. Here is a real example… it looked like we have an incredibly active customer that loves our product but they recently answered our NPS survey with a 2 stating our pricing didn’t make sense for our business. This allowed us an opportunity to start a conversation on how we could better price our product for a particular customer prior to them churning.

A strong NPS is a great sales tool as well. It is something we can speak to with our customers, investors, potential hires, etc. Not only can we point to company logos as customers but we can prove that they love using the product. It’s also great for motivating the team internally as it touches all parts of the business.

NPS qualitative feedback is also amazing. The score is great but understanding why they scored the way they did is gold. At Visible we hear two things over and over again. 1) It’s simple and 2) great customer support. We always think about these two main pieces of feedback as we build the product and talk to our customers. We want to make sure we don’t overcomplicate the product and continue to serve the customer the best we can.

Finally, NPS is a great signal for early stage companies to use as an early identified or product-market fit before they have metrics at scale.

How Visible Implements NPS

We use NPS for all of our customer relationships. We’ve tried using NPS for free trial users or if customers used a particular feature but found that data didn’t yield any insightful data. We care most about the customers who providing us with their credit card in exchange for our service.

We use Promoter.io to handle the surveying, scoring and all things related to our NPS. There are a bunch of providers in the market but found that Promoter works best for our needs. Once a new customer signs up on Visible we then tag them as customer in Intercom. This then adds that customer to a queue in Promoter where we set a 20 day delay before the first survey is sent.

Why 20? We don’t want to survey right away as we want them to get all the benefits of the product, have a customer success interaction and fully dive into our offering. With a 20 day delay we also give ourselves 10 days to address any problematic issues with a customer that may be paying us monthly to avoid churn. From there the customer gets surveyed automatically 60, 90 and 180 days after the most recent survey. Each survey has an auto-reminder 3 days after an initial send if they haven’t responded.

Do unanswered NPS surveys correlate to churn?

There is a solid argument to make that detractor NPS scores (0 to 6) correlate to revenue churn; however, what about customers that don’t respond to NPS surveys? My hypothesis was that if customers don’t care enough to answer a simple survey that just takes one click to answer, do they really care about the solution?

Of our customers that churned in the past 6 months, 43% of them responded to the NPS survey. That response rate falls in line with our active customer base. Of those that answered, all of them were promoters (answered with 9 or 10)! This was actually quite perplexing and something I don’t have a great answer to (yet). If you do, we’d love to hear from you! I wish I had an amazing, ground-breaking takeaway for this last point but the reality is we are still in first inning of our NPS journey. As we get more data, more experience and learnings we’ll make sure to update it!

Questions, thoughts, comments? Email hi at visible dot vc. Want to share your NPS with your team and stakeholders? Sign up for Visible!

Up & to the right,

-The Visible Team