As Q3 comes to an end, it is easy to get behind trying to close last seconds deals, make the right hires, or push product updates but it is vital to stay organized for your Q3 board meeting.

A board meeting is not something founders and CEOs should lose sleep over. If executed and prepared for properly board meetings can become an integral part of your company’s success. However, it is easy to lose focus and can easily turn into hours of tracking down data, reading bullet points off a slide, and losing grip of the conversation.

To help lighten the load of board meeting prep we’ve put together a short guide to help have your ducks in a row before your meeting:

Pre Board Meeting Reporting

Being the CEO presenting at a board meeting it can feel like all eyes and pressure are on you. With sending over a structured report before the meeting you can turn the tables and put the pressure on the board to come to the meeting prepared. You never want to spring any surprises during a board meeting, by sending out the packet ahead of time you’ll avoid said surprises and set the expectation that everyone should come prepared. This will also give everyone a chance to read through the packet, request any changes and avoid tedious discussions during the meeting.

“Sometimes, if someone asked about something and clearly hadn’t done their homework, I’d say, ‘Oh yeah, that’s in the board pack.’ That’s the most damning thing that can happen to a board member — realizing that all of their peers prepared for the meeting and they didn’t.” – Jeff Bonforte (Former CEO of Xobni)

With that being said, it is important that you supply the board with the correct information in a timely manner. Most founders/CEO have found it best to send over their pre-meeting report/packet at least 4 days in advance.

Make the report comprehensive and relevant. This can include financials, wins, losses, near term concerns, plus goals for the next quarter.

Putting together a pre-meeting report can be a long process (and probably should be) as you reflect on the past quarter and lay out your vision for the next quarter. Putting the time in will be worth it as it will save precious time and allow you to discuss what truly matters.

Be on the lookout for a pre-board meeting Visible Update template early next week!

Set an Agenda

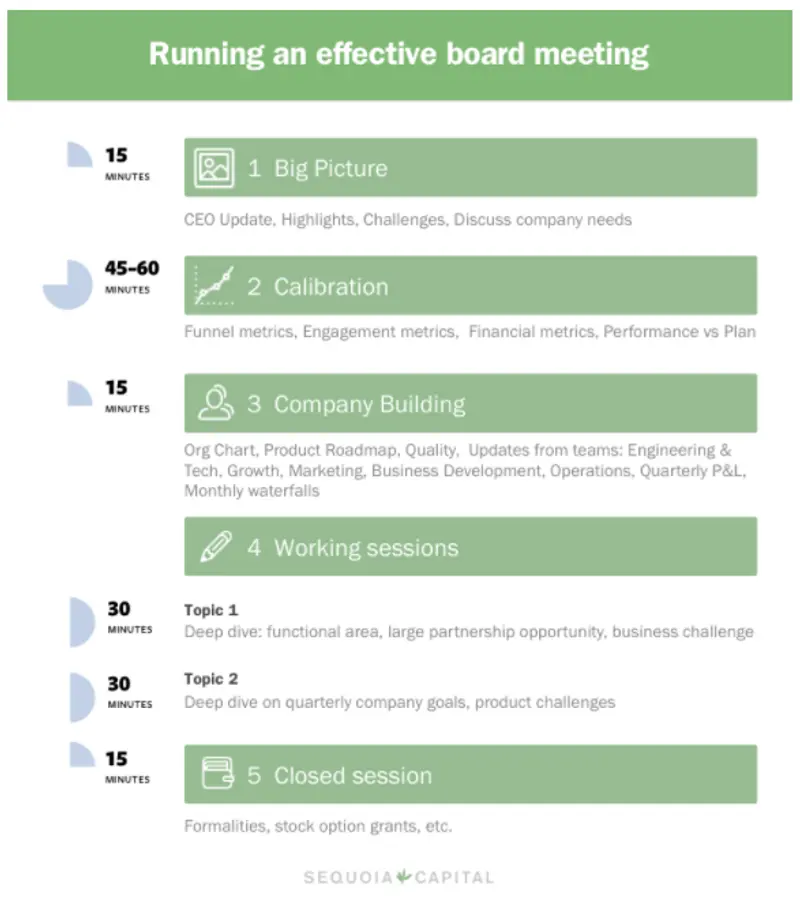

Lets face it, getting a group of people in a room to stay focused is next to impossible. To make the most of your time, lay out an agenda and stick to it! We have found that most board meetings should last anywhere from 2-4 hours. Below you will find an example agenda from the team at Sequoia Capital:

Read Sequoia’s guide for preparing a board deck/agenda here.

Ideally, if you sent over your metrics and data beforehand you should be able to shorten the time needed to discuss specific metrics. This will allow to focus on what truly matters over the next quarter; fundraising, hiring, product improvements, etc. Not a bad idea to include your agenda when sending over your board report/packet as well as your board deck.

Related Resource: Crafting the Perfect SaaS Board Deck: Templates, Guidelines, and Best Practices

1-on-1 Meetings

If you are able to carve out time with each of your board members beforehand to discuss any topics one on one – do it! No need for a lengthy discussion but board members will appreciate being kept in the loop and offering input in setting the agenda. If you have any previous asks left hanging now would be a good time to address those. Additionally, this gives you an opportunity to feel out how certain members feel about different topics and votes so you can be prepared to answer any questions and avoid surprises.

Provide Solutions

Take a look back at the previous quarter and ponder your wins, losses, product updates, etc. and have answers ready to any questions you might face. Instead of an in-depth product review it might be most efficient to focus on any of the improvements you made over the last quarter and why you made them. This way you can avoid countless product requests being thrown around from people who are likely not even using your product.

If your sales were down in July, why was that? If your churn was high in August, why was that? While it’s never fun to look back at losses from the quarter it will make your life much easier to have an answer and solution moving forward.