When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target. Through this we’ve learned a ton and want to share the learnings with our audience through a 4 part series.

Part 1 of 4: Pacing

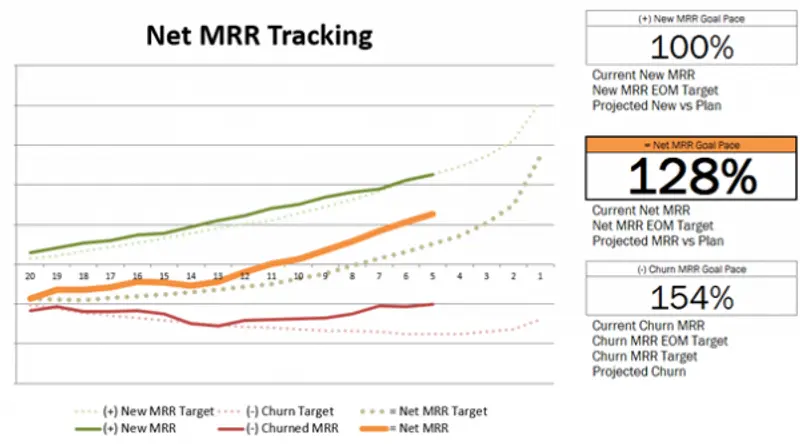

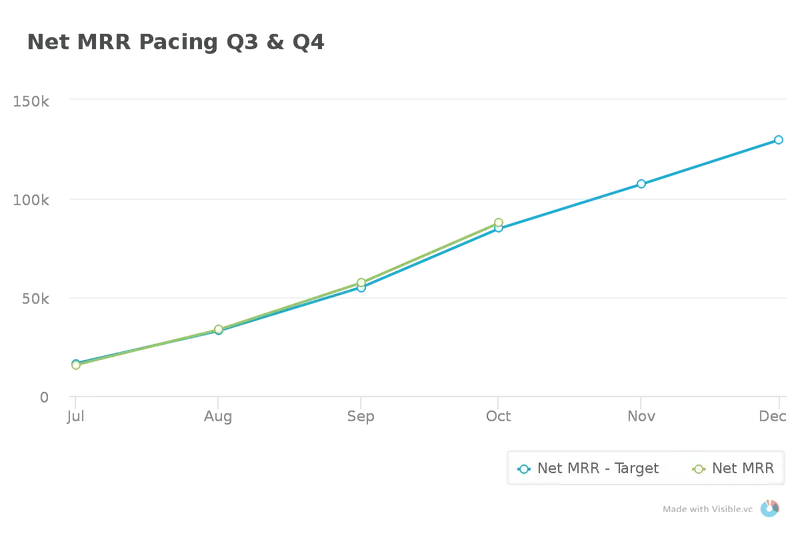

Today is Part 1 of the series, pacing. Pacing is a great way to apply weights to different periods throughout a range. E.g. You may close 40% of your deals in the last month of the quarter as reps have more urgency. Pacing should let you know if you are on track or not.The above chart is an example of pacing. This one in particular related to recurring revenue businesses by day but you can apply it to any business and timeframe. The goal is to be pacing 100% to your goal (the dotted line) throughout a period.

The inspiration for this came from David Skok’s SaaS 2.0 post, specifically from the Hubspot example.

Through a period of time the Hubspot team wanted to know how they were pacing towards their monthly goal this way they could make any adjustments on the fly to hit their goal.

As you can see, the end of a period for SaaS sales may be weighted higher as there is more urgency for a rep to close a deal but you weights could vary depending on seasonality, buying cycles, business models, etc. Another view could be: This chart is showing we are pacing above where we should be relative to our Q4 target.

I love pacing because it helps make adjustments but gets the team aligned on where you should be. You might be only 2 weeks into a quarter but you want to know where you are compared to where you are supposed to end up. Being 10% to your Quarter target may be acceptable and makes sure the entire team and stakeholders are aligned while understanding the health of particular KPIs.

- What is your ultimate report?

- Want us to create it in Visible for you?

- Want access to the Google Sheet template that powered this post? Drop us a note.

Up & to the right,

-The Visible Team