In recent years, the world of Non-Fungible Tokens (NFTs) has exploded in popularity, with various use cases and projects emerging across the digital landscape. As a result, venture capitalists (VCs) and NFT investors have started actively staking their capital in NFT projects and use cases. This trend represents a significant shift in the investment landscape, with traditional investors recognizing the potential of NFTs to revolutionize various industries and create new revenue streams.

From gaming and art to real estate and collectibles, NFTs offer a unique opportunity for investors to get involved in a rapidly growing market and support innovative projects with the potential for massive returns.

Also check out, 10 VC Firms Investing in Web3 Companies.

NFT 101: Understanding the Basics

NFTs are tokens that we can use to represent ownership of unique items. They let us tokenize things like art, collectibles, even real estate. They can only have one official owner at a time and they’re secured by the Ethereum blockchain – no one can modify the record of ownership or copy/paste a new NFT into existence. – ethereum.org

NFTs are unique digital tokens that represent one-of-a-kind assets that cannot be replicated, making them valuable as digital collectibles. Though they are held in a crypto wallet and function as a type of cryptocurrency, they cannot be used to purchase goods or services. Rather, their value is derived from their uniqueness and the potential to increase in value over time. This has made NFTs an attractive investment opportunity for venture capitalists, who recognize their potential to revolutionize various industries and create new revenue streams.

Examples of NFTs include digital art pieces, memes, gifs, music albums, videos, virtual real estate, and even tweets. Upon purchase, the ownership of an NFT is guaranteed through a digital signature, creating a secure and transparent investment opportunity for those looking to support innovative projects with the potential for significant returns. While NFTs may seem like digital paperwork at their core, they represent a promising future in the world of digital assets and have already captured the attention of traditional investors.

Where Is the Value of an NFT Derived From?

Venture capitalists are investing in NFTs for several reasons, including the potential for significant returns, the growing popularity of NFTs, and the promise of innovative use cases for the technology.

Unlike traditional collectibles, the value of NFTs is derived from their one-of-a-kind nature, which is stored on the Ethereum blockchain. This allows for secure ownership verification and differentiates NFTs from standard cryptocurrency tokens like ETH.

This ownership verification is crucial as it provides evidence of the rarity and scarcity of an item, giving it value in the eyes of collectors. This can range from digital art, to music, to even tweets or other unique content. With blockchain technology providing ownership verification, the value of NFTs is no longer solely dependent on the market but also on their rarity and provenance. Additionally, NFTs are enabling the possibility of shared ownership, which allows for communities of fans to own a piece of the creator’s work and incentivizes their success. As a result, venture capitalists see NFTs as a promising investment opportunity that could potentially change the way creators monetize and distribute their content, while also creating new revenue streams for investors.

Also check out, Top VCs Investing in the $100 Billion Creator Economy.

NFTs are gaining popularity as a way for creators to monetize their digital content and intellectual property. As more artists, musicians, and other creators adopt NFTs, the market is expected to grow, presenting new opportunities for investors. Furthermore, NFTs have the potential to revolutionize various industries by enabling secure ownership and authentication of digital assets. For example, NFTs can be used in gaming, virtual real estate, and even in the art world to prove provenance and authenticity.

Another reason VCs are interested in NFTs is that they represent a new and exciting asset class, with the potential for high growth and significant returns. As such, venture capitalists are investing in NFT marketplaces, NFT-focused companies, and NFT collections.

Venture capitalists are investing in NFTs in a variety of ways, including through direct investments in NFT projects and platforms, as well as by investing in companies that use NFTs as part of their business model. Many VCs are investing in NFT marketplaces that allow creators to sell their NFTs, such as OpenSea, Nifty Gateway, and SuperRare. They may also invest in NFT-focused companies that are creating new use cases for the technology, such as digital identity verification or supply chain management.

Overall, venture capitalists are investing in NFTs as a way to tap into the growing popularity of the technology and to support innovative projects that have the potential for significant returns. As the market for NFTs continues to grow, it is likely that venture capitalists will continue to play a major role in shaping the future of the industry.

Proven NFT Use Case Examples

Pier Kicks predicts we are on our way to the “Metaverse” — a “self-sovereign financial system, an open creator economy, and a universal digital representation and ownership layer via NFTs (non-fungible tokens).”

NFTs made their debut focusing mainly on art, music, and trading cards because it was the most widely adopted collectible investment items with an existing community of fans to tap into- giving them instant value. This was the start though and the beauty of NFTs is that this traditional concept can now be expanded upon in so many ways.

Also check out, The Top VCs Investing in Community Driven Companies.

Now fast-forward 2 years later and according to our favorite crypto newsletter, The Milk Road, it looks like the NFT use cases that are here to stay are:

Rewards for Super Fans

- A status symbol – there is actual proof that fans made the discovery early.

- A membership card – a way for NFT holders to get access to exclusive perks.

- A way for fans to “invest in your success”- if a fan buys someone’s NFT early it can be an investment and a way to fund the project/ artist/ person.

Digital Collectables

- Art- before NFTs art wasn’t able to be digitally collected, which is why this was probably the first and best use case so far.

- Branded collectibles- we’re now seeing the high fashion world take part in the craze as well and eventually in the metaverse people will be able to show off these digital assets on their avatars.

Membership as an Asset

- “NFTs turn ‘memberships’ into tradeable assets. NFTs let you ‘invest’ in a social group, rather than just paying fees for access.” Making things like a SoHo House membership digitally transferrable.

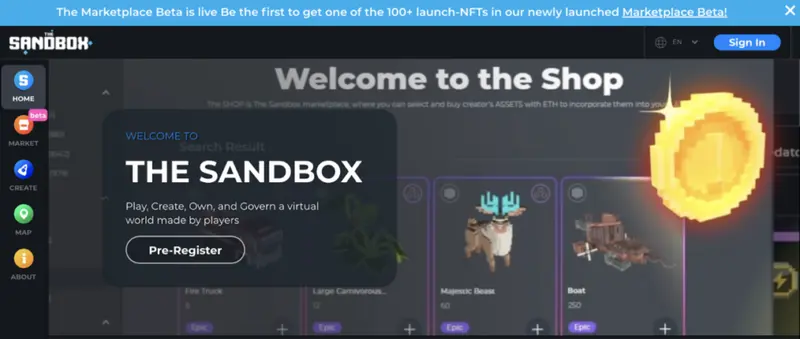

Video Game Assets

- “In the future, games will issue items as NFTs. Those are things you OWN. You can sell them. You can bring them into new games. You can rent them out to other players.”

NFTs In the Future of Investing

As the use cases for NFTs continue to expand, venture capital (VC) firms are taking notice and are increasingly interested in investing in startups and businesses that are utilizing NFTs in innovative and impactful ways.

One area where VC firms are likely to invest in NFTs is in the real estate industry. As mentioned, tokenizing real-world assets is still in its early days, but once certain securities, insurance, and infrastructures are built out, the use cases could be endless. We can expect to see VC firms investing in startups that are developing blockchain-based platforms that allow for the tokenization of real estate assets, making it easier for individuals and institutions to buy and sell fractional ownership in property.

VC firms are also likely to invest in startups that are utilizing NFTs in the realm of official documentation. The ability to create, transfer, and verify ownership of digital assets using NFTs has the potential to revolutionize the way that official documents are handled. For example, NFTs could be used to store and verify educational degrees, professional licenses, and other certifications. We can expect VC firms to invest in startups that are building the necessary infrastructure and platforms to enable the tokenization and verification of these types of official documents.

In addition to real estate and official documentation, VC firms are likely to invest in startups that are utilizing NFTs in the sports and entertainment industries. NFTs provide a new way for fans to connect with their favorite teams, artists, and celebrities. For example, NFTs could be used to create limited-edition merchandise, exclusive content, or even fan experiences. We can expect VC firms to invest in startups that are building platforms and marketplaces that enable these types of fan experiences.

Overall, as the use cases for NFTs continue to expand, we can expect to see increased interest and investment from VC firms. This investment will help to drive innovation in the space and create new opportunities for startups and businesses that are utilizing NFTs in creative and impactful ways.

As a side note, for any companies looking to drop NFTs to your customers or fans, thirdweb is a platform worth exploring.

Resources for Founders

- CoinDesk: CoinDesk is a leading media outlet covering the cryptocurrency and blockchain industry. They have a dedicated section on their website for NFT news and analysis, providing updates on the latest developments in the space.

- CryptoSlate: CryptoSlate is a popular cryptocurrency news and media outlet that covers NFTs and their various use cases. They have a section dedicated to NFT news and analysis, providing insights on the latest trends and developments in the industry.

- Crunchbase: Crunchbase is a leading platform for discovering and tracking innovative companies and investors. They have a dedicated section on their website for NFT-related companies, providing information on the top investors in the space and their investment history.

- NFT Accelerator: NFT Accelerator is a program that provides funding, mentorship, and resources to startups that are building NFT-based businesses. They focus on helping founders navigate the challenges of building businesses in the rapidly-evolving NFT ecosystem.

- OpenSea: A popular NFT marketplace that allows creators to sell and trade their NFTs. Founders can use OpenSea to sell their own NFTs and learn more about the market.

- SuperRare: Another NFT marketplace that focuses on digital art. SuperRare has a curated selection of high-quality NFTs and offers a unique auction system that founders may find helpful.

- Nifty Gateway: A user-friendly NFT marketplace that specializes in drops, where a limited number of NFTs are released at a specific time. Nifty Gateway is owned by Gemini, a cryptocurrency exchange, and has attracted high-profile creators and investors.

- The Block: A news and research site that covers the blockchain and cryptocurrency industry, including NFTs. Founders can use The Block to stay up to date on the latest trends and developments in the NFT space.

- NFT Vision Hack: A hackathon and accelerator program for NFT-focused startups. Founders can apply for the program to receive funding and support from industry experts.

- Metapurse: A crypto-based investment fund that focuses on NFTs and virtual real estate. Founders can learn more about NFT investing and get in touch with Metapurse for potential investment opportunities.

- NFT School: An educational platform that provides resources and tutorials on NFTs and blockchain technology. Founders can use NFT School to learn more about the technical and practical aspects of creating and selling NFTs.

- NonFungible.com: A data analytics platform that tracks the NFT market, including sales data, price trends, and project rankings. Founders can use NonFungible.com to get a better understanding of the market and the performance of their own NFT projects.

Top VCs and NFT Investors Actively Investing in NFT Projects

With the increasing popularity and potential of NFTs, many venture capital firms and angel investors are diving into this new field of digital ownership. These investors are actively seeking out promising NFT startups and providing the necessary funding to turn these ideas into reality. In this next section, we will highlight some of the top NFT investors who are leading the way in this emerging industry. From Silicon Valley giants to influential individual investors, these are the players shaping the future of NFTs.

Animoca Brands

About: Animoca Brands is a global leader in gamification and blockchain with a large portfolio of over 380 investments, and with the mission to advance digital property rights and contribute to building the open metaverse. The company and its various subsidiaries develop and publish blockchain games, traditional games, and other products, many of which are based on popular global brands including Disney, WWE, Power Rangers, MotoGP™, Formula E, and Snoop Dogg.

Their mission is, “To deliver digital property rights to the world’s gamers and Internet users, thereby creating a new asset class, play-to-earn economies, and a more equitable digital framework contributing to the building of the open metaverse.”

Investment Stages: Seed, Series A, Series B

Recent Investments:

- MPCH Labs

- Thirdwave

- Revolving Games

Shima Capital

About: Shima Capital is an investment fund that focuses on supporting cutting-edge blockchain startups.

“Our goal has always been to invest in strong founders across all crypto verticals, a goal we achieved throughout 2022.

#1 in seed-focused gaming projects

#5 in CeFi, DeFi, Infrastructure, & Web3

#3 in total projects invested (actual # is closer to ~120)”

Investment Stages: PreSeed and Seed

Recent Investments:

- Magna

- Thirdwave

- Sender

NGC Ventures

About: NGC Ventures is one of the largest institutional investors of blockchain and distributed ledger technologies, and has been a key contributor to a number of leading blockchain projects.

We strategically leveraging and amplifying our portfolio to help create and enhance each one’s competitive advantages.

Selectively partnering with leading investment professionals and technical developers in the world.

Investment Stages: Seed, Series A

Recent Investments:

- Chainsafe

- Kin Insurance

- Fan Controlled Football

HG Ventures

About: We partner with visionary entrepreneurs who are focused on bringing impactful R&D to market.At HG Ventures, we understand the dynamic landscape of your industry and bring our passion, expertise, and assets to support you as you execute your strategy for success.

We invest in early stage to growth stage companies developing advanced materials and systems for transportation, infrastructure, environmental services and specialty chemicals.

We provide resources spanning deep market insight, manufacturing and supply chain assistance, pilot testing of products, R&D expertise and equipment, introductions to our customers and service providers, and more.

Traction metrics requirements: We will invest at the pre-revenue and pre-product stage, but we want to see the beginnings of a dedicated, full-time executive team.

Investment Stages: Early to Growth Stage- Seed, Series A, Series B,

Recent Investments:

- Circulor

- 6k

- Transcend Software

Paradigm

About: Paradigm primarily invests in crypto-assets and businesses from the earliest stages of idea formation through to maturity. Every once in a while, a new technology comes along that changes everything. The internet defined the past few decades of innovation. We believe crypto will define the next few decades.

Paradigm is an investment firm focused on supporting the crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and continue supporting our portfolio companies over time.We take a deeply hands-on approach to help projects reach their full potential, from the technical (mechanism design, smart contract security, engineering) to the operational (recruiting, regulatory strategy).

Thesis: Paradigm is an investment firm focused on supporting the great crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and support our portfolio with additional capital over time.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

- Uniswap Labs

- Nxyz

- Exponential

AU21 Capital

About: AU21 Capital is a Venture Capital firm dedicated to procuring value for teams expanding the frontiers of blockchain technology. Our team brings decades of executive and operational experience at industry titans including Huobi and Galaxy Digital. Our business development and investment acumen shines through our portfolio companies, including partnerships with Astar, Axie Infinity, Injective, Marlin, Cere, Covalent, Casper labs, Serum, Fantom, Harmony, Iotex, Coin98, Polkadot, Star Atlas among many others. We also serve as trusted partners to sector-leading launchpads, and work routinely alongside top exchanges to bring products to market.

Investment Stages: Seed, Series A

Recent Investments:

- IQ Labs

- The Unfettered

- Cryption Network

Awesome People Ventures

About: Awesome People Ventures is an early-stage fund focused on Web3. We invest in the future of work and life. We support our founders with capital, hands-on growth support, and access to an exclusive talent network. Awesome People Ventures is backed by Marc Andreessen, Chris Dixon, Multicoin, and founders of top crypto projects. Awesome People Ventures invests in a diverse set of founders, who operate with integrity and are building long-standing companies.

Investment Stages:Pre-Seed, Seed

Recent Investments:

- Treeswift

- Solid World DAO

- Jia

Exnetwork Capital

About: Exnetwork Capital was founded in 2018 as a means to democratize access to opportunities to support blockchain projects. Since then, it has evolved to be a multi-faceted organization that supports not just the well-known configurations of blockchain organizations but radical ones such as anonymous and distributed teams.

Investment Stages: Seed

Recent Investments:

- Reign of Terror

- KlayCity

- Volare Finance

ConsenSys Ventures

About: ConsenSys Ventures is a venture capital arm ConsenSys, a blockchain venture production studio.

Investment Stages: Accelerator, Pre-Seed, Seed, Series A

Recent Investments:

- Kiln

- WalletConnect

- Sardine

Looking for Funding? Visible Can Help- Start Your Next Round with Visible

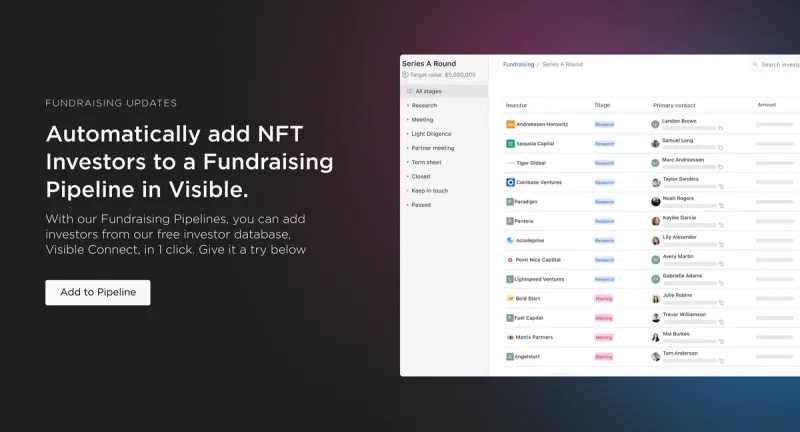

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.