At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: The Understandable Guide to Startup Funding Stages

Just as a sales and marketing funnel starts by finding the right leads, the same is true for a fundraise. Founders raising venture capital should start by identifying the right investors for their businesses.

If you’re a founder located in France and are looking for venture capitalists in your area, check out our list below:

1. Alven Capital Partners

As put by their team, “Alven is an independent venture investment firm with a successful track record of 5 successive funds backing more than 130 startups over 20 years.

Our team consists in seasoned investors and functional experts with significant startup experience, to identify promising startups and accelerate their growth.”

Learn more about Alven by checking out their Visible Connect profile →

Location

Alven has offices in Paris and London and invests in founders across Europe.

Portfolio Highlights

Some of Alven’s most popular investments include:

- Algolia

- ChartMogul

- Stripe

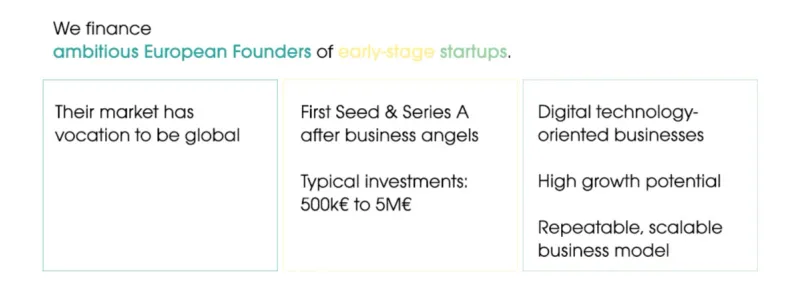

Funding Stage

Alven attempts to be the first check into a business after angel investors — typically seed or series A. Their typical investment is between €500K and €5M.

2. Partech

As put by their team, “Partech is a global investment platform for tech and digital companies, led by ex-entrepreneurs and operators of the industry spread across offices in San Francisco, Paris, Berlin and Dakar.

We invest from €200K to €75M in a broad range of technologies and businesses for enterprises and consumers, from software, digital brands and services to hardware and deep tech, across all major industries.”

Learn more about Partech by checking out their Visible Connect profile →

Location

Partech has offices across the globe and has multiple funds to invest in companies across the globe.

Portfolio Highlights

Some of Partech’s most popular investments include:

- Bolt

- The Bouqs Co.

- Zeel

Funding Stage

Partech has multiple funds that are geared towards different stages — from seed to growth stage.

3. Sofinnova Partners

As put by their team, “At Sofinnova Partners, we focus on breakthrough innovations that have the potential to solve the world’s most pressing problems. Experience, agility, and diverse points of view push us forward, driving our ability to evolve in a complex environment.

“Partners for Life” is a cornerstone of our identity: nurturing strong relationships through trust and transparency. We invest in people and science to create opportunity. We commit to long-term partnerships with entrepreneurs who are as passionate as we are about pushing the frontiers of innovation to contribute to a better future.

Founded in 1972, Sofinnova Partners has backed more than 500 companies over 50 years, creating market leaders around the globe. Today, Sofinnova Partners has over €2.5 billion under management.”

Learn more about Sofinnova Partners by checking out their Visible Connect profile →

Location

Sofinnova is located in Paris.

Portfolio Highlights

Some of Sofnnova’s most popular investments include:

- Avantium

- Kiro

- NuCana

Funding Stage

Sofinnova has 6 different fund strategies that are targeted on different stages and markets. They are:

- Sofinnova Capital

- Sofinnova MD Start

- Sofinnova Crossover

- Sofinnova Industrial Biotech

- Sofinnova Telethon

- Sofinnova Digital Medicine

Related Resource: The Top VCs Investing in BioTech (plus the metrics they want to see)

4. Seventure Partners

As put by their team, “Seventure Partners adopts an extremely rigorous but collegial process when selecting innovative companies for investment. Determining whether we can establish a relationship based on trust and work effectively with a company’s management team are key elements that we take into consideration.

Investments are aimed at strengthening the equity capital of innovative companies at all stages: from seed to growth capital. As we are often the lead investor, we actively partner with entrepreneurs, encouraging and supporting them in reaching their full potential in order to achieve a leadership position within their fields.

Our presence as directors on the company’s board or in a supervisory role creates a holistic approach that supports entrepreneurs in their development and companies throughout the key phases of their growth.”

Learn more about Seventure Partners by checking out their Visible Connect profile →

Location

Seventure is located in Paris.

Portfolio Highlights

Some of Seventure Partner’s most popular investments include:

- Hivency

- Skinjay

- Sumup

Funding Stage

Seventure invests in companies across all stages — from seed to growth stage.

Related Resource: A Quick Overview on VC Fund Structure

5. Eurazeo

As put by the team at Eurazeo, “From fledgling startups to SMEs, mid-caps and multinationals, we detect, finance, accelerate and support companies that are inventing and reinventing themselves, innovative entrepreneurs, and emerging talent.

We turn constraints into opportunities, challenges into ways to create value, and bold ideas into success stories.

Every day, we work alongside management teams and investors at the grass-roots level. In the right place, at the right time, and over the long term, we help them reveal the best of themselves and, ultimately, contribute to creating meaningful growth.”

Learn more about Eurazeo by checking out their Visible Connect profile →

Location

Eurazeo has offices across the globe.

Portfolio Highlights

Some of Eurazeo’s most popular investments include:

- Swile

- Grab

- Wefox

Funding Stage

Eurazeo funds companies across all stages.

6. Omnes Capital

As put by their team, “Our Venture Capital activity, the historic heart of Omnes, with €700M under management, supports innovative European start-ups in the fields of deeptech.

We back extraordinary founders executing on a clear vision and building worldwide leading businesses in the fields of techbio, cybersecurity, new space, quantum computing, new materials, carbone capture and novel food.”

Learn more about Omnes Capital by checking out their Visible Connect profile here →

Location

Omnes Capital is headquartered in Paris.

Portfolio Highlights

Some of Omnes’ most popular investments include:

- Opensee

- Artifakt

- Gourmey

Funding Stage

As put by their team, “First investment from €2M to €7M with potential follow-on up to €20M.”

7. Vantech

As put by their team, “Ventech is a global early-stage VC firm based out of Paris, Munich, Berlin, Helsinki, Shanghai and Hong Kong with over €900m raised to fuel globally ambitious entrepreneurs and their visions of the future positive digital economy.

Since inception in 1998, Ventech has made 200+ investments such as Believe, Vestiaire Collective, Botify, Freespee, Ogury, Veo, Picanova and Speexx; and 90+ exits including Webedia, Meuilleurs Taux.com, Curse, StickyADS.tv and Withings).”

Location

Vantech has offices across Europe and Asia including Paris, Berlin, Munich, Helsinki, Hong-Kong, Shangai.

Related Resource: 8 Most Active Venture Capital Firms in Europe

Portfolio Highlights

Some of Vantech’s most popular investments include:

- Adore Me

- Mobius Labs

- Picanova

Funding Stage

Vantech invests in companies across all stages.

Related Resource: Private Equity vs Venture Capital: Critical Differences

8. Aster

As put by their team, “Aster Capital arranges equity and debt-secured accounts for Proof of Funds uses on a fixed-return basis to facilitate various funding requirements, providing organizations and individuals the capability to meet on-going project needs. The investment process is simple and secure, and can be completed in as little as two banking days. Aster can arrange funding for various types of accounts and instruments for a broad range of requirements.”

Location

Aster has offices in Paris, London, and Nairobi. They make investments in companies located in Europe, US, and Israel.

Portfolio Highlights

Some of Vantech’s most popular investments include:

- Betterway

- Habiteo

- Candi

Funding Stage

Vantech funds companies that are raising anything from a seed round to series B.

Looking for Investors? Try Visible Today!

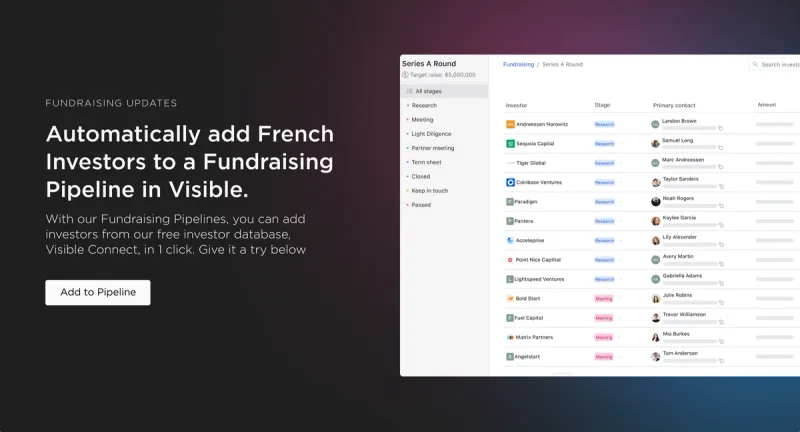

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.